Now part of the Infrastructure Investor Global Passport

An Infrastructure Investor Global Passport subscription connects you with the global infrastructure community. Bringing together investors, industry leaders and strategic market insights.

The Global Summit is now just one of the key touchpoints that you will get over the next 12 months with your Infrastructure Investor Global Passport. Start connecting with the industry from January.

Today’s leaders. Tomorrow’s infrastructure. The Global Summit.

The no.1 event in the industry, the Infrastructure Investor Global Summit will be back as an in-person event on 18-21 October.

Bringing together infrastructure’s most influential decision-makers for four days of networking and industry-leading content in Berlin. Expand your network and gain new insights to drive your investment strategies forward.

Investors who attended in 2020 include:

Connect with the infrastructure community year-round

![]()

Market insights from leading experts

Hear from leading institutional investors, managers, and advisors from across the globe. All content will be recorded and available on-demand after the event.

![]()

One-click networking

Connect with global leading institutional investors in-person, through video meetings, forum discussions and private messaging. Find the people you want to meet and setup meetings beforehand.

Twelve months access to the community

Now as part of the Infrastructure Investor Global Passport, benefit from year-round, 24/7 access to infrastructure’s most influential global community.

2020 Keynote speakers

Lord John Browne

Build better infrastructure for the future

This was the focus of Browne’s session, an advocate for greater imagination in planning and design.

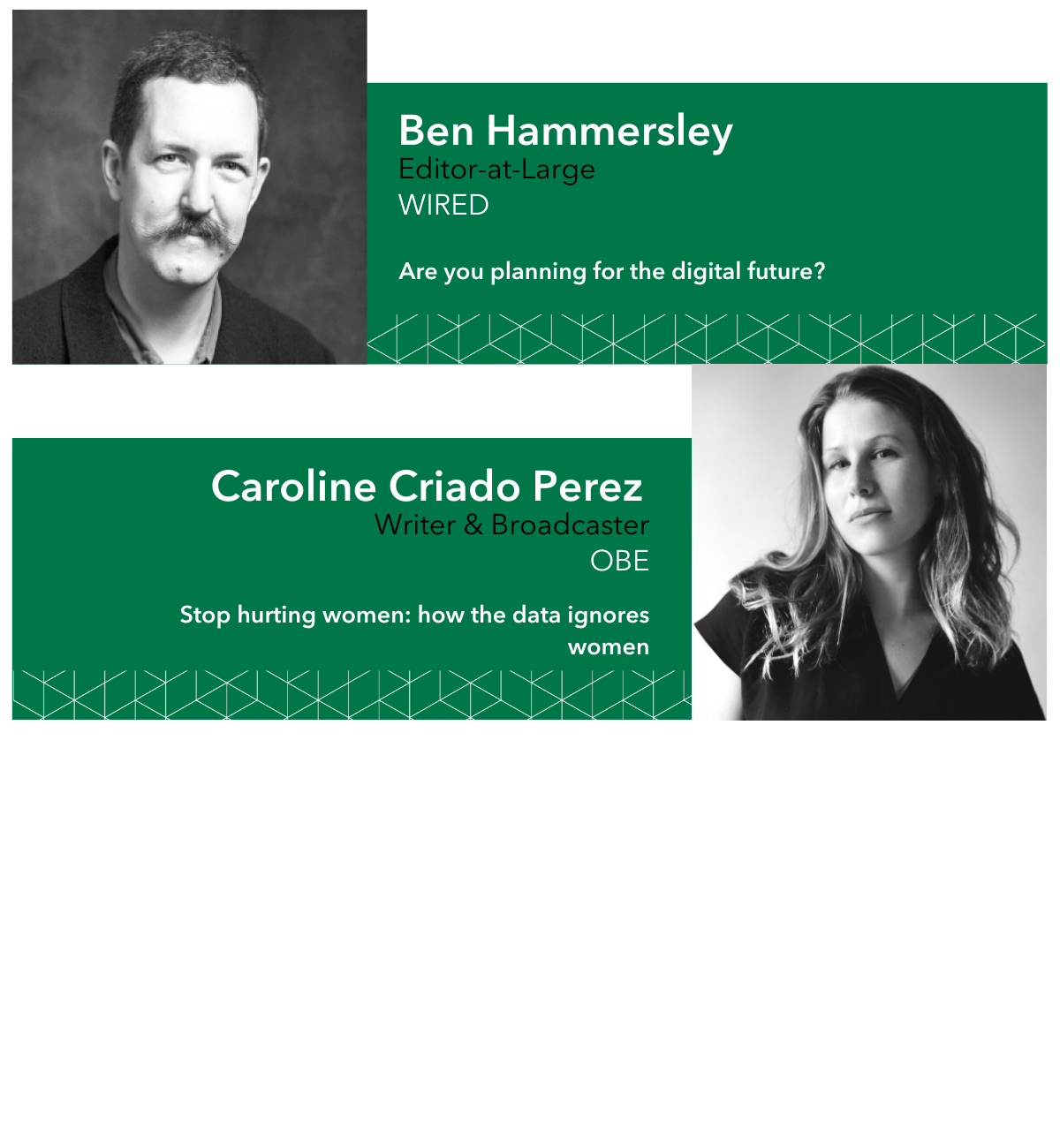

Ben Hammersley

Are you planning for the digital future?

Futurist Ben Hammersley, back by popular demand, shared his expertise on how to do so.

James Kerr

Turn your game around

Hear how high-performing teams work from the author of ‘Legacy’, the story of how the All Blacks did this and won consecutive Rugby World Cups.

Dr Ayesha Khanna

How is digital transforming urban areas globally?

Ayesha shared her expertise on the future of cities to address this question.

Unrivalled access to the global infrastructure community

The Infrastructure Investor Global Passport

The Global Summit is now part of something much bigger.

The Infrastructure Investor Global Passport is a new way for industry leaders to stay connected to the market, meet investors, secure capital commitments and gain a strategic edge throughout the year.

Testimonials

Lincoln Webb

Senior Vice President, BCI

If you are serious about infrastructure investing, Infrastructure Investor’s Global Summit should be a fixture in your calendar.

Stephane Wattez-Richard

Executive Director, Conquest AM

The Global Summit is the best event to meet peers, investors and keep up-to-date on the key challenges & opportunities the asset class faces today.

Holger Haaf

Uniper

To meet so many people in such a short time is not possible without the Summit.

Sponsorship opportunities

The Infrastructure Investor Global Summit offers a unique opportunity for organisations to raise their profile as a part of the premier meeting for infrastructure investment professionals.

For more information on available sponsorship opportunities contact Alexander Jakes, alexander.j@peimedia.com, +44 (0)203 862 7498.

Sponsorship Opportunities

The Infrastructure Investor Global Summit offers a unique opportunity for organisations to raise their profile, as a part of the premier meeting for infrastructure investment professionals.

For more information on available sponsorship opportunities contact Alexander Jakes, alexander.j@peimedia.com, +44 (0)203 862 7498

Connect with infrastructure leaders from around the globe

Meet the entire industry online

Make valuable connections with decision-makers

First time attendee? A warm welcome!

We understand that first impressions are often lasting impressions and we want to ensure your first visit to the Global Summit is worthwhile.

There are multiple forums, private meetings and public networking, seminars and streams all taking place under one roof. With 2,500+ attendees across the Summit week, this is a large event with a lot going on daily. To help our many new attendees, we’ve put together a ‘first-timers’ guide to help you make the most out of your time at the Summit.

Decide which forums to attend

There are seven forums running across the four days of the Summit. The flagship Global Investor Forum runs across two days on Tuesday and Wednesday, with co-located specialist forums running either side on Monday and Thursday. Build your package based on the subjects most relevant to your role and your company’s objectives. It isn’t possible to do everything, so lots of our attendees partner with colleagues to cover sessions happening at the same time.

Explore the week here or download the event brochure to find out more.

On-site helpdesk

If you need help with finding your way around onsite, come to our dedicated helpdesk at the venue. The team can help you navigate the various forums, access and make use of the mobile guide and networking app, and locate public and private meeting spaces.

Register at the early rate for maximum savings

Ticket savings are available up to 6 weeks before the event and the earlier you book, the bigger the saving. There are also savings for package bookings when you book multiple forums and days as well as group bookings when you bring members of your team with you. Speak to one of our team who can talk you through the options available and help you build the best package for you and your team.

Set your objectives and plan your networking

Consider your objectives for the Summit and plan your schedule accordingly. Details of keynotes, sessions, workshops and scheduled networking events are available online before the event so keep an eye out on which topics you want to attend and the speakers you most want to hear from.

Networking is a key feature of the event, so make use of our technology to help plan your meetings in advance. Once you’ve booked your place, you will be able to access the event app to send meeting requests and build your agenda before you arrive. There are also dedicated tables on site themed around key sectors, geographies and strategies.

Dedicated first timers’ lounge

Visit our first timers’ lounge to get your bearings, meet fellow first-timers and take a tour of the venue and technology from our team. Meet with our concierge and let them help you run through your plans for Summit week.

Plan your trip and experience Berlin

The Hilton Hotel is located on the famous Gendarmenmarkt square, in the bustling city center in Berlin Mitte district. Check out the venue page for event timings, travel information and some city info.

Become a Global Summit Navigator

Our brand-new Navigator Pass is a bespoke service which helps you to navigate your way around the Global Summit, identify the right people on our attendee list in advance and arrange time to meet them while in Berlin. Find out more here.

TIMING

Monday 12th – Thursday 15th October 2020

Registration will be open from 7.45 on Monday 12th October.

LOCATION

Hilton, Berlin, Mohrenstraße 30, 10117 Berlin, Germany

ACCOMMODATION

Once you have registered you will receive an email with a booking link for nearby hotels at a reduced rate. There is limited availability operating on a first come first serve basis.

We advise that you do not engage with any third party travel company unless appointed by PEI Media. Please note that HotelMap have been appointed by PEI Media to assist with accommodation booking and a link will be sent to you once registered for the event, should you wish to use the service. If directly contacted by a third party, we advise that you are vigilant and do not hand over any personal details. If in doubt please contact customerservices@peimedia.com.

From Berlin International Airport Tegel:

By taxi:

Taxis are available 24 hours a day. The journey time is approximately 20 minutes, costs approx. EUR 25.00 per way.

By public transportation:

Take Bus 128 in the direction of Osloer Strasse to Kurt-Schumacher Platz and switch to metro U6 in the direction of Alt-Mariendorf to Stadtmitte, approx. 30 minutes, costs EUR 2.80 per person.

or

Take Bus X9 in the direction of Zoologischer Garten to Ernst-Reuter-Platz and then switch to metro number U2 in the direction of Pankow to Stadtmitte, approx. 30 minutes, costs EUR 2.80 per person.

From Berlin Brandenburg Airport Schoenefeld:

By taxi:

From Berlin Brandenburg Airport, taxis are available to take you directly to the Hilton Hotel, Berlin. The journey normally takes around 40 minutes from the airport to the hotel, costs are approx. EUR 35-40 per way.

By public transportation:

Take Train RB14 or RB7 in the direction of Nauen or S9 to S+U Friedrichstrasse and switch to metro U6 in the direction of Alt-Mariendorf to Stadtmitte, approx. 45 minutes, costs EUR 3.20 per person.

About Berlin

Berlin is known for its vibrant culture, exciting history, fabulous food and impressive architecture, so while you are here, why not make the most of your time and explore the city.

Whether you need inspiration for entertaining your clients, you want to learn about the city’s fascinating history or you simply want to take advantage of the laidback lifestyle, take a quick look at these for how best to spend your time:

https://monocle.com/travel/berlin/

https://berlinfoodstories.com

https://www.cntraveler.com/destinations/berlin

The annual meeting place for 600+ institutional investors

- Meet the fund managers doing the deals and the developers and corporates seeking investment and looking to sell assets and recycle capital

- Explore the latest trends and opportunities offered by the growth of the asset class

- More managing partners, founders and CEOs attend and speak than any other infrastructure event

- Hear from leading Fund Managers and fellow infrastructure investors from around the globe as they cover every aspect of infrastructure investment

We offer a limited number of complimentary passes to qualified investors, subject to validation and limited to two passes per organisation. To apply for your complimentary pass, contact our Investor Liaison team, investor.enquiry@peimedia.com.

Our 2020 institutional investor audience

Our LP attendees in 2019 were focused on the following sectors…

They were based in…

They were made up of the following types of institutions…

And had regional appetite in the following…

Qualified investors get access to:

- Comprehensive ‘all access’ package, giving the opportunity to attend all four days of the Summit

- An invitation to attend a closed door investor breakfast briefing or think tank where you can benchmark with your peers

- A bespoke R&A fundraising report detailing market activity from across the asset class built by Infrastructure Investor

- Exclusive access to our digital subscription service detailing recent news and analysis and data on funds and managers *subject to eligibility

We offer a limited number of complimentary passes to qualified investors, subject to validation and limited to two passes per organisation.

To apply for your complimentary pass or for more information, please contact Katherine Watson.

E: investor.enquiry@peimedia.com

T: +44(0)203 937 6766.

*Please note that complimentary passes are only available to the following types of organisations: development finance institutions, endowments, foundations, insurance companies, public and corporate pension funds, subject to PEI validation. Funds of funds and asset managers do not qualify.

One Summit. Seven Forums.

The Infrastructure Investor Global Summit offers four days full of unrivalled networking and exclusive content. Attending allows you to make valuable connections and learn new insights to help drive your investment strategies forward.

The Summit consists of seven specialist forums, offering something for everyone involved in infrastructure. For more information on what will be covered at the specialist forums, click on the events listed below.

The only way to make the most of Summit is to register for your all-access pass which means you can attend sessions from any of the forums, as well as take part in all the networking on offer.

Ticket options available:

Standard Pass

Our most popular pass, allowing you access to the whole event with just one ticket.

3 Day Pass A

Access Monday, Tuesday and Wednesday only. Emerging Markets, Government, ESG & Sustainability and Global Investor Forums.

.

3 Day Pass B

Access Tuesday, Wednesday and Thursday only. Global Investor, Energy Transition, Digital Infrastructure and Infrastructure Debt Forums.

1 Day Pass

A single day pass for those specifically interested in the topics and themes on Monday or Thursday.

2020 Keynote speakers

Lord John Browne

Former CEO, BP

Executive Chairman,

L1 Energy

Dr Ayesha Khanna

Co-Founder and CEO,

ADDO AI

Ben Hammersley

Editor-at-Large,

WIRED

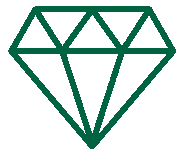

Caroline Criado Perez OBE

Writer & Broadcaster

James Kerr

Founding Partner,

Fable Partners

Wiebe Wakker

Sustainable Adventurer and Founder, Plug Me In

Lord John Browne, former CEO, BP & Executive Chairman, L1 Energy

John Browne’s new book ‘Make, Think, Imagine’ has as its central idea that every society needs to think big and plan physical infrastructure for the future. He discussed the changing nature of global energy markets, including the effect of climate change on the business model of companies operating in extractive industries and the risks posed by investing in potentially stranded assets.

Ben Hammersley, Editor-at-Large, WIRED

Back by popular demand, futurist Ben Hammersley explained how to prepare for the digital future. Attendees heard from one of the world’s leading thinkers explain how the information revolution affects infrastructure assets around the world.

James Kerr, bestselling author of Legacy & Founding Partner, Fable Partners

James Kerr is the man behind the award-winning book Legacy: What the All Blacks Can Teach Us About the Business of Life. James explained how high-performing teams put leadership, teamwork and handling pressure at the heart of daily life.

Dr Ayesha Khanna, Co-founder and CEO, ADDO AI

Dr Ayesha Khanna shared her expertise on the future of cities and specifically addressed how digital applications are transforming urban areas across the globe. Khanna is co-founder and CEO of ADDO AI and has been a strategic advisor on artificial intelligence, smart cities and fintech to a wide variety of clients.

Caroline Criado Perez, OBE, Writer & Broadcaster

Caroline Criado Perez is a best-selling and award-winning writer, broadcaster and award-winning feminist campaigner. Her #3 Sunday Times best-selling second book, Invisible Women: exposing data bias in a world designed for men, was published in March 2019 by Chatto & Windus in the UK & Abrams in the US.

It spent 16 weeks in the Sunday Times bestseller lists, is being translated into nineteen languages, and is the winner of the 2019 Royal Society Science Book Prize, the 2019 Books Are My Bag Readers’ Choice Award, and the 2019 Financial Times Business Book of the Year Award. Caroline was the 2013 recipient of the Liberty Human Rights Campaigner of the Year award, and was named OBE in the Queen’s Birthday Honours 2015.

Brunello Rosa, CEO & Head of Research, Rosa & Roubini Associates

Brunello Rosa is CEO and Head of Research at R&R. He is a visiting lecturer at the department of international politics and a research fellow of the City Political Economy Research Centre at City, University of London. He is also a research associate at the Systemic Risk Centre of the London School of Economics and Political Science, where he is also a practitioner lecturer in finance for MSc students and in macroeconomics for executive-education professionals.

Wiebe Wakker, Sustainable Adventurer and Founder, Plug Me In

Wiebe Wakker is a sustainable adventurer known from his journey in an electric car from the Netherlands to New Zealand. With his project ‘Plug Me In’ Wiebe wanted to educate, inspire and accelerate the transition to a low-carbon future.

His journey crossed 34 countries in 1.222 days and was completely powered by strangers who offered him energy to bring him and his Blue Bandit to the other side of the world.

Wiebe talked about how he dealt with challenges along the way, what he learned from hundreds of people he met in various parts of the world and inspires with motivating lessons learned on the road.

Jean Francis Dusch

CEO, Edmond de Rothschild UK, CIO Infrastructure Debt, Edmond de Rothschild AM UK

Cheryl Edleson Hanway

Regional Head of Industry – Infrastructure and Natural Resources, IFC – International Finance Corporation

Leigh Harrison

Head of EMEA, Senior Managing Director, Macquarie Infrastructure and Real Assets (MIRA)

Patricia Rodrigues Jenner

Member of Boards LGAS/AER plc and Investment Committees , GLIL Infrastructure/AIIM

Dominik Thumfart

Managing Director and Global Co-Head of Origination, Infrastructure & Energy, Deutsche Bank

Dan Wells

Partner, Foresight Group Co-Manager, Foresight Energy Infrastructure Partners, Foresight Group

Your route to more than 600 of the world's institutional infrastructure investors

We’ve just released our 2020 event preview, giving a snapshot of what you can look forward at the event in March.

-

Exciting features and highlights you won’t want to miss

-

An overview of the global investor audience

-

How to make the most of the summit

-

Opportunities to ensure you build valuable connections

-

Our inspirational out of industry keynotes

Shaping the future of the asset class

Benefit from more keynotes and speakers, increased meeting spaces, the world’s largest investor attendance and enhanced networking you simply can’t get anywhere else. This is your chance to participate in creating the future of the industry.

Take a look at the event brochure to find out more about our exceptional speaker line up, reasons to attend and what the event has in store in 2020.

10 years of the Summit

The Berlin Global Summit was two years into its stride when the first issue of Infrastructure Investor was released over ten years ago and has since become the leading infrastructure conference globally.

We chart its expansion from April 2009, when around 200 delegates attended, through to 2019, when the figure exceeded 2,400. Here we explore how it has evolved over time to meet the ever-changing needs of the asset class.

Meet our 2020 Keynotes

Our out-of-industry keynotes are equipped with the knowledge and expertise that will help you plan for the future across all areas of infrastructure. Hear from the likes of Lord John Browne, Ben Hammersley, Dr. Ayesha Khanna and many more…

Hear from more than 300 industry experts across the week

2020 Advisory Board

Our 2020 advisory board has been carefully curated to include some of the industry’s most influential practitioners from the biggest names in infrastructure investment.

Build valuable connections with the entire global infrastructure industry

2,500+

attendees

600+

institutional and private investors

55+

countries

Join the Summit for unrivalled networking opportunities

Easily connect on the networking app

Using our networking app, search the full attendee list, send messages and schedule in meetings with the right people.

Connect with your peers at the Emerald Gala reception

Build new relationships and initiate future investment opportunities on the Monday evening.

Private meeting spaces

A quiet space away from the bustle of the event, private meeting rooms provide a space for your team to meet investors and get deals done.

![]()

Q&A with keynote speakers

Watch a keynote speaker in the main room or catch them in a Q&A with an invited audience later in the day for a more intimate exchange.

Tailor your four-day agenda to meet like-minded people

Choose to attend sessions from any of the seven specialist forums and connect with people focused on the same interest areas as you.

More public meeting spaces than ever before

Meet institutional and private investors at various venues during the Summit to connect with potential partners in a more relaxed atmosphere.

Pre-Event Resources

Global Summit to take place in October

31 March 2020

That these are challenging times is plain for all to see. “Business as usual” is taking a new shape, and, like you perhaps, we’re working out what that looks like.

The well-being of our many thousands of customers, partners and our own personnel is foremost, which is why we are rescheduling the Infrastructure Investor Global Summit 2020 from its current dates to 12-15 October, in Berlin.

In the meantime, we will continue to work to provide valuable insights on the challenges and opportunities the industry faces and we will be communicating regularly with the Infrastructure Investor community to provide details of the Global Summit in October.

Register your interest to be notified of the latest event updates and for further queries, please contact customerservices@peimedia.com.

Global Summit On-Demand

The Infrastructure Investor Global Summit has been postponed to 12-15 October 2020, but we are not waiting for you to come to us. Instead we’re bringing the Global Summit to you with the launch of Global Summit On-Demand.

A digital programme exclusively for paid delegates to the 2020 Global Summit, the On-Demand platform will give you access to recorded webcasts reflecting the Global Summit agenda, a curated stream of relevant articles and a platinum subscription to Infrastructure Investor, our in-depth intelligence service providing industry news, analysis and data.

What's Included?

Exclusive webcasts with some of the key names in global infrastructure investment discussing the topics from this year’s agenda

Access to Infrastructure Investor’s unrivalled insight and analysis from our award winning editorial team.

The latest data and analysis, special reports, rankings, LP/GP profiles and allocations across strategies and regions

Daily updates straight to your inbox with the latest news from across the asset class

How do I get access?

Purchase your ticket to attend the Infrastructure Investor Global Summit this October and get access to On-Demand.

One click access to the infrastructure market

As we all continue to search for ways to maximise business efficiency and returns during the covid-19 pandemic, the Infrastructure Investor Global Summit is committed to connecting the global infrastructure investment community so business can continue as normal as possible.

To deliver on this commitment of creating valuable connections and fundraising for the asset class, the Global Summit is now a virtual experience. Attendees can navigate through the event week though one-click access with real-time content and extended networking.

Redefining the conference experience

![]()

Twelve months of limitless cross-border interactions

Connect with top infrastructure investors through virtual networking. As part of the Infrastructure Investor Global Passport, receive twelve months access to the global community.

The most extensive investor audience yet

No travel restrictions means that the Global Summit Online brings together an even more extensive investor audience. Our investor community includes ATP, Employees Retirement System of Texas, EIF, GIC, Japan Post Bank, Mitsui & Co Alternative Investments, PensionDanmark, Swiss Re, World Bank Pension Plan and many more.

![]()

Maximise your time, maximise your returns

Join the virtual conference for unlimited networking opportunities with enhanced search capabilities allowing you to connect with other attendees who are relevant to your business.

![]()

Exclusive insights and data analysis

Infrastructure leaders from across the globe will keep you at the forefront of the markets and provide solutions as the recovery begins from the covid-19 pandemic.

![]()

All content available when you need it

Join sessions as they happen live or on-demand when they require the content, no matter which time zone you are in.

A personalised Global Summit experience

With four days of leading content, tailor your own virtual experience by creating your own agenda with the sessions that are important to you and your business.

How does it work?

Hear from leading investors and managers

Discover how your peers are responding to the impact of the pandemic and discover investor’s priorities for the next year.

Access four days of interactive content from leading speakers. Watch keynote interviews, panel discussions, debates and much more.

With the online platform you can:

- Create your own daily agenda so you don’t miss a meeting or a key session

- Take part in the sessions through speaker Q&A and live polling

- Watch any sessions you missed at a later date. All sessions will be available on-demand until the end of January

Catch up with old colleagues and make new connections

Connect with leading investors and managers through video meetings, forum discussions and private messaging.

The Summit’s virtual experience provides you with twelve months access to the platform and therefore the infrastructure community.

Through the platform you can:

- Filter and search the delegate list to find the people you want to meet

- Arrange video meetings with other attendees for a private meeting and get deals done

- Take part in forum discussions with other attendees with similar interests to get answers to your most pressing questions and share ideas on key topics

Explore the sponsor exhibition

Explore the virtual exhibition hall and chat with sponsors to discover solutions to your business concerns and find ways to improve the service for your customers.

Through the platform you can:

- Visit the virtual exhibition booth to discover the range of solutions available to help you better serve your customers

- Interact with the exhibitors you can request more information with the click of a button or arrange a meeting to discuss the products and services in more detail

A new way to experience the Infrastructure Investor Global Summit

Join us in Berlin or take part online

In these uncertain times, staying connected with the community and hearing what the future looks like for infrastructure is more important than ever. That is why the Global Summit will be available as a virtual experience alongside the event in Berlin. While we are excited to welcome those who are able to join us in Berlin at the Hilton this October, we understand that this may not be possible for everyone.

Therefore, this year the event will take place in Berlin for those who are able to attend but virtual attendance is also an option. By bringing together physical and digital attendees, the Global Summit is still able to offer you the best networking experience with an even wider audience for you to connect with.

Your options explained

Attending the event in Berlin

Benefit from all the fantastic content and networking in person and enjoy a break from your desk to join the infrastructure community.

With a physical attendee ticket, you will also have access to the virtual event so can benefit from on demand viewing. This will allow you to watch any sessions you may have missed and you can also connect with those who are unable to attend in person.

Attending the event virtually

This option gives you remote access to the event, allowing you to take part in the Infrastructure Investor Global Summit from anywhere, anytime.

You’ll have access to all sessions in real time or on demand. Virtual networking allows you to connect with the online attendees and those in Berlin. Virtual access will start four weeks before the event and will be available until the end of January.

Virtual Pass FAQs

Below we have answered some FAQs to help give you a greater understanding of what the platform is and is not. If you have any other questions that aren’t answered here please email customerservices@peimedia.com.

General

So, what is it?

The Infrastructure Investor Global Summit virtual platform will replicate all the best parts of the in-person conference experience.

You can:

– Watch live panel sessions happening in Berlin and ask questions of the speakers

– Watch and download recordings of the panels at a time more convenient for you, with the platform open until the end of January 2021

– Network with delegates who are both attending in-person in Berlin and those tuning in from around the globe just as you are from 4 weeks prior to the event until the end of January 2021

– Participate in virtual roundtables and themed networking rooms to discuss the topics that matter to you with like-minded peers

How do I access the platform?

The platform will launch 4 weeks out from the event. As a registered attendee, you will be sent a unique code to access the platform. That code is unique to you and cannot be shared with anyone else, just like other password-protected sites.

How will I know how to use the platform?

We will run a full introductory webinar with the functionality of the platform and the Infrastructure Investor team is available to help you out at any point. The advantage of launching it 4 weeks out is that we can help you iron out any issues you might be having with plenty of time before the event!

Content

Do I need to sit in front of my laptop all day?

No. There will be live content (which is where you can take part in live Q&As), but all content will be made on demand until the end of January 2021, so you can watch any session at a time convenient to you.

The discussion rooms will also be live until the end of January 2021 to add your viewpoint to a conversation and catch up on the live comments from the conference if you cannot make a session. You can also direct message speakers of interest to ask them questions or schedule a meeting if you enjoyed their presentation or panel discussion after the fact.

I have watched enough webinars over the past 6 months, why would I want more?

We hear you – which is why we have structured the platform to ensure you are part of the conversation. You will be able to:

– Ask questions of panel speakers during the session

– Spend time face-to-face via video conference with speakers to ask questions after the session

– Join roundtables to discuss the topics that matter to you with like-minded peers

– Focused networking breaks where you can discuss the strategies and opportunities you are interested in

– Pop in to sponsor booths to connect via video and discuss their offerings or a presentation that they just gave

What if I forget a session I want to attend is on?

You can build your own personal agenda within the platform and opt-in to receive notifications when sessions are about to begin. Of course, you can always watch the session on demand until the end of January 2021.

Networking

Is “virtual networking” just a buzzword for direct messaging or email?

Absolutely not! The virtual platform will feature direct messaging functionality, but it also has in-built video conferencing that allows you to invite up to 5 other people into a single meeting. Just select your potential business partner/s from the attendee list and invite them to chat.

Will my invitations for meetings just get lost in the platform?

No, any invitations for meetings will go directly to the recipients registered email address with your meeting proposal just as they normally would through Outlook, iCal, Google Calendar, and other email platforms. Once the recipient has responded, you will also receive a notification to your inbox.

Won’t I be at a disadvantage to the other attendees who are there in person?

It is hard to beat in-person interactions and networking; however, the virtual platform also has its advantages.

– You will be able to see all attendees who are attending each session, or have viewed the recording, to help identify potential business partners and to give a common conversation starting point when sending meeting requests

– At a live event, you may be just hoping to bump into another attendee, speaker or exhibitor, with the virtual platform you have the full list of attendees in front of you where you can click on a name and request a meeting or send them a message

– Networking and messaging functionality will be available for longer than just 12-15 October, meaning you can set times with your key targets in advance of or after the event to ensure you get full value from attending the event virtually

If people are walking around the live event in Berlin, how will I be able to network with them through a computer?

This is a key reason as to why the platform will be available from four weeks before the event until the end of January 2021. Our virtual-only attendees will have the chance to organise meetings with in-person attendees at a time that suits both parties, be that before, during or after 12-15 October.

What about the timezone difference? How do I set meetings on my timezone?

The platform shows available meeting times as per your computers timezone. For example, if you are based in London, a meeting you set for 9am from your account will show to a recipient in Berlin as 10am, reducing the human error impact of incorrectly guessing timezone.

It is worth noting that event timings will be running on Berlin Time (CEST) which is UTC +2. The platform will note the timezone abbreviation next to most timings to avoid confusion.

Build valuable connections with the global infrastructure industry from wherever you are

Meet the people you want, online, without the need to travel. Our virtual event platform connects the industry through interactive networking sessions to make sure you can get the most out of your time at the event.

Meet the right people

Quickly and easily find and connect with the right people. Enhanced search capabilities and sophisticated filtering allow you to narrow down potential contacts by region, investment strategy and sector. This will ensure you don’t miss a single new opportunity.

See who is attending through the attendee list and schedule a meeting with them.

Lead the global conversation

Whatever your area of interest, our ‘birds of a feather’ sessions allow you to quickly identify other attendees with the same focus. These sessions are the virtual equivalent of a breakout or roundtable, so you are face-to-face with like-minded peers to push forward the asset class.

Click into one of our themed rooms to meet contacts and discuss your selected topics.

Chat and arrange 1-2-1 video meetings

Benefit from four days of video meetings with the infrastructure community. Book 1-2-1 meetings throughout the week with global institutional investors in virtual meeting rooms or arrange group meetings with up to five participants.

Twelve months access to the community

Included in your Global Passport subscription, you will have twelve months access to the platform. Access a database of global investors, and benefit from year-round connectivity.

Unrivalled access to the global infrastructure community

Infrastructure Investor is committed to connecting the global infrastructure community so businesses can continue as normally as possible during abnormal conditions.

Infrastructure Investor Global Passport holders will have access to the asset class’s most influential decision-makers across the world.

The Global Passport includes a ticket to five of Infrastructure Investor’s industry-leading virtual events. This includes the Infrastructure Investor Global Summit Online, a virtual edition of the no.1 event in the industry.

Five unique events, one Global Passport

The Infrastructure Investor Global Passport gives you unfiltered access to the decision-makers attending Infrastructure Investor’s five industry-leading events. Connect with investors through the passport up until February 2021.

The Infrastructure Investor Global Summit 2020 agenda was made up of seven specialist forums. Taking place from Monday 12th was the Emerging Markets, Energy Transition, Digital Infrastructure, Infrastructure Debt, ESG & Sustainability and Government Forums. Tuesday 13th – Thursday 15th was the Global Investor Forum.

Download the 2020 agenda

Agenda

Infrastructure Investor Global Summit Online 2020 - Monday 12th

Virtual Platform tutorial

Welcome from Infrastructure Investor

Global macroeconomic and geo-political scenarios post-Covid19

Chair’s welcome & Opening panel

Panel Session : Shaping the future – the changing definition of infrastructure and opportunities it will bring in debt investment

- What might be considered as infrastructure assets in the near future? And will debt investors be provided with opportunities as the definition broadens?

- What can investors do to get ahead of the curve to anticipate coming infrastructure debt opportunities in the future?

- To what extent will digital infrastructure assets be relevant for infrastructure debt funds in coming years?

- How much will energy transition continue to impact infrastructure debt markets?

Chair’s welcome remarks to Infrastructure Debt Forum by Hans-Peter Dohr, Senior Managing Partner, Institutional Capital Associates

Moderator: Dominik Thumfart, Global Co-Head of TIE Origination, Deutsche Bank

Themed networking: A global debt market in constant motion

Themed networking: Sustainable investment in infra debt

Jean Francis Dusch

CEO, Edmond de Rothschild UK, CIO Infrastructure Debt, Edmond de Rothschild AM UK

Read bioRisk vs reward – investor suitability to varying debt opportunities & finding relative value across the capital structure

Panel Session

- Assessing the capital structure in infrastructure debt – what investments are particularly appealing right now?

- How are investors going about evaluating their suitability for different opportunities in infrastructure debt?

- How can GP’s aid them in this assessment and provide them with a suitable strategy?

- Can investors be confident of discipline when it comes to their GP’s strategy? What measures can be put in place to give the investors reassurance?

Moderator: Tod Trabocco, Director, Strategy & Research, ITE Management

Meet the speakers Q&A

Themed networking: Navigating the economy in the post-coronavirus era

Chair’s welcome & opening panel

Working with the deal team: The role of ESG in fundraising and value creation

Panel Session

- How seriously are investment teams really taking ESG?

- Influencing investment teams to ensure ESG is not an afterthought

- Examining the role of ESG in due diligence; historically and now

Chair’s welcome remarks to ESG and Sustainability Forum by Chris Heathcote

Moderator: Mary Nicholson, Global Chief Risk and Sustainability Officer, MIRA

ESG Due Diligence Scenario Session: Deal or No Deal

Managing climate risk within an infrastructure portfolio

Panel Session

- TCFD Update: What are the implications of the latest update for infrastructure investors?

- How can investors use the recommendations to help predict climate risk across the portfolio?

- What metrics are most relevant to measure climate risk?

- Developing a resilience plan to reduce climate risk in infrastructure investments

Moderator Thibault Richon, Managing Director, SWEN Capital Partners

Chair’s welcome & opening panel ‘Assessing ongoing political, regulatory & ESG issues in emerging jurisdictions’

Jin Yong Cai

Partner and GIP Emerging Markets Managing Partner, Global Infrastructure Partners

Read bio

Breakout panel: Power generation – will solar and wind investments ever catch up with coal?

Chair’s welcome & opening panel ‘Improving infrastructure delivery: choosing the right procurement model for your project’

Simplifying governmental regulatory policies to promote investment into infrastructure

Matthew Vickerstaff

Deputy CEO and Head of Project Finance, Infrastructure and Projects Authority

Read bioUrban renewal projects: how different governments are driving the conversion to smart, sustainable, resilient cities

Lunchtime break

Building together: Encouraging deeper collaboration between government, multilateral lenders, and private capital

Breakout panel: Addressing physical climate risks in investment models

Risk sharing: improving the balance between governments, private capital and MLDBs

European Investment Project Portal (EIPP) - the meeting place for project promoters and investors

Government Project showcase - Sydney’s Central Precinct Renewal project

Keynote: The growing power of EVs

Chair’s welcome & opening panel ‘Converging sub-asset classes – examining the synergies between data centres, towers & fibre’

Panel Session

- What are the market developments that are blurring the lines between these three assets?

- How is 5G in particular bringing the three closer together?

- Cost or revenue basis – are there true strategic synergies between these or is this simply a financial play? Do customers genuinely overlap?

- What impact should this convergence have on an investor’s approach to digital infrastructure?

Moderator: Alessandro Ravagnolo, Principal – Consulting, Analysys Mason

Themed networking: Impacts of increasing 5G activity on the fibre market

Meet the speakers

Looking to the long-term in your investment approach when it comes to digital infra

Panel Session

- As the market develops at speed, what can savvy investors do to evaluate regulatory risk in the long term?

- Overbuild risk considerations at a time when the world looks to embrace increasing fibre rollout

- Assessing long-term market penetration when it comes to fibre and other digital infra assets, and why investors must take this into account

- Various models to evaluate across the world – market-based models, concession models, wholesale models, PPP’s and more

Moderator: Manuel Etter, Head – Corporate Development, Loon

Themed networking: Data centres: taking centre stage?

Meet the speakers

Chair’s welcome & opening panel ‘The Maturing of the Energy Transition: Opportunities in a merchant-power world’

Panel Session

- An assessment of global risk/return profiles: How much risk is too much?

- Are return expectations in recently raised funds realistic?

- Specialisation into new technologies & geographies

- Where do investors expect opportunities in the next 5 years?

Chair’s welcome remarks to Energy Transition Forum by Patricia Rodrigues Jenner, Non-Executive Director

Moderator: Frédéric Palanque, Partner, Conquest

Patricia Rodrigues Jenner

Member of Boards LGAS/AER plc and Investment Committees , GLIL Infrastructure/AIIM

Read bio

Themed networking: Battery Storage

Meet the speakers

Renewable Energy Sector Post Covid-19: Impacts on power price and future demand expectations

- To what extent will behavioural changes caused by covid-19 permanently impact demand?

- How will the PPA market be affected by these shifts? Are we likely to see renegotiations and shorter contracts?

- How should managers reconcile forecasted price increases with facts on the ground?

Themed networking: Solar

Meet the speakers

Keynote: Leadership through a time of upheaval

Agenda

Global Investor Forum Online 2020 Day 1 - Tuesday 13th

Networking opens

Networking tutorial

Welcome from Infrastructure Investor

Chair's introduction

Bringing ESG and sustainability issues into the mainstream

Panel Session

- ESG- if not now, when?

- The impact of ESG during a pandemic

- Moving sustainability from a reporting function to top of the CEO’s inbox

- What can investors do to prioritise action on ESG issues?

Moderator: Rick Walters, Infrastructure, Director, GRESB

Meet the speakers

Moderated Q&A and networking with the panel

Themed networking- ESG and sustainability

Keynote speech - Planning infrastructure for the future

Every society needs to think big and plan physical infrastructure for the future. But few governments and political leaders do this in practice.

Former BP Chief Executive John Browne calls for greater imagination in planning and design and explains how this can deliver infrastructure of greater boldness and better quality.

Meet the speaker

Talk to Lord Browne live about the themes of his keynote

Themed networking- Infrastructure of the future

Lunchtime break

Keynote panel - Infrastructure today, tomorrow and the next decade

The Global Summit is now in its 14th year and Infrastructure Investor has recently celebrated our 10th anniversary. Where is the asset class today compared to a decade ago and what are the most notable developments? We pick the brains of industry experts to see what the market thinks the next 10 years will bring.

Moderator: Gregory Smith, President & CEO, InstarAGF Asset Management

Meet the speakers

Moderated Q&A and networking with the panel

Leigh Harrison

Head of EMEA, Senior Managing Director, Macquarie Infrastructure and Real Assets (MIRA)

Read bio

Themed networking- Infrastructure in 2020

What does the rise of sector-specific and region-focused funds mean for infrastructure investors?

Panel Session

- Understanding the matrix of geography and sector.

- Comparing generalist sector-focused funds with more specialist regional vehicles.

- Which sub-sectors have developed the most and in which geographies?

- Lessons learned from specialist approaches in PE and other asset classes

Moderator: Nicholas Hughes, Partner, Clifford Chance

Meet the speakers

Moderated Q&A and networking with the panel

David Giordano

Managing Director, Global Head - BlackRock Climate Infrastructure, BlackRock

Read bio

Themed networking- Specialist funds

Keynote - Stop hurting women: how the data ignores women and creates poor urban infrastructure plans

Keynote Speech

followed by

Meet the speaker

Put your questions to Caroline Criado Perez live

Themed networking- Diversity and inclusivity

The state of play: Infrastructure investors on a difficult start to 2020

Panel Session

- A panel of experts analyse the state of the infrastructure market as we enter a new decade amid the covid-19 pandemic

- Managing valuation shocks and portfolio liquidity issues

- Views on new fund commitments

- Re-upping with existing managers

Moderator: Alexander Chester, Partner, Clifford Chance

Meet the speakers

Moderated Q&A and networking with the panel

Jean Francis Dusch

CEO, Edmond de Rothschild UK, CIO Infrastructure Debt, Edmond de Rothschild AM UK

Read bio

Themed networking- The state of the market

Chair's summary

Agenda

Global Investor Forum Online 2020 Day 2 - Wednesday 14th

Chair’s welcome back and summary of day one

Patricia Rodrigues Jenner

Member of Boards LGAS/AER plc and Investment Committees , GLIL Infrastructure/AIIM

Read bioValue creation in a secondary buyout: Antin & Lyntia

Interview

- Carving out a PE-owned business with a presence in multiple locations

- Recruiting new managers to complement the existing management team

- Developing and executing a plan to refocus the business

- How do value creation levers differ across asset classes?

Speakers:

- Mauricio Bolaña, Partner, Antin Infrastructure Partners

- Eduardo Taulet, Executive Chairman, Lyntia

Interviewed by Zak Bentley, Infrastructure Investor

Meet the speakers

Talk to Mauricio and Eduardo about the Lyntia deal

Speed networking

Big Data and infrastructure

Panel Session

- How and to what extent can investors make use of the data created by their assets?

- Working out what to collect and what’s valuable

- The growing impact of data in improving asset management

- Would sharing open source data help with industry risk management and improve goodwill towards the asset class?

Moderator: Anish Butani, Director, bfinance

Meet the speakers

Moderated Q&A and networking with the panel

Themed networking- Big data

Lunchtime break

The big reveal: Infrastructure Investor’s ranking of largest investors globally

Presentation

Infrastructure Investor’s Research & Analytics team has produced a ranking based on the market value of investors’ private infrastructure investment portfolios both through third-party managed vehicles and direct investments. We reveal the top 30 institutions in the GI50 and compare how the ranking has changed over the past year.

Speaker: Nicole Douglas, Head of Investor Research, Infrastructure Investor

Keynote interview - How lessons from elite sport can be applied to business after covid-19

Learn how to get back to normal and what we can learn from the experience of professional sports teams and leagues about the future of business.

James Kerr, Founding Partner, Fable Partners & bestselling author of Legacy: What the All Blacks Can Teach Us About the Business of Life.

Meet the speaker

Talk to James Kerr live about the themes of his keynote

Surviving rough seas: Infrastructure in a downturn

Panel Session

- Are infrastructure assets behaving as expected?

- How today’s fund structures differ from the past

- Testing the resiliency and discipline of managers

- Fulfilling return expectations in trickier times

Moderator: Bruno Candes, Partner, InfraVia Capital Partners

Meet the speakers

Moderated Q&A and networking with the panel

Recep Kendircioglu, CFA

Global Head of Infrastructure Equity, Manulife Investment Management

Read bio

Themed networking- Infrastructure in a downturn

Co-operative investing- the next trend in core infrastructure?

- How investors are working to identify investment strategies of common interest

- Finding the best value-for-money manager to implement them

- Better aligning supply (variety of funds and their terms) with investor demand

Moderator: Eugene Zhuchenko, Founding Partner, ETORE Advisory

Meet the speakers: Co-operative investing

Moderated Q&A and networking with the panel

Isela Bahena

Managing Director, Private Infrastructure, Nuveen Real Assets and Infrastructure

Read bio

Midmarket infrastructure- is there still value in a rapidly growing segment?

- Assessing how new vehicles and spinoffs are moving into the space

- Finding value by geography, cap size and strategy

- Is the midmarket large enough for funds to deploy at the scale they claim?

Moderator: Ross Posner, Managing Partner, Ridgewood Infrastructure

Meet the speakers: Midmarket

Moderated Q&A and networking with the panel

Stretch Break

The evolving definition of infrastructure as the asset class matures

Panel Session

- Exploring the limits of the ‘infrastructure’ designation

- How funds can evolve their offering to better meet investor portfolio needs

- Do definitions or returns matter more to investors in 2020?

- Are funds chasing double digit returns still acting in the best interests of their clients?

Moderator: Lawrence Slade, Chief Executive Officer, Global Infrastructure Investor Association

Meet the speakers

Moderated Q&A and networking with the panel

Chair's summary

Patricia Rodrigues Jenner

Member of Boards LGAS/AER plc and Investment Committees , GLIL Infrastructure/AIIM

Read bioAgenda

Global Investor Forum Online 2020 Day 3 - Thursday 15th

Chair’s welcome back and summary of day two

Energy investments in the 2020s

Panel Session

- Where are the best opportunities in renewables to be found?

- Development risk and opportunities

- The role of non-renewables and the energy transition

Moderator: Lawrence Slade, Chief Executive Officer, Global Infrastructure Investor Association

Meet the speakers

Moderated Q&A and networking with the panel

Themed networking- Energy

Listed infrastructure- is it the best option for core, core+ and other investors?

Panel Session

- The role of listed as a complementary/alternative opportunity in an infrastructure portfolio

- Achieving portfolio balance through the right mix of assets

- Examining sectors where listed assets can offer superior value to unlisted

Moderator: Fraser Hughes, Chief Executive Officer, Global Listed Infrastructure Organisation

Meet the speakers

Moderated Q&A and networking with the panel

Matt Bushby

Managing Director, Head of Infrastructure Business Development, ClearBridge Investments

Read bio

Themed networking: Listed infrastructure

Keynote - Smart Cities 2.0: The Future of Urban Living

Meet the speaker

Meet Ayesha Khanna and put your questions to her live

Themed networking- Smart cities

Lunchtime break

Communications and digital infrastructure

Panel Session

- Is there still value to be had in the sector de jour?

- Looking beyond towers, fibre and data centres

- PE, infrastructure or something else- what do investors think of the move to digital?

Moderator: Jordan Stutts, Senior Writer, Infrastructure Investor

Themed networking- Digital

Highlights of the Infrastructure Investor Insight findings

Presentation and Panel

The Infrastructure Investor Research & Analytics team surveyed investors in the asset class to capture investor sentiment, relationships with funds, and performance predictions. Investors range from established infrastructure players with diverse fund portfolios, to those planning to make their first infrastructure fund commitments in 2020. Following a brief presentation of the survey’s findings, the panellists will share and discuss their observations and predictions for infrastructure investments.

Moderator: Nicole Douglas, Head of Investor Research, Infrastructure Investor

Gavin Winbanks

Director, Capital Investment & Entrepreneurship - Department for International Trade

Read bioChanging investor sentiment towards direct and co-investments in infrastructure

Panel Session

- Getting the internal setup right to go direct

- Are direct strategies better suited to private rather than public plans?

- How co-investments can provide investors transparency without the underlying risk

- Achieving the right balance of fund, direct and co-investments?

Moderator: Mark Weisdorf, Managing Partner, Mark Weisdorf Associates

Chair’s summary and conference closing remarks

2020 Speakers

Jean Francis Dusch

CEO, Edmond de Rothschild UK, CIO Infrastructure Debt, Edmond de Rothschild AM UK

Cheryl Edleson Hanway

Regional Head of Industry – Infrastructure and Natural Resources, IFC – International Finance Corporation

Leigh Harrison

Head of EMEA, Senior Managing Director, Macquarie Infrastructure and Real Assets (MIRA)

Patricia Rodrigues Jenner

Member of Boards LGAS/AER plc and Investment Committees , GLIL Infrastructure/AIIM

Dominik Thumfart

Managing Director and Global Co-Head of Origination, Infrastructure & Energy, Deutsche Bank