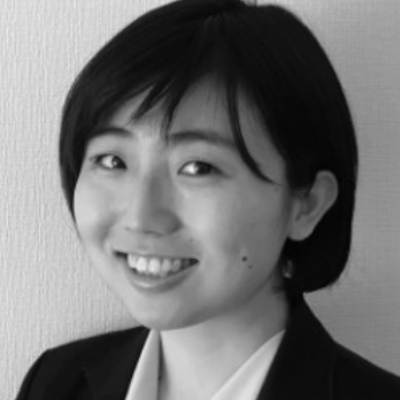

Xiaodong (Akina) Chang

Fund Manager, Private Equity Investment Department, Tokio Marine Asset Management

6月29日にて開催する第5回年次「PDI Tokyo Forum」では、世界各国のプライベート・デット・コミュニティーが一堂に集まり、グローバルな権限を有するグローバルなファンドマネージャーと日本の機関投資家とを結びつけます。

急激に変化するグローバル環境を鑑み、東京フォーラムでは、基準の設定、グローバルな機会の提示、貴社の業績アップに資するネットワークを構築する機会を提供し続けます。

最も信頼がおけるグローバルなプライベート・デットの情報発信の場「Private Debt Investor」の地位を活用するにあたり、このフォーラムは、日本における主要LPとの人脈づくりの場として、または影響力のあるグローバルなGPとの交流の場として最適です。

このカンファレンスを構成する主要な話題:

GPIF(年金積立金管理運用独立行政法人)、第一生命保険、ブラックロック、The Carlyle Group、ゆうちょ銀行をはじめとする巨大投資家とコロナ禍以来、初めて直接交流することができます。

投資家のニーズ変化と、さまざまな戦略への欲求が変更していることを理解できます。

日本の投資家やグローバルなプライベートクレジットのリーダーたちと情報交換し、今後のポートフォリオ戦略について話し合いましょう。

10兆円規模の大学ファンドを運用する国立研究開発法人科学技術振興機構(JST)

マネージング・ディレクター

オルタナティブ投資統括責任者

日本で10兆円規模を誇る大学ファンドのJSTから、同機構のオルタナティブ投資を強化するという方針に沿ったプライベートデット投資アプローチをご紹介いただきます。

Metrics Credit Partners

マネージング・パートナー

PEとデットの機関投資家のAndrew Lockhart氏が、オーストラリアのプライベート・デットマーケットについての情報を共有してください。

日本でプライベート・デットに特化した唯一のカンファレンスとして、当フォーラムは最も有力なグローバルGPと交流ができます。市場の最新トレンドについて同業者と知見を交換し、2023年およびそれ以降の投資機会について話し合う場をご提供します。

日本の大手機関投資家が参加する当フォーラムは、日本の巨大な機関投資家と親睦を深め、ファンドマネジャーの選考方法について学ぶだけでなく、つながりを構築して、資金調達を推進できる絶好の機会です。

自社のスキルとサービスを世界中のシニアプライベートデット専門家に示し、プライベート・デット市場でビジネスを成長させましょう。

よく考慮された関連性の高い内容です。この資産クラスに関する投資家の考えについて良好な洞察が得られます。

非常に良く構成されたカンファレンスです。アセットに関する主要参入者とのコネクションや洞察を得られる好機です

これまで出席したカンファレンス中で、PDIのイベントほどプライベート・デット投資とストラクチャリングの専門知識を統合したカンファレンスは他にありません

プロデューサー Ms Niann Laiに電子メールでご連絡ださい: niann.l@peimedia.com.

弊社は、ブランドが適切な投資家と出会い、コミュニケーションギャップを解消し、影響力のあるプライベートデットコミュニティにおける露出を最大化できるようお手伝いいたします。参加者は、地域および世界の主要プライベートデット投資家、ファンドマネージャー、アセットマネージャーの意思決定者限定となっています。スポンサーシップの特典:

ブランディングやソートリーダーシップに関するご相談は、Beth Piercy(beth.p@peimedia.com または +44 20 7566 5464)までご連絡ください。

ご関心のある議題をプロデューサー Niann Lai(ニアン・ライ)に電子メールでご連絡ださい: niann.l@peimedia.com.

Partner, Head of Japan Relationship Management and Investor Relations, Ares Global Client Solutions Group

Read bio

Executive Director, Head of Private Equity Investments, Japan Science and Technology Agency (JST)

Read bioプロデューサー Ms Niann Laiに電子メールでご連絡ださい: niann.l@peimedia.com.