Connecting infrastructure with Japanese capital

Network with Japan’s most active and influential institutional investors at the Infrastructure Investor Network Tokyo Forum, part of the Infrastructure Investor Japan Korea Week. Debate the current state of the Japanese infrastructure market to develop new investment strategies and expand your fundraising horizons.

Benefit from unparalleled in-person networking to gain valuable insight into Japanese investors’ current appetite in the asset class and better understand the issues shaping the region’s infrastructure market.

Buy your Infrastructure Investor Network membership today and join us at the Tokyo Forum this June.

Apply for a complimentary Institutional Investor pass

A limited number of complimentary passes are available for eligible allocators and institutional investors to join the event.

To qualify for a complimentary pass, you must meet the eligibility criteria in representing a pension fund, insurance company, sovereign wealth fund, private wealth manager, foundation, endowment, family office or corporate investment division.

Apply for a pass and a member of our team will be in touch to confirm your eligibility.

Hear from our inspirational keynote speakers

Expand your fundraising horizons

Gain access to 2,000+ investors and managers globally. Setup pre-event meetings and continue the conversation after the event with your Network membership.

Uncover high-yield opportunities

Share perspectives on Asian investment strategies, learn more about Japanese investor appetite and identify high-yield assets across the region with leading investment practitioners.

Build a global network of influential investors

Create and nurture sustainable relationships with infrastructure’s elite by using our sophisticated networking platform.

Gain insight from Japan’s leading experts

Discuss the current state of Asia’s infrastructure market and debate investment strategies with Japans most successful institutional investors.

Part of the Japan Korea Week

The Infrastructure Investor Tokyo Forum is just one part of the Japan Korea Week; the largest gathering of institutional investors in Asia. Attracting the most active and influential institutional and private investors, the event is the go-to event to fundraise with Asia’s biggest investors.

If you are interested in speaking at the Tokyo Forum, please contact Andrew Wolff

Masatoshi Akimoto

Member of the House of Representatives, Parliamentary Vice-Minister for Foreign Affairs, House of Representatives, Ministry of Foreign Affairs

Hiroshi Matsui

General Manager, Alternative Funds Investments Department, Sumitomo Mitsui Trust Bank

Vignesh Shan

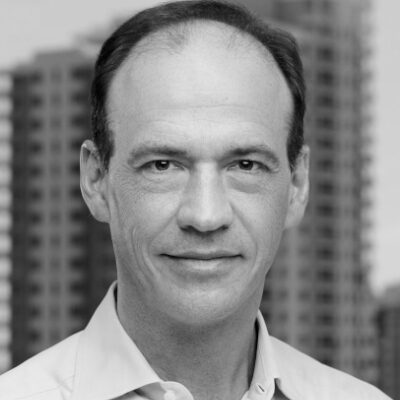

Director, Head of Asia Pacific Investments for BlackRock Infrastructure Solutions, BlackRock

Roland Thompson

Executive Officer and Head of Business Improvement / General Affairs, Green Power Investment

Yuriko Watanabe

Director, Infrastructure Investment/Private Equity Investment Department, Japan Post Bank

Year-round infrastructure networking

The Infrastructure Investor Japan Korea Week will take place in-person and virtually on our industry-leading platform.

Easily seek out relevant investors, get maximum visibility, and maintain relationships across the global industry.

Attendance at the event is now exclusive to Network members – our new investor/manager network. Book a demo to see how, in addition to attendance at the Japan Korea Week, subscription can help grow your business.

Secure your next investor

Japan Korea Week attendees shape the industry

Your access to Japan Korea Week will provide more value than ever before, with year-round access to a directory of global infrastructure’s most influential network.

Advance your fundraising

Expand your fundraising horizons by meeting the most active Japanese and Korean institutional investors.

Uncover high-yield opportunities

Share perspectives on Asian investment strategies and identify high-yield assets across the region with leading investment practitioners.

Save time building your network

Create and nurture sustainable relationships with infrastructure’s elite by using our sophisticated networking platform.

Stay connected with the global network

Helge Rau

wpd AG

The Japan and Korea infrastructure conferences are always an excellent opportunity to meet investors and learn about new developments and trends in the infrastr…

Lydia Gaylord

InstarAGF

PEI continues to drive value for the infrastructure investor marketplace in providing a fulfilling virtual experience with insightful content from top industry…

Yusun Chung

Schroders Korea

The PEI infrastructure events were helpful in connecting various parties in the industry.

Japan Korea Week attendees get more

By attending the Infrastructure Investor Japan Korea Week, you will join infrastructure’s most influential global network. Subscription will give you:

- Access to Japan Korea Week

- Virtual access to all of Infrastructure Investor’s global events

- Access to the investor directory

- Frequent virtual and in-person networking opportunities

- And much more…

Pre-Event Resources

Position your brand at the centre of the infrastructure community

Strengthen your market credibility, put your brand in front of your key target markets and meet your investment and business goals.

Sponsorship gives you:

• VIP access

• Thought-leadership opportunities

• High-profile branding

• And much more …

For more information on the available sponsorship opportunities, please contact Alexander Jakes at alexander.j@peimedia.com or call +44 (0) 203 862 7498.

インフラと日本資本の架け橋

2023年6月15(木)~16日(金)に開催する「Infrastructure Investor Tokyo Forum」は、日本や世界中の最も活発かつ影響力のある機関投資家と接触する機会となります。日本のインフラ市場の現状を協議し、新たな投資戦略を練り、資金調達範囲を拡大しましょう。

日本の投資家と直接交流するこの絶好の機会を活かして、インフラ分野への関心度を探り、アジア地域のインフラ市場の行方を方向付ける課題について詳細な情報を得ましょう。

資金調達範囲を拡大

資金調達の可能性を広げるために、日本で最も活発で影響力のある機関投資家と接触するチャンスを活かしましょう。

高利回りの投資機会を発見

主要投資家とアジア市場での投資戦略について意見を交わし、地域の高利回り資産を見つけましょう。

影響力のある投資家のグローバル ネットワークを構築する

当社の洗練されたネットワーキング プラットフォームを使用して、インフラストラクチャのエリートと持続可能な関係を築き、育てます

日本の大物投資家の見解を聞く

日本屈指の機関投資家とアジアインフラ市場の現状と投資戦略について協議しましょう。

過去の参加者リスト:

日本で最も活動的で影響力のある投資家とつながる

Japan Korea Week の一環

「Infrastructure Investor Tokyo Forum」 は機関投資家が集結するアジア最大イベントである「Infrastructure Investor Japan Korea Week」の構成プログラムとして開催されます。最も活動的で影響力のある機関投資家と個人投資家が参加意欲を示しており、アジア最大の投資家から資金を調達するための注目イベントです。

Networkコミュニーティーの一部に

「Infrastructure Investor Tokyo Forum」に予約した瞬間に、インフラ資産クラスを方向付ける実力者が名を連ねる世界的ネットワークの一員になります。

Network 保有者には、投資家ディレクトリへの通年アクセス、業界リーダーとの豊富な接触機会、以下をはじめとするインフラ投資家カンファレンスへの年間シートといった特典が付与されます。

日本や韓国のインフラ投資へ加速

第6回年次の「Infrastructure Investor Network Japan Korea Week」は6月12〜16日に東京とソウルに再上陸します。 日本や世界中の最も活発かつ影響力のある機関投資家を一堂に集めて、インフラ投資の機会や未来を再発見しましょう。

日本や韓国の大物機関投資家およびゲイトキーパーとグローバルインフラ市場の現状を協議し、新たな投資戦略を練り、資金調達範囲を拡大しましょう。

全ての参加者は「Infrastructure Investor Network」の一員になります。インフラ資産クラスを方向付ける実力者が名を連ねる世界的ネットワークのメンバーたちと交流して、イベント前後も様々のコンテンツを楽しめます。

Why Japan Korea Week?

唯一無二のネットワーキング

2,000人以上のグローバルな投資家や経営者と繋がることが可能です。イベント内外での会員限定ミーティングを組むことができます。

業界のリーダーから聞く知見

アジアで最も経験豊富で、成功をおさめているインフラ投資家からの貴重な経験談を聞くことができます。

資金調達を加速する

最も活躍な日韓の機関投資家と出会うことで、資金調達の可能性を広げることが可能です。.

グローバルな機関投資家に会う

カンファレンスを構成する主なテーマ:

- 日韓投資家のインフラやその他のアセットクラスに対する知見

- 世界投資家が考える日本・世界のインフラ市場への投資機会

- グローバルなマネージャーと効率的に協働するためのヒントとノウハウの分析

- 脱炭素化、デジタル化、進化するエネルギー転換を理解することでインフラ投資戦略を多様化

- インフラデット、再生可能エネルギーなど、トレンドとなる戦略についての解説

「PEIインフラストラクチャーイベントは、業界の様々な関係者同士を繋げるのにとても有効な手段でした。」

Yusun Chung, Private Asset Director, Schroders

イベント情報

2022イベント要約

イベントのレポートをダウンロードして、イベントを経験していただくことが可能です。

- 第一線で活躍するスピーカーや投資家の情報を得ることができます。

- カンファレンスでは重要な洞察や、

- その他多くの貴重な情報を得ることができます。

機関投資家向けの参加パス

『Infrastructure Investor Japan Korea Week』は、インフラ投資を行っている機関投資家やアロケーターが一堂に会する、唯一無二のプラットフォームです。

数に限りがございますが、ご対象のアロケーターや機関投資家の皆様に無料の参加パスをご用意しておりますので、ぜひご参加ください。

条件を満たされているペンションファンド、保険会社、政府系ファンド、プライベート・ウェルス・マネージャー、財団、エンダウメント、ファミリーオフィスの担当者、または企業の投資部門の方に無料パスをお配りしております。

お申し込みいただきました後、担当者より確認のご連絡を差し上げます。

Apply for a complimentary Institutional Investor pass

Complimentary passes are available for allocators and institutional investors to join the Infrastructure Investor Tokyo Forum.

Complimentary investor passes are limited to foundations, endowments, trusts, insurance companies, single family offices, sovereign wealth funds and pension funds who are actively making fund commitments and do not engage in third-party fundraising activities or collect fees for advisory/consulting services.

Apply for a pass and a member of our team will follow up with you to secure your pass.

Confirmed attending investors include:

Network with Japan's most active investors

Institutional Investors at Japan Korea Week 2023

The forum is the largest meeting place for institutional and private investors, and other members of the infrastructure community in Asia.

Check out the benefits of joining the conference and who among your peers you will be joining. Apply for a complimentary pass for your or your team today.

What to expect?

Network with your peers

Enrich your network, build lasting relationships, and exchange valuable perspectives with your investor peers through investor-only breakfasts, networking breaks, lunches and much more.

Gain expert insights

Hear from our industry-leading speaker line-up, discover the latest trends and stay aligned with future innovations in the market.

Explore opportunities

Discover remarkable investment opportunities in sectors including emerging markets, energy transition, infrastructure debt and more.

Meet with the best and brightest funds

Connect and arrange one-to-one meetings with infrastructure’s biggest fund and asset managers in the market.

What to expect on the event day

300+

Attendees

75+

Speakers

100+

Institutional Investors

5+

Networking hours

Apply for a complimentary Institutional Investor pass

A limited number of complimentary passes are available for eligible allocators and institutional investors to join the event.

To qualify for a complimentary pass, you must meet the eligibility criteria in representing a pension fund, insurance company, sovereign wealth fund, private wealth manager, foundation, endowment, family office or corporate investment division.

Apply for a pass and a member of our team will be in touch to confirm your eligibility.

2023 Agenda

For more information on speaking at the Japan Korea Week, please contact Andrew Wolff

E: andrew.w@peimedia.com

Agenda

Infrastructure Investor Tokyo Forum - Day 1 - Thursday 15th

Japanese LP breakfast briefing (by invitation only)

Registration & networking

PEI Opening remarks & Keynote Presentation [Japanese]

Masatoshi Akimoto

Member of the House of Representatives, Parliamentary Vice-Minister for Foreign Affairs, House of Representatives, Ministry of Foreign Affairs

Read bioKeynote Panel: Infrastructure’s role in uncertain economic times [English]

- Given rising interest rates and economic uncertainty how will investor returns evolve?

- What will infrastructure investors need to do differently to protect the strengths of this asset class?

- In an increasingly competitive market for assets, how do funds keep their competitive advantage and access the best deals?

Break

Panel: The evolution of energy transition strategies [English]

- How has the energy security crisis impacted on investment strategies and returns in the sector?

- Looking beyond conventional renewable assets – which areas hold the most exciting investing opportunities?

- Energy Transition as an ESG strategy

Vignesh Shan

Director, Head of Asia Pacific Investments for BlackRock Infrastructure Solutions, BlackRock

Read bio

Presentation: The Multiple Dimensions of the Energy Transition: An Australian Perspective [English]

- The global energy transition is evolving across several primary dimensions

- The importance of navigating the external factors to ensure portfolio resilience

- Short term uncertainty masks longer term value capture opportunities along these dimensions

- Australia is particularly well positioned for infrastructure investment as the energy transition unfolds

Lunch & Networking

Panel: Diversification in the investment portfolio [English]

- Decarbonisation and digitalization – will these two strategies continue to dominate?

- How can investors best diversify risk/return through diversification?

- Investment opportunities in the new definition of Infrastructure: hydrogen supply chain, energy efficiency, battery. Where does one draw the line with PE? Should infrastructure be redefined?

Panel: The role of infrastructure debt in the portfolio [English]

- How have debt funds performed in the current inflationary environment?

- Does infra debt have a comparative advantage to equity in light of the current global economic and political volatility?

- How best to configure ESG into infra debt investing – what are the challenges with the current changing regulations?

- Understanding the Japan infrastructure debt and financing landscape – how does is compare with other OECD markets?

Break

Panel: Investing in the infrastructure of the future, the role of technology in the asset class [English]

- What is infrastructure of the future and how do we define it?

- Is Infratech an infrastructure play or is it best to play in the PE space or debt?

- How do we assess risk/return when taking on technology risk?

Panel: Understanding Japanese LPs appetite for the asset class [Japanese]

- How do LPs view infrastructure in comparison to other private market asset classes? Still at the head of the pack?

- How have rising interest rates and the energy crisis impacted on LPs strategies?

- Core/Core plus & Open/Close funds – which strategies are currently seen as preferential?

Cocktail Reception

Agenda

Infrastructure Investor Tokyo Forum - Day 2 - Friday 16th

Registration and networking

PEI Opening remarks

Keynote Presentation [English]

Kikuko Emae

Senior Director and Head of Infrastructure, Government Pension Investment Fund (GPIF)

Read bioKeynote Panel: International Investors’ take on Japan’s investment opportunity [English]

- How do international GPs and investors evaluate the opportunities for investing in Japan. How much has the weakened yen catalysed interest?

- Does offshore wind and solar remain the principal interest? How easy is it to access renewable deals for foreign entities?

- Building good partnerships with investment companies in Japan. Success case studies

Break

Panel: The next frontier of infrastructure investing in Japan [English/Japanese]

- The hydrogen investing opportunity in Japan – understanding the current FIT framework.

- What can the government do encourage more private capital into emerging sectors?

- Digitalisation and datacentres – are these markets in danger of becoming overheated in Japan?

Roland Thompson

Executive Officer and Head of Business Improvement / General Affairs, Green Power Investment

Read bioPanel: Working with Japanese gatekeepers [Japanese]

- How have current macro-economic headwinds affected fund selection? A priority still for core?

- How do gatekeepers view ESG and sustainability themes when selecting a GP?

- The blurring definition of infrastructure – is this a concern for gatekeepers?

Hiroshi Matsui

General Manager, Alternative Funds Investments Department, Sumitomo Mitsui Trust Bank

Read bio