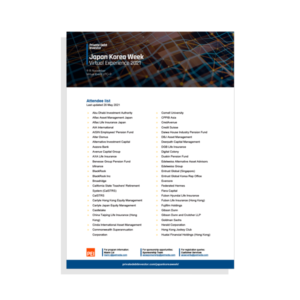

AIA Life Insurance

KDB Life Insurance

Fubon Hyundai Life Insurance

GIC Real Estate International Korea

Government Employees Pension Service

Hanwha Life Insurance

Korea Development Bank

Korea Investment Corporation (KIC)

Korea Investment Management

Korea Fire Officials Credit Union

Kyobo AXA Investment Managers

Kyowon Invest

National Federation of Fisheries Cooperatives

National Forestry Cooperative Federation

Pension Fund of Japanese Corporations

Perpetual Investors

Public Officials Benefit Association (POBA)

Shinhan Bank

Samsung Asset Management

Shinhan Financial Group

The Korean Teachers' Credit Union (KTCU)

The Police Mutual Aid Association

Westlake Capital Partners

Woori Bank

그외 다수.