Investor

Asia Summit Virtual Experience 2020

30 November - 4 December 2020,

Virtual event UTC +8

INFRASTRUCTURE INVESTOR ASIA SUMMIT IS NOW AVAILABLE IN VIRTUAL

Join Asia's premier infrastructure investment meeting place

Strengthen your relationships with Asian infrastructure’s leaders at the Infrastructure Investor Asia Summit Virtual Experience on 30 November – 4 December 2020.

Asia’s premier infrastructure investment meeting place is now virtual to ensure you have the knowledge and connections in a tumultuous year to make smart business decisions. Until the end of February 2021, you have the flexibility to arrange 1-to-1 meetings around your schedule and catch up on insightful sessions at your leisure.

Join industry-leading institutional investors, fund and asset managers, developers, and strategic partners to light a path forward for Asian infrastructure investment and LP outbound capital allocation.

Hear from the industry leaders

CEFC and Future Fund to keynote at the Summit

Featured speakers

This year’s Infrastructure Investor Asia Summit will be running as an immersive virtual experience opening with a day focused on Asian renewable energy strategies, the Renewable Energy Forum on 30 November, followed by the Investor Forum on 1-2 December. Your experience is no longer confined to a couple of days, with expanded video networking and connectivity with the community until the end of February 2021.

WHO TO EXPECT DURING THE SUMMIT?

Connect with industry leaders for unlimited opportunities

Join Asia’s leading Infrastructure community now!

Your event guide to Infrastructure Investor Asia Summit

Find the best way for you to attend the Summit as well as:

- Asia-Pacific is the most attractive market for infrastructure investors

- Why Asia Summit Virtual Experience?

- Key speakers

- Highlighted panels

- Booking information

- And many more…

What past delegates said

Metro Pacific Water

Mikkel Gutierrez

The calibre of the attendees was impressive!

National Australia Bank

Michael Bradley

Excellent opportunity to hear about current developments in the industry and make new connections.

New Development Bank

Roman Novozhilov

Good exchange of current market opportunities with variety of views expressed by high calibre speakers and participants.

30 November

The 3rd annual Renewable Energy Forum will take a deep dive into the strategies generating returns in the region and the investment prospects currently available through our immersive virtual experience.

1-2 December

The Investor Forum is a must-attend virtual conference if you are investing in Asian infrastructure or global fundraising from the region’s behemoth LPs.

YOUR TICKET TO THE GLOBAL INFRASTRUCTURE COMMUNITY

The Infrastructure Investor Global Passport

The Infrastructure Investor Global Passport connects you to the virtual community of infrastructure decision-makers. In addition to the Asia Summit, you will also have access to four of Infrastructure Investor’s industry-leading virtual events in 2020.

WHAT TO EXPECT DURING THE SUMMIT?

Access the Asia Summit anytime, anywhere

![]()

Extended networking days

![]()

World-class content on-demand

![]()

Strategic fundraising advice

![]()

Bespoke LP profiles

![]()

Flexible attendance

This year’s Infrastructure Investor Asia Summit will be running as an immersive virtual experience opening with a day focused on Asian renewable energy strategies, the Renewable Energy Forum on 30 November, followed by the Investor Forum on 1-2 December. Your experience is no longer confined to a couple of days, with extended video networking and connectivity with the community until March of 2021.

Agenda

Renewable Energy Forum - Monday 30th

Tutorial Q&A

PEI welcome and opening remarks followed by: Keynote Panel: Asia as the growth centre for renewables

- How is the Asian renewables sector dealing with the Covid-19 crisis?

- What are the macroeconomic issues that facing renewables as an investment sector?

- Asia as an investment destination compared to the US and Europe in 2020

Keynote Presentation

Interactive Roundtable: Autonomous Vehicles and new Transportation Solutions: Will They Have a Meaningful Impact on Infrastructure Planning and Investment?

Panel: Investing in Asian offshore wind

- Analysis of current deal pipeline and impact of project delays

- The current landscape of offshore wind in Japan

- Investment perspectives on the sector

Interactive Roundtable: Private Credit Investment Opportunities in Emerging Asia Renewable Energy

Break

Panel: Infratech and the energy in transition

- The impact of disruption and its implications for technology

- Improving efficiency and accelerating investments in innovation, e.g. carbon capture and storage

- Understanding the emergence of new technologies

Interactive Roundtable: Chinese Renewables & Energy Storage

Presentation: Green Hydrogen: what are the investment opportunities?

Panel: Investing in solar

- State of the market: how has the crisis affected addition of solar capacity?

- In which areas in Asia is solar showing the most promise?

- Can India’s solar market regain investor confidence?

Speed Networking

Close of Conference

Agenda

Investor Forum Day 1 - Tuesday 1st

Website user Q&A

PEI welcome remarks & Keynote Panel: Investing in Asia in the time of Covid-19

- The current state of Asian economies and their impact on infrastructure growth

- Assessing the impact – which sectors have been hit the hardest?

- What is the new normal for infrastructure in Asia?

Luca Tonello

General Manager, Global Structured Finance, Sumitomo Mitsui Banking Corporation

Read bioPresentation: The impact of Covid 19 on unlisted infrastructure equity returns in Asia Pacific - Q3 2020 update

Interactive Roundtable: Indian Infrastructure

Keynote Case Study: The impact of Covid-19 on airports and transportation – implications for investors

Panel: Meet the GPs – how do they assess their portfolios and the current market?

- Amid the crisis, in what sectors hold value? What are the opportunities in distressed assets?

- How have GPs adjusted to the ‘new normal’? How has this affected their investment strategies and operations?

- How do GPs evaluate the current fundraising environment?

Prasad Gadkari

Executive Director and Chief Strategy Officer, National Investment & Infrastructure Fund (NIIF)

Read bio

Break

Interactive Roundtable: ASEAN Infrastructure

Panel: New growth opportunities in infrastructure and the rise of digital

- New areas of infrastructure investing – digital infra, data centres etc.

- The impact of 5G in spurning the digital revolution

- Are they recession proof? What are the growth opportunities?

Kishore Moorjani

Senior Managing Director, Head of Tactical Opportunities for Asia, Blackstone

Read bio

Panel: Implementing successful investment strategies for Emerging Asian markets

- Where are the attractive markets and sectors for emerging markets in Asia?

- The renewable energy sector in ASEAN – a strong rebound?

- Which sectors are seeing a drive in PPPs?

Josha Bingcang

Senior Vice President for Conversion and Development Group Head, Government of the Philippines

Read bio

Interactive Roundtable: Digital Infrastructure

Interview: An introduction to the UK regulatory system for Asian investors

- Examining the role of regulators and the evolution of relationships with industry

- How does the system of price controls balance investor and consumer interests and underpin reliable investment in UK infrastructure?

- Future challenges: infrastructure investment in context of Net Zero and the Covid-19 recovery

Speed Networking

Close of Day One

Agenda

Investor Forum Day 2 - Wednesday 2nd

PEI opening remarks followed by Panel: Understanding the APAC LP – portfolio allocations & investment strategy

- How have APAC LPs been revaluating their portfolios?

- Where are they increasing/decreasing their allocations? In which areas have they been hit?

- How have LPs been dealing with travel constraints and challenges of executing due diligence?

Interactive Roundtable: LP Roundtable (LPs only)

Developing Infrastructure as a sustainable asset class

- Does all infrastructure need to be sustainable post Covid-19?

- Creating long term sustainable infrastructure portfolios for investors

- Preparing portfolios for the climate change challenge

Dennis Chan

Head of Infrastructure, Managing Director, China Ping An Insurance Overseas (Holdings)

Read bio

Speed Networking

Agenda

Virtual Summit - Thursday 3rd

Interactive Roundtable: Australian Infrastructure

Agenda

Virtual Summit - Friday 4th

Interactive Roundtable: Women in Infrastructure

Interested in speaking at the Summit? Please contact Mr. Andrew Wolff at andrew.w@peimedia.com.

2020 Speakers

Josha Bingcang

Senior Vice President for Conversion and Development Group Head, Government of the Philippines

Prasad Gadkari

Executive Director and Chief Strategy Officer, National Investment & Infrastructure Fund (NIIF)

Rohit Nanda

Head of Asia, Principal Investments - Infrastructure, Sumitomo Mitsui Banking Corporation

Partner with Infrastructure Investor Asia Summit

The Infrastructure Investor Asia Summit will offer a unique opportunity for organisations to raise their profile among senior decision-makers from across the world.

For exclusive sponsorship package of the summit, please contact sponsorship team at asiasponsorship@peimedia.com, call +852 3704 4624.

Download the materials for 2020 Asia Summit

Stay up to date with the latest from Asia’s most influential meeting of global infrastructure investment leaders. From the confirmed attendee list to the latest agenda and the event overview, check back to this page for the information you need to know about the Summit.

Pre-Event Resources

Infrastructure Investor Japan Korean Week Interactive roundtable highlight

By Infrastructure Investor

Connect with Asia's leading infrastructure stakeholders anytime, anywhere

As we all continue to search for ways to maximise business efficiency and returns during the covid-19 pandemic, Infrastructure Investor Asia Summit is committed to connecting the global infrastructure investment community so business can continue as normal as possible.

To deliver on this commitment of creating valuable connections and fundraising for the asset class, Infrastructure Investor Asia Summit is now an immersive virtual experience.

Navigate the conference week through one-click access from the comfort and safety of your time zone available on your device, with real-time and on-demand content, and extended networking running from 30 November to 4 December 2020.

![]()

Limitless cross border interactions

Connect with top infrastructure investors through virtual networking. The platform allows you to book unlimited private video meetings with LPs, headline speakers and many more.

![]()

Exclusive insights and data analysis

Infrastructure leaders from across the globe will keep you at the forefront of the markets and opportunities available in.

![]()

Maximise your time, maximise your returns

By joining our scaled-up virtual conference, you will receive unlimited networking opportunities with enhanced search capabilities to ensure you meet everyone relevant to your business.

![]()

All content available when you need it

Tune in live as it happens or on-demand when you need it so you don’t miss a second of the content, no matter which time zone you are in.

Access Infrastructure Investor Asia Summit, from wherever you are

![]()

Extended networking days

![]()

World-class content on-demand

![]()

Strategic fundraising advice

![]()

Bespoke LP profiles

![]()

Flexible attendance

Don’t miss the opportunities to build relationships with Asia’s largest LPs

Join the new era of networking

Infrastructure Investor Asia Summit remains the premier annual meeting place for the world’s leading institutional investors, fund and asset managers, developers, advisers, and strategic partners to make decisions that defines the future of Asian infrastructure in today’s virtual world.

Our immersive virtual platform allows you to connect with the opinion leaders shaping the future of Asian and global infrastructure investment from the comfort of your (home) office, allowing you to stay ahead during volatile times.

The virtual conference will give you greater access to, and interactivity with, LPs and peers than ever before through extended networking and premium on-demand content available the end of March, 2021.

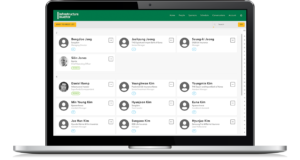

Meet the right people

Enhanced search capabilities, including the ability to see the list of attendees to an agenda session and sophisticated filtering allow you to narrow down potential business partners by region, investment strategy and sector to ensure you don’t miss a single new opportunity.

- See who is attending through the attendee list and schedule a meeting with them

- Use the filter function to meet the right people

Chat and arrange 1-to-1 video meetings

Book unlimited 1-on-1 video meetings with Asian LPs, speakers and global attendees in virtual meeting rooms. Just search for your desired attendees and invite them for a chat. Once you have set up your meeting you can invite other event attendees to join.

- Create a want to meet list to help you gather the people you want to meet in one simple place

- Connect & chat with peers using conversations tab to start a new conversation

- Schedule 1-to-1 video meetings in your built-in schedule

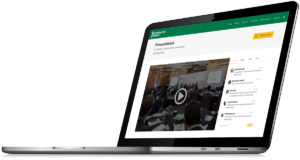

Lead the global conversation

Through interactive roundtable sessions, you can knowledge share with the global Infrastructure Investor community. Interactive roundtable is the virtual equivalent of a breakout or roundtable at a traditional conference, you will be face-to-face with like-minded peers to discuss the asset class’ latest trends and strategies.

- Join interactive roundtable sessions from to discuss the trends moving the industry forward

- In public forums, create new topics and chat with your global leaders

Ask your questions to the titans of industry

Following panels during the conference week, speakers will be available for live Q&A to answer your questions. Discuss challenges and strategies with the panellists and your peers during and after the sessions.

- Engage through live polling and surveys

- Built-in calendar to create your own daily schedule so you don’t miss your favorite sessions

- Automated reminders

Content on-demand when you need it

All content will be streamed live and then available on-demand through the platform until March of 2021. Watch the live content or watch when it suits you from the comfort of your home (office).

- On-demand playback gives you access to sessions until March of 2021

- Private messaging and discussions are also available until the March of 2021 to connect privately and directly online

Book your virtual passes today

Virtual passes offer you limitless cross-border access to the global infrastructure’s most influential community and extended networking until the end of February 2021 with the largest LPs and global GPs in the region.

Unrivalled access to the global infrastructure community

Infrastructure Investoris committed to connecting the global infrastructure community so businesses can continue as normally as possible during abnormal conditions.

Infrastructure Investor Global Passport holders will have access to the asset class’s most influential decision-makers across the world.

The Global Passport includes a ticket to five of Infrastructure Investor’s industry-leading virtual events. This includes the Infrastructure Investor Global Summit Online, a virtual edition of the no.1 event in the industry.

FIVE unique events,

ONE Global Passport

8 September

Meet Korean investors exploring global opportunities

10-11 September

Connect with Japanese capital on global infrastructure

12-15 October

Today’s leaders. Tomorrow’s infrastructure. The Global Summit

30 November – 2 December

Join Asia’s no.1 meeting place for infrastructure investors

2-3 December

Meet investors looking for North American opportunities