International

CFOs & COOs Virtual Roundup All Access

25 March 2021,

Eastern Standard Time (EST) - Virtual, Available Anywhere

Virtual roundups are part of CFO All Access

A CFO All Access subscription is a new way to keep modern CFOs and their teams in the know with high-level content and networking right across the year.

The two roundups scheduled for 2021 are now part of the many essential updates we’ll give you throughout the year with your CFO All Access.

Critical and timely content for you

As a component of CFO All Access, the Virtual Roundup responds to an ever-evolving climate with an interactive virtual meeting of CFOs, COOs and Senior Finance Executives looking to benchmark processes and strategies that are shifting due to these unprecedented times.

The Roundup will provide vital peer insight and feedback on issues impacting firms and portfolio companies and will facilitate the development of solutions for driving the business forward during a crisis in a strategic and operationally focused manner.

The Virtual Roundup will shed light on how CFOs and COOs are addressing subscription lines and alternative sources of capital, virtual fundraising, challenges with valuations, private equity regulation, diversity and inclusion within the firm and much more.

Virtually speaking...

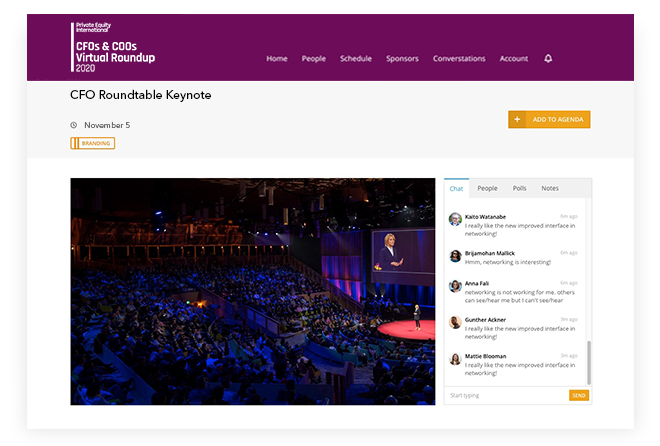

The CFOs & COOs Virtual Roundup delivers the content to you—wherever you are—in a convenient and accessible manner. From your own workspace, engage in dynamic discourse via collaborative roundup and think tank sessions with fellow finance and operations executives, experience insightful panel discussions and receive a roadmap for the course ahead from an authoritative keynote interview.

Engage in a virtual experience designed to provide CFOs & COOs with a unique forum to receive best practices and solution-driven methods to tackle new and emerging challenges.

Network with peers in interactive roundup sessions and invite-only think tank discussions from the comfort of your workspace.

The ease of accessibility and navigation of the Roundup’s virtual platform will allow the private equity community to advance the dialogue on the recent disruptions to the economy and PE industry and its impact on the roles and responsibilities of CFOs and COOs.

What is the CFOs & COOs Virtual Roundup and why do you need to attend?

Co-led by industry experts, the Roundup sessions are collaborative, strategic and solution driven for attendees to discuss the most pressing challenges that are having an impact on their role and responsibilities.

Think Tanks are facilitator led, interactive group discussions for CFOs and COOs to ask questions and converse on a range of hot topics. The invite-only, closed-door sessions for GPs promote open dialogue on best practices for managing the firm.

Breakout sessions are designed for attendees to craft a personalized event agenda. Breakout sessions boast informed panelists delving into critical discussions relevant to today’s finance and operations executives.

Exclusive keynote interviews are a hallmark of the CFOs & COOs events. Industry leaders clear their schedules for in-depth and engaging conversations that assess and raise awareness of industry trends, challenges and solutions.

Your subscription includes:

Click on the events below for more information

Please note annual agenda is subject to change

Virtual access to CFO & COO insight from your own workspace

Discover new strategies to move the firm forward

Discover how your peers are responding to the impact of the pandemic and explore new strategies for managing the evolving CFO & COO roles.

Access interactive content including an engaging keynote interview, collaborative roundup sessions, panel discussions, invite-only think tanks and more.

With the online platform you can:

- Create your own daily agenda so you don’t miss a meeting or a key session

- Take part in the sessions through speaker Q&A and live polling

Catch up with colleagues and make new connections

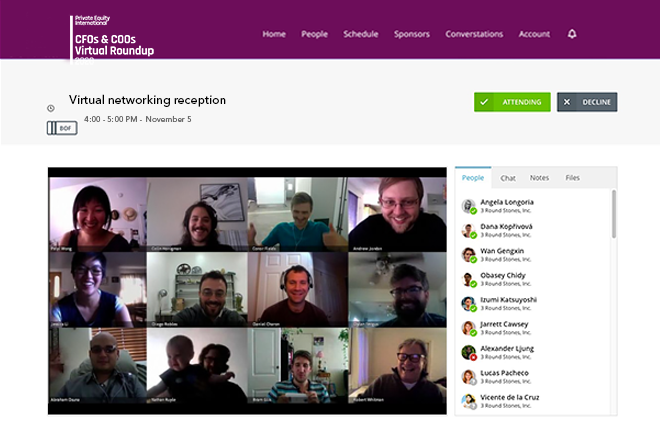

Connect with your peers through video meetings, roundup discussions and private messaging.

The Roundup’s virtual experience provides you with access to the private equity community.

Through the platform you can:

- Filter and search the delegate list to find the people you want to meet

- Arrange video meetings with other attendees for a private meeting

- Take part in Roundup discussions with other attendees with similar interests to get answers to your most pressing questions and share ideas on key topics

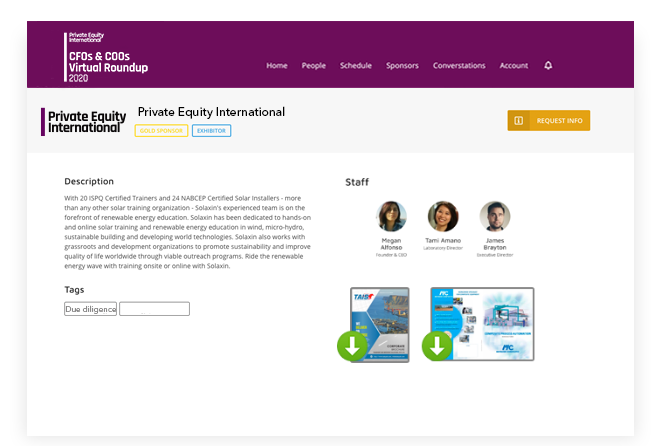

Explore the sponsor exhibition

Explore the virtual exhibition hall and chat with sponsors to discover solutions to your business concerns.

Through the platform you can:

- Visit the virtual exhibition booth to discover the range of solutions available to improve finance and operations at your firm

- Interact with the exhibitors and request more information with the click of a button or arrange a meeting to discuss the products and services in more detail

Additional questions you might be asking

What time zone is the event held in?

What if I have a question or any problems during the event?

-

- Members of our team will be available for the duration of the event to answer any of your questions and help in any way we can.

-

- To get in touch with us:

- Go to the menu bar within the platform, select ‘People’, filter by ‘PEI Media’ and select a member of staff on the Event Operations Team. Then send a message by clicking their profile and they will respond as soon as possible.

- If you are having problems accessing the platform, email regny@peimedia.com

What equipment do I need?

How do I access the platform?

How will I know how to use the platform?

I have watched enough webinars over the past 6 months, why would I want to watch more?

- Ask questions of panel speakers during the session

- Spend time face-to-face via video conference with speakers to ask questions after the session

- Join roundtables to discuss the topics that matter to you with like-minded peers

- Focused networking breaks where you can discuss the strategies and opportunities you are

interested in - Pop in to sponsor booths to connect via video and discuss their offerings or a presentation that they have given

What if I forget that a session I want to attend is on?

You can build your own personal agenda within the platform and opt-in to receive notifications when sessions are about to begin.

Is “virtual networking” just a buzzword for direct messaging or email?

What about the timezone difference? How do I set meetings on my timezone?

2020 Agenda

For speaking opportunities for 2021 Roundup, contact Shamara Ray at shamara.r@peimedia.com.

Agenda

Plenary session - Thursday 5th

Chair’s welcome

Chairman:

Joshua Cherry-Seto, Chief Financial Officer and Chief Compliance Officer, Blue Wolf Capital Partners

Spotlight discussion | Positioning diversity and inclusion at the forefront of your firm strategy

• Asking the tough questions—do you have a diverse and inclusive firm?

• Conducting a thorough analysis of areas of opportunity within your firm

• How is your firm making headway on new initiatives with diversity and inclusion?

• Determining how the business community can collaborate to identify deficiencies and rectify D&I issues

Moderator:

Isobel Markham, Senior Editor, Private Equity Group, Americas, PEI Media

Panelists:

April Evans, Partner, CFO and CCO, Monitor Clipper Partners

Sanjay Sanghoee, COO, CFO and CCO, Delos Capital

Yokasta Segura-Baez, Managing Director, Capital Dynamics

The next four years: a first look into the election’s impact on private equity

• What direction will private equity regulation take in the coming term?

• Assessing whether there are any changes in store for carried interest

• Will the election results heighten or diminish the uncertainty in PE?

• Analyzing what’s necessary to get the economy in good shape

Moderator:

Jason Mulvihill, Chief Operating Officer & General Counsel, American Investment Council

Panelists:

Michael Elio, Partner, Stepstone Group

Kevin Slaton, Chief Financial Officer and Chief Compliance Officer, Insight Equity

Morning coffee break

Roundup A | Effect of the pandemic on subscription lines and alternative sources of capital

• Examining how the pandemic has changed the terms

• Moving away from uncommitted lines to committed lines only

• Utilizing alternative sources of capital due to the near-term scarcity of capital

• Evaluating the cost of capital and competition over bank assets

• Responding to the uptick in LPA amendments requesting additional access to capital

• Capital struggles: portfolio companies requesting greater recycling provisions for LPs

Facilitator:

Jeremiah Loeffler, COO – Credit, Crestline Investors, Inc.

Roundup B | Dissecting the virtual fundraising process

• Adapting to the acceleration of virtual fundraising opportunities

• Launching a virtual fundraise: what you need to know

• Evaluating how to do it and make it interactive

• Determining the right platform

• How are firms doing virtual roadshows?

• What are the technology platforms? Is live or streaming the best approach?

• Key considerations: one-on-one meetings vs. mid-sized or large groups?

• How receptive are investors to virtual fundraising?

• Best practices for virtual fundraising and roadshows

Facilitators:

Thomas Mayrhofer, CFO and COO, EJF Capital, LLC

Stephanie Paine, Chief Financial Officer, Pritzker Private Capital

Roundup C | Private equity regulation: update and projections

• What has been the SEC’s focus in the midst of the pandemic?

• Examining how reporting is changing as a result of COVID

• Differentiating what the SEC is looking at differently post COVID and what it means for your firm

• SEC views on how your valuations and fundraising were done during the COVID period

• New regulatory changes and the corresponding reporting requirements

Facilitator:

James V. Gaven, Senior Counsel and Chief Compliance Officer, Welsh, Carson, Anderson & Stowe

Roundup D | Impact of private equity taking advantage of government assistance

• What financing or assistance did PE access: government programs, PPP loans, etc.?

• If PE is keeping the loans, are they taking forgiveness?

• How does assistance impact the whole portfolio, LPs and reputational risks?

• How have firms communicated to their investors

• Retention tax credits

• Are Main Street programs applicable to private equity?

Facilitator:

Pamela Hendrickson, COO & Vice Chairman, Strategic Initiatives, The Riverside Company

Take a break on your own or grab a bite and join one of the interactive lunch & chat sessions

Optional lunch & chat A | Establishing a return to work profile for your firm and portfolio companies

• Return to work considerations and employee sentiments your firm should be focusing on

• Unraveling the risks of resuming operations within the office

• Assisting portfolio companies with their return to work criteria and process

• Update on vaccine progress and how it impacts return to work decision-making

• Inventive methods employed by private equity to redefine how and where employees work

• Peer perspectives for maintaining firm culture in a remote environment

Facilitator:

Abrielle Rosenthal, Managing Director, Chief Compliance Officer and Chief Human Resources Officer, TowerBrook Capital Partners LP

Abrielle Rosenthal

Managing Director, Chief Compliance Officer and co-Chief Human Resources Officer, TowerBrook Capital Partners L.P.

Read bioOptional lunch & chat B | Onboarding systems: adopting a transparent and seamless process

• Allocating resources to identify and implement optimal onboarding systems

• Gauging how data flows through systems and the insights you get once it’s clean

• Combining onboarding data, PPM, distributions, communications and client insight to share with the deal team

• Managing the increased volume of onboarding and rise of retail investors in your funds

• Methods for onboarding new employees remotely

Facilitator:

Kate de Mul, Director, Client Services, KKR

Track A | How will firms approach valuations in the year ahead?

• Considering different ways to look at valuations: calculations, forward looking, adjustments for COVID, etc.

• Approaches for companies that experienced a short-term impact but not a long-term one

• How are firms handling companies that won’t get back to pre-COVID levels right away?

• Potential challenges with valuations if the economy fails to bounce back in 2021

• EBITDAC: examining the COVID aspects to EBITDA and methods for doing valuations

• How to come up with the right valuations for portfolios given recent unknowns impacting the industry

Moderator

Joshua Weiner, Director, GP Fund Solutions

Panelists:

Andrew Petri, Chief Financial Officer, Pfingsten Partners, L.L.C.

Béla Schwartz, Chief Financial Officer, The Riverside Company

John Yantsulis, CFO & Partner, Searchlight Capital Partners

Track B | Technology in the age of COVID: long-term planning for future situations and needs

• Tech tools, platforms and perspectives firms have been adopting in response to COVID

• Assessing the infrastructure your firm already has in place

• Using your existing technology to its fullest and ensuring teams are implementing all the functionality of the software

• LP communications: emerging approaches and new templates

• Advancements on the radar: employee tracing to ensure staff safety, privacy and mitigate liability

Moderator

Yuriy Shterk, Chief Product Officer, Allvue

Panelists:

Sandra Kim-Suk, Chief Financial Officer, Norwest Equity Partners | Norwest Mezzanine Partners

John W. Polis, Chief Operating & Technology Officer, Star Mountain Capital

Louis Sciarretta, Chief Operating Officer, Kline Hill Partners

Tina St. Pierre, CPA, Partner and Chief Administrative Officer, Landmark Partners

Tina St. Pierre, CPA

Partner, Chief Administrative Officer, Secondaries, Landmark Partners, an Ares company

Read bioTrack A | Passing the test—crisis management and risk management across firms and portfolios

• Handling crisis and risk management with an efficient analysis of the level of threat

• Instituting robust risk management and communication strategies

• Managing crisis and risk given different market dynamics

• Are firms drawing fully on revolvers to ensure cash is readily available to run the business if credit markets go south

Moderator:

John McGuinness, Chief Compliance Officer and Corporate Counsel, StepStone Group

Panelists:

Melissa Gliatta, COO, Thor Equities, LLC

Isaiah Massey, Managing Director – Chief Financial Officer, CAZ Investments LP

Todd C. Schneider, Chief Financial Officer, Shorehill Capital

Track B | Emerging processes and technologies making advances in data management

• Shedding light on data management and the systems available

• How technology is changing the way portfolio monitoring is conducted

• Data technology and what protection requirements to expect from third-party service providers

• Threats on the horizon: putting cyber measures in place to prepare your firm to meet risks

• Enhancing transparency through real time data and LP reporting

• Emerging technologies advancing data management, cyber risk, ESG and HR

Moderator:

Drake Paulson, Senior Director, eVestment Private Markets

Panelists:

Jeffrey Gilbert, Chief Operating Officer and General Counsel, Carnelian Energy Capital

Daren Schneider, CFO & CCO, JLL Partners, LLC

James Stevenson, Chief Financial Officer, ABS Capital Partners

Afternoon break

Think tank A | Comparing and contrasting what CFOs are doing to their firms’ bottom line during the pandemic

• Surveying what kinds of cost cutting measures firms have employed

• Measuring the type of impact cost cutting has made to firm

• Compensation levels-what’s different now and have bonuses been affected?

• Ways CFOs are dealing with how their company financials and P&Ls have been impacted by COVID

Facilitator:

Christine Smoragiewicz, Chief Financial Officer, Intervale Capital

Think tank B | Exploring the alternatives: ingenuity in LP communication

• Strategies for reporting to LPs during COVID

• Advances in webinars, virtual AGMs and the reporting structure to communicate better with LPs

• Examining how the metrics being requested and reported have changed

• Interpreting the increased focus on different types of metrics and the mechanisms for delivery: liquidity, leverage, etc.

• Updating and providing communications regularly to investors

• Giving LPs a view into your firm’s culture, work environment and portfolios

Facilitator:

Kristine O’Connor, Managing Director and Chief Financial Officer, Franklin Park

Think tank C | What will change and lessons learned as a result of COVID

• What is going to change prospectively given what firms have learned from the pandemic?

• What adjustments can be made at the portfolio level?

• Prioritizing the implementation of safeguards for the firm and portfolio

• Proactive measures: identifying the processes that you should have been doing differently all along

• Determining whether board meetings and LPACs can continue to be virtual or prerecorded

Facilitator:

Shant Mardirossian, Partner, Chief Operating Officer, Kohlberg & Company

Think tank D | Innovation alert: ascertaining the best way to meet with management teams

• Overcoming the challenges of considering a deal and meeting with new management in the current climate

• How have firms been meeting remotely or in a socially distanced manner?

• What are firms doing regarding cross-border deals?

• Benchmarking the most creative ways firms are meeting

Facilitator:

Joshua Cherry-Seto, Chief Financial Officer and Chief Compliance Officer, Blue Wolf Capital Partners

Closing remarks – end of conference

Learn, engage and connect online

The Roundup’s virtual experience uses an online platform and provides you with access to quality streamed content from insightful industry experts and peers.

The platform allows you to sit in on roundup sessions, think tanks, breakouts, and even schedule 1-to-1 meetings with other CFOs, COOs and senior finance executives.

Attend from anywhere

Simply join the event online and participate from your own workspace.

Expand your network

Mingle with other attendees during our designated networking hours or schedule your own private meetings

Online networking can never replace face-to-face interaction, but done right, it can provide a very effective way for people to build their professional relationships and knowledge.

Take advantage of these benefits:

- Attendee and Partner directories: Use our searchable directory of our delegates, solution providers and speakers, so you can quickly find the right people and companies to connect with.

- Private messaging: Reach out privately and directly online (without having to expose email and phone number to “the world”)

- Virtual Meet-ups: Schedule one on one video conferences for informal meetups, allowing you to connect and talk about topics of interest throughout the event.

Meet with the country’s leading solution providers in our virtual exhibit space

Just like any conference, you have the opportunity to meet with sponsors and chat with solution providers.

Our features include:

- See what solutions exhibitors have to improve the finance and operations at your firm.

- Automated reminders

- Online meetings with exhibitors: Easily “request information” from exhibiting companies and share your information.

2020 Roundup Speakers

The 2020 Roundup featured finance and operations executives from preeminent private equity firms. Interested in speaking at the Roundup in 2021? Please contact Shamara Ray at shamara.r@peimedia.com or call +1 212 633 1453.

Abrielle Rosenthal

Managing Director, Chief Compliance Officer and co-Chief Human Resources Officer, TowerBrook Capital Partners L.P.

Tina St. Pierre, CPA

Partner, Chief Administrative Officer, Secondaries, Landmark Partners, an Ares company

Engage, interact and enhance your brand

The Roundup offers a unique opportunity for organizations to raise their profile by meeting with the largest gathering of private equity finance and operations executives professionals.

For exclusive sponsorship packages for 2021, contact Cristiana Crocco at cristiana.c@peimedia.com or call +1 646 921 0923.

Pre-Event Resources

Frequently asked questions

We understand that the world of virtual events is a new one, so we have put together a series of FAQs to make things clearer.

If you have a question that isn’t covered below please contact us at customerservices@peimedia.com and a member of our team will get back to you.

When are the conference sessions and networking?

The virtual conference will take place on:

Thursday, November 5

10:00am EST – 4:15pm EST

What is the CFOs & COOs Virtual Roundup?

The CFOs & COOs Virtual Roundup is an interactive virtual meeting of CFOs, COOs and Senior Finance Executives seeking to benchmark processes and strategies that are shifting due to the current climate. Providing vital peer insight and feedback on issues impacting firms and portfolio companies, the Virtual Roundup will facilitate the development of solutions for driving the business forward during a crisis in a strategic and operationally focused manner.

Is the Virtual Roundup replacing the annual CFOs & COOs Forum?

No. PEI introduces the CFOs & COOs Virtual Roundup to our portfolio of events for private equity finance and operations executives to dialogue with peers on strategically navigating new challenges and is a pivotal component in bringing the PE community together in a virtual setting.

Will there be opportunities to network during the Roundup?

The CFOs & COOs Virtual Roundup will include many opportunities for participants to network during collaborative roundup discussions, interactive think tank sessions and informal lunch & chat meetings.

How will I know how to use the platform?

We have a dedicated virtual experience page to help you navigate the platform. The advantage of having access a few weeks before is that we can help you iron out any issues you might be having with plenty of time before the event.

Do I need to be technologically savvy to participate in the Virtual Roundup?

The ease of accessibility and navigation of the platform will allow for a seamless virtual experience. Click the virtual experience tab for additional information and frequently asked questions regarding the platform.

Additional questions?

Please feel free to contact us directly at regny@peimedia.com.