Korean capital, global opportunities

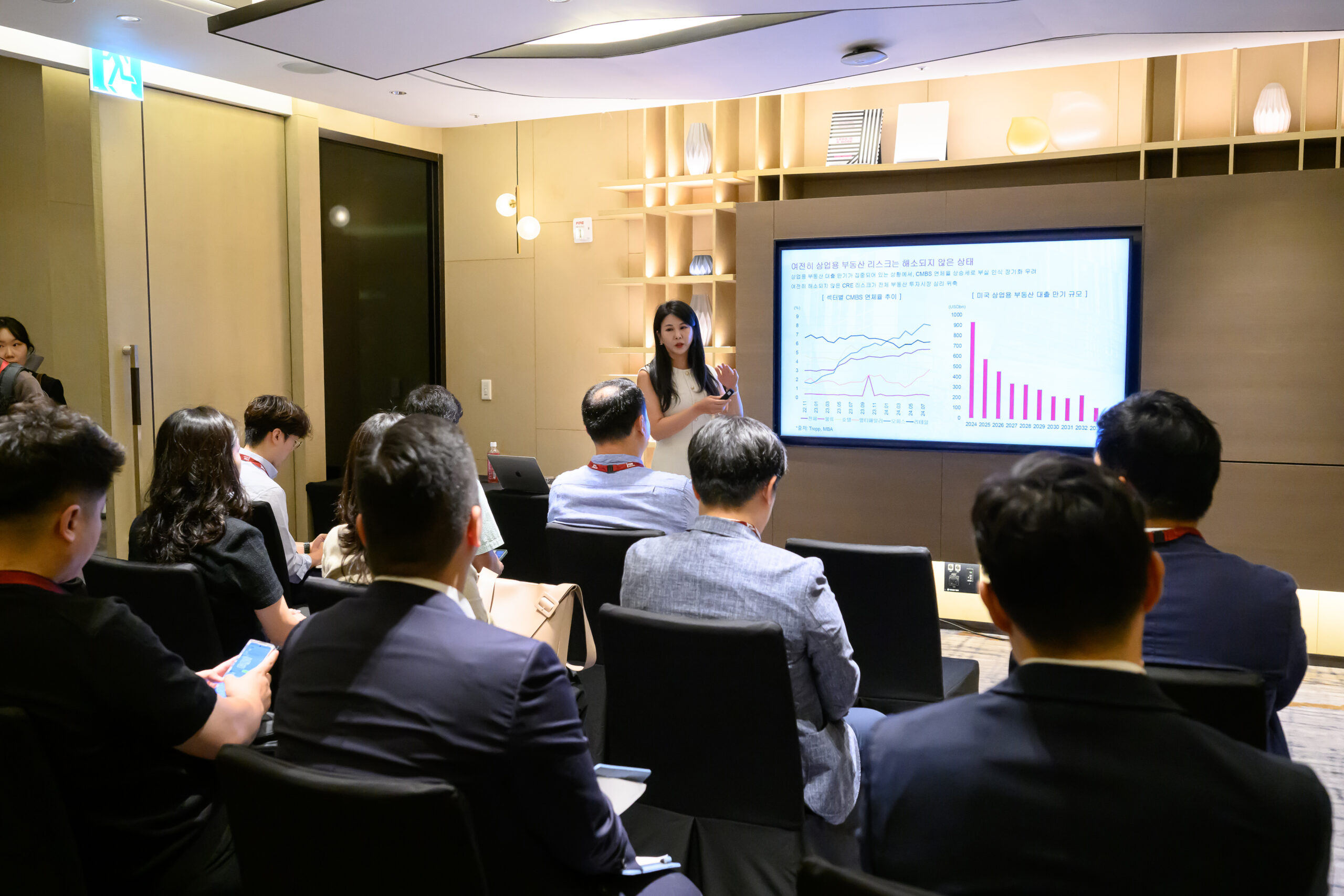

The PERE Network Seoul Forum brings together Korea’s most active institutional real estate investors and senior global fund managers for a focused day of insight, discussion and connection. With institutional investors outnumbering managers by nearly 1.5:1, the forum is designed to facilitate high-quality conversations around capital deployment, valuations, private credit and global real estate strategy.

PERE Network Seoul Forum 2026 will take place on Tuesday, 2 June 2026 in Seoul. Register your interest to receive agenda highlights, speaker updates and early access to registration for Korea’s leading private real estate gathering.

Spotlight download: PERE’s 100 Most Influential

Access our exclusive ranking on the individuals who defined the last 10 years of institutional private real estate — arguably the most challenging and transformative period the sector has ever seen.

Each name on this list left a lasting mark on a market that’s navigated everything from a record bull run, to a global pandemic, to a dramatic reset shaped by inflation and geopolitical upheaval.

300+

attendees

30+ Speakers

150+ LP attendees

2.5:1 LP to GP ratio

Why attend Seoul Forum?

Boost your fundraising

Get the latest insight from Korean investors and align your investment strategies with their allocation appetite.

Gain investor insight

Understand how to strategically position your portfolio to appeal to Korean investors, learn from peers how to tailor to pitch to regional investors.

Better connections

Set up pre-event meetings and continue the conversation after the Forum with your membership to PERE Network. Gain access to 1,400+ investors and managers globally, regular monthly insights and online meetings with fellow industry leaders.

Thought leadership, branding and networking opportunities

Partner with PERE Seoul Forum

The PERE Seoul Forum is Korea’s leading gathering for institutional investors allocating to global private real estate. As a sponsor, you will connect with a concentrated audience of senior decision makers from Korean pension funds, insurance firms, sovereign wealth funds, and other major capital allocators.

The agenda, shaped by the insights of PERE’s editorial team and reflecting the real priorities of investors, gives you a high-impact platform to share expertise, build brand visibility, and engage with limited partners exploring opportunities across diverse real estate strategies. Sponsoring the forum allows your firm to become part of Korea’s core private real estate conversation, strengthen relationships with key allocators, and influence investment decisions across the region.

170+ Attendees

Engage with a highly targeted audience of Korean institutional investors and global real estate managers to build valuable connections and expand your network.

90+ LPs

Meet Korea’s most active real estate investors, including pension funds, insurance companies and sovereign wealth funds, who are actively exploring new opportunities.

20+ Speakers

Hear exclusive perspectives from a carefully selected line up of senior leaders and industry experts, gain market intelligence, and shape the direction of global real estate.

Why Partner with the event?

Network with institutional real estate investors

Engage directly with senior decision makers from pension funds, insurance companies, sovereign wealth funds, family offices, and global managers who are actively allocating to private real estate.

Elevate your brand visibility

Increase awareness of your firm with a highly engaged audience through digital promotion, on site branding, and premium networking opportunities across each PERE event.

Showcase your thought leadership

Position your firm as a market leader by contributing to editorially driven agendas, sharing insights on stage, and demonstrating expertise on the most important topics in private real estate.

Access year round PERE Network connectivity

Extend the impact of your sponsorship with membership to the PERE Network, giving you year round access to more than 1,400 investors and managers through directories, virtual meetings, and exclusive insights.

Drive thought leadership, build valuable connections, and maximise brand visibility

The opportunities to elevate and strengthen your brand

Branding

Pre-Event Resources

Institutional Investors at PERE Seoul Forum 2026

Why attend as a Korean investor?

This is your room. Join over 150 of Korea’s most active LPs to benchmark strategies, compare notes on global allocations, and pressure-test where capital should go next. Meet the managers chasing your mandate and see how they plan to deliver in today’s market.

Complimentary investor passes are limited to foundations, endowments, trusts, insurance companies, single family offices, sovereign wealth funds and pension funds who are actively making fund commitments and do not engage in third-party fundraising activities or collect fees for advisory/consulting services.

Spotlight download: PERE’s 100 Most Influential

Access our exclusive ranking on the individuals who defined the last 10 years of institutional private real estate — arguably the most challenging and transformative period the sector has ever seen.

Each name on this list left a lasting mark on a market that’s navigated everything from a record bull run, to a global pandemic, to a dramatic reset shaped by inflation and geopolitical upheaval.

Meet 2025's Korean institutional investors

Meet the biggest global funds

Network and arrange one-to-one meetings with the biggest and leading real estate managers before, during and after the event.

Network with your peers

Connect with your peers and understand their strategies and allocation approach to real estate.

Get the latest insights

Discuss the opportunities and challenges your peers are facing in the market.

Explore opportunities

Find investment opportunities across traditional and emerging sectors.

Connect, invest and succeed

Value that extends beyond the event

PERE Seoul Forum attendees access unparalleled advantages that extend far beyond the scope of the event day. With the PERE Network membership, forum attendees expand their network, build lasting relationships and discover opportunities year-round through a personalized service plan that fits their needs.

Accelerate your fundraising

Find investors who match your investment strategies and set up meetings ahead of the event on our membership platform.

Expand your investor network

Showcase your profile ahead of the event and use our membership team to connect with the right decision makers.

Better connections

Access unique, critical insight exclusive to members throughout the year along with preferential rates to attend any event within the PERE Network portfolio.

The Network’s dedicated membership team will ensure your experience at the Seoul Forum is first class with personalized introductions and timely roundtable discussions.

Connect with top LPs, build lasting relationships and discuss opportunities that will help take your firm to the next level with the PERE Network.

Unlock your fundraising potential at the forum and beyond with the PERE Network.

Unlock your firm’s potential at the Forum and beyond when you join the PERE Network.

Better connections with the PERE Network

Purchase 12 month membership to attend the Seoul Forum, and enjoy exclusive access to:

- Our network directory of 1,400+ leading investors and fund managers for you to connect with

- Preferential rates to attend other PERE events in UK, America, Singapore and Tokyo

- Invite-only peer groups, monthly webinars and knowledge hubs for deeper insights

Our network makes decisions that shape markets

We are a professional membership offering exclusive access to investors, a wide range of resources, thought leadership and more. The Network provides members with essential information on market trends, compliance topics, regulatory insights, useful tools, online and in-person events and a comprehensive resource library. Members have access to behind-the-scenes, closed-door conversations among a community of peers who share their knowledge and expertise within our trusted Network.

Seoul Forum attendees get more

By attending the Seoul Forum you will join real estate’s most influential global community, PERE Network. Membership will give you access to:

- PERE Connect – our new tailored networking service

- Content and insights to drive better decisions

- Access to the investor directory

- And much more …

Talk to our team to find out how the Forum and the PERE Network membership can help grow your firm.

PERE Global Events

Join our events globally to gain access to in-depth content, insights, and in-person networking opportunities with institutional investors. Contact our team to learn more.

한국의 자본과 글로벌 기회

2025년 6월 3일 PERE Seoul Forum이 한국 투자자와 글로벌 매니저를 연결하기 위해 돌아왔습니다.

PERE 서울에 참석하시면 한국 기관투자자들과의 네트워크 확장 및 그들의 통찰력과 자분 배분전략을 파악하실 수 있습니다.

한국 투자자의 요구를 이해하고 국내외 자본 흐름의 미래를 결정하세요.

자금 조성을 빠르게 하는 팁

한국 기관투자자의 최신 시장 인사이트와 자본배분 성향을 확인하시고 귀사의 투자전략에 반영하세요.

전략적 통찰력 확보

기관 투자자들이 2025년과 그 이후에 집중할 코어 부문과 전략을 확인하세요.

더 나은 네트워킹

PERE Network 를 통하여 이벤트 전 미팅 일정을 잡으시고 포럼 후에도 대화를 지속하세요. PERE Network에 접속하시면 전 세계 1,00명 이상의 투자자 및 펀드 매니저들과 네트워킹 및 매월 다양한 업계 리더들의 인사이트 비디오를 보실 수 있습니다.

PERE Seoul Forum 에서 최고의 인맥 만들기

모든 PERE Seoul Forum 참석자는 네트워킹 플랫폼인 PERE Network의 12개월 멤버십에 가입이 됩니다.

저희 멤버십 회원은 플랫폼을 통해 연중 1,400명 이상의 투자자 및 펀드매니저들과의 이벤트 전후 네트워킹을 하실 수 있습니다.

무료 기관 투자자 패스 신청

적합한 기관 투자자에게는 무료 포럼 참석권이 제공됩니다.

무료 투자자 패스는 재단, 기부금, 보험 회사, 단일 패밀리 오피스, 국부 펀드 및 연금 기금등 펀드 LP 출자를 적극적으로 하고 자문/컨설팅 서비스에 대한 수수료를 징수하지 않는 기관으로 제한됩니다.

패스를 신청하시면 저희 팀이 참석 가능 여부를 알려드립니다.

Our 2025 Advisory Board of Senior Industry Voices

Our advisory board plays a key role in shaping the agenda, ensuring the discussions address real market needs for both Korean LPs and global investors. They provide insights on market trends, identifying the most pressing topics for LPs, and ensuring the conversations reflect what matters most to today’s real estate investors.

Get ready to connect with the most influential players in real estate

Access to the Seoul Forum

Event access and 12-month Network membership –

US$4,045

Early bird pricing ends 7 March

Group Rate:

Purchase 3 or more passes in one transaction to unlock our group discount. Contact: luca.g@pei.group

Benefits include:

- All-access pass to the forum

- Full access to the PERE Network membership for a year

- Insights from + expert speakers

- Network with investors, fund managers and developers

- Access to exclusive networking events

- Matchmaking and networking platform

Investor pass

A limited number of complimentary passes are available for eligible allocators and institutional and private investors.

Limited to foundations, endowments, trusts, insurance companies, single family offices, sovereign wealth funds and pension funds.

Benefits include:

- All-access pass to the forum

- Full access to the PERE Network membership

- Insights from + expert speakers

- Network with investors, fund managers and developers

- Access to exclusive networking events

- Matchmaking and networking platform

View the 2026 agenda

Download the 2026 agenda to see how Korea’s top real estate allocators are thinking about risk, returns, and fund allocation in the year ahead. Access an editorially curated, LP-driven agenda that highlights what Korean investors want—and how global managers plan to deliver it.

Have a topic you think belongs on the 2026 agenda? Reach out to Malathi Maratheyah to share your ideas and help shape the conversation.

Agenda

Main Conference - Tuesday 2nd

Investors’ Breakfast Briefing

- A yearly conference tradition bringing together Korean institutional investors for a closed-door, intimate conversation on the state of real assets.

- A data-driven, honest discussion designed to surface real concerns, real sentiment, and real priorities for the year ahead.

- This year, investors in real estate and infrastructure come together in one room to compare perspectives and share what is truly top of mind.

*Open to institutional investors only, email Elliott Chae (elliott.chae@pei.group) to RSVP.

Fundraising Workshop - What Overseas Managers Need to Know about Korean Investors

- How are Korean institutional investors

redefining their approach to global

managers and what shifts are

shaping capital commitments? - Investors’ expectations on fund

terms, on-the-ground presence, and

alignment - What must global managers do to build relationships and long-term success across the region?

*Open to all, email Genevieve Yap (genevieve.yap@pei.group) to RSVP.

Registration and Networking

View from the Commentary Box- PERE Editor recaps the biggest headlines of H1’26

- A recap of the most consequential breaking news and the top stories that defined global private real estate in H1 2026.

- Interpreting key data points that reveal how fundraising and transaction activity performed in the first 6 months of 2026.

- What these developments mean for investors heading into H2 2026 and the themes to watch for the rest of the year.

Opening Remarks from Conference Chair

Keynote Interview

Keynote Panel: Deploying Capital in 2026- Trends, Valuations, and Global Politics

- Where are the opportunities investors can’t afford to miss?

- How do valuation uncertainty, widening bid–ask gaps, and markets repricing at very different speeds influence deployment timing and the ability to hit investor return targets?

- How is global politics influencing ease of doing business and cross-border deals, and where long-term conviction continues to hold?

Break

Presentation

Panel: Global Managers’ Perspectives – Comparing Opportunities Across Regions and Sectors

- Which regions or sectors are genuinely outperforming expectations?

- What are managers seeing on the ground that investors can’t afford to miss?

- How are managers positioning themselves to capture the next wave of outperformance before everyone else sees it?

Lunch and Networking

Panel: Private Credit’s Next Phase - Where Real Estate Debt Still Delivers

- Where is real estate debt still offering compelling risk-adjusted returns, and how are structures evolving across regions and asset types?

- How is borrower demand shifting in 2026, and what types of deals are creating the strongest opportunities for private real estate lenders?

- How are investors allocating to real estate credit today, and which strategies are drawing the most conviction as the market enters its next phase?

Panel: Turning Value into Liquidity- Valuations, Secondaries, and Exit Pathways

- How are investors assessing value creation and determining fair valuations in a market where pricing signals vary widely across regions and sectors?

- What roles do secondaries, recaps, and continuation structures play in converting that value into credible exit options?

- How are institutional investors and global managers using these pathways to return capital, unlock liquidity, and redeploy into new opportunities?

Panel: Understanding Korea’s Gatekeepers: How Securities Firms Shape GP Access to Korean Capital

- How do Korea’s securities firms act as the key gatekeepers determining which managers and strategies gain access to institutional investor capital?

- What influences their evaluation of global managers — and how do track record, structure, and alignment factor into their recommendations?

- What do global managers need to know about the regulatory shifts, product structures, and local practices that shape how Korea’s securities firms connect them with investor capital?

Break (The following sessions will be co-located with Infrastructure Investor Seoul.)

Panel: Spotlight on investing in datacentres

- Where do managers see data centres as sitting on the risk-return spectrum within real assets?

- How are investors assessing the market overall? Is the AI trend continuing to a boom that is translating to investment on the ground?

- What solutions are managers coming up with to get around the issues over power and grid connectivity?

Real Assets LP Panel: Navigating New Horizons: Korean LPs Expanding Role In Global Real Assets

- Which real asset themes—energy transition, data/compute infrastructure, transportation, logistics—are Korean investors most focused on?

- How are investors incorporating geopolitical risk, currency exposure, and valuation discipline into underwriting and pacing decisions?

- Fund manager selection, have priorities changed for investors in the past year?

Joint Cocktail Reception

2026 Speakers coming soon

Download the 2025 agenda to revisit the hottest topics that were discussed at the Forum.

Please contact Malathi Maratheyah at malathi.maratheyah@pei.group for a discussion on key topics and future speaking opportunities at upcoming PERE Seoul Forums.

2025 Speakers

Attendees at the PERE Seoul Forum 2025 heard directly from Korea’s most active real estate institutional investors—what they had been buying, where they were pulling back, and how their allocation strategies were set to evolve into 2026. For those looking to understand Korean capital, the forum was the room to be in.

Jun-sang Ahn

Global Head of Real Estate Investments, National Pension Service of the Republic of Korea (NPS)

Joseph Chien

Head of Private Real Estate in Asia and Co-Head Private Real Estate Partnerships, Partners Group

Ryan Kwangbok Lee

Indonesia Country Manager, Korea Overseas Infrastructure & Urban Development Corporation (KIND)

Sean K. Lee

Deputy CIO, Senior Managing Director, Head of Alternative Investment Division, Korea Investment Corporation (KIC)

Thought leadership, branding and networking opportunities

Be part of thought-provoking discussions with leading institutional investors, fund and asset managers, developers, advisers, and strategic partners. Sponsorship gives you:

- VIP access

- Thought-leadership opportunities

- High-profile branding

- And much more…

For exclusive sponsorship packages for 2026, contact Charlotte Hung, our Global Business Development Manager of Real Estate at charlotte.h@pei.group.