Fuelling North America’s real estate rebound

Join the most influential names in real estate at PERE America 2025 in New York City on November 4–5 as the forum celebrates its 20th anniversary. This premier event brings together top global investors, fund managers, and decision-makers for two days of high-impact networking and market-shaping insights.

Highlights include:

- Keynotes and discussions featuring sovereign wealth funds, public pensions, and active institutional investors

- Actionable insights into U.S. deployment, global credit markets, and value creation strategies

- Breakout sessions on residential, industrial, offices, data centers, retail, hospitality

- High-impact networking from breakfast meetings to evening cocktail receptions

Secure your seat today and be part of the conversations shaping tomorrow’s real estate.

Key discussion topics:

The smartest bets on the U.S. as the market rebounds

The appeal of Europe as an investment destination

New trends shaping value-add strategies to meet changing market demands

Opportunities arising from the growing flow of global capital into U.S. debt markets

Whitepaper: North American real estate investors:commitments and strategies

Our latest comprehensive report explores fundraising in the American real estate sector and the strategies and investments preferred by institutional investors, both domestically and internationally.

Download the full version to read more.

Explore our featured networking opportunities

Build a network that transcends the Forum

20th anniversary networking cocktails

Round out your first day at the Forum with a toast to outstanding professionals whose vision, creativity, and commitment have transformed the private real estate market. Then unwind over refreshments, connect with new faces, and broaden your professional community.

Investor council breakfast meeting

In this interactive session, hear your investor peers’ most pressing challenges and their innovative solutions. With an emphasis on real-world applications, you’ll walk away with actionable strategies and fresh ideas to enhance outcomes at your firm.

Come prepared to learn and share!

The Power Mixer: 20 Years of PERE Connections

Joint grand networking cocktails. Meet senior real assets decision makers as PERE and Infrastructure Investor members combine for enhanced networking you won’t find anywhere else.

2025 speakers:

Connect with American investors. Increase your visibility. Lead the industry.

Elevate your brand

Reach out to Charlotte Hung at charlotte.h@pei.group

or call +44 203 937 6767

2025 speakers

The PERE America Forum is the premier gathering of global investors, featuring a world-class speaking faculty of equity and credit leaders who share key opportunities, challenges, and insights shaping real estate strategies across the region.

For more information on speaking opportunities or to discuss key themes for the 2025 agenda, please contact Brix Sumagaysay at brix.s@pei.group.

Inna Khidekel

Partner, Senior Managing Director & Co-Head, Client Solutions Group, Bridge Investment Group

Thought leadership, branding and networking opportunities

Position your brand at the center of North America’s most influential private real estate gathering. It’s an unmatched opportunity to showcase your expertise to a curated audience of global investors, fund managers, and decision-makers actively shaping the future of the asset class.

- Access influential capital: Connect directly with institutional investors allocating to real estate strategies

- Showcase thought leadership: Position your firm as a trusted expert through speaking roles

- Maximize brand visibility: Gain prominent exposure before, during, and after the event across all key marketing channels

Connect with Charlotte Hung (charlotte.h@pei.group) to craft a custom package that gets you in front of the investors and decision-makers who matter most.

Connect, invest and succeed

Value that extends beyond the event

PERE America Forum attendees access unparalleled advantages that extend far beyond the scope of the event day. With the PERE Network membership, forum attendees expand their network, build lasting relationships and discover opportunities year-round through a personalized service plan that fits their needs.

Accelerate your fundraising

Find investors who match your investment strategies and set up meetings ahead of the event on our membership platform.

Expand your investor network

Showcase your profile ahead of the event and use our membership team to connect with the right decision makers.

Better connections

Access unique, critical insight exclusive to members throughout the year along with preferential rates to attend any event within the PERE Network portfolio.

The Network’s dedicated membership team will ensure your experience at the America Forum is first class with personalized introductions and timely roundtable discussions.

Connect with top LPs, build lasting relationships and discuss opportunities that will help take your firm to the next level with the PERE Network.

Unlock your firm’s potential at the Forum and beyond when you join the PERE Network.

Better connections with the PERE Network

Purchase 12 month membership to attend the America Forum, and enjoy exclusive access to:

- Our network directory of 1,400+ leading investors and fund managers for you to connect with

- Preferential rates to attend other PERE events in UK, Singapore, Japan and Korea

- Invite-only peer groups, monthly webinars and knowledge hubs for deeper insights

Our network makes decisions that shape markets

We are a professional membership offering exclusive access to investors, a wide range of resources, thought leadership and more. The Network provides members with essential information on market trends, compliance topics, regulatory insights, useful tools, online and in-person events and a comprehensive resource library. Members have access to behind-the-scenes, closed-door conversations among a community of peers who share their knowledge and expertise within our trusted Network.

America Forum attendees get more

By attending the America Forum you will join real estate’s most influential global community, PERE Network. Membership will give you access to:

- PERE Connect – our new tailored networking service

- Content and insights to drive better decisions

- Access to the investor directory

- And much more …

PERE Global Events

Join our events globally to gain access to in-depth content, insights, and in-person networking opportunities with institutional investors. Contact our team to learn more.

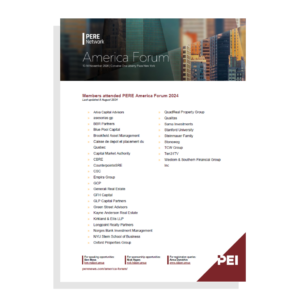

Institutional Investors at the PERE America Forum

Join us at the America Forum, where you’ll connect with over 200 institutional investors and fund managers from around the globe.

This is your chance to discover the latest investment opportunities in private real estate and gain invaluable insights into how your peers are tackling the industry’s biggest challenges. Limited complimentary passes available for qualified institutional investors!

Don’t miss out! Apply for a pass and a member of our team will follow up with you to secure your pass.

PERE America Forum is co-located with Infrastructure Investor America Forum and New Private Markets Investor Summit: North America. Don’t miss your chance to network with investors allocating to different asset classes at the joint networking cocktail reception.

Benefits for attending investors include:

PERE Investor council breakfast meeting

This off-the-record session for investors will discuss the pressing challenges and their innovative solutions. With an emphasis on real-world applications, you’ll walk away with actionable strategies and fresh ideas to enhance outcomes at your firm.

Investor-led panels

Gain actionable insights from thought leaders in private real estate on navigating market volatility, identifying high-growth sectors, and building resilient portfolios in today’s dynamic landscape.

Network with your peers

Connect with other institutional investors to understand their strategies and allocation approach to real estate. Discover co-investing opportunities.

Connect with your investor peers

Join discussion on what your peers are doing so you can sharpen your investment strategies. Our growing list of investors include:

Complimentary passes are available for allocators and institutional investors to join the PERE Network’s America Forum.

Complimentary investor passes are limited to foundations, endowments, trusts, insurance companies, single family offices, sovereign wealth funds and pension funds who are actively making fund commitments and do not engage in third-party fundraising activities or collect fees for advisory/consulting services.

Apply for a pass and a member of our team will follow up with you to secure your pass.

Pre-Event Resources

Whitepaper: North American real estate investors: commitments and strategies

By PERE America Forum

Editorially curated and newly expanded agenda

What’s new this year:

- Deeper dives into commercial real estate trends

- A full day dedicated to real estate credit strategies

- Fresh focus on value creation and asset management

- Emerging opportunities in proptech and alternative sectors

Keen to join the speaking faculty? Contact Brix Sumagaysay today.

Agenda

Day 1 - Tuesday 4th

Registration and networking breakfast

Breakfast briefing - Power players of real estate: How sovereign wealth and public pensions are reshaping the real estate map

Discover how sovereign wealth giants and public pension titans are setting bold new priorities, transforming the global real estate game, and reshaping asset classes with billions in long-term capital.

Presenter: Diego Lopez, Founder and Managing Director, Global SWF

PEI welcome and chairman’s opening remarks

View from the commentary box: 20 years of PERE

Jonathan Brasse, Editor-in-Chief, Real Estate, PEI Group

Keynote interview: How global institutional investors are engaging real assets strategies

Rachel EJ Oh, head of New York office of Korea’s preeminent state investor NPS, makes her PERE event debut in a keynote fireside conversation with Jonathan Brasse, PEI’s Editor-in-Chief, Real Estate, to dissect the growing trend of viewing investment markets through a real assets lens.

- Taking the current pulse of the trend: why a concerted real assets thesis increasingly represents today’s secular forces

- Today’s turmoil and its impact: what current macroeconomic predicament means for investment in real assets

- How managers are responding: what they are getting right, wrong and still need to understand about institutional requirements

- Common ground: which sub-sectors within the real assets universe share the most elements and why that is important

Rachel EJ Oh, Head of New York office, NPS

Jonathan Brasse, Editor-in-Chief, Real Estate, PEI Group

Keynote panel: Insights on the future of global real estate as an asset class

- Explore how managers are positioning their portfolios to attract investors amid high interest rates and geopolitical concerns

- Is real estate selling itself well-enough to global investors?

- How are institutional investors shaping global real estate, and what opportunities exist for private wealth to participate?

Moderator: Evelyn Lee, Editor, PERE

Jeff Giller, Partner and Head of Real Estate, StepStone Real Estate

Jonathan Pollack, Starwood Capital Group, President

Panel: US deployment outlook

- What are the smartest bets on the U.S. as the market rebounds?

- A keen look at secular trends in the country today informing investment decisions (interest rates, capital costs, shifting consumer demands, etc.)

- Beyond traditional property sectors, what alternative sectors are gaining attention?

Moderator: David Hodes, Managing Partner, Hodes Weill & Associates

Laurel Durkay, Managing Director, Morgan Stanley Real Estate Investing (MSREI)

Stephen Holler, Senior Vice President, Legal, QuadReal Property Group

Nael Mustafa, CEO, GFH

Networking coffee break

Presentation: Private real estate in numbers

- The latest LP allocations data

- The largest deals and most active managers in the past year

- The top performing funds based on IRR from the past decade

Panel: The appeal of Europe as an investment destination

- How is Europe’s market diversity appealing to both institutional and private investors seeking variety and geographical diversification?

- Comparing risk and return profiles of European markets to other real estate markets

- How are European cities adopting sustainability initiatives, and how are these impacting real estate investment trends?

Michael Abel, Founder & CEO, Greykite

Rune Kock, CEO, NREP (part of Urban Partners)

Maria Surina, Managing Director, Real Assets Investment Group, Cambridge Associates

Investor panel: Allocations, appetite and activity in real estate today

- Unpacking key factors shaping today’s allocation strategies – market trends, risk appetite, and the hunt for long-term yield

- How are economic and geopolitical factors shaping global vs. regional real estate allocations?

- How does real estate hedge against inflation through value growth, rising income, intrinsic worth, and debt?

Moderator: Greg Dool, Americas Editor, PERE

Karen Horstmann, Managing Director, Real Estate, CDPQ

Anthony Liparidis, Managing Director and Head of Real Assets, Bessemer Trust

Ed Lerum, Head of Global Logistics Real Estate, Norges Bank Investment Management

Navid Chamdia, Head of Real Estate Investments, Qatar Investment Authority

Charles Lavallee, Director, Real Estate Investments, PSP Investments

Networking lunch break

Panel: Navigating opportunities in residential real estate

- With rising global demand for student housing, how will managers and developers respond?

- How will tariffs impact construction costs and the build-to-rent sector?

- How are family offices and private wealth shaping residential real estate?

Moderator: Guelda Voien, Editor, PERE Deals

Rob Lester, Senior Vice President, Chief Investment Officer, The RMR Group

Chad Buchanan, Managing Partner, Twin Light Capital

Panel: Institutional capital in industrial real estate

- What are the best strategies for scaling institutional capital in the industrial sector?

- How can investors structure capital and manage risks in warehousing?

- Leveraging automation to future-proof warehousing assets and increase value

Moderator: Nancy Lashine, Founder and CEO, Park Madison Partners

Gila Cohen, Partner and Chief Investment Officer, Vanbarton Group

Networking coffee break

Panel: Data centers – fuelling the future of the digital revolution

- Predicting future demand from AI and the scale of digitalization opportunity

- New trends in capital allocation and fundraising challenges in the sector

- Analyzing the supply-demand imbalance, and profitability trends of data centers

Emily Azer, Director, Data Infrastructure, GI Partners

Lisa Strope, Vice President, Research, TA Realty

Panel: Hospitality reimagined – capitalizing on the boom in global travel

- Is hospitality a “mainstream” investment? Where do opportunities lie in global markets?

- Can hospitality provide optimism for investors in times of volatility?

- Secondary and tertiary markets that offer growth potential

Moderator: Rose Hasham, Board Member/Real estate SIG Lead, Harvard Business School Club of Dallas

Stephany Chen, Senior Vice President, Acquisitions, Trinity Investments

Panel: New trends shaping value-add strategies in real estate

- How to meet changing market demands, scale up, and overcome efficiencies

- How does value creation offer investors flexibility and resilience for the future?

- Insights on the impact of different value creation levers

Moderator: Silvana Oliva, Senior Advisor, Independent

Heather Fernstrom, Co-Founder & Managing Partner, Alliance Global Advisors

Panel: The use of tech and AI as a differentiating factor in value creation

- Using AI and technology to enhance decision-making, improve efficiency, and drive profitability

- How data-driven decisions add value

- Embracing technological advancements and operational risks

Moderator: Ali Humphrey, Managing Partner, Arna Advisors

Marie Ffolkes, Managing Partner, GenNx360 Capital Partners

Armel Traore dit Nignan, Head of Data Analytics, Principal Real Estate

Networking coffee break

Panel: Modernizing the ‘new office’

- Analyzing ‘best-quality’ office buildings in today’s standards

- Addressing the growing demand from tenants for tech-enabled and energy efficient properties

- The pivotal role of technology in decarbonization, enhancing returns, and increasing resiliency of offices

Diana Hsieh, Head of Asset Management, US, Oxford Properties

Panel: Retail reinvented – why tenant experience is a value strategy

- Examples of best-in-class retail platform in today’s environment

- How tenant experience initiatives translate into measurable KPIs

- How are landlords supporting tenants with digital integration to drive customer traffic and sales?

Moderator: Harrison Connery, Senior Reporter, PERE

Closing keynote: Reimagining real assets – investing for resilience, growth, and the future

- Real estate vs. infrastructure allocation strategies: How institutional investors are balancing these asset classes for risk-adjusted returns

- How do differing fundamentals between real estate and infrastructure create opportunities for a blended portfolio strategy?

- How are inflation, interest rates, and economic cycles impacting real assets globally and how to build portfolios that withstand shocks?

Networking cocktail reception

End of day 1

Agenda

Day 2 - Wednesday 5th

Breakfast briefing (RSVP required)

The role of AI and technology in capital allocation, due diligence and value creation

Investor breakfast briefing (off-the-record, invite-only meeting)

Join PERE members to discuss macro real estate challenges, the changing face of real estate debt, the lending environment and more in an off-the-record discussion group.

Registration and networking

Welcome remarks

Chairperson: Nathalie Paladitcheff

Keynote interview: Financing the future – unlocking value in private real estate credit

- Shifts in borrower profiles and capital needs in today’s market and how private credit is filling the financing gap

- As interest rates rise and bank lending tightens, how can private lenders seize value through recapitalizations, bridge loans, and rescue capital?

- The role of fintech and AI in origination, underwriting, and asset management

Moderator: Samantha Rowan, Editor, PERE Credit

Keynote panel: Key trends shaping real estate debt ahead of the coming cycle

- Opportunities and challenges arising from the growing flow of global capital into U.S. debt markets

- How are borrowers and lenders adjusting underwriting standards in a persistently high-rate environment?

- What strategies can be used to remain resilient during downturns or capital market disruptions?

Moderator: Randy Plavajka, Deputy Editor, PERE Credit

Tamara Lawson, CFO, QuadReal

Paul Rahimian, CEO, Parkview

Lesley Lanefelt, Head of Nordic Investments, Velo Capital (part of Urban Partners)

Networking coffee break

Fireside chat: How non-bank lenders are reshaping real estate finance

This session will tackle at the rise of non-bank lenders and the increasing focus on flexible, tailored debt solutions.

Moderator: Samantha Rowan, Editor, PERE Credit

Panel: Navigating C-PACE – balancing risk and return in structured finance

- A deep dive at the growing role of C-PACE and why its intersection with the CMBS market is critical for borrowers and investors

- How are servicers and legal teams rethinking consent frameworks to support energy-efficient improvements without jeopardizing senior loan positions?

- Real-world strategies for integrating C-PACE into CMBS-backed deals

Natalie Herald, Head of Commercial Mortgage – Alternatives, MassMutual

Alexandra Cooley, Chief Investment Officer and Co-Founder, Nuveen Green Capital

Panel: Unlocking portfolio value – strategic use of back leverage in real estate funds

- How does back leverage enable funds to increase returns without selling core assets?

- Managing liquidity and capital efficiency across the fund lifecycle

- Navigating investor concerns, risk management and structural considerations

Moderator: Nicole Byrns, Partner, Dumar Capital Partners

Patti Unti, Portfolio Manager, Monticello AM

Matthew Jones, Chief Investment Officer – Credit Investments, Harbor Group International

Panel: The future of real estate secondaries

- How are secondary transactions enhancing liquidity in real estate, and what does this mean for institutional investors?

- Discussing valuation challenges and strategies for managing risks in secondary transactions

- What are the common exit strategies for investors, and how do they differ from traditional investments?

Moderator: Guelda Voien, Editor, PERE Deals

Sheelam Chadha, Founder, Managing Partner, Dry Capital

Kayley Laren, Senior Vice President, Investments, Real Estate, Brookfield

Panel: NextGen: The new generation of real estate emerging managers

- What leadership qualities are most important for managing diverse teams and driving innovation in real estate management?

- A keen look at strategies to build more resilient portfolios that can withstand economic volatility, climate change, and other external shocks

- How are the skill sets required for managers evolving in response to technological, economic, and market changes?

Moderator: Kelly Ryan, Partner, Kirkland & Ellis

Inna Khidekel, Partner, Senior Managing Director & Co-Head, Client Solutions Group, Bridge Investment Group

Sarah Schwarzschild, Chief Operating Officer, Mavik Capital Management

Danielle Even, Executive Director, Real Estate Investments, GCM Grosvenor

Jennifer Keith, Managing Partner, ETHOS Real Estate

Inna Khidekel

Partner, Senior Managing Director & Co-Head, Client Solutions Group, Bridge Investment Group

Read bio

Networking coffee break

Panel: Innovative pathways to scale U.S. affordable housing solutions

- Explore how public-private partnerships and policy frameworks unlock scalable capital for affordable housing

- Investment strategies that balance social impact with long-term returns

- Why affordable housing is becoming a resilient, mission-aligned asset class

Chris Schilling, Head of Acquisition, Hudson Valley Property Group

Panel: Capitalizing on the life sciences boom

- Key trends fuelling growth in lab space, R&D campuses, and biomanufacturing facilities

- Location, design, and tenant needs – how developers and investors are rethinking asset requirements in an innovation-led market

- Navigating vacancy, regulatory hurdles, and the capital-intensive nature of life sciences assets

Moderator: Harrison Connery, Senior Reporter, PERE

Panel: PropTech – which technologies truly matter?

- A look at the most adopted new tools across underwriting, asset management and tenant engagement

- How LPs are using tech adoption as proxy for manager sophistication and what they expect from GPs in terms of reporting and data transparency

- How GPs are deciding which tools to integrate, where to invest in proprietary solutions, and how to scale PropTech across assets and fund strategies

Christopher Shelton, Managing Director, Product & Engineering, RealINSIGHT

Daniel Erb, Chief Executive Officer, Strand Capital

Networking lunch

Presentation: Private real estate credit in numbers

- The latest LP allocations data

- The largest deals and most active managers in the past year

- The top performing funds based on IRR from the past decade

Investor panel: Navigating challenges in global real estate debt

- As equity fundraising recovers, what role will credit products have in a growing role in real estate portfolios?

- How are institutions tackling the housing crisis with the use of real estate debt?

- How are investors changing investment strategies as market outlook remain clouded

Moderator: Anna-Marie Beal, Senior Reporter, PERE Credit

Alberto Agazzi, Head of GRE International, Generali Real Estate

Prashant Raj, Managing Director, US Real Estate Debt, QuadReal

Michael Caracciolo, VP, Asset Management, U.S. and Head of New York Office, CDPQ

Panel: Bridging the gap – flexible financing solutions for real estate’s maturity wall

- What alternative capital solutions are helping borrowers navigate the refinancing crunch?

- How are lenders and investors adjusting return expectations in a repricing market?

- Can flexible financing structures align the interests of borrowers, lenders, and equity partners in today’s uncertain environment?

Kate Mulcahy, Managing Director, 3650 Capital

Jessica Lee, CIO, Real Estate Credit, Manulife Investment Management

Michael Felman, President and Chief Executive Officer, MSF Capital Advisors

Don MacKinnon, Head of Commercial Real Estate Credit and a Portfolio Manager, Sound Point Capital

Don MacKinnon

Head of Commercial Real Estate Credit & Portfolio Manager, Sound Point Capital

Read bioClosing remarks and end of conference

Get ready to connect with the most influential players in real estate

Access to the America Forum

Event access and 12-month Network membership –

US$3,895

*Early bird pricing ends 29 Aug

Group Rate:

Purchase 3 or more passes in one transaction to unlock our group discount. Contact: anna.d@pei.group

Benefits include:

- All-access pass to the forum

- Full access to the PERE Network membership for a year

- Insights from + expert speakers

- Network with investors, fund managers and developers

- Access to exclusive networking events

- Matchmaking and networking platform

Investor pass

A limited number of complimentary passes are available for eligible allocators and institutional and private investors.

Limited to foundations, endowments, trusts, insurance companies, single family offices, sovereign wealth funds and pension funds.

Benefits include:

- All-access pass to the forum

- Full access to the PERE Network membership

- Insights from + expert speakers

- Network with investors, fund managers and developers

- Access to exclusive networking events

- Matchmaking and networking platform

Our leading advisory board in 2025

Interested in speaking at the PERE Seoul Forum? Please contact Rida Shaikh today.