Scottie D. Bevill

Senior Investment Officer, Global Income Strategies Teachers' Retirement System of the State of Illinois

22 - 23 September 2021,

Eastern Time (ET) - Available Anywhere

The Private Debt Investor Virtual Forum 2021 brought together senior professionals engaged in the continued expansion of private debt as an asset class for a live and interactive virtual conference. The Forum entered its eighth successful year as the premier platform for investors to discuss how private credit strategies fit into their investment portfolios.

Attending the Private Debt Investor Virtual Forum enabled attendees to:

Hear from top-performing private debt managers in live interactive discussions

Participate in invitation-only think tanks to share best practices and industry concerns

Tailor your PDI virtual experience by customizing your personal profile and agenda

Platform highlights:

Absolutely invaluable! The perspectives from GPs, LPs, and industry analysts all in one place made this the most beneficial investor meeting I will attend this…

Particularly liked the number of institutional investors who attended.

Fantastic event to get a pulse of the private debt market.

In response to covid-19, organizers of PEI’s Private Debt Investor New York Forum have made the decision to transition from an in-person conference to a live virtual conference. The decision to move our event to a virtual platform was done based on the consideration of our attendees’ safety and official health recommendations.

The virtual conference will take place on:

Wednesday, September 22: 9:00 am EST – 5:15 pm ET

Thursday, September 23: 9:15 am EST – 1:35 pm ET

The platform shows available meeting times as per your computer’s timezone. For example, if you are based in New York, a meeting you set for 12 pm from your account will show to a recipient in Los Angeles as 9 am, reducing the human error impact of incorrectly guessing timezones.

It is worth noting that event timings will be running on the Eastern Time Zone. The platform will note the timezone abbreviation next to most timings to avoid confusion.

You can view our latest agenda.

Two weeks prior to the event, on September 8, all attendees will be sent a link to access our virtual conference app. As a registered attendee, you will be sent a unique link to access the platform. That link is unique to you and cannot be shared with anyone else.

To learn more about this platform, please view our “How it works” page.

No. There will be live content (which is where you can take part in live Q&As) and select sessions will be made on demand, so you can watch sessions at a time convenient to you.

Every registration ticket will include access to all general sessions, breakouts, interactive discussions, virtual networking sessions & private video chat, and on-demand playback of select sessions.

We have updated our pricing to reflect our virtual conference. Please visit the book now page for additional details.

A member of our team will be reaching out to either confirm your attendance to this year’s virtual event, transfer your registration to next year, or discuss other available options. If you have not heard from anyone, please reach out directly to our customer service team at regny@peimedia.com.

Please feel free to contact us directly at regny@peimedia.com.

As we navigate the current global health crisis, we continue to offer the private debt community a Forum to engage, learn, and network. PDI will deliver the same first-class dynamic content and peer networking opportunities through our virtual platform.

Join us on September 22-23 for a virtual experience exploring a broad spectrum of private credit strategies across the capital structure including senior secured loans, subordinated debt, distressed, special situations, niche strategies, real estate, infrastructure and more.

Watch our video guide for a preview of what to expect.

Utilize PDI’s virtual meeting tools to schedule private face to face video meetings with institutional investors and fund managers

Hear impactful panel discussions and keynote presentations from top-performing private debt managers

Tailor your PDI virtual experience by customizing your personal profile and agenda

Receive access to select sessions up to one year post-event anytime, anywhere

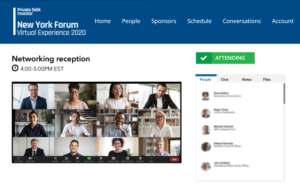

Network at any time throughout the two-day PDI Virtual Forum. Take advantage of our virtual meeting tools by sending a message or scheduling a face-to-face video meeting with Forum attendees.

Through the integrated Zoom platform, participate in a wide range of impactful discussions in various formats including invitation-only think-tanks, sector-focused breakout sessions and keynote fireside chats with industry leaders.

Platform highlights:

Learn more about our event sponsors and partners in the virtual networking rooms. The virtual networking rooms can be accessed at any time and there you can:

The virtual PDI New York Forum will connect you with the leaders in the private debt community providing a place to engage, learn, and network.

Network at any time throughout the two day PDI New York virtual Forum. Take advantage of our virtual meeting tools by sending a private message or scheduling a face to face video meeting with Forum attendees.

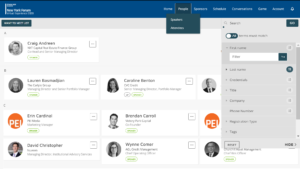

Gain access to the virtual platform two weeks before the event. Customize your own individual profile and personal agenda. Begin browsing through fellow attendee and speaker profiles.

Get a jumpstart on your PDI virtual experience when the platform opens Wednesday, September 8.

These 25-minute video meetings are set-up through an auto scheduler based on mutual selection during the designated meeting times.

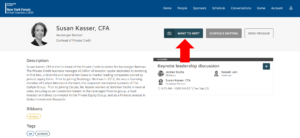

Attendees can add fellow attendees to their “want to meet” list; once two people have both added each other to their individual lists a private, face to face video meeting will be scheduled and added to both attendees’ personal agendas.

Search attendee profiles, send fellow attendees a message, and schedule a private, face to face video meeting anytime during the conference. Meetings will take place as private, face to face video meetings.

Use the built-in search function to filter the list of attendees based on selected criteria such as fund type, sector focus, strategy, AUM, etc. Join your private meetings through your personalized agenda.

The Virtual Forum offered a unique opportunity for organizations to raise their profile as a part of the premier meeting for investors allocating to private debt.

For information on available 2021 sponsorship opportunities, please contact Tyler Mitchell at +1 646 795 3279 or tyler.m@peimedia.com.

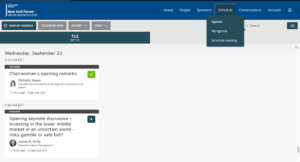

View each tab below to explore the 2021 two-day virtual agenda, packed with insightful panel discussions and keynote presentations.

*Please Note: All session times listed are in the Eastern Time Zone*

Facilitator:

Gene Miao, Senior Investment Strategist, Churchill Asset Management

PDI Welcome:

Seth Kerker, Director of Events, Americas, PEI

Chairwoman’s Opening Remarks:

Michelle Noyes, Managing Director, Head of Americas, AIMA

Managing Director, Head of Americas, Alternative Investment Management Association (AIMA)

Read bioModerator:

Jordan Stutts, Senior Writer, Private Markets, PEI

Keynote Speakers:

David M. Brackett, Chief Executive Officer, Antares Capital

David Golub, President, Golub Capital

Discussion Topics:

Moderator:

Chad Valerio, Managing Director and Portfolio Manager, Opportunistic Credit, Onex

Panelists:

Scottie D. Bevill, Senior Investment Officer – Global Income Strategies, Teachers’ Retirement System of the State of Illinois

James F. Del Gaudio, Senior Portfolio Manager, Private Credit, Commonwealth of Pennsylvania Public School Employees’ Retirement System (PSERS)

Ryan Morse, Director, Alternative Investments, Pennsylvania State Employees’ Retirement System (SERS)

Discussion Topics:

2020 was an interesting case study on the strengths of the private credit market compared to other debt and credit investments

Moderator:

Katrina S. Rowe, P.C., Partner, Kirkland & Ellis LLP

Panelists:

Symon Drake-Brockman, Co-Founder and Managing Partner, Pemberton Asset Management

Shannon Fritz, Senior Managing Director, Antares Capital

Kevin Marchetti, Chief Risk Officer, Varagon Capital Partners

Jay Ramakrishnan, Managing Director, Head of Originations, AB Private Credit Investors

CEO & Founder of Brightwood Capital Advisors, Sengal Selassie will sit with PEI’s Jordan Stutts to discuss the firm’s strategic approach to seeking alpha in mid-market direct lending, while supporting US based companies.

Moderator:

Jordan Stutts, Senior Writer, Private Markets, PEI

Featured Speaker:

Sengal Selassie, CEO & Founder, Brightwood Capital Advisors

Discussion Topics:

Moderator:

Kyle Campbell, Senior Reporter, PEI

Panelists:

Abbe Borok, Managing Director and Head of U.S. Debt, BentallGreenOak

Greg Dineen, Partner/Chief Credit Officer, Torchlight Investors

Mikhail Gurevich, Managing Partner, Dominion Capital (LP) (family office)

Tinting Zhang, Founder and CEO, TerraCotta Group

Discussion Topics:

Moderator:

Samantha Rowan, Editor, PEI Media

Panelists:

Paul Colatrella, Managing Director-Infrastructure Debt, Fiera Private Debt

Daniel Fuchs, Director – Infrastructure Debt, BlackRock Real Assets

Hitesth Kumar, Portfolio Manager, Orchard Global Asset Management

Discussion Topics

Moderator:

Jeff Hammer, Global Co-Head of Secondaries-Private Markets, Manulife Investment Management

Panelists:

Tim Henn, Senior Vice President, Portfolio Advisors

Rick Jain, Partner & Global Head of Private Credit, Pantheon Ventures

Cari Lodge, Managing Director and Head of Secondaries, Commonfund Capital

Discussion Topics

Moderator:

Alona Gornick, Managing Director, Private Credit Origination, Churchhill Asset Management

Panelists:

Milwood Hobbs, Jr., Managing Director and Head of North American Sourcing & Origination, Oaktree Capital Management

Liddy Karter, Managing Partner, Mizzen Capital

Jacqueline Taiwo, Principal, TowerBrook & Co-Founder, Black Women in Asset Management

Managing Director and Head of North American Sourcing & Origination, Oaktree Capital Management

Read bio

Discussion Topics:

Moderator:

Patrick Dalton, Chief Executive Officer, FrontWell Capital Partners Inc.

Panelists:

Taylor Boswell, Chief Investment Officer of Carlyle Direct Lending, The Carlyle Group

Brent Humphries, President, AB Private Credit Investors

Marc Lipschultz, Co-Founder and Co-President, Blue Owl Capital

Brad Marshall, Senior Managing Director, Blackstone Credit

Michelle Noyes, Managing Director, Head of Americas, AIMA

Managing Director, Head of Americas, Alternative Investment Management Association (AIMA)

Read bioKeynote Speaker:

James H. Kirby, President & Co-Founder, Deerpath Capital Management

Discussion Topics

Moderator:

Benjamin E. Rubin, Partner-Private Credit Group, Proskauer

Panelists:

Douglas Goodwillie, Managing Partner & Co-Head, Middle Market Direct Lending, Kayne Anderson Capital Advisors

Kevin Griffin, CEO & CIO, MGG Investment Group

Joel Holsinger, Partner, Portfolio Manager, Co-Head of Alternative Credit, Ares Management Corporation

Jocelyn Lewis, Executive Director, IHS Markit

Discussion Topics

Moderator:

Jeffrey Dorigan, Senior Vice President, BBH Alternative Fund Services

Panelists:

Ray Costa, Managing Director-Corporate Credit, Benefit Street Partners

Jon Fox, President and Partner, Värde Partners

Jun Hong Heng, Founder and Chief Investment Officer, Crescent Cove Advisors

Michael Morris, Managing Director, Northleaf Capital

Senior Vice President of BBH Alternative Fund Services, Brown Brothers Harriman

Read bio

Discussion Topics

Moderator:

Gretchen Bergstresser, Partner and Global Head of Performing Credit, CVC Credit Partners

Panelists:

Young Choi, Partner, Senior Trader & Portfolio Manager, Rockford Tower Capital Management

Wynne Comer, Chief Operating Officer, AGL Credit Management CLO

Karen Lau, Portfolio Manager, Onex

Dagmara Michalczuk, Principal and Portfolio Manager, Tetragon Credit Partners

Partner, Senior Trader & Portfolio Manager, King Street Capital Management & Rockford Tower Capital Management

Read bio

Discussion Topics

Moderator:

Faith Rosenfeld, Governing Partner and Chief Administrative Officer, HPS Investment

Partners

Panelists:

Jens Ernberg, Managing Director and Co-head of Private Credit, Capital Dynamics

Ariel Goldblatt, Partner, Stepstone Group (LP)

Tanner Powell, Partner, Apollo Global Management