Navigate Korea’s evolving credit landscape

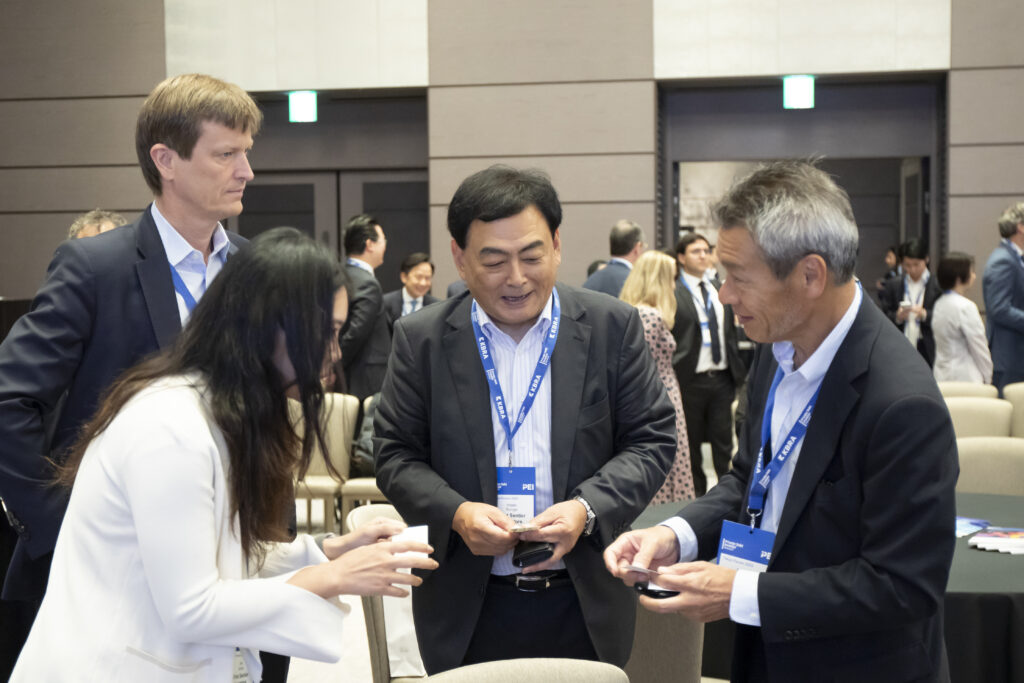

Korean LPs are expanding their allocations to private debt. The Seoul Forum provides the platform for you to navigate investor expectations with confidence.

Convening the most recognised Korean pension funds, insurers, family offices and advisors to explore evolving return expectations.

This is the meeting place to understand where capital is flowing.

Baladura Cenk, Asset Bridge

"It was indeed amazing to get insights and professional points of view of investors."

Keynote Feature

Due diligence 2.0: AI’s role in private credit

How can you harness AI from a risk management perspective during the due diligence stage? Our closing keynote will provide key insights into:

- Spotting red flags earlier with AI monitoring

- Streamlining portfolio screening and stress testing

- Generating sharper insights into borrower behaviours

2026 Speakers include:

Join over 100 Korean LPs

Meet the brightest allocators in Korea and advance your fundraising.

Inform your strategy

Gain the insights you need to position your fund effectively for Korean capital.

Unlock long-term fundraising success

Access the LP decision-makers and form lasting relationships.

Part of PDI Japan Korea Week

Two Forums, one week, unparalleled LP access. Private Debt Investor Japan Korea Week is your gateway to the investor connections you won’t meet anywhere else. Across the Seoul and Tokyo Forums you’ll meet 300 leading Korean and Japanese investors actively allocating in private credit.

Apply for a complimentary Institutional Investor pass

A limited number of complimentary passes are available for allocators and institutional investors to join the event.

Complimentary passes are limited to foundations, endowments, insurance companies, single-family offices, sovereign wealth funds and pension funds who are actively making fund commitments and do not engage in third-party fundraising activities or collect fees for advisory/consulting services who are actively making fund commitments and do not engage in third-party fundraising activities or collect fees for advisory/consulting services.

Apply for a pass and a member of our team will follow up with you.

Post-Event Resources

Join us again

Discover latest event information

Pre-Event Resources

아시아 최고의 프라이빗 뎃 컨퍼런스

6월 29일(목) 페어몬트 앰배서더 서울에서 열리는 제6회 연례 PDI Seoul Forum에서 한국 및 전 세계 주요 기관투자자들과 다시 만나보세요.

KIC, 국민연금공단, 행정공제회 등 다수의 투자자들과 함께 기관투자자들의 자산 배분과 포트폴리오 전략을 형성하는 동향을 분석하세요.

주요 주제는 다음과 같습니다:

- 2023년 한국 및 글로벌 투자자 성향 및 배분 선호도

- 자본 흐름 및 의사 결정 프로세스를 형성하는 새롭고 정교한 전략 평가

- 불확실성 속의 포트폴리오 성장

- 안전한 피난처 전략과 포트폴리오 발견

올해 놓칠 수 없는 프라이핏 뎃 컨퍼런스 시리즈

PDI Seoul Forum은 PDI Japan Korea Week의 개막포럼으로서 서울에서 글로벌 커뮤니티를 참여하셔서 글로벌 시장 통찰력을 획득하세요.

Why Seoul Forum?

사모 부채 투자자들이

놓칠 수 없는 연례 회의

교직원공제회, 롯데손해보험, 삼성화재해상보험 등 거대 투자자들과 함께 국내 유일무이한 프라이빗 뎃 컨퍼런스에 참여하세요.

글로벌 인사이트.

지역별 특화된 정보

지역 전문가 및 글로벌 펀드 매니저와 함께 글로벌 시장에 대해 자세히 살펴보시고 포트폴리오 구축 위한 최적의 전략 조합에 대해 알아보세요.

단 일주일 만에 자금 조성 활동을 가속화하세요

투자자 네트워크를 확장하고, 싱크탱크에 가입하며, 보다 유연한 환경에서 한국의 프라이빗 뎃 투자 의사 결정권자들과 강력한 관계를 구축하세요.

2023 연사진

컨퍼런스를 형성하는 주요 주제:

- Private Debt Investor 의 LP 연구 보고에서 투자자 관점 배우기

- 발전하는 실사 프로세스와 위험 완화를 위한 노하우 이해

- 프라이빗 뎃의 미래 – 기회는 어디에?

- 전략 심층 분석: 주류 대 틈새 전략 평가 – 어디에 머물러야 하나?

- 그 외

기관 투자자 참가 패스 신청

자산 배분 기관과 기관 투자자이신 경우 이벤트에 참여할 수 있는 제한된 수의 무료 패스가 제공됩니다.

참석권을 받으시려면 연금 기금, 보험 회사, 국부 펀드, 개인 자산 관리자, 재단, 기부금, 패밀리 오피스 또는 기업 투자 부서를 대표하는 자격 기준을 충족해야 합니다.

패스를 신청하시면 저희 팀원이 참가 확정 여부 확인을 위해 연락할 예정입니다.

2026 Agenda

If you are interested in speaking opportunities at the event please contact Niann Lai at Niann.l@pei.group

Agenda

PDI Seoul Forum 2026 - Tuesday 14th

Registration and networking

Welcome remarks from PEI

LP keynote fireside chat [Korean]

Presentation [English]

Panel: Macro-economic and geopolitical outlook, growth areas and private debt investments trends [English]

- 2025 marks a breakout year for private credit. Based on PDI’s Fundraising Report, average fund sizes surpassed $1 billion for the first time – unpack the drivers behind this milestone and how scale is reinforcing resilience, liquidity, and investor confidence.

- Examine the role of private debt and how managers are navigating tariff-related volatility and unlocking new pricing power

- Discuss diversification benefits, growth of ABF and credit secondaries opportunities

Networking break

Presentation: PDI market data and trends [English]

Panel: The enduring value of direct lending in the US vs Europe [English]

Presentation: : Private debt insights related to mid & long-term strategy of Korean government [English]

Janghyuk Lee

Professor, Korea University Business School, & Member, Mid & Long term Strategy Committee (Ministry of Planning and Budget)

Read bioNetworking lunch

Afternoon remarks

Panel: The next frontier for private credit [English]

- Growth in specialty finance and opportunistic credit

- Investment-grade alternatives in emerging markets

- Senior lending in SEA – opportunities and challenges

- NAV finance and secondaries market outlook

Presentation: How global LPs are approaching private credit?

- How institutional investors are approaching private credit today, from portfolio construction to long-term capital deployment

Panel: The rise of asset-backed finance (ABF) [English/ Korean]

- Examine how ABF strategies are helping Korean investors diversify risk in increasingly volatile markets.

- Understand the next phase of commercial real estate credit and its structural transformation

- Discuss shifting appetites for infrastructure debt and how regulatory pressures are driving a move toward more diversified, risk-adjusted credit opportunities

Yoonsuk Oh

Senior Manager, Private Equity Investment Team, Cooperative Banking Alternative Investment Department, National Agricultural Cooperative Federation

Read bio

Networking break

LP insight panel: What's top of mind for forward-looking allocators [Korean]

- According to the PDI 2025 LP Perspectives study, more than half of global investors are keen to ramp up their private debt allocations. What are Korean LPs allocating to and what concerns them today?

- How do different segments of the private debt market align with the investment needs of Korean LPs?

- Key factors Korean LPs prioritize during due diligence, how past due diligence experiences have shaped LP decision-making

- Thoughts on the prevalence of open-ended or semi-liquid funds in the private credit market — do they represent a threat or an opportunity?

Case studies

This session will feature three private credit managers delivering focused five‑minute pitches showcasing their expertise, followed by five‑minute Q&A segments with each manager.

- Semi-liquid products BDCs

- Private credit secondaries

- APAC real asset debts opportunities

Panel: The future of private debt - Aligning GP strategies with Korean LP expectations [Korean/ English]

- How Korean LPs’ demand for private debt is evolving

- Why deep alignment with Korean LP expectations is critical to scaling private debt strategies

- How GPs can position their private debt strategies to win future fundraising mandates

Closing keynote: Due diligence 2.0: AI's role in private credit [English]

How AI can be harnessed in private credit from a risk management perspective especially during the due diligence stage

Guan Seng Khoo

Advisory Board Member, International Advisory Council of Sovereign Investors

Read bioClosing remarks

Networking drinks reception

Wrap up the day with networking over drinks! Join the hosts and meet a wide range of industry peers and potential partners.

End of conference

Raise your profile among senior private debt decision-makers

Build and develop your company’s brand image, strengthen your market credibility, and meet your investment and business goals. Sponsorship gives you:

- VIP access

- Thought-leadership opportunities

- High-profile branding

- And much more…

For more information on available sponsorship opportunities, please contact Beth Piercy at beth.p@pei.group or call +44 20 7566 5464.

2026 Sponsors

기관 투자자 참가 패스 신청

자산 배분 기관과 기관 투자자이신 경우 이벤트에 참여할 수 있는 제한된 수의 무료 패스가 제공됩니다.

참석권을 받으시려면 연금 기금, 보험 회사, 국부 펀드, 개인 자산 관리자, 재단, 기부금, 패밀리 오피스 또는 기업 투자 부서를 대표하는 자격 기준을 충족해야 합니다.

패스를 신청하시면 저희 팀원이 참가 확정 여부 확인을 위해 연락할 예정입니다.

한국 최고의 사모 대출 투자자들과 만나보세요

Investors at PDI Seoul Forum

The Forum is the largest meeting place for institutional and private investors, and other members of the private debt community in Korea.

Apply for a complimentary pass for you or your team today.

참가패스를 신청하세요

자산 배분 기관과 기관 투자자이신 경우 이벤트에 참여할 수 있는 제한된 수의 무료 패스가 제공됩니다.

참석권을 받으시려면 연금 기금, 보험 회사, 국부 펀드, 개인 자산 관리자, 재단, 기부금, 패밀리 오피스 또는 기업 투자 부서를 대표하는 자격 기준을 충족해야 합니다.

패스를 신청하시면 저희 팀원이 참가 확정 여부 확인을 위해 연락할 예정입니다.

Contact producer, Niann Lai at Niann.l@pei.group if you’re interested in speaking at the conference.

2026 Speakers:

Janghyuk Lee

Professor, Korea University Business School, & Member, Mid & Long term Strategy Committee (Ministry of Planning and Budget)

Yoonsuk Oh

Senior Manager, Private Equity Investment Team, Cooperative Banking Alternative Investment Department, National Agricultural Cooperative Federation

Introducing the Private Debt Investor Network

A year-round community designed to connect, inform, and empower private debt professionals.

Raise capital. Navigate shifting markets. Find the right deals. Stand out with LPs.

As a private debt professional, the road to success is complex, but you don’t have to travel it alone.

The Private Debt Investor Network, powered by PEI’s global insights and LP relationships, gives you the tools and connections to grow your firm and thrive in your role.

Your Launchpad: PDI Seoul Forum

Step into gathering of senior decision-makers from leading Korean LPs and global funds. The PDI Seoul Forum is your gateway to new investors, actionable insights, and best-in-class private credit strategies.

Unmatched Access to LPs

Fundraising shouldn’t stop after the Forum. As a member, you’ll gain year-round invitations to regular allocator meetings — where relationships deepen and opportunities grow.

Personalised Member Support

You’re never just a name on a list. Your dedicated Network Manager will:

- Make custom LP introductions

- Help you build your peer network

- Connect you with relevant advisors

Plus, our Member Directory helps you stay connected across the community.

Insights That Power Performance

Break through the noise with curated research, real LP perspectives, and analysis tailored to your needs. Make faster, smarter decisions that position your firm to win.

Thanks for your interest

Thank you for your interest in the PDI Seoul Forum 2026 on 14 April. Your requested resource will be emailed to you shortly.

If you do not receive an email from us, please reach out to customerservices@pei.group.

Explore our event website for more information and secure your seat here, we look forward to seeing you in April.