Investor

Japan Korea Week Virtual Experience 2021

10 November 2021,

Virtual Event UTC+9

Asia’s leading private debt fundraising conference

The PDI Japan Korea Week on 10 November has successfully connected Japan and Korea’s leading investors and fund managers to discover new opportunities in the private debt markets.

Join the private debt community to fundraise from Japanese and Korean LPs, share global investment opportunities, and gain actionable insights on the latest trends.

The Summit will connect you to regional investors effectively, guide your decision-making, and provide 7/24 networking on one platform.

Download 2021 brochure for more information about the Week.

Learn how to fundraise with Japanese and Korean LPs

![]()

LPs cut to the chase

LPs share their outlook for the post-pandemic private debt.

![]()

Gatekeepers’ view

Learn the secrets and tactics of managing LP relationships from regional placement agents and gatekeepers.

![]()

Interactive networking

Discuss diversified strategies and dive deeper into trending topics in the networking programme.

Our speaking faculty:

Download the agenda to see the trends changing Asia-Pacific investor appetite and markets, including:

- Private debt global market outlook and key trends to keep an eye on in 2022

- Middle market direct lending in North America and Western Europe

- Japanese and Korean investors’ appetite and allocation plan in the private debt

- and many more…

View the exclusive live session on-demand

Asset management in the new normal

View this exclusive session today to discover Japanese and Korean investor appetite shifts and their blueprints for 2022 and beyond.

Gain insight from Cabot Capital Partners, Hamilton Lane, Mitsui & Co. Alternative Investments and Vogo Fund Asset Management on how investors choose their fund managers, due diligence process changes amid disruption, and much more.

Meet our investors at networking platform today

Secure your place at PDI Japan Korea Week today, you will gain immediate access to APAC investors and PDI APAC Summit content on-demand.

The APAC Summit will connect you with Asia’s behemoth investors. Connect with global leaders to analyse Asia-Pacific’s most promising private credit markets from an LP standpoint as the region is set to offer the highest growth potential in 2021.

Explore even more about your experience, content, and attendee lists here.

Key conversations shaping private debt trends

View trending topics and strategies in focus at the PDI Japan Korea Week.

Tell us your preferred topics or ask your burning questions to our producer, Ms.Rida Shaikh (rida.s@peimedia.com)

Agenda

Exclusive - Tuesday 28th

Asset management in the new normal

- Lessons learnt from due diligence processes given the disruptions from 2020

- Mid-year review: How LPs are choosing their overseas private debt managers right now? Are you witnessing a change in how LPs choose their cross-border GPs?

- Are LPs still considering new relationship under the global social distancing? Do you see many LPs adopting to doing due diligence online for both known and unknown managers?

- Looking back – Which private credit markets do LPs feel more interested during 2021? Developed or emerging markets?

- Looking forward – Which market has the best potential for new private debt investment from Q4 onwards?

- ESG requirements are being more stringent than pre-pandemic when evaluating GPs, do you see this trend among Japanese and Korean LPs?

- The frequently asked questions raised by LPs during the pandemic

Speed networking

New to virtual or an experienced attendee? Spend some time meeting the key stakeholders in private debt space, and PEI introduce you upcoming LP roundtables. Attendees could join and are matched with speakers and other attendees for a randomly allocated video chat, discuss the topic with speakers and put their questions to them face-to-face. Attendees could then follow up afterwards via the platform directory to continue the conversation.

Agenda

Main Day - Wednesday 10th

Welcome from PDI and opening remarks; Opening panel: Global outlook on credit markets and fundraising

- The dynamics shaping private credit markets — deal activity, leverage metrics, spread levels – and what it all means for LPs.

- Which markets and strategies will be resilient through the next 24 months?

- The future of fundraising post-pandemic.

Panel: Hot strategies in focus

- What are the hottest private debt strategies among Asian investors today: Senior debt, mezzanine or distressed?

- How do you view prospects for the next 12-24 months?

- How are distressed debt players viewing the deal market and the recovery curve post-pandemic?

Japanese session - Panel: Gatekeepers in the driving seat of Japanese overseas allocations

- What is Japanese LPs preference in private market investment now, in short-term and long-term?

- What are the hottest overseas credit products among collateralised loan obligation (CLO) trances, bank loan funds and asset-backed lending?

- What are the merits of having a direct agent in Japan, in terms of reporting, monitoring and tax issues?

Korean session - Panel: Going behind the investment scene with Korean insurers

- The pandemic caused unprecedented market volatility in 2020, what is driving LP allocations, and what further appetite shifts can we expect from investors in 2022?

- What are focused strategies in terms of capital, asset type and geography?

- Where are the next target markets in the post-pandemic world?

- What do Korean LPs consider vital in choosing a private debt fund manager?

Break

Korean session - KIC’s view: Spotlight on ESG

- What are the key considerations for KIC as it relates to ESG investment in private debt?

- How has covid-19 highlighted the urgent need for action on climate change?

- How KIC applies ESG framework during the manager selection process and differentiate the asset managers?

Case studies: Is the APAC corporate debt the next frontier?

- Deep dive on GP investment case studies, leading by a facilitator to understand the covenant quality and potential pitfalls LPs that need to be wary of.

- View on the APAC or specific region: India / Australia / China / as an attractive hub for debt funds. What should investors take into account when allocating their capital into the APAC private debt markets?

Japanese session - Panel: How Japanese LPs are preparing for unpredictable markets?

- The pandemic caused unprecedented market volatility in 2020, what is driving LP allocations, and what further appetite shifts can we expect from investors in 2022?

- What are focused strategies in terms of capital structure, asset type, and geography?

- Where are the next target markets in the post-pandemic world?

- What do Japanese LPs consider vital in choosing a private debt fund manager?

Korean session - Panel: The inside view with Korean asset managers and securities firms

- Analysis of the key opportunities to emerge from the pandemic.

- How do Korean gatekeepers view the possible additional regulation of the private debt industry?

- What is your advice to investors who are considering private credit in the current credit cycle?

Presentation: European core middle market private debt (LPs only)

- Development and outlook of the European private debt market

- Lessons learned from Covid-19 – pricing, terms, etc.

- ESG integration

Presentation: Benefits of a global approach to mid-market private credit investing (LPs only)

- Growth and evolution of middle market lending post-Covid

- Key pockets of opportunity emerging in the market

- Building relationships in key markets

Panel: Middle market direct lending in developed markets

- How does private lending look in the North America and Western Europe?

- Which markets are proving more resilient since the pandemic and downturn started?

- What are some of the key differences, merits and challenges of sponsored vs non-sponsored transactions?

- How do the upper and lower middle markets compare for deals, returns and terms?

Presentation: European lower middle market direct lending (LPs only), followed by Close of PDI Japan Korea Week Main Day

- How to originate loans

- Better loan structures

- The difficulties of doing ESG analysis on smaller companies.

Your access to Japanese and Korean outbound investors

The Week will connect you to leading Japanese and Korean LPs across a unique three-day programme on 9-11 November. Join invitation-only sessions to immediately connect with most active LP allocators to the strategies that interest you.

Your ticket also allows you access to Pan-Asia investors at the PDI APAC Summit on-demand. Discover new opportunities in Asia-Pacific markets and how LPs are currently allocating to private credit strategies.

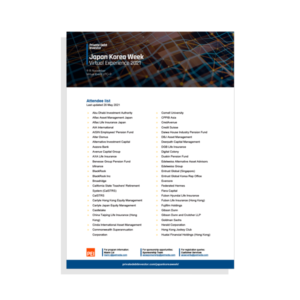

Meet regional investors and global credit leaders

Meet our 2021 attendees

View the live session on-demand

Asset management in the new normal

View this exclusive session today to discover Japanese and Korean investor appetite shifts and their blueprints for 2022 and beyond.

Gain insight from Cabot Capital Partners, Hamilton Lane, Mitsui & Co. Alternative Investments and Vogo Fund Asset Management on how investors choose their fund managers, due diligence process changes amid disruption, and much more.

“A good opportunity to stay connected to market

participants and hear their opinions remotely.”

Tetsuya Nagamochi

Shinsei Bank

Learn how to fundraise with Japanese and Korean LPs

![]()

LPs cut to the chase

LPs share their outlook for post-pandemic private debt allocations

![]()

Gatekeepers’ view

Learn the secrets and tactics of managing LP relationships from regional placement agents and gatekeepers.

![]()

Interactive networking

Discuss diversified strategies and dive deeper into trending topics in the networking programme.

Instant access to APAC investors

Get your networking access today and begin networking with Asia-Pacific investors.

The early networking access only available to ticket holders.

Get a taste of the week

View PDI Japan Korea Week in a nutshell. Get your access today.

Pre-Event Resources

Discuss key trends with our speakers

Discover the industry-shifting topics and strategies from our latest agenda.

Download agenda today. Tell us what you want to hear at the Week by contacting our producer Rida Shaikh.

Our 2021 speakers:

Partner with the PDI Japan Korea Week

The PDI Japan Korea Week will offer a unique opportunity for organisations to raise their profile among senior private debt decision-makers across the world.

For exclusive sponsorship package for the PDI Japan Korea Week, please contact sponsorship team at asiasponsorship@peimedia.com, call +852 3704 4624.