Conference Cancelled

It is with deep regret that we announce the cancellation of this year’s Forum due to the impact of the novel Coronavirus (COVID-19) outbreak. This is not a decision we have taken lightly and the overriding concern that have caused us to make this decision at this time has always been the responsibility we feel towards our conference delegates, speakers, and partners.

We apologize for any inconvenience caused, but as always, the safety and health of our participants, community and staff are our priority and we feel this is the best option.

GOOD NEWS: We will be hosting Virtual ExecConnect: online 1-1 private meetings.

General Partners: Interested in our Virtual ExecConnect 1-1 private meetings program? Contact Andrew Yale at Ayale@buyoutsinsider.com to discuss Virtual ExecConnect packages.

Limited Partners/Family Offices: Interested in our Virtual ExecConnect 1-1 private meetings program? Contact Grant Catton at gcatton@buyoutsinsider.com or at 646-321-4864 for complimentary meetings!

If you have any questions, please contact: regny@peimedia.com

To view our terms and conditions, click here.

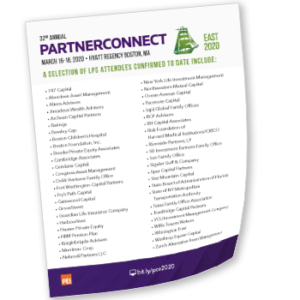

The Private Equity Industry’s preeminent event, bringing together LPs and Private Equity GPs for two days of learning, networking and private meetings.

Hosted by PEI and the publishers of Buyouts, VCJ, and PEHub since 1988 – PartnerConnect East brings together the most influential PE professionals for fundraising, deal-sourcing and intelligence sharing.

Join 300+ senior investment executives, including 125+ LPs and 125+ Private Equity GPs. Our truly innovative program features thought leaders discussing:

- LP views on allocating capital to PE funds

- Deal sourcing and valuations in the current environment

- How operating partners are maintaining value in portfolio companies

- Politics and private equity

- Fundraising post Covid-19

- The exit market

- Seeding and anchoring emerging GPs

- Family office fund investing

- Mega institutional investor sentiment

The event also features our unique ExecConnect LP-GP Meetings Program and our closed-door Think Tanks for LPs and GPs.

PartnerConnect East is resourceful, see for yourself:

Featured Speakers

RSVP to dweinstein@buyoutsinsider.com if you plan on attending.

Pre-conference workshop details:

-

October 21 – 4:oo PM

-

Powered by eVestment

-

Hyatt Regency Boston

-

Followed by Ice Breaker Reception

Why You Should Attend?

- Unparalleled content produced by our award-winning journalists

- Targeted event that specifically focus on the Buyouts ecosystem

- Intimate and structured networking opportunities

- ExecConnect Private LP-GP Meetings Program to help you achieve your fundraising goals

- LP & GP Think Tanks designed to foster candid discussions amongst your peers

- Strict vetting process for all attendees

Who Should Attend?

- Institutional Investors that invest in Private Equity funds and/or Independent Sponsors

- Managers in the following categories: Leveraged Buyouts, Growth Equity, Secondaries, Distressed/Special Situations

- Service providers throughout the PE ecosystem: Placement Agents, Lawyers, Tax Advisory, Consultants, Software/Data Providers and the like

- Deal intermediaries who advise or manage deal flow opportunities in private capital

- CEOs of PE backed private firms

View Our Event Highlights

PartnerConnect conferences bring together qualified investors, fund managers, independent sponsors, family offices & service providers for unbeatable networking and award-winning panels.

SEE WHAT OUR ATTENDEES HAVE TO SAY

Vishal Verma

Edgewood Ventures

Partner Connect is an amazing Conference that brings together like mind Influencers to target today’s dynamic market place

Ramin Behzadi

7 Gate Ventures

Besides the friendly staff, high quality panels and talks and super relevant attendees, the LP/GP ExecConnect platform is the most amazing thing that I have eve…

Michael Gordon

TriNet

Great conference for getting deals done and meeting new potential partners

Ramin Behzadi

7 Gate Ventures

Besides the friendly staff, high quality panels and talks and super relevant attendees, the LP/GP ExecConnect platform is the most amazing thing that I have ever experienced in similar events. It is the true definition of an efficient networking that really differentiates PartnerConnect’s events

Agenda

PartnerConnect East Day 1 - Wednesday 21st

Pre-event Workshop: Capturing Investor Relations Alpha

Location: Adrienne Salon on the 4th Floor (Hyatt Regency)

This workshop, led by eVestment Private Markets, will breakdown the state of private markets fundraising today and explore strategies and tactics that can help GPs outperform their peers when it comes to fundraising and building lasting, long-term relationships with limited partners.

The session will discuss the challenges faced fundraising GPs today, from intense competition to stringent due diligence processes as well as insights on how to leverage technology to gain a competitive advantage over peers.

Ice Breaker Reception

Agenda

PartnerConnect East Day 2 - Thursday 22nd

Registration & Networking Breakfast

PEI Welcome Remarks

Seth Kerker, Director Events – Americas, PEI

Featured Presentation | AlixPartners - 5th Annual PE leadership Survey Results

Speaker:

Ted Bililies, Managing Director & Chief Talent Officer, AlixPartners

Chief Investment Officer Roundtable

- A group of CIOs giving their high-level views and sentiment on private equity

- How they managed/are managing their portfolios given Covid-19

- How they enact their vision within their organization as CIO

- Features CIOs from different type of firms

Keynote Panelists:

Brendan MacMillan, Chief Investment Officer, (qp) global family offices

Kashif Siddiqui, Chief Investment Officer, Risk Management Foundation of Harvard Medical Institutions/CRICO

Morning Keynote

Networking Break

LPs Discuss Their Private Equity Allocations in an Unprecedented Market

- How LPs are thinking about their PE allocations amidst the crisis

- The sectors and strategies LPs are shifting in and out of

- LPs view on operational and market risk

Panelists:

Nirav Desai, Director of Investments, Boston Children’s Hospital

Kaitie Gannett, Director, Private Debt and Equity, Northwestern Mutual Capital

Udayan Mitra, Head of Investments – Private Equity, Altera Advisors

Operating Partners Tell-All: How GPs are building and maintaining value in their portfolio companies

Now more than ever PE firms are relying on their operational expertise. Three elite operating partners discuss how they are maintaining value and building value in the areas of:

- Digitalization, innovation & technology

- Human capital

- Finance

Panelists:

David Averett, Managing Director, Peak Performance Group, Summit Partners

Michael Magliochetti, Operating Partner, Riverside Partners, LP

Marco Mendes, Head of Portfolio Group – North America, Advent International

The 2021 Exit Market: What are the options for GPs?

The exit market has undoubtedly seen a shock like never before. Nevertheless, exits will come. A group of LPs and GPs will explore the trends in the exit market for Q4 and the beginning of 2021 including:

- IPOs

- Strategic buyers

- Acquisition by another private fund or venture investor

- Secondaries

- Add-ons and carve-outs

Panelists:

Keirsten Lawton, Managing Director and Co-Head of US Private Equity Research, Cambridge Associates

Stephen Master, Principal, GTCR

Matthew Witheiler, Private Equity Managing Director, Wellington Management

Moderator:

Chris Lawrence, Managing Partner, Founder, Labyrinth Capital Partners

RCP Advisors Research Presentation: Middle Market PE Post Covid-19

- Research into how middle market PE fared throughout the crisis

- Exploration of middle market valuations and volatility

- Data driven insights

Panelists:

Ross Koeing, Vice President, RCP Advisors

Luncheon

Instructional: Building an LP Base from Start to Funded

- How to intelligently raise a PE fund

- Do’s and don’ts for raising capital, including LP “faux pas”

- Concrete steps to access institutional capital

Panelists:

Maurice Gordon, Managing Director & Head of Private Equity, Guardian Life

Diane Mulcahy, Advisor, Senior Fellow, Director of Private Equity, Kauffman Foundation

Tarek Saghir, Principal, GroveStreet

How Newer and Smaller Managers Can Access Capital Amid the Coronavirus

There is widespread concern for newer and smaller managers, with super buyside firms expected to soak up a larger percentage of capital than ever before. A mix of allocators and managers will discuss concrete strategies for emerging managers to access capital in a fearful and cash-stricken market.

The Institutionalization of the Independent Sponsor Market

- Exploration of the growth of independent sponsors in the wider institutional landscape

- How Covid-19 impacted the independent sponsor model, for better or for worse

- Tips for new and existing independent sponsors to access institutional capital

Panelists:

Douglas Song, Managing Partner, Prodos Capital

Scott Johnson, Founder and CEO, SJ Partners

Scott Reed, Co-Head of U.S. Private Equity, Aberdeen Standard Investments

Moderator:

David Acharya, Partner, AGI Partners

Family Offices as Fund Investing LPs

- PE fund strategies they are favoring

- Specific sectors they are focusing on or exiting

- Their process when doing GP due diligence

- How to best work with and approach a Family Office

Panelists:

Shuvam Bhaumik, Managing Partner, SB Investment Partners

Mehmet Budak, Founder and Chief Investment Officer, Bessley Capital

Mitra Sen, Senior Director, San Family Office

The (R)Evolution of Deal Sourcing

- How seasoned PE firms approach deal sourcing

- How, by making deal flow king, PE firms get more deals on their desk and higher returns

- Strategies for smaller firms to increase deal flow

Panelists:

Chris Cathcart, Managing Partner, The Halifax Group

William Gonzalez, Senior Vice President, Business Development, Audax Private Equity

Sujit John, Senior Vice President, Partners Group

Opportunities in Health Care

With a health crisis on a scale never seen before, health care will likely remain one of the most heavily invested sectors in private equity. A high-level group of LPs and GPs will discuss:

- Where the home run deals are in health care

- How valuations are right now and how they may look after the crisis subsides

Panelists:

Matthew Blevins, Managing Partner, Clearview Capital

Stephan Cella, Principal, Sun Capital

Sean McDonell, Director, Alternative Investments, Barings

Moderator:

Whit Matthews, Senior Investment Director – Private Equity, Aberdeen Standard Investments

Co-Investment Access in a Post Covid-19 Private Market

Co-Investments outpaced the growth of the wider PE market in the bull-run. Our panelists will look at how the space will change after the crisis.

- Will new co-investment opportunities be easier or harder to find?

- Did the crisis make many LPs rethink their co-investment strategies?

- How are valuations in the co-investment secondaries market?

- What type of GPs might utilize co-investments more than others?

Competitive Capital Structures to Win the Deal

- How to ensure the capital structure benefits all stakeholders and makes you a competitive buyer

- Inventive ways of structuring PE deals

- How certain deal structures may fare better than others in a turbulent market

Panelists:

Pietro Cinquegrana, Managing Director, CDIB Capital

David Clark, Managing Director, Head of Financial Sponsors, Raymond James

Salil Patel, Managing Partner, Virtuosity, Investment Director, Five Birds (SFO)

Moderator:

Michael Oates, Partner, Withum

Afternoon Networking Break

Fireside chat

Cocktail Reception

LP Dinner (By Invitation Only)

Agenda

PartnerConnect East Day 3 - Friday 23rd

Networking Breakfast

LP Think Tank

–How to structure your portfolio in turbulent times

-GPs behaving badly

-Co-investment

-Exploring secondaries

-Most effective ways to conduct due diligence

-Managing Liquidity

GP Think Tank

–Making sense of valuations

-Managing LP relationships

-Co-investments

-How to best manage a team

-Exploring secondaries

-Deal sharing amongst your peers

Welcome Remarks

Fireside Chat

Networking Break

Investor Outlook: Mega Institutional Investors

- How mega LPs are viewing the private equity

- How they’re dealing with the denominator effect and approaching their portfolios

- How their investment and due diligence process works and how it differs from smaller LPs

Panelists:

Matt Curtolo, Director, Private Equity, MetLife Investments

Eric Simas, Principal, HarbourVest Partners

Emerging Managers: The Economics of Seeding and Anchoring New GPs

- How seeding and anchoring deals are structured

- Benefits for the GP and seeding platform

- What GPs are a good fit and which ones aren’t

Panelists:

Ryan Bailey, Founder and Managing Partner, Pacenote Capital

Ami Samuels, Partner, Gatewood Capital Partners

Jared Weiner, Partner, Archean Capital Partners

Moderator:

Steve Yardumian, Partner, Withum

LP Corner: How are GP's valuing their portfolio companies?

- How GPs are valuing and reporting their valuations to LPs

- How this process should go and how it can be abused

- Knowledge for LPs to increase their knowledge of this opaque yet important process

Panelists:

Jared Barlow, Managing Partner, Kline Hill Partners

Douglas Burrill, Senior Vice President, Valuation Director, PIMCO

Chase Paxton, Director of Finance & Valuation, NGP

Moderator:

Tom Angell, Partner, Withum

Closing Remarks

Kashif Siddiqui

Chief Investment Officer, Risk Management Foundation of Harvard Medical Institutions/CRICO

WHAT IS EXECCONNECT

ExecConnect is a proprietary private meeting program consisting of meticulously pre-scheduled 20-minute meetings between mutually interested GPs and LPs. Each One-to-One Meeting is carefully vetted by ExecConnect Directors to ensure that LPs looking to commit capital and GPs looking to raise capital meet in a relaxed, efficient and effective manner. View the list of attendees in advance, pre-select those you would most like to meet and let us do the rest! You’ll arrive at PartnerConnect East with a full schedule of meetings organized by our VIP team.

ExecConnect removes the countless hours of research and travel needed for investors and managers whose goals are in symmetry, to meet in person. The time and hassle you avoid is incalculable.

If you are a General Partner (GP), please contact Andrew Yale via email at andrew.y@peimedia.com or via telephone on +1 (646) 989-8025.

If you are a Limited Partner (LP) looking for investment opportunities or to meet and screen new GP’s in a time-efficient, personalized manner, please contact Grant Catton via email at gcatton@buyoutsinsider.com or via telephone on +1 (646) 321-4864. Limited Partners who accept three or more meetings will receive complimentary admission to the entire event.

APPLY FOR AN INSTITUTIONAL INVESTOR PASS

As an accredited institutional investor you may qualify for a Complimentary Institutional Investor Pass. Recipients of this Investor Pass may attend the entire conference program and the general networking reception, if you agree to participate in our ExecConnect 1:1 meeting program for at least three 20-minute private meetings with fund managers of your choice at a time of your choice.

By applying for a complimentary pass below, you certify that your firm is a qualified institutional investor that commits capital to alternative asset managers, or that your firm advises institutional investors to make such commitments. You also certify that your firm is an accredited investor as defined by Rule 501 of Regulation D of the Securities Act of 1933. You agree to take at least 3 private meetings as part of the ExecConnect Meetings Program.

Please note: Fund of Funds who qualify for a complimentary pass are restricted to those who are responsible to approve, oversee or research primary commitments to fund managers. Professionals who work on secondaries, directs, fundraising, marketing, business development, or in an administrative capacity, would not qualify. We will be in touch once you have submitted your application. If you have any questions in the meantime, please contact gcatton@buyoutsinsider.com.

Venue

Hotel Information

Click here to reserve hotel accommodations in our room block at the Hyatt Regency Boston. Rooms are limited and are on a first-come-first-served basis; early booking is strongly advised.

Cutoff date to book is Thursday, October 1, 2020.

Hyatt Regency

Partner with PartnerConnect East 2020

PartnerConnect East offers a unique opportunity for organizations to raise their profile by meeting with the largest gathering of private equity fundraisers, investors, and dealmakers. PartnerConnect East welcomes 300+ senior LPs, GPs, and VCs as they gather for intimate one-on-one networking challenges creators across two days of sessions.

For exclusive sponsorship packages for 2020, contact Lawrence Dvorchik at lawrence.d@peimedia.com or call +1 646 545 4429.

Sign Up for 1:1 private meetings with qualified investors through

PartnerConnect East ExecConnect program!

The ExecConnect Private Meeting Program provides an opportunity to cut through the clutter and engage in one-on-one meetings between LPs looking to commit capital and GPs looking to raise it. These 20-minute meetings are pre-scheduled to ensure you meet with executives who best match your fundraising and investment goals.

For more information on how GP’s can participate in ExecConnect and get one-on-one meetings with LP’s, please contact Andrew Yale via email at AYale@buyoutsinsider.com or via telephone on +1 (646) 989-8025.

—

PartnerConnect On-Demand Webinar Series

family office & financial advisors, wealth managers, GPs and LPs.

Here you will find thought leadership webinars to assist financial professionals in the fund marketing and investor servicing industry — highlighting the markets and investment opportunities that matter to you. Due to compliance regulations, we are only able to share the recording with you. We do not provide the presentations for download. You will be asked to register prior to viewing the recordings.

Family Office Master Class: Making Money, Doing Good with Opportunity Zone Funds

Watch this webinar on opportunity zone funds—partnership or corporations set up by entrepreneurs, developers and money managers to invest in the nearly 9,000 state-designated opportunity zones across the country. Looking to save millions of dollars in capital gains taxes? Eager to have a positive impact in poor communities by investing in real estate, infrastructure projects and private equity? Don’t miss this webinar

GP Fundraising: Identifying Active Family Offices for Funds, Co-Investments

PE/VC Masterclass: Building Processes for Agile and Flexible Deal Flow Management

IR Masterclass: Keeping LPs Satisfied in an Age of Transparency

Want to Drive Operational Efficiency? The C-Suite Needs to Lead Organizational Change

PE/VC Best Practices: How Independent Sponsors Source Deals and Raise Capital

PE/VC Best Practices: How Independent Sponsors Can Identify and Win Profitable Deals

PE/VC Best Practices: Putting LPs at Ease on Cybersecurity and IT Outsourcing

IR Masterclass: Avoiding Top Timewasters in LP Communications and Reporting

ADDITIONAL PARTNERCONNECT WEBINARS OF INTEREST INCLUDE:

PE/VC Best Practices: How to Compensate Top Talent

View Here

GP Best Practices: How to Expand Your Portfolio Companies Abroad

View Here

What to Do NOW to Prepare for Coming Regulatory, Legislative, Tax changes

View Here

Ready for a Downturn? New Strategies for Cutting Portfolio Company Costs

View Here

GP Fundraising: Identifying Active Family Offices for Funds, Co-Investments

View Here

Inside the LP Mind: Allocating to Private Real Estate in the Current Environment

View Here

LP Perspective: Best Practices in Benchmarking Private Equity Returns

View Here

The Fundraising Survival Guide for Emerging Real Estate Managers

View Here

Emerging Managers: How to Build a Successful Co-investment Program for Investors

View Here

LP Perspective: What Public Pensions Want From PE/VC Fund Managers

View Here

IR Master Class: Keeping LPs Satisfied in an age of Increasing Transparency

View Here

Top Strategies for Raising Money from Family Offices

View Here

Top Trends Generating Investment Opportunities in The Tech Sector

View Here

Improving Your Deal Sourcing Operations

View Here

Identifying Potential Investors for Emerging Manager Funds

View Here

PE/VC Roadshow Bootcamp: Getting Your Pitch Ready for Prime Time

View Here

![Img Orlando Bravo[1]](https://www.peievents.com/en/wp-content/uploads/2019/12/img-orlando-bravo1.jpg)