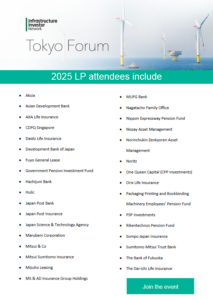

Connecting Japanese capital with global infrastructure

The Infrastructure Investor Tokyo Forum once again proved to be the region’s largest and most influential gathering of infrastructure investors. Attendees gained unmatched insights from a world-class speaker line-up, explored trends through our editorially-curated agenda, and connected with Japan’s most active LPs through premium networking opportunities..

Register your interest for the 2026 edition to be the first to receive event updates, speaker announcements, and early access to booking. Don’t miss your chance to be part of Japan’s premier infrastructure investment forum.

350 attendees

looking to connect, share peer-to-peer insights and advance their fundraising

.

150 LPs

pure-play, infrastructure-focussed LPs to connect with at our unrivalled networking opportunities

.

65 speakers

to deliver you unmatched insights from our editorially-led agenda so you can make informed investment decisions

.

Keynote spotlight

Keynote Spotlight:

Ryosuke Yoshida, Director & Investment Lead, Infrastructure, Private Market Investment Department, Government Pension Investment Fund (GPIF)

Hear from one of the world’s most influential infrastructure investors at the Infrastructure Investor Tokyo Forum. Discover how the largest pension fund is navigating shifting market dynamics and reshaping its infrastructure allocations. Gain exclusive insights into investment priorities, risk management strategies, and evolving appetite for assets. Don’t miss this rare opportunity to understand the forces driving capital flows across Japan and beyond.

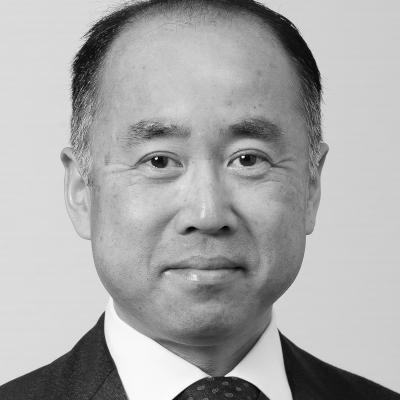

Keynote Spotlight:

Akihiro Konishi, Chief Investment Officer, Federation of National Public Service Personnel Mutual Aid Associations

Gain insider insights from a leading Japanese institutional investor at the Infrastructure Investor Tokyo Forum. Find out how one of the country’s major pension funds is managing risk, driving diversification, and increasing infrastructure investments amid global market shifts. Get a clear view of the trends set to shape Japanese capital flows in the years ahead.

Key themes:

Digital Infrastructure & AI

Emerging opportunities for Japanese LPs

Japanese LP evolution

What is driving their investment strategies in light of the current market?

US infrastructure market

Decarbonisation efforts, regulatory impacts, and policy changes under a second Trump administration

Corporate PPAs in Japan

Driving demand for renewables and shaping the future of energy storage

The role of the strategic investor

Collaborations and lessons learned from investing in Japan’s infrastructure

Don't miss the region's industry leading event.

Gain transformative insights

Share perspectives on Asian investment strategies, learn more about Korean investor appetite and identify high-yield assets across the region with leading investment practitioners

Expand your fundraising horizons

The Tokyo Forum is home to 150+ investors, gain access to them with across our 2 networking days and secure your next investment.

Build a global network of influential investors

Create and nurture sustainable relationships with infrastructure’s elite by using our sophisticated networking platform.

Speaker

enquiries

Andrew Wolff

andrew.w@pei.group

T: +81 (0) 3 6205 3224

Sponsorship

enquiries

Alexander Jakes

alexander.j@pei.group

T: +44 (0) 203 862 7498

Registration

enquiries

Luca Greene

luca.g@pei.group

2024 Agenda

For more information on speaking at the Japan Korea Week, please contact Andrew Wolff

E: andrew.w@pei.group

Agenda

Tokyo Forum - Day 1 - Thursday 13th

Registration and networking l 受付&ネットワーキング

PEI Opening Remarks (English) l PEIの開会挨拶 (英語)

Keynote Presentation: Infrastructure and Japan’s investment screening regime (English) l 基調講演:インフラストラクチャーと日本の投資審査制度 (英語)

Keynote Panel: Infrastructure investing at maturation: Will it remain a resilient asset class? (English) l 基調パネル: 成熟期のインフラ投資:今後も強靱な資産クラスとなりうるか?(英語)

- How will the interest rate environment and continuing geopolitical uncertainty shape GPs’ investment strategies going forward?

- Will the impact of digitalisation and decarbonisation continue to drive investment opportunities in the asset class?

- 2023 was a challenging year for fundraising – are GPs seeing stronger interest in 2024?

Break l 休憩

Panel: Seizing on the growth opportunities in the energy transition (English) l パネル:エネルギー転換の成長機会をつかむ (英語)

- How do you find value in growth technologies such as hydrogen and carbon capture?

- What are untapped or niche areas of the energy transition to look at with the most growth potential?

- How should LPs view supply chain and regulatory challenges when making investments?

Don Dimitrievich

Portfolio Manager, Senior Managing Director, Energy Infrastructure Credit, Nuveen

Read bio

Presentation: Climate Resilient Infrastructure – Unlocking the Value of Resilience (English) l プレゼンテーション:気候変動に強いインフラ- レジリエンスの価値を解き明かす (英語)

Lunch and Networking l 昼食&ネットワーキング

Panel: The rise and rise of infrastructure secondaries (English/ Japanese) l パネル :インフラセカンダリーの台頭 (英語/日本語)

- What are the key market drivers spurring on the growth of infrastructure secondaries?

- Understanding the pricing dynamics of the current secondaries market

- How can secondaries investing benefit Japanese LPs as a means of J-curve mitigation?

Panel: Investing in infrastructure through an ESG lens (English/ Japanese) l パネル:ESGレンズを通したインフラ投資 (英語/日本語)

- The case for ESG: why it should be at the forefront of Japanese LPs’ investing decisions in the asset class

- The role of data in ESG investing: are we moving towards greater standardisation?

- Successful case studies where ESG integration has created long-term value for infrastructure assets

Panel: Equity vs Debt – which is the better strategy in the current market? (English) l パネル:エクイティ対デット - 現在の市場でより良い戦略は? (英語)

- How have infrastructure debt GPs performed in the current interest rate environment?

- Does infra debt have a comparative advantage to equity in light of the current global economy?

- Which types of deals will be attractive for infrastructure debt in the near-to-mid-term?

Panel: Specialise or diversify? What are the optimal investing strategies for Japanese LPs in the current environment? (English) l パネル:専門化か多様化か? 現在の環境において日本のLPの最適な投資戦略は何か? (英語)

- How has the macroeconomic climate impacted on asset allocations?

- What are the correlations and synergies between investing in GX and DX? (energy transition & digital)

- What are the main drivers behind the increasing number and size of sector specific funds in the market? Where are the opportunities in the mid-market?

Panel: Spotlight on the Australian market (English) l パネル:オーストラリア市場に焦点を当てる (英語)

- Are there still major privatisation investing opportunities in the pipeline?

- Investing in Australian mid-market renewables

- Understanding the current local regulatory environment – help or hindrance?

Danny Latham

Partner, Head of Igneo Infrastructure Partners, Australia & NZ, Igneo Infrastructure Partners

Read bio

Presentation: Spotlight on renewables assets (English) l プレゼンテーション:再生可能なアセットに焦点をあてる (英語)

Break l 休憩

Presentation: Finding value in European mid-market infrastructure (English) l プレゼンテーション:欧州でのインフラストラクチャーミッドマーケットにおける価値を見つける (英語)

Panel: Japanese LPs – still bullish for increasing infrastructure allocations? (Japanese) l パネル:日本のLPは、インフラへ資産配分をさらに増やすことに依然楽観的か? (日本語)

- As Japanese LPs now have some track record in the asset class – how do they evaluate their commitments so far?

- How has the depreciating yen impacted on LPs’ investment strategies?

- What are the lessons learnt so far from their investments? Would they have made any changes in retrospect?

Takeshi Ito

Senior Investment Officer & Chief Operation Officer, AISIN Employees' Pension Fund

Read bio

Cocktail Reception l カクテルレセプション

Agenda

Tokyo Forum - Day 2 - Friday 14th

II Membership breakfast briefing (English) l II メンバーシップ朝食ブリーフィング (英語)

Registration and networking l 受付&ネットワーキング

PEI Opening Remarks (English) l PEIの開会挨拶 (英語)

Keynote Presentation (English) l 基調講演 (英語)

Kikuko Emae

Senior Director and Head of Infrastructure, Government Pension Investment Fund (GPIF)

Read bioKeynote Panel: Accelerating Japanese institutional capital into infrastructure and alternatives (Japanese) l 基調パネル:日本の機関投資家のインフラとオルタナティブ投資への資金投入を加速させる (日本語)

- What structural and regulatory changes need to be made to help accelerate LPs investments into infrastructure and private markets? What is the future role of the gatekeeper model in this context?

- Which Japanese LPs have found the most success from allocating to infrastructure and what are the takeaways that other Japanese investors can learn from their success?

- Corporate pension funds are still lagging; how do we enable them to invest more in private markets and infrastructure?

Break l 休憩

Panel: Japan’s domestic renewable energy investing challenge – where is the deal flow? (English/ Japanese) l パネル: 日本国内での再生可能エネルギー投資における課題 – ディールフローどこにあるのか?(英語/日本語)

- Corporate PPAs and renewables, navigating investment opportunities in the post FIT era

- Battery storage and the growing demand for grid-scale batteries – where are the investing opportunities for private capital?

- Are there opportunities in investing in niche power assets that may have been overlooked?

Panel: Moving up the risk curve – the case for investing in core plus and value add (English) l パネル:リスクカーブの上昇 - コアプラスとバリューアッドへの投資事例 (英語)

- What are the relative merits of investing in higher-risk assets as opposed to core infrastructure in the current economic environment?

- As competition has increased for core-plus infrastructure assets, are returns still as attractive as in previous years? Are deals harder to access?

- Which subsectors and geographies have the strongest growth potential?

Lunch and Networking (followed by Close of conference) l 昼食&ネットワーキング (フォーラム終了)

If you are interested in speaking at the Seoul Forum, please contact Andrew Wolff

Our 2024 speaker line-up

Ryusuke Bushimata

Director, Research Division & Legal Office, International Bureau, Ministry of Finance, JAPAN

Danny Latham

Partner, Head of Igneo Infrastructure Partners, Australia & NZ, Igneo Infrastructure Partners

Tadasu Matsuo

Managing Director and Head of Global Alternative Investments, Japan Science and Technology Agency (JST)

Thank you to our sponsors

Pre-Event Resources

Apply for a complimentary Institutional Investor pass

Complimentary investor passes are limited to foundations, endowments, trusts, insurance companies, single family offices, sovereign wealth funds and pension funds who are actively making fund commitments and do not engage in third-party fundraising activities or collect fees for advisory/consulting services.

Apply for a pass and a member of our team will be in touch to confirm your eligibility.

Find your next investment opportunity

Put your capital to the right place

Network with your peers

Our LP-only breakfast, lunch and networking breaks are just some of the opportunities you will have to enrich your network, exchange valuable perspectives with your LP peers and diversify your investment strategy.

Gain expert insights

Safeguard your investments by hearing from our industry-leading speakers, discover the latest trends and stay aligned with future innovations in the market.

Explore opportunities

Discover remarkable investment opportunities in sectors including emerging markets, energy transition, infrastructure debt and more.

Meet with the best and brightest funds

Connect and arrange one-to-one meetings with infrastructure’s biggest fund and asset managers in the market.

Apply for your complimentary pass

Complimentary investor passes are limited to foundations, endowments, trusts, insurance companies, single family offices, sovereign wealth funds and pension funds who are actively making fund commitments and do not engage in third-party fundraising activities or collect fees for advisory/consulting services.

Apply for a pass and a member of our team will be in touch to confirm your eligibility.

日本の資本を世界のインフラと結びつける

「Infrastructure Investor Tokyo Forum」で、日本の最も影響力のある機関投資家とのつながりを強化し、資金調達の可能性を高めませんか?

このフォーラムは、対面のネットワーキングを通じて、日本の投資家がこの資産クラスに対してどのような選好を抱いているかを把握する貴重な機会です。また、この資産クラスの長期的な強靭性を探求し、将来の投資を確実にする知見を深めることも可能です。

ぜひ、「Infrastructure Investor Network」のメンバーシップを取得し、2024年6月に開催する東京フォーラムにご参加ください。

2023年の投資家参加企業は以下の通りです。

東京フォーラムの主要テーマは次のとおり:

・ 現在の経済環境におけるコアインフラストラクチャーに対する高リスク資産への投資メリット

・ 成長技術における価値発見の方法

・ ESG投資におけるデータの役割

・ 円安がLPの投資戦略に与える影響

・ バッテリー蓄電システムと増加するグリッドスケールバッテリーの需要

Japan Korea Weekの詳細を見る:

さらなる洞察で、より強固な戦略を練る:

並外れたネットワーキング:

世界中の3,000人以上の投資家やマネージャーのグローバルネットワークにアクセスしましょう。イベント前にミーティングを予約し、「Infrastructure Investor Network」の会員として、イベントを超えて会話を続けましょう。

業界リーダーの声を聞く:

アジアで最も経験豊富で成功を収めているインフラ投資の実務者から、貴重なインサイトを得ませんか?

資金調達を進める:

最もアクティブな日本および韓国の機関投資家との出会いにより、資金調達の可能性を拡大しましょう。

機関投資家向け無料パスを申し込む

部の無料パスは、年金基金、保険会社、政府系ファンド、プライベートウェルスマネージャー、財団、基金、ファミリーオフィス、または企業の投資部門を代表する、対象者であるインストゥルメンタルなアロケーター、機関投資家、および個人投資家のために用意されています。

イベントに参加するためには、こちらで興味がある話題を登録してください。弊社のチームメンバーがお問い合わせいただいた方の資格を確認するために連絡させていただきます。

If you are interested in speaking at the Tokyo Forum, please contact Andrew Wolff

E: andrew.w@pei.group

Akihiro Konishi

Chief Investment Officer, Federation of National Public Service Personnel Mutual Aid Associations

Danny Latham

Partner, Head of Igneo Infrastructure Partners, Australia & NZ, Igneo Infrastructure Partners

Dimitrios Papatheodorou

Head of High Yield Investments, Infrastructure Debt Investment Team, HSBC Asset Management

David Povall

Senior Executive Officer, Offshore Wind Renewable Energy Division, The Kansai Electric Power Co.

Masahiro Sakakibara

Head of Frontier & Creation Unit, Global Business Division, Chubu Electric Power

Alexander Wellsteed

Principal Evaluation Specialist, Independent Evaluation Department, Asian Development Bank

Yohei Yagyu

Infrastructure Specialist, Global Infrastructure Facility, Infrastructure Finance Department, World Bank

Ryosuke Yoshida

Director & Investment Lead, Infrastructure, Private Market Investment Department, Government Pension Investment Fund (GPIF)

This is where the future of infrastructure is built.

Get ready to connect with the East Asia's most influential players in infrastructure

Access to the Tokyo Forum

Event access and 12-month Network membership

US$ 4,495

Group Rate:

Purchase 3 or more passes in one transaction to unlock our group discount. Contact: luca.g@pei.group

Are you an investor?

A limited number of complimentary passes are available for eligible allocators and institutional and private investors. Limited to foundations, endowments, trusts, insurance companies, single family offices, sovereign wealth funds and pension funds.

Our 2025 agenda

Download the 2025 agenda to see the trends shaping Japanese investors’ allocation strategies and markets across the region.

Agenda

Infrastructure Investor Network Tokyo Forum - Wednesday 4th

Registration & networking ❘ 受付 & ネットワーキング

PEI & Chair Opening remarks (Japanese) ❘ 開会の挨拶 (日本語)

Keynote Presentation (English/Japanese) ❘ 基調講演 (英語/日本語)

Akihiro Konishi

Chief Investment Officer, Federation of National Public Service Personnel Mutual Aid Associations

Read bioKeynote Panel: Infrastructure Investing in a Volatile World: Balancing Opportunities and Geopolitical Risks (English) ❘ 基調パネルディスカッション:不安定な世界におけるインフラ投資:機会と地政学的リスクのバランス (英語)

- In an increasingly unstable geopolitical landscape, how will infrastructure as an asset class fare compared to other private markets in 2025?

- Will ongoing geopolitical risks and volatility have tangible impacts on the renewables sector and its appeal as a subsector?

- Amid increasing concerns about overpaying for assets, how do GPs ensure they source the best deals?

- ますます不安定化する地政学的状況において、2025年にはアセットクラスとしてのインフラは、他のプライベート市場と比べてどのように推移するか。

- 現在進行中の地政学的リスクと不安定性は、再生可能エネルギー部門とそのサブセクターとしての魅力に具体的な影響を及ぼすか。

- 資産に対する過剰な支払いに対する懸念が高まる中、GPはどのようにして最良の取引を確実に見出すか。

Alexander Wellsteed

Principal Evaluation Specialist, Independent Evaluation Department, Asian Development Bank

Read bio

Break ❘ 休憩

Panel: Renewables Platforms as an Investment Strategy (English) ❘ パネルディスカッション:投資戦略としての再生可能エネルギープラットフォーム (英語)

- Europe vs. U.S. vs. APAC – which global jurisdictions are proving the most attractive?

- How can investing in renewables platforms mitigate risk, diversify portfolios, and enhance scalability?

- Distributed energy vs. large-scale renewables: understanding the benefits and limitations of distributed energy systems versus large-scale renewable projects.

- 欧州・米国・アジア太平洋 – 世界で最も魅力的なのはどの管轄区域か。

- 再生可能エネルギープラットフォームへの投資によって、どのようにリスクを軽減し、ポートフォリオを多様化し、拡張性を高められるか。

- 分散型エネルギーと大規模再生可能エネルギー:分散型エネルギーシステムと大規模再生可能エネルギープロジェクトの利点と限界を理解する。

Danny Latham

Partner, Head of Igneo Infrastructure Partners, Australia & NZ, Igneo Infrastructure Partners

Read bio

Presentation: Understanding LP sentiment with the II Global Investor 75 ranking (English) ❘ プレゼンテーション (英語)

Lunch & Networking ❘ 昼食・ネットワーキング

Panel: The Rise of Digital Infrastructure and AI (English) ❘ パネルディスカッション:デジタルインフラとAIの台頭 (英語)

- How can digital infrastructure investments be optimized to support the real-time data needs of AI, including advancements in data centers, high-speed networks, and edge computing?

- What are the key investment opportunities for institutional investors in AI-driven infrastructure, such as smart cities, 5G networks, and energy management systems?

- What strategies can investors use to balance regulatory, technological, and cybersecurity risks while maximizing returns in this rapidly evolving sector?

- データセンター、高速ネットワーク、エッジコンピューティングの進歩など、AIにおけるリアルタイムデータの必要性をサポートするために、デジタルインフラへの投資をどのように最適化できるか。

- スマートシティ、5Gネットワーク、エネルギー管理システムなどのAI主導のインフラストラクチャに対する機関投資家の主な投資機会とは何か。

- 急速に進化するこの分野で、投資家はどのような戦略を採用して規制、技術、サイバーセキュリティのリスクのバランスを取りながら収益を最大化できるか。

Panel: Optimizing Returns in Energy Transition – Strategies for Japanese Investors (English) ❘ パネルディスカッション:エネルギー転換におけるリターンの最適化 ― 日本の投資家向け戦略 (英語)

- Identifying high-yield opportunities in renewables, battery storage, and emerging transition technologies.

- Understanding the current offshore wind market – can a crisis give rise to new investment opportunities?

- Renewables – managing supply chain challenges and high costs to maintain investor appeal.

- 再生可能エネルギー、バッテリーストレージ、エネルギー転換新興技術における高収益機会を特定する。

- 現在の洋上風力発電市場を理解する – 危機は新たな投資機会を生み出すことができるか。

- 再生可能エネルギー – 投資家にとっての魅力を維持するために、サプライチェーンの課題と高コストを管理する。

Hiroto Mizugaki

Senior Fund Manager, Infrastructure Investment Group, Tokio Marine Asset Management

Read bio

Break ❘ 休憩

Panel: Driving sustainable strategies in infrastructure investing (English/Japanese) ❘ パネルディスカッション:インフラ投資における持続可能な戦略の推進 (英語/日本語)

- Aligning sustainability with profitability, how can infrastructure investors balance the need for fair pricing with ambitious net zero goals?

- How should infrastructure funds address physical and transition risks in their portfolios while seizing opportunities in renewables?

- What’s the most effective way for infrastructure investors to engage with portfolio companies’ sustainability projects?

- 持続可能性と収益性を一致させながら、インフラ投資家は公正な価格設定の必要性と野心的なネットゼロ目標とのバランスをどのように取ることができるか。

- インフラファンドは、再生可能エネルギーの機会を捉えながら、ポートフォリオ内の物理的リスクと移行リスクにどのように対処すべきか。

- インフラ投資家がポートフォリオ企業のサステナビリティプロジェクトに関与する最も効果的な方法とは。

Yohei Yagyu

Infrastructure Specialist, Global Infrastructure Facility, Infrastructure Finance Department, World Bank

Read bioPanel: Unlocking Value: The Evolving Landscape of Infrastructure Secondaries Investment (English) ❘ パネルディスカッション:価値を解き放つ:インフラセカンダリー投資における進化する状況 (英語)

- How does investing in secondaries compare to primary infrastructure investments in terms of returns?

- How is the nature of deals in the secondary infrastructure market evolving?

- How are investors navigating liquidity, portfolio diversification, and the growing demand for secondary market transactions in private infrastructure deals?

- リターンの点から見ると、セカンダリー投資はプライマリーインフラ投資と比べてどうでしょうか。

- セカンダリーインフラマーケットにおける取引の性質はどのように変化しているか。

- 投資家は、流動性、ポートフォリオの多様化、民間インフラ取引におけるセカンダリーマーケット取引の需要の高まりにどのように対応しているか。

Panel: Investing in Infrastructure Debt: A Sector for All Cycles (English) ❘ パネルディスカッション:インフラデットへの投資:あらゆる景気サイクルにおけるセクター (英語)

- How does infrastructure debt offer resilience across economic cycles, and what characteristics make it an attractive option in the current period of geopolitical uncertainty?

- Understanding the case for sub-investment grade strategies

- Does appetite for infrastructure debt remain strong in a falling interest rate environment?

- インフラデットは、景気サイクル全体にわたってどのようにレジリエンスを提供するか。また、地政学的不確実性が高まっている現在の状況において、インフラデットが魅力的な選択肢となるのはどのような特徴からか。

- 投資適格級以下の戦略のケースを理解する。

- 金利が低下傾向にある環境下でも、インフラデットへの投資需要は依然としてその高さを維持しているか。

Dimitrios Papatheodorou

Head of High Yield Investments, Infrastructure Debt Investment Team, HSBC Asset Management

Read bio

Break 休憩

Panel: Investing in Global vs. Regional Infrastructure Funds (English/Japanese) ❘ パネルディスカッション:グローバル・インフラファンドと地域インフラファンドへの投資 (英語/日本語)

- How do global infrastructure funds compare to regional ones in terms of diversification and risk management?

- What are the potential return differences between investing in global versus regional infrastructure funds?

- In what ways do regional funds offer unique opportunities for infrastructure investment that may be less accessible to global funds? E.g., Accessing Asian investment opportunities.

- 分散化とリスク管理の面で、グローバル・インフラファンドは地域インフラファンドと比べてどうか。

- グローバル・インフラファンドと地域インフラファンドへの投資における潜在的なリターンの違いは何か。

- 地域ファンドは、グローバルファンドがアクセスしにくい可能性のあるインフラ投資において、どのような独自の機会を提供しているのか。例:アジアの投資機会へのアクセス。

Panel: The Maturation of Japanese LPs’ Investment Strategies (Japanese) ❘ パネルディスカッション:日本のLP投資戦略の成熟 (日本語)

- As Japanese investment has grown, are we seeing greater sophistication in their investment strategies? Are closed-end funds gaining traction compared to the historically popular open-end funds?

- Are more Japanese LPs investing directly without gatekeepers, and will the role of gatekeepers remain central moving forward?

- How do Japanese investors view current geopolitical risks when making allocations?

- 日本の投資が拡大するにつれ、LP投資戦略はより洗練されつつあるのか。クローズドエンド型投資信託は、歴史的に人気のあったオープンエンド型投資信託に比べて人気が高まっているのか。

- ゲートキーパーを介さずに直接投資する日本のLP投資は増えているか。また、ゲートキーパーの役割は今後も中心的な位置を占め続けるのか。

- 日本の投資家は資産配分を行う際に、現在の地政学的リスクをどのように見ているのか。

Cocktail Reception ❘ カクテルレセプション

Agenda

Infrastructure Investor Network Tokyo Forum - Thursday 5th

Registration & networking ❘ 受付 & ネットワーキング

PEI Opening remarks (English) ❘ PEIによる開会の挨拶 (英語)

Keynote Presentation (Japanese) ❘ 基調講演 (日本語)

Ryosuke Yoshida

Director & Investment Lead, Infrastructure, Private Market Investment Department, Government Pension Investment Fund (GPIF)

Read bioPanel: Understanding the role of Japanese strategic investors in the infrastructure market (English/Japanese) ❘ パネルディスカッション:インフラ市場における日本の戦略的投資家の役割を理解する (英語/日本語)

- How are strategic investors approaching investments in datacentres and renewables?

- What lessons have strategic investors learned from past investments in infrastructure, and how have these experiences shaped their current strategies?

- What roles do partnerships and collaborations play in the investment strategies of strategic investors within the infrastructure sector and beyond?

- 戦略的投資家はデータセンターや再生可能エネルギーへの投資にどのように取り組んでいるのか。

- 戦略的投資家は過去のインフラ投資からどのような教訓を学び、これらの経験は現在の戦略にどのような影響を与えたのか。

- インフラセクター内外における戦略的投資家の投資戦略において、 連携と協働はどのような役割を果たしているのか。

David Povall

Senior Executive Officer, Offshore Wind Renewable Energy Division, The Kansai Electric Power Co.

Read bio

Masahiro Sakakibara

Head of Frontier & Creation Unit, Global Business Division, Chubu Electric Power

Read bio

Shinichi Yasuda

Senior Vice President, Structured Finance Department, Development Bank of Japan

Read bioBreak ❘ 休憩

Panel: The Continuing Evolution of Japan's Energy transition (English) ❘ パネルディスカッション:日本のエネルギー転換における継続的な進化 (英語)

- What are the primary drivers behind the increasing demand for corporate PPAs in Japan, and how is this impacting the renewable energy market?

- Evaluating the outcomes of the second-round battery auction: does it bode well for future growth?

- How will government mandates shape the financial outlook for battery and energy storage companies in Japan?

- 日本における企業PPAの需要増加の主な要因は何か。また、これは再生可能エネルギー市場にどのような影響を与えているのか。

- 第2回長期脱炭素電源オークションの結果の評価:将来の成長にとって良い兆候となるか。

- 政府の規制は、日本の蓄電池およびエネルギー貯蔵関連企業の財務見通しにどのような影響を与えるか。

Panel: Harnessing Investment Opportunities in the Mid-Market Sector (English) ❘ パネルディスカッション:中堅企業における投資機会の活用 (英語)

- Why does the mid-market provide more favorable exit dynamics and faster capital velocity compared to large-cap investments?

- Mid-market specialists vs. multi-strategy platforms – which investment strategies are the most compelling?

- Is there a risk that generalists in the mid-market could get squeezed out?

- なぜ中堅企業は、大企業への投資と比較して、より有利なエグジットダイナミクスとより速い資本流動性を提供するのか。

- 中堅企業のスペシャリストとマルチ戦略プラットフォーム – より魅力的投資戦略はどちらか。

- 中堅市場のゼネラリストが締め出されるリスクはあるか。

Lunch & Networking ❘ 昼食・ネットワーキング

Close of Conference ❘ カンファレンス終了

Agenda

Infrastructure Investor Network Tokyo Forum - Friday 6th

Women in Real Assets Networking Function (Collocated with PERE Tokyo Forum) リアルアセット分野における女性ネットワーキングイベント(PERE東京フォーラムと共催)

Venue: The Executive Centre, JP Tower, 2 Chome-7-2 Marunouchi, Chiyoda City, Tokyo 100-7014, Japan

会場:The Executive Centre(エグゼクティブセンター)、JPタワー

〒100-7014 東京都千代田区丸の内2丁目7-2

(Open to women only, RSVP required・女性限定・要予・)

This is where the future of infrastructure is built.

Get ready to connect with the Japan's most influential players in infrastructure

Access to the Tokyo Forum

Event access and 12-month Network membership

US$ 4,195

Group Rate:

Purchase 3 or more passes in one transaction to unlock our group discount. Contact: luca.g@pei.group

Access to the Japan Korea Week

Event access and 12-month Network membership

US$ 7870

.

.

Group Rate:

Purchase 3 or more passes in one transaction to unlock our group discount. Contact: luca.g@pei.group

Are you an investor?

A limited number of complimentary passes are available for eligible allocators and institutional and private investors. Limited to foundations, endowments, trusts, insurance companies, single family offices, sovereign wealth funds and pension funds.