Trent Winduss

Partner, Head of Asia Secured Debt Investments and Head of Australia, Phoenix Property Investors

Eddie Yeh

Joint General Manager and Head of Real Estate Finance Group, Sumitomo Mitsui Banking Corporation

The only exclusively debt-focused real estate event in Asia, the 2nd annual PERE Debt Forum was successfully held through PERE Asia Week virtual experience on 16 November 2020.

The interactive virtual experience connected delegates to Asia’s leading institutional investors supplementing equity investments with debt strategies to the global fund managers financing projects across the world.

The Debt Forum is your best opportunity to build your network of credit-focused real estate investors.

Jiroo Eoh

Team Head

ABL Life Insurance

Bill Schwab

CEO, LCI Investment Company

and former Global Head of Real Estate

Abu Dhabi Investment Authority

Trent Winduss

Head of Asia Secured Debt Investments and Head of Australian Investments Phoenix Property Investors

Helena Wright

Vice President, Sustainable Infrastructure & Energy Finance

WWF

Key themes to be explored across the day include:

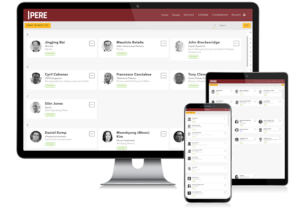

The PERE Global Passport connects you to the virtual community of real estate decision-makers that attend all six of PERE’s industry-leading events with special perks that give you the advantage to secure capital commitments and finalize your next project over your peers. All without leaving your (home) office!

The specialised events at PERE Asia Week capture the key themes of the industry with good interaction with participants to discuss topical trends.

It was my first conference and will be a regular event on my calendar in years to come.

The full PERE Asia Week was an informative and insightful event worth attending!

Advance your investment strategies by learning the tactics generating the highest yields and connect with those putting them into practice. As the only conference in Asia focused on real estate debt strategies, the knowledge-sharing with global peers and fund managers will be second-to-none.

Demonstrate your unique value-add capabilities to institutional investors increasingly searching for diversified global exposure in private lending facilities as real asset debt strategies are desired as an alternative to bond investing.

Connect with your entire potential client base on our virtual meeting place to showcase your strategic insight to regional investors searching for opportunities worldwide and leading fund managers connecting capital to projects with just a few clicks.

With a focus on premium networking and content, the flagship PERE Asia Summit connects the world’s most sought after audience for global industry-leading knowledge-sharing and discussions.

Enhance your real estate debt strategy by exchanging ideas with the most influential LPs and demonstrate your unique value-add capabilities to turbocharge fundraising for 2021 and beyond.

We are currently working hard to create a world-class agenda yet again for the 2020 Forum. For any enquiries, please contact Niann Lai at Niann.l@peimedia.com.

This ranking will highlight the 50 largest managers of real estate debt funds based on the amount of capital raised from institutional investors between 1 Jan 2015 and 31 Dec 2019.

Partner, Head of Asia Secured Debt Investments and Head of Australia, Phoenix Property Investors

Read bio

Head of Real Estate Client Coverage, APAC, Morgan Stanley Capital International (MSCI)

Read bio

We are currently working hard to create a world-class speaking faculty yet again for PERE Debt Forum 2020. For any enquiries, please contact Niann Lai at niann.l@peimedia.com

The 2nd annual PERE Debt Forum offers a unique opportunity for organisations to raise their profile by meeting with a global audience of senior decision-makers in the global private real estate debt space.

For exclusive sponsorship packages for 2020, contact the Sponsorship Team at asiasponsorship@peimedia.com or call +852 2153 3846.

PERE is committed to connecting the global real estate community so business can continue as normal as possible during abnormal conditions.

Through state-of-the-art technology, PERE Global Passport holders will have the asset class’ most influential decision-makers across the world instantly available for face-to-face video meetings to drive their business forward.

Join ADIA, Allianz Real Estate, CPPIB, CalSTRS, GPIF, NPS and many more investors at all six of PERE’s industry-leading virtual conferences across the year.

The Global Passport is a virtual community of real estate decision-makers that allows you to secure capital commitments and build your client portfolio without leaving your (home) office.

Fill in your details to download the Global Passport brochure for more information.

14-18 September

Maximise your fundraising at Korea’s #1 global real estate conference

14 – 18 September

Connecting Japanese capital to private real estate

9-13 November

North America’s most powerful networking

16-20 November

Financing global private real estate with Asian capital

16-20 November

Shaping the future of private real estate at PERE’s flagship conference

16-20 November

Europe’s largest gathering of private real estate leaders

PERE Global Passport holders get access to the most influential global real estate community across all six of our industry-leading conferences to ensure their business stays as normal as possible in abnormal times.