One month to go until the 48th Annual CU Leadership Convention!

August 12-15, 2025

Caesars Palace Las Vegas

Book more and save!

Why Attend

If there was ever a time we need to show up, make our presence known in the industry, and come together to get answers to the toughest challenges facing CU Leaders, it is now! That is why the country’s #1 event for CU Leaders is proud to bring together world-renowned speakers & 60+ CU practitioners leading more than 55 timely presentations to help you:

- Seize new opportunities using AI and digital transformation strategies

- Manage margins in uncertain times

- Grow deposits

- Protect your CU’s tax-exempt status at the local & national levels

- Increase profitability

- Advance critical diversity efforts from the front-line to the boardroom

- Recruit & retain top talent

- Boost lending

- Leverage Fintech

- Shield members’ data from cyber threats

- Apply sound governance practices

- Manage your CU’s balance sheet in unpredictable markets

- Craft succession plans for years to come

- Add more creativity and problem-solving in your CU

- Take advantage of new technology to optimize efficiency

- And so much more…

Heading to CU Leaders 2025?

New speakers, new sessions, new content — Discover our updated brochure!

Don’t miss what’s new — download the refreshed edition and stay ahead of the curve.

You’re in good company!

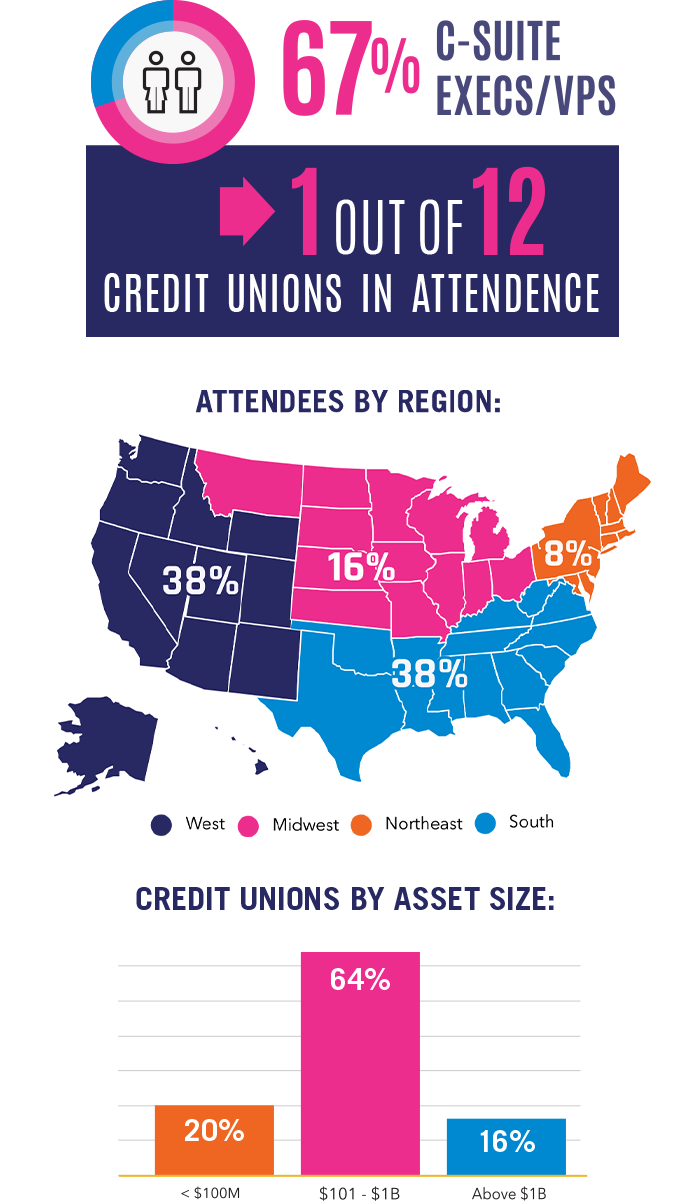

Discover the innovative, forward-thinking, growth-minded CUs ready to network with you at this year’s CU Leadership Convention.

CEO Forum: AI in Action – Unlocking Efficiency, Innovation & Growth for Credit Unions

Vishal Madhavan, Managing Director & Partner, Boston Consulting Group

AI is transforming financial services today—not tomorrow. This executive session, tailored for credit union CEOs, explores how AI is delivering real ROI through enhanced customer engagement and operational efficiency. Learn how credit unions can leverage AI to compete and thrive.

Session Highlights:

- AI Snapshot: Overview of AI’s current impact in banking, with real success stories.

- Practical Use Cases: Automate support, streamline marketing, manage risk, and optimize operations.

- Peer Exchange: Interactive discussions on implementation, challenges, and lessons learned.

- Visionary Workshop: Map a future-forward, AI-powered customer journey to spark innovation.

- Whether you’re exploring AI or refining your approach, this session offers insights and strategies to move forward with confidence.

Hear from Dr James Pogue at the CU Leadership Convention!

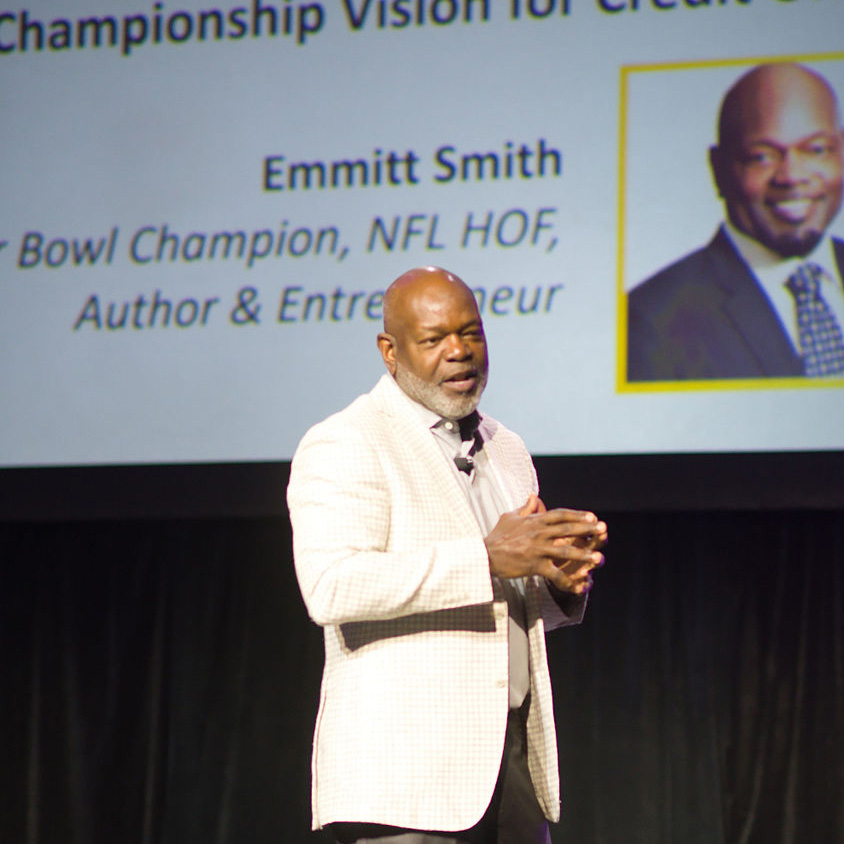

Get ready to supercharge your leadership! In this high-energy session, Dr. James Pogue unveils The Connection Quotient – a game-changing tool that helps credit union leaders ignite team performance, boost engagement, and lead with real impact. Walk away with bold, practical strategies to turn expertise into unstoppable leadership.

Mindblowing entertainment announced: Mentalist Frederic Da Silva!

Award Winning Mentalist Frederic Da Silva is performing his mind reading magic show, Paranormal, at the CU Leadership Convention! Be prepared for an evening of mystery, magic, and hypnosis as Frederic delivers a mind-bending, unforgettable evening.

Janelle Shane joins our Keynote Speaker line-up!

Featured on the main TED stage, in the New York Times, The Atlantic as well as being Futurist in Residence at the Smithsonian, Humorist and Artificiation Intelligence expert Janelle Shane is here to de-mystify all that AI is, and help you explore what AI can do for you in her Keynote presentation What AI Can Do – and Can’t.

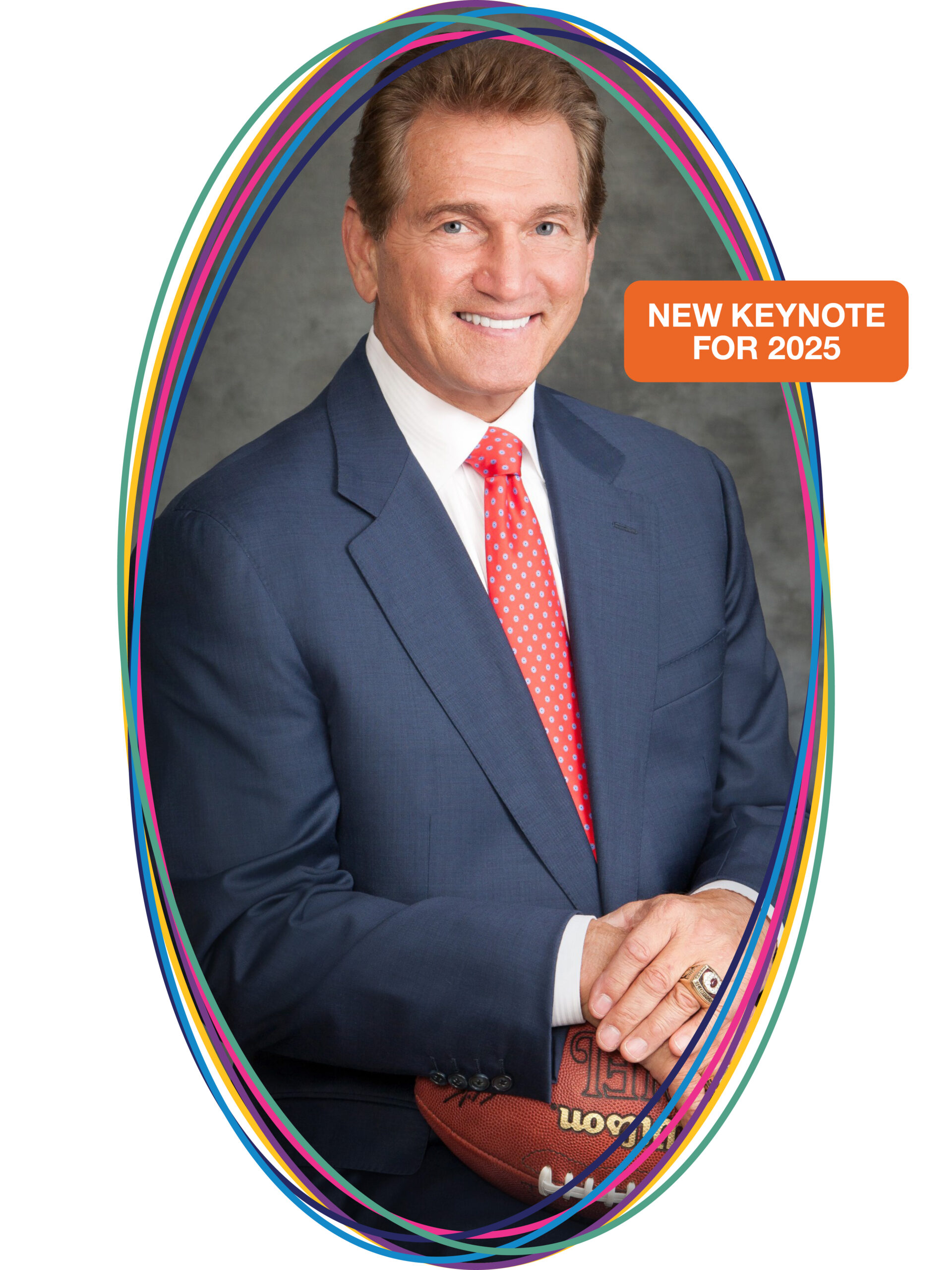

Announcing our 2025 Keynote Speaker: Super Bowl Champion Joe Theismann

Joe Theismann’s journey is more than a comeback story – it’s a masterclass in navigating disruption with purpose and resilience. In this dynamic keynote, credit union leaders will gain powerful, actionable takeaways on how to lead through change, stay focused under pressure, and inspire teams during uncertain times. Drawing from his own dramatic shift from NFL stardom to sudden adversity, Joe shares how a strong mindset, clear vision, and commitment to growth can transform setbacks into opportunities. This session equips CU leaders with the tools to drive innovation, embrace change with confidence, and lead their organizations to new heights.

Discover what’s new for 2025 – Agenda items and speakers you won’t want to miss!

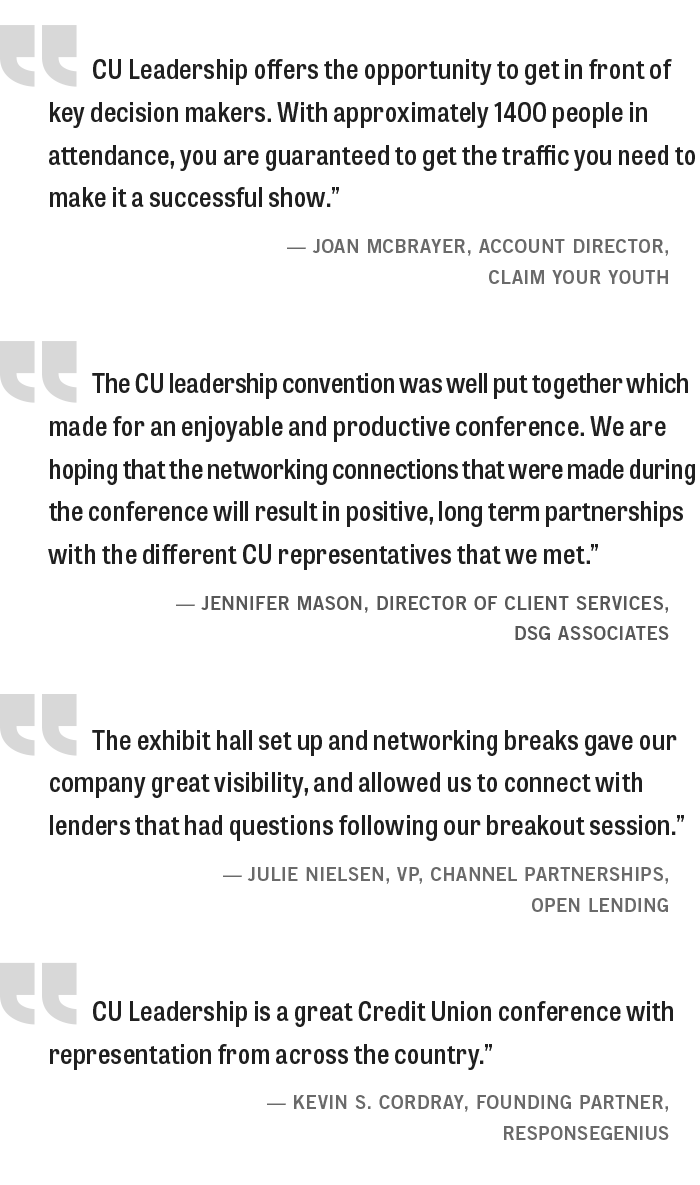

Hear why our 2024 audience can’t wait to return in 2025!

60+ sessions

packed with real

world guidance

Dozens of new thought leaders… plus, our returning all-star speakers

9 NEW BREAKOUT SUMMITS discussing today’s hottest topics

3 NEW Deep Dive Pre-Conference Workshops

Expanded Breakfast of Champions idea sharing session

NEW exhibit hall featuring 50+ solution providers

Opening night entertainment and reception

And much more!

Here are just a few of the HOT TOPICS we’ll be discussing in 2025:

- Generative AI and how CUs can use the newest technology to reduce risk & increase member loyalty

- Best practices to manage liquidity in a high-rate, inflationary market

- Executive compensation plans proven to attract and retain your top talent

- Lending solutions that are generating double-digit growth rates – without sacrificing rates

- Effective methods for recruiting new board members

- Sound practices for retaining core deposits, despite rising rates

- New tools some of the top CUs are using to leverage digital optimization

- Governance tactics to keep your board focused on strategic decision-making

- Tactics to build life-long members – not rate-hoppers

- Practical tactics to boost net interest margins in a high-rate environment

- Strategies CUs are using to regain trust with members – and beat the banks on service

- Newest Fintech solutions that are giving CUs a competitive edge

- M&A strategies – and pitfalls – every director and C-suite executive must know

- Proven solutions CUs are employing to attract Gen Y and Z in a digital world

- New regulatory priorities by NCUA and CFPB on lending, overdraft fees, M&As, cybersecurity, crypto, vendor oversight and more

- Leadership strategies that are proving effective in a post-pandemic world

- And much more…

We welcome CU Leaders from all aspects of the movement! Attendees welcome but not limited to:

- CEOs & Presidents

- Board Chairs/Directors

- Supervisory Committee Members

- Chief/VP of DEI

- Chief/VP of Marketing

- Chief/VP of Finance

- Chief/VP of Lending

- Chief/VP of Technology

- Chief/VP of HR

- Chief/VP of Business Lending

ONE ticket = ALL sessions

Pick and choose to attend any sessions from among 9 UNMISSABLE Breakout Summits

- Discover how to create a culture of “internal employee mobility” and retain your best leaders who drive growth.

- Apply the Momentum Mindset® framework—a proven system that empowers you to move from constant reaction to proactive, confident leadership in your credit union.

- Create digital partnerships and give your CU a competitive advantage to acquire more members & loans.

- Take home the proven tactics to achieve 6.5% loan growth – more than twice the industry average.

- See how one CU earns a return after losses and expenses of 11.50% on non-prime loans.

- Find out how the most innovative CUs are using AI to drive loan growth & create new opportunities.

- Get a blueprint for building meaningful partnerships that drive growth and innovation.

- Discover how CUs are using the newest apps to gain a competitive edge – and deliver bottom-line results.

- Find out how to reach new market segments using Fintech.

- Learn where inflation, interest rates, unemployment & consumer spending are heading in the next 12-18 months.

- Get the strategies you need for unprecedented economic times.

- Discover the tactics the most innovative CFOs are using to manage their balance sheets.

- Find out how one of the most successful CUs uses a “triple-win approach” for managing M&As.

- Learn how to guard against cyber threats and leverage critical security controls with tested backups & Recovery Time Objectives.

- Craft a succession plan that supports your CU’s 5-year strategy & complies with NCUA’s newest regs.

- Discover how to create more happiness in your CU and boost more creativity, problem-solving and bottom-line performance.

- Get the most effective strategies to recruit and retain your top talent.

- Build a high-trust, member-centric culture to drive meaningful and lasting change

- Learn how one CU is appealing to new market segments by serving members during life’s darker moments.

- Take home a proven playbook for capturing attention and creating campaigns that deliver killer results.

- Apply a digital first approach to marketing and double or even triple your ROI.

- Get solutions every CU needs to successfully reach the “unreachable” — Gen Z and Millennials.

- Grow membership and deposits in a hyper-competitive market.

- Target niche-oriented markets that have gone largely unnoticed by Big Banks.

- See how CUs are leveraging AI to engage members – and drive profitable returns.

- Find out how top performing CUs are using AI to drive operational efficiency and reduce costs.

- Get the same AI tools others use to streamline workflows with limited staff.

Be a part of the #1 event for growth-minded CU Leaders in 2025 – just one month to go!

The more you book the more you save! Attending the CU Leadership Convention as a group? Save even MORE with our Group Pricing!

100% Money-Back Guarantee

We’re so confident that the CU Leadership Convention will meet your credit union needs that we are offering our 100% Money-Back Guarantee. If you don’t return to your credit union with the strategies needed to contribute to the growth of your organization, write us and we will promptly return your entire registration fee—no questions asked.

Cancellations and Substitutions:

Our cancellation and substitution policy are as follows: If you’re unable to attend, you’re welcome to send a substitute. Or, if you cancel in writing by Thursday, May 1, 2025, you may get a full refund. After that date, there is no refund, but you may use your registration fee at next year’s CU Leadership Convention. Registrants who do not cancel and do not attend are liable for the full conference fee. Cancellations via phone will not be accepted.

Connect Face-to-Face with C-Suite Leaders & Directors from August 12th – 15th, 2025 in Las Vegas

The 48th Annual CU Leadership Convention is a one-of-a-kind, in-person experience: a unique blend of networking, collaboration and thought leadership between credit union c-suite executives, presidents, board chairs and sponsors.

The program is custom designed to encourage conversation about best practices, relationship building and knowledge sharing across all functional areas on the most pressing issues facing credit unions today.

Join us in Las Vegas from August 12th – 15th, 2025, to engage with over 1,000 forward-thinking CU leaders looking for answers to their most challenging issues.

Premier Sponsorship Programs

Premier Sponsorship provides a complete 360-degree experience throughout all aspects of the event.

Principal Sponsorship

- The Exclusive Principal Sponsor of one of the CULC Summits (Leadership, Trending, Lending, Human Resources, FInTech, Branding & Marketing and Financial Management)

- Keynote speaking opportunity kicking off the specified summit on Wed., July 31

- Premium branding as the Principal Sponsor of the summit of your choosing

- Premium branding where sponsors appear throughout the CU Leadership Convention

- Full page advertisement in event guide

- Six (6) staff passes (in addition to your speaker, 7 total)

- 10’ x 20’ exhibit space (includes standard pipe and drape)

- Company logo & listing on website

- Company listing in event guide

- Pre- and post-show email to CULC registrants

- Seat drop pre-speaking session (1)

- Pre and post show registrant lists

Lead Sponsorship

- Branding: Your firm will be branded at the Lead Sponsor level

- One speaking opportunity (specific details to be determined with CULC Chairman)

- Full page advertisement in event guide

- Four (4) staff passes (in addition to your speaker, 5 total)

- 10’ x 20’ exhibit space (includes standard pipe and drape)

- Company logo & listing on website

- Company listing in event guide

- Pre and post show registrant lists

Sponsorship

- Branding: Your firm will be branded at the Sponsorship level

- One speaking opportunity (specific details to be determined with CULC Chairman)

- Half-page advertisement in event guide

- Three (3) staff passes (in addition to your speaker, 4 total)

- 10’x10’ exhibit space (includes standard pipe and drape)

- Company logo & listing on website

- Company listing in event guide

- Pre and post show registrant lists

Additional Sponsorship Opportunities

Taking place on the night before the conference kicks off, this premier program provides sponsor with a private hosted dinner for a curated audience of CEOs.

- Branding: Your firm will be promoted as a sponsor of the Forum, where sponsors are listed.

- Attendee Passes: Your firm receives three (3) passes to attend the CEO Dinner and CU Leadership Convention

- Pre and post show registrant lists (name, title, company)

Curated session: Your firm will have the opportunity to create an interactive session and work with CULC to curate an audience from the CULC attendees.

- 10’x10’ exhibit space (includes standard pipe and drape)

- Company logo & listing on website

- Company listing in event guide

- Two (2) staff passes (allows access to conference sessions and public networking events)

- Pre and post show registrant lists (name, title, company)

Every attendee will create a walking billboard for your firm throughout the event. Sponsor’s logo will appear on the event lanyards provided to all attendees upon registration.

- Branding:

- Your firm will be branded at the Sponsor level

- Your firm will be branded as sponsor on break signage

- 10’x10’ exhibit space (includes standard pipe and drape)

- Company logo & listing on website

- Company listing in event guide

- Two (2) staff passes (allows access to conference sessions and public networking events)

- Pre and post show registrant lists (name, title, company)

The 4×7 Tech Demo will feature a session with 7 firms receiving 7 minutes on stage to present and demonstrate their technology offering.

- Branding as a sponsor and participant in the 4×7 Tech Demo

- One presentation slot in one Tech Demo (exact one TBD)

- 10’x10’ exhibit space (includes standard pipe and drape)

- Company logo & listing on website

- Company listing in event guide

- Two (2) staff passes (allows access to conference sessions and public networking events)

- Pre and post show registrant lists (name, title, company)

As the exclusive sponsor of CULC’s registration area, your brand will be in the one place every single attendee must visit.

- Branding:

- Your firm will be branded at the Sponsor level

- Your firm will be branded as sponsor on break signage

- 10’x10’ exhibit space (includes standard pipe and drape)

- Company logo & listing on website

- Company listing in event guide

- Two (2) staff passes (allows access to conference sessions and public networking events)

- Pre and post show registrant lists (name, title, company)

Sponsor receives premium sponsorship branding on every tote bag, distributed to all attendees.

- Branding:

- Your firm will be branded at the Sponsor level

- Your firm will be branded as sponsor on break signage

- 10’x10’ exhibit space (includes standard pipe and drape)

- Company logo & listing on website

- Company listing in event guide

- Two (2) staff passes (allows access to conference sessions and public networking events)

- Pre and post show registrant lists (name, title, company)

Sponsor may suggest a branded password for WiFi access during the event. This will be advertised on signage and tent cards throughout the venue.

- Branding:

- Your firm will be branded at the Sponsor level

- Your firm will be branded as sponsor on break signage

- 10’x10’ exhibit space (includes standard pipe and drape)

- Company logo & listing on website

- Company listing in event guide

- Two (2) staff passes (allows access to conference sessions and public networking events)

- Pre and post show registrant lists (name, title, company)

Sponsor receives premium sponsorship branding surrounding the networking breaks

- Branding:

- Your firm will be branded at the Sponsor level

- Your firm will be branded as sponsor on break signage

- 10’x10’ exhibit space (includes standard pipe and drape)

- Company logo & listing on website

- Company listing in event guide

- Two (2) staff passes (allows access to conference sessions and public networking events)

- Pre and post show registrant lists (name, title, company)

Be the first to greet attendees in the morning as the host of the conference breakfasts.

- Branding:

- Your firm will be branded at the Sponsor level

- Your firm will be branded on breakfast signage as the sponsor

- 10’x10’ exhibit space (includes standard pipe & drape)

- Company logo & listing on website

- Company listing in event guide

- Two (2) staff badges (allows access to conference sessions and public networking events)

- Pre and post show registrant lists (name, title, company)

Align your firm with the premier think tank session – The Breakfast of Champions!

- Branding:

- Your firm will be branded at the Sponsor level

- Your firm will be branded as sponsor on break signage

- 10’x10’ exhibit space (includes standard pipe and drape)

- Company logo & listing on website

- Company listing in event guide

- Two (2) staff passes (allows access to conference sessions and public networking events)

- Pre and post show registrant lists (name, title, company)

- Thought Leadership Sponsor may help in the sessions at the discretion of the CULC Chairperson

- Sponsor may provide branded pens/pads for the session

Sponsor receives exclusive sponsorship branding on aisle signs throughout the exhibit hall

- Branding:

- Your firm will be branded at the Sponsor level

- Your firm will be branded as sponsor on break signage

- 10’x10’ exhibit space (includes standard pipe and drape)

- Company logo & listing on website

- Company listing in event guide

- Two (2) staff passes (allows access to conference sessions and public networking events)

- Pre and post show registrant lists (name, title, company)

Be one of 15 exhibitors participating in the contest for attendees.

Each passport sponsor will be featured on a bingo style card. Attendees must visit and engage with passport sponsors at their booth visit sponsors and have the sponsor stamp their card with their unique stamp.

Upon completion, attendees turn their cards in for a chance to win prizes.

- Branding: Your firm will be branded at the Sponsor level

- 10’x10’ exhibit space (includes standard pipe & drape)

- Company logo & listing on website

- Company listing in event guide

- Two (2) staff passes (allows access to conference sessions and public networking events)

- Pre and post show registrant lists (name, title, company)

You’re invited to the #1 event for growth-minded CU Leaders

The CU Leadership Convention held every summer in Las Vegas is regarded as one of the top conferences for credit union executives and directors with more than 1,200 attendees and 50+ solution providers.

Previously known as the Directors & CEO Conference, the country’s leading event for Directors, CEOs and C-suite level leaders is now the CU Leadership Convention. For 47 years, the conference has delivered the best content, packed with practical guidance and innovative solutions from the country’s leading SMEs, CEOs, executives, directors and consultants willing to share what’s working – and what’s not.

This year is no exception! Join us in Vegas to share ideas, network and learn from the country’s leading credit union experts. This year’s convention features:

- 63 sessions with real-world guidance from CEOs, directors and SMEs.

- 9 NEW Breakout Summits on today’s hottest topics, including AI, liquidity, DEI lending, HR, leadership, fintech and more. Pick and choose your favorite topics!

- 3 NEW Deep Dive Pre-Conference Workshops on Board Governance, Data, AI, and Financial Management.

- Expanded Breakfast of Champions idea exchange: Share your best idea, with proven results, and hear from your peers about their biggest successes to revolutionize your CU (Limited to the first 300 paid attendees)!

- NEW exhibit hall featuring 50+ solution providers.

- Opening night entertainment and reception.

- And much more!

Since we are not an association or a CUSO, we deliver unbiased perspectives from the industry’s leading thought leaders, so you have the information you need to better serve your communities, your members and your employees. This commitment to top-quality content and thought-provoking speakers – all while in America’s most exciting city – makes the CU Leadership Convention a must-attend event for any credit union leader.

We look forward to seeing you in Vegas!

Dennis J. Sullivan, Chairman

For Board Members:

- Learn and adopt best-in-class strategies to grow your credit union and improve profitability in a sustainable way.

- Build on your current plans and ideas by exchanging information with fellow innovative board directors pioneering the credit union movement.

- Discover how to generate 10-12x the returns for your credit union at the all-new CU Leadership Summit – dedicated to helping board directors provide their C-suite with the right level of direction. Take your board director skills to the next level by learning about the hottest topics for credit unions, including new sessions on how AI and Liquidity impact CUs.

- Differentiate yourself from banks by gaining access to fintech experts, solution providers and unvarnished perspectives focused on supporting credit unions and their boards to win more business.

- Crowdsource innovation – take part in this year’s Expanded Breakfast of Champions idea exchange. Share your best idea, with proven results, and hear from your peers about their biggest successes to revolutionize your CU (Limited to the first 300 paid attendees).

- Join this getaway with your spouse, unwind and enjoy all that the US entertainment capital has to offer.

For C-Suite Executives:

- Learn about the hottest topics in the movement, based on your area of expertise. Choose from 8 Summits covering fintech, leadership, marketing, DEI, HR and more to develop actionable strategies that will have impact in your CU.

- Get the best of both worlds at CU Leadership Convention – entertainment and education. Connect with your peers over breakfast or at one of our evening events whilst experiencing the most progressive speakers, content and solution providers for your CU by day.

- Network with fellow C-suite to tackle shared challenges and discover innovative solutions, including how to communicate effectively with your board.

- Learn the top 3 emerging risks every executive needs to know and find out how to apply the big changes affecting strategy, structure, governance, and leadership for credit unions, so you can play your part in driving growth.

See what you missed in 2024…

The CU Leadership Convention is one of the largest events in the country bringing together credit union directors, CEOs, Presidents, and C-suite executives from across the nation.

Keynote speakers and entertainment acts have featured Dan Rather, Jon Taffer, Cal Ripken Jr., Chris Gardner, Howie Mandel, Jay Leno, and Penn & Teller. Most importantly, the convention hosts more than 60 industry experts to share best practices and guidance to help credit unions of all sizes grow and better serve their employees, members and their communities. In addition, the convention includes more than 50 solution providers in its exhibit hall showcasing the newest technology and services available to credit unions.

Celebrating its 47th anniversary July 30-August 2, 2024 at Caesars Palace in Las Vegas, the CU Leadership Convention typically hosts more than 1,200 credit union leaders. Content is focused on the key areas of managing credit unions including lending, Fintech, cybersecurity, DEI, finance, leadership, Generative AI, member service, and branding. The convention is hosted by PEI Group, and is not affiliated with any trade group or political organization so we can give you unvarnished content designed to help you grow and solve your toughest challenges.

To download any of the Resources, a valid work email is required. Personal emails that use @outlook.com, @gmail.com, @yahoo.com, @icloud.com, etc. cannot be accepted.

Pre-Event Resources

Learn, play, and unwind at Caesars Palace

It’s time to indulge and treat yourself while learning and networking at the 48th CU Leadership Convention. Play, dine and unwind like royalty at Caesars Palace Las Vegas: the remarkable, palatial, center-strip resort. From luxurious hotel rooms to world-class entertainment, it’s time to experience a trip that’s one for the books.

Caesars Palace Las Vegas

3655 Las Vegas Blvd S, Las Vegas, NV 89109

866-227-5944

Hotel bookings are now open!

Phone reservations: 1.866.227.5944

Reservation Contact: Lynn Taggart ltaggart@flamingolasvegas.com

All convention registrants also get these exclusive benefits as guests at Caesars Palace:

- Unlimited local phone calls

- Two (2) admissions per day to Fitness Center

- In-room internet access to include two (2) devices per room per day

Hotel Deposit & Cancellation Policy:

All reservations must be guaranteed with a deposit for the first night’s guestroom and tax charge. If reservation is guaranteed to a credit card, the first night’s guestroom and tax charge, per guestroom, will be billed immediately to the cardholder’s account. Any reservations made via the telephone call center will be assessed a fee of $15.00 plus current sales tax, per reservation. This fee will not apply to reservations made via the internet.

Property allows individual attendee cancellations without penalty up to seventy-two (72) hours prior to the attendee’s scheduled arrival date. Property will charge the individual attendee one night’s guestroom rate plus tax for cancellations within seventy-two hours (72) hours of the scheduled arrival date or failure of the individual attendee to check-in on the scheduled arrival date (each a “no-show”).

It is Property’s standard policy to require a credit card or cash deposit from individual attendees upon check-in for incidental charges. Hotel check in time is 4:00 pm. Check out time is 11:00 am. Any departures after 11:00 AM are subject to the full day charge. Each guestroom must have at least one registered guest twenty-one (21) years of age or older.

Learn, play, and unwind at Caesars Palace

See what you missed in 2024…

Great news! The CU Leadership Convention is proud to partner with the African-American Credit Union Coalition to host this year’s AACUC Annual Conference, and we look forward to welcoming you to Las Vegas!

As an AACUC member, you will enjoy all the benefits of networking and sharing ideas – and you get the opportunity to experience the country’s most thought-provoking speakers, world-class entertainment, and more chances to apply innovative solutions to the challenges facing credit union leaders today – all in America’s most exciting city! AACUC Members are eligible for an exclusive registration discount! Keep scrolling to access the discount.

Here are just 10 of the benefits AACUC members will enjoy:

- Special opening-day welcoming reception for members to meet old friends and forge new relationships.

- AACUC curated breakout sessions — including our ALL-NEW DEI Summit — discussing the hottest topics in lending, HR, Fintech, Financial Management, Marketing & Branding, Leadership and much more.

- Special Pete Crear Lifetime Achievement Award luncheon celebrating this year’s winners.

- AACUC thought-leaders featured throughout the convention all four days!

- A unique opportunity to meet with more than 60 solutions providers in the country’s largest exhibit hall for credit union leaders.

- More chances to learn what’s working — and what’s not — from more than 1,000 of your colleagues.

- Celebrate this year’s recipient of the Renée Sattiewhite Neoteric Changemaker Award winner!

- More opportunities to network and collaborate with your peers at the exclusive AACUC Member Lounge.

- World-class entertainment you and your guests can only experience in Las Vegas!

- A special closing party for you to relax and enjoy your time with friends and colleagues.

- And much more…

Don’t miss Olympic great Jackie Joyner Kersee

Named by Sports Illustrated as “The Greatest Female Athlete of the 20th Century.”

2024 Pete Crear Lifetime Achievement Awards Luncheon

Come celebrate the 2024 Pete Crear Lifetime Achievement Award Honorees during the 47th CU Leadership Convention on Wednesday, July 31. Congratulations to Sandra DeVoe Bland, Board Chair of SRP Federal Credit Union, and Dan Berger, retired President/CEO of NAFCU. This prestigious award recognizes a credit union professional or volunteer whose career best embodies the African-American Credit Union Coalition’s mission to increase the strength of the global credit union community.

Sandra DeVoe Bland

Board Chair

SRP Federal Credit Union

Dan Berger

Retired President/CEO

NAFCU

We look forward to welcoming you to the 47th CU Leadership Convention, presented in partnership with AACUC.

Register TODAY and SAVE with your AACUC Member Discount Code!

Access the AACUC Member Discount code by logging into the AACUC Info Hub.

Not an AACUC Member?

Have questions for AACUC about your membership status or the AACUC Member Discount?

Contact us at membership@aacuc.org.

Great news! The CU Leadership Convention is proud to partner with the African-American Credit Union Coalition to host this year’s AACUC Annual Conference, and we look forward to welcoming you to Las Vegas!

As an AACUC member, you will enjoy all the benefits of networking and sharing ideas – and you get the opportunity to experience the country’s most thought-provoking speakers, world-class entertainment, and more chances to apply innovative solutions to the challenges facing credit union leaders today – all in America’s most exciting city! AACUC Members are eligible for an exclusive registration discount! Keep scrolling to access the discount.

Here are just 10 of the benefits AACUC members will enjoy:

- Special opening-day welcoming reception for members to meet old friends and forge new relationships.

- AACUC curated breakout sessions — including our ALL-NEW DEI Summit — discussing the hottest topics in lending, HR, Fintech, Financial Management, Marketing & Branding, Leadership and much more.

- Special Pete Crear Lifetime Achievement Award luncheon celebrating this year’s winners.

- AACUC thought-leaders featured throughout the convention all four days!

- A unique opportunity to meet with more than 60 solutions providers in the country’s largest exhibit hall for credit union leaders.

- More chances to learn what’s working — and what’s not — from more than 1,000 of your colleagues.

- Celebrate this year’s recipient of the Renée Sattiewhite Neoteric Changemaker Award winner!

- More opportunities to network and collaborate with your peers at the exclusive AACUC Member Lounge.

- World-class entertainment you and your guests can only experience in Las Vegas!

- A special closing party for you to relax and enjoy your time with friends and colleagues.

- And much more…

Don’t miss Olympic great Jackie Joyner Kersee

Named by Sports Illustrated as “The Greatest Female Athlete of the 20th Century.”

2024 Pete Crear Lifetime Achievement Awards Luncheon

Come celebrate the 2024 Pete Crear Lifetime Achievement Award Honorees during the 47th CU Leadership Convention on Wednesday, July 31. Congratulations to Sandra DeVoe Bland, Board Chair of SRP Federal Credit Union, and Dan Berger, retired President/CEO of NAFCU. This prestigious award recognizes a credit union professional or volunteer whose career best embodies the African-American Credit Union Coalition’s mission to increase the strength of the global credit union community.

Sandra DeVoe Bland

Board Chair

SRP Federal Credit Union

Dan Berger

Retired President/CEO

NAFCU

We look forward to welcoming you to the 47th CU Leadership Convention, presented in partnership with AACUC.

Register TODAY and SAVE with your AACUC Member Discount Code!

Access the AACUC Member Discount code by logging into the AACUC Info Hub.

Not an AACUC Member?

Register with my AACUC Discount Code:

Have questions for AACUC about your membership status or the AACUC Member Discount?

Contact us at membership@aacuc.org.

CULTURE DISRUPTOR. STRATEGY SHAPER.

DR. JAMES POGUE

TAKES THE STAGE IN 2025!

Keynote Presentation: The RIGHT Kind of Uncomfortable™ – Leading with Courage, Culture, and Connection

Dr. James Pogue, The Connection Quotient: Elevating the Industry Experts to A Leadership Powerhouse

In many credit unions, leaders are often promoted for their technical expertise, with the expectation that their leadership abilities will evolve. While this can be the case for some, for others, the transition to

effective leadership doesn’t always happen naturally.

So, what happens when disruption strikes? When change accelerates into full-scale chaos?

Leaders who lack practiced leadership skills in key organizational areas often manage teams that are disengaged, less

productive, and ultimately less profitable.

In this session, we will explore proven strategies that enable leaders to identify and address their leadership gaps. Attendees will engage with The Connection Quotient, a sophisticated assessment tool designed to help leaders build stronger teams, drive deeper engagement, and cultivate a thriving organizational culture.

This session will underscore the importance of having a clear, actionable roadmap to elevate industry experts into true leadership powerhouses. Participants will leave with practical insights and tools to transform leadership potential into impactful, sustainable success.

ANNOUNCING OUR 2025 KEYNOTE SPEAKER: NFL CHAMPION JOE THEISMANN

Keynote Presentation: The Challenge of Change

NFL Legend Joe Thiesmann

Drawing from personal experience, Joe Theismann knows how to deal with the Challenge of Change. On November 18, 1985, he was on top of his game -a two-time Pro Bowl player and the most productive quarterback in the history of the Washington Redskins. Later that evening, he found himself in a hospital bed with a compound fracture to his leg, shattering both his career and his boyhood dream. At age thirty-five, he was faced with starting over his personal life and professional career. In this stirring presentation, credit union leaders will learn how to tackle change by keeping a positive mental outlook and committing to a vision that guides you to the top.

JANELLE SHANE JOINS OUR 2025 KEYNOTE SPEAKER LINEUP!

Keynote Presentation: What AI Can Do – and Can’t

Janelle Shane, Artificial Intelligence Speaker, Humorist

AI is making headlines and disrupting banking. But what IS artificial intelligence, and what is it good at? AI expert Janelle Shane takes a weird and humorous approach to a complex topic and talks about the kinds of problems where AI will succeed, fail, or succeed at solving the wrong problem entirely. She has been featured on the main TED stage, in the New York Times, The Atlantic, WIRED, Popular Science, All Things Considered, Science Friday, and Marketplace, as well as being Futurist in Residence at the Smithsonian. Her book, “You Look Like a Thing and I Love You: How AI Works, Thinks, and Why It’s Making the World a Weirder Place” uses cartoons and humorous pop-culture experiments to look inside the minds of the algorithms that run our world, making artificial intelligence and machine learning both accessible and entertaining. Shane was named one of Fast Company’s 100 Most Creative People in Business, and an Adweek Young Influential.

Teresa Freeborn

President and author of Suits and Skirts - Game On! The Battle for Corporate Power, Kinecta FCU

Agenda

Deep Dive Pre-Conference Workshops - Tuesday 12th

Convention Registration Opens

Deep Dive Hot-Topic Workshop #1 - Mergers & Acquisitions - Strategic Considerations for Member Focused CUs

Join one of the country’s leading M&A experts, Pete Duffy, as he discusses how both organic growth and mergers should play a role in your strategic plan. Find out the steps innovative CUs are already taking to prepare for this tectonic shift in the market.

In this lively and interactive presentation, you will get:

- Industry-leading research on how to develop an effective M&A strategy.

- Tactics to apply the “Three Legged Stool” as a foundation for meeting and exceeding member expectations.

- Key trends impacting the business of credit unions.

- Real-life examples (no hypothetical scenarios!) showing how CUs are outperforming their peers – and an honest assessment of whether the growth is truly sustainable.

- A no-nonsense discussion of the “Why’s and How’s” behind the most productive mergers.

While names will be withheld, nothing else will be left out of this straightforward talk. Based on Duffy’s extensive M&A experience with credit unions nationwide, he will provide a behind-the-scenes look into the deals, the role of Fintechs, and the outlook ahead for credit unions of all sizes. This pre-conference workshop is ideal for members of the board and C-suite to get the information needed to determine the best path forward for your CU.

Pete Duffy, Managing Director of Merger Advisory Services, SRM

Deep Dive Hot-Topic Workshop #2 - Staying on Strategy: Applying Your Strategic Plan into Your Operations and Culture

As a long-time CEO of Partners FCU and Logix CU and years of serving on the board of directors of some of the largest and most impactful organizations in the CU industry, John knows first-hand about the challenges of staying on strategy and best practices for incorporating a vision for the future into your culture. In this special workshop you get insights into 3 key areas to keep your entire leadership team focused for long-term success.

- Always-On Strategy – Learn how to augment your strategic planning processes with an agile approach that complements a volatile business environment.

- One-Page Initiatives – Anywhere between 50-75% of strategic initiatives fail to deliver the desired outcomes. Poor alignment on strategy, tactics, and goals is often the problem. Learn how to create alignment on complex initiatives by using a one-page plan that will greatly increase the odds for success.

- Partnerships – 60-70% of digital transformations fail to deliver the desired outcomes. And many, if not all, are dependent on technological partners. Learn how to assess your partnerships and then create plans to strengthen them, thereby increasing the odds for success. This approach is based on the book, “The Partnership Advantage” by John Janclaes

Attendees will receive a workbook summarizing the three disciplines as well as FREE copy of The Partnership Advantage – How Harnessing the Power of Partnerships Can Revitalize Community Financial Institutions.

John Janclaes, Founder & CEO, The CEO Corner

Deep Dive Hot-Topic Workshop #3 - Governance: Leadership Strategies for Directors in a New Era of Banking

In today’s fast-moving business landscape, effective governance can no longer operate as it has in most credit unions. This intensive, half-day session is designed for CU directors and executives who want to lead with clarity, agility, and confidence in a rapidly evolving environment.

Using practical tools—like the Board-CEO Roles and Responsibilities Matrix—you’ll define the boundaries of authority, clarify expectations, and ensure your board is both empowering and appropriately challenging management. Learn the essentials of Strategic Governance, what high-performing boards do to remain strategic, and how to set stretch goals without stepping into operational weeds.

We’ll cover:

- How to ask the right questions and frame issues strategically

- Key financial ratios every director must understand

- Ways to leverage your expertise without overstepping governance boundaries

- Tools to stay focused on strategy and out of day-to-day operations

- Navigating growth with speed and confidence—even with incomplete information

Through interactive scenarios and real-world examples, this crash course will sharpen your ability to drive results, monitor performance, drive results, and avoid becoming a colleague in success and not a bottleneck to progress. Walk away with practical frameworks and a renewed sense of purpose in your governance role. This session is ideal for: Directors, CEOs, and senior leaders who want to govern smarter and lead faster.

Tim Harrington, President, TEAM Resources

Agenda

Conference - Wednesday 13th

Registration

Exhibit Hall Grand Opening & Continental Breakfast

Opening Keynote: The Challenge of Change

Drawing from personal experience, Joe Theismann knows how to deal with the Challenge of Change. On November 18, 1985, he was on top of his game -a two-time Pro Bowl player and the most productive quarterback in the history of the Washington Redskins. Later that evening, he found himself in a hospital bed with a compound fracture to his leg, shattering both his career and his boyhood dream. At age thirty-five, he was faced with starting over his personal life and professional career. In this stirring presentation, individuals and organizations learn how to tackle change by keeping a positive mental outlook and committing to a vision that guides you to the top.

Joe Theismann

Hot Topics Roundtable Panel - Are We Living in Perilous Times? Tax-Exemption Status, Regulatory Changes & Industry Outlook

5 x 5: 5 speakers share their one best strategy that will have the biggest impact on CUs in just 5 minutes or less

Samuel Jones, PhD, Founder & Owner, Transform Now

Tim Harrington, President, TEAM Resources

Matt Maguy and Jim Pond, Co-founders, JXM

Renee Sattiewhite, President & CEO, AACUC

Networking Break in Exhibit Hall

Lunch

Networking/Dessert in Exhibit Hall

Leadership Summit - The Modern Credit Union Leader: What It Takes to Win with Marketing in 2025

Ever feel like you’re pouring time, talent, and budget into marketing…but not seeing anything measurable across your credit union? Winning in 2025 requires more than great creative, fresh direct mail, and one team trying to drive growth, it demands measurable, accountable marketing that everyone in your credit union understands and supports. The modern credit union leader influences and engages in more than his or her own department. They bridge departments, wrangle data, build trust, and most of all they eliminate the data black hole by leading with clarity, metrics, and intention. Great results, and growth for your credit union, come from more than just your marketing team. It’s an organizational focus where everyone is accountable. We’ll explore insights and stories from the front lines of marketing and data, giving all leaders actionable ideas they can implement today to power their growth through 2025 and beyond.

Ben Udell, SVP Product Marketing & Innovation, Marquis

Sponsored by Marquis

Marketing & Branding Summit - Open a Can of Whoop Ads: Practical Steps to Grab Attention & Deliver a Killer ROI

Matt Maguy and Jim Pond, co-founders of JXM, take the gloves off and walk credit union leaders through a proven playbook for capturing attention and creating campaigns that don’t just look good—they hit hard and deliver results—the pinnacle of performance-based pugilism. This session discusses how to sell bold ideas internally, avoid the common traps of committee marketing, and take the first step toward unleashing your brand’s full potential.

You will learn:

- A proven formula for cutting through the noise with marketing haymakers

- Fresh ideas to inject energy and results into your next campaign

- Practical tips for rallying leadership around bold ideas

Plus, every attendee gets a mini toolkit to help them start opening their own Can of Whoop Ads in their CU. Walk away with the same battle-tested tactics we’ve used to help credit unions turn ‘meh’ campaigns into member magnets—no jargon, no fluff, just a real-deal strategy and value you can use immediately.

JXM Co-Founders Matt Maguy & Jim Pond

FinTech Summit - Turn Member Financial Wellness Into Your Growth Engine

Credit unions were founded to serve communities, but big banks are winning the digital satisfaction race. Bankjoy CEO Mike Duncan reveals how gamification can help credit unions reclaim their competitive advantage by bringing their unique “people-helping-people” mission into the digital banking age. In this session, discover how to:

- Bridge the personalization gap: 72% say personalization affects banking choices, yet big banks aren’t delivering the tools members want

- Capture unmet demand: 88% of Gen Z/Millennials want financial education while 40% of consumers lack basic financial literacy

- Turn engagement into growth: Members using financial wellness tools generate valuable data for targeted cross-selling opportunities

- Create financial partnerships that differentiate you from big banks and drive sustainable growth

Michael Duncan, Founder & CEO, Bankjoy

Sponsored by Bankjoy

Lending Summit - Practical, yet innovative strategies to leverage human connection and boost loan growth

Over the last decade, St. Cloud Financial Credit Union has defied the industry norm—achieving exceptional growth without a formal sales strategy. The results speak for themselves: since 2014, SCFCU has grown its loan portfolio by over 309%, nearly quadrupling loan volume—compared to a 110% average loan growth among credit unions of similar size ($250-$500M in assets). Membership has more than doubled during the same period, outpacing peers in member acquisition and loyalty. This growth has been driven not only by relationship-first service but also by smart innovation. Find out how SCFCU strategically expanded its loan portfolio beyond traditional categories like auto and residential lending and how the credit union leaned into human connections to help fuel its growth. Discover practical strategies you can apply to drive similar results—without a sales script—and learn how a culture rooted in connection can elevate both your loan performance and member experience.

Jed Meyer, President & CEO, St. Cloud Financial CU

HR Summit

CXO Summits – details to follow

Trending Summit - Succession Planning: How to Craft a Plan that Supports Your CU’s 5-Year Strategy

According to NCUA, 25% of CUs either lacked succession for leadership positions or had a plan that was inadequate leading to a newly adopted rule that requires succession plans for the board of directors, supervisory committee, C-suite execs and their assistants, the credit committee and loan officers. Learn what exactly is required by NCUA and how to do more than just “check the box” and create an effective succession plans that supports your CU’s 5-year strategic plan. Failure to plan for vacancies is already leading to leadership vacuums, disrupting operations, and is one of the top reasons for the rise in mergers. Discover the steps you can take to minimize risk and use the plan as an opportunity to bolster your growth for years to come.

Paul Dionne, Chief Strategy Officer, Quantum Governance, L3C

Growth Summit - Mastering Uncertainty: Grow Deposits, NII, and Loyalty in Any Environment

Uncertainty is the new normal – but it doesn’t have to stall your growth. In this session, Kasasa CEO Gabe Krajicek shares proven strategies that help community financial institutions thrive in any market. Learn how to lower deposit costs, improve NII, and build deeper consumer loyalty without disruptive overhauls. Backed by real-world examples, this conversation will challenge conventional thinking and equip you with practical tools to turn margin pressure and market volatility into long-term growth. Walk away ready to lead with confidence – no matter what the market throws at you.

Gabe Krajicek, CEO, Kasasa

Sponsored by Kasasa

Transitional Break

Leadership Summit - Fintech Partnerships - How CUs Can Gain a Competitive Advantage to Acquire More Members & More Loans

In an era where members increasingly seek loans through third-party platforms and aggregators, CUs must rethink their member acquisition strategies. This session explores how strategic partnerships with Fintechs enable CUs to meet borrowers at their digital point of need—whether for unsecured loans, RV/boat financing, HELOCs, or auto refinancing. Learn how leading CUs are leveraging these collaborations to meet members where they are and provide instant approvals on e-commerce platforms, auto sales sites, and other digital touchpoints, capturing high-quality applicants and turn “one and done” borrowers into engaged, long-term members. Take home proven tactics for attracting new “accounts and cross-selling other loans and deposits, credit cards, and other services to turn them into real “members”—a critical step in building loyalty.

Tim Harrington, President, TEAM Resources

Marketing & Branding Summit - What makes your CU Unapologetically Unique?

In today’s hyper-competitive world, your credit union needs to stand out from the crowd to get seen—and a CD rate special isn’t going to cut it in the long run. But it takes more than just a catchy tagline. Proudly living your unique difference requires laser-focused alignment between marketing, operations, and human resources. Dive into examples from O Bee Credit Union’s famous “Pub Style Banking” approach and other industry stand-outs to learn how you can spark enduring interest and loyalty at your credit union.

Andrew Downin, CEO, O Bee CU

Fintech Summit - Fintech Partnerships: A Blueprint for Credit Union Success

Discover how collaborative fintech partnerships are reshaping the credit union landscape. Join Nick Evens, President and CEO of Curql Collective, and Curql Portfolio Company, ModernFi, as they explore the lessons learned and best practices from ground-breaking partnerships. This session will highlight the exponential value generated for credit unions and fintech through creative collaboration models.

What You’ll Learn:

- The Dual-Sided Value Proposition: How credit unions and fintech mutually benefit from strategic partnerships.

- From Vision to Reality: Real-world examples of bringing transformative fintech solutions to market.

- Lessons Learned: Insights into overcoming common challenges and maximizing partnership potential.

- Driving Member Value: How these partnerships enhance member experiences and credit union competitiveness.

- Actionable Strategies: Tips for identifying and leveraging fintech opportunities tailored to your credit union’s goals.

This session is your blueprint for building meaningful partnerships that drive growth and innovation. Don’t miss it!

Nick Evens, President and CEO, Curql Collective

Adam DeVita, Founder & COO, ModernFi

Lending Summit - Go small to go BIG! How CUs are growing loan portfolios with niche marketing

There’s an old saying in business, “If you’re not growing, you’re dying.” Last year, loan growth dropped to 3.1% YoY, the lowest rate in at least 10 years, according to NCUA. Yet, some CUs are finding opportunities for loan growth by serving niche markets. Find out how two very different CUs – one rural and one urban – are growing their loans by twice the national average by targeting specific segments and how you can apply the same strategies without spending a fortune experimenting with new strategies. Take home the same tactics that have already been proven to achieve 6.5% loan growth in 2023 and 5.5% in 2024.

Maria Martinez, CEO, Border CU

HR Summit - Top Strategies for Effective Succession Planning in the C-Suite

With the National Credit Union Administration (NCUA) now requiring credit unions to establish formal succession plans, the need for proactive leadership continuity has never been greater. For CEOs and board leaders, this ruling highlights the urgency of ensuring seamless transitions amid accelerating retirements and increasing competition for top talent. This session provides senior executives with actionable strategies to meet regulatory requirements, strengthen organizational stability, and drive long-term growth. Whether you’re refining an existing plan or starting from scratch, you’ll gain valuable insights to navigate succession planning with confidence.

Key Takeaways:

- Meeting NCUA Requirements: Understand the regulatory expectations and how to align your succession planning strategy accordingly.

- Defining the Leadership Pipeline Framework: Pinpoint critical roles, competencies, and gaps to build a sustainable leadership bench.

- Fostering Organizational Trust and Collaboration: Strengthen the foundation of leadership continuity through trust, engagement, and a culture of resilience.

- Strategic Succession Planning Approaches: Create actionable pathways for leadership transitions that align with business goals and compliance mandates.

This is more than a regulatory exercise—it’s an opportunity to build a robust leadership strategy that not only fulfils NCUA requirements but also positions your organization for enduring success.

Tamra Gaines, CMM, CPC, ELI-MP, Founder, TamraGaines.com

Trending Summit - Top Cybersecurity Challenges Facing CUs Today & How to Respond

Discover how cyber-thieves are not just stealing money, but sensitive information from your employees and members using everything from mobile devices to AI in this true-crime presentation from FBI Special Agent (ret.) John Iannarelli. Using real-life cases, “FBI John” reveals how credit unions are vulnerable to a cyberattack and how to protect their employees, members and the institution. Key takeaways: (1) Understand the latest cyber vulnerabilities. (2) Learn how to avoid becoming a victim. (3) Know what to do if a cybercriminal does attack.

John Iannarelli, Founder, FBI John

Growth Summit - M&A Panel Discussion: A No-Holds Barred Conversation about the Good, the Bad and the Ugly

You won’t want to miss this panel discussion on one of the hottest topics impacting CUs today – Mergers & Acquisitions. Everyone has an opinion on the topic. It’s either the death of CUs or it is the solution that will give the industry a competitive advantage. Yet, it appears mergers will only increase. But why are some M&A deals successful and others not? In this discussion, you will hear from those who involved in some of the most recent mergers as they reveal the real key drivers behind the M&A activity, how to structure deals to better compete in the market, prepare for the “what-ifs” in a merger, and whether a bank acquisition is right for you and your CU. Plus, find out why some deals fall apart and the lessons learned.

Pete Duffy, Managing Director of Merger Advisory Services, SRM

Mark Lovewell, EVP & CFO, California CU

Jared Freeman, President & CEO, OneAZ CU

Transitional Break

Leadership Summit - Momentum Now: A Proven System to Lead with Confidence in Your Credit Union

Momentum Now: A Proven System to Lead with Confidence in Your Credit Union

In this in-depth breakout session, Dr. Jones will introduce you to the Momentum Mindset® framework—a proven system that empowers you to move from constant reaction to proactive, confident leadership in your credit union.

Building on his six-minute presentation, Dr. Jones will guide you through the “why,” “what,” and “how” of resilient leadership in uncertain times. You’ll gain a deep understanding of the forces shaping today’s challenges and learn practical strategies to turn those challenges into opportunities.

What You’ll Learn:

- The WHY: Uncover the Pyramid of Possibilities™, a tool for understanding the underlying forces creating today’s pressures—and how to turn them to your advantage.

- The WHAT: Explore the core principles of the Momentum Mindset® iceberg, revealing the hidden elements that make up resilient, confident leadership.

- The HOW: Learn three actionable steps to bring the Momentum Mindset® framework into your credit union, equipping your team to thrive in any environment.

This session will provide you with a strategic roadmap to bring back to your team, so you can lead with resilience, clarity, and purpose. Join us to gain the tools and insights to navigate the future of your credit union with confidence.

Samuel Jones, Ph.D., CSP, Founder, Transform Now, Inc.

Marketing & Branding Summit - Shifting to a New Value Proposition to Drive Your CU Forward

FinTech Summit - Leverage the Power of AI to Gain Valuable Member Insights – Unavailable Until Now!

Leverage the Power of AI to Gain Valuable Member Insights – Unavailable Until Now!

Using the power of AI, Steve Bone will share powerful, new results from a months-long data mining analysis of members payment activity across 50+ credit unions. Discover how the data is being used to describe, predict and solve member problems CUs across the country are facing today. Find out how you can use the data to create member personas, improve member engagement, optimize interchange payment activity, learn how members are using payment cards, and much more. This analysis has never been discussed publicly until now! Be among the first to get the insights from this new analysis and give your CU a competitive advantage.

Steve Bone, President & CEO, MAP, LLC

Lending Summit - Leveraging Data Analytics to Grow Your Loan Portfolio

Unlocking Growth Through Data: How Smart Strategy and Automation Drove a 2,100% ROI

Join Armand Parvazi. a proven credit union strategist and growth architect, as he shares the real-world tactics that helped him deliver a 2,100% return on marketing investment and boost products-per-new-member by 39%. In this dynamic session, financial institution leaders will discover how to turn existing loan data into a powerful tool for strategic growth. Learn how to identify lending trends, understand borrower behavior, and uncover high-impact opportunities hiding in plain sight. Armand will also walk through how automation and journey mapping can transform outreach, personalize offers, and significantly improve conversion rates. Whether you’re looking to drive deeper member engagement, sharpen your lending strategy, or align loan growth with institutional goals, this session offers the practical insights and data-driven approach you need to make it happen.

Armand Parvazi, Strategic Advisor, CU Collaborate

HR Summit - The Neuroscience of Leadership: Empowering Employees to Thrive

Sandra McDowell, Founder, eLeadership Academy

Trending Summit - Building a High-Trust, Member-Centric Culture

Building a High-Trust, Member-Centric Culture

Join us for an insightful session on fostering a high-trust, member-centric culture within your credit union. This session will explore the importance of viewing employees and members as one unified customer of your brand and will focus on three essential areas: Trust, Culture, and Authenticity. Participants will walk away with actionable steps to align their brand with both employee and member expectations. The session will cover baseline assessments, strategy development, and market insights to drive meaningful and lasting change. Don’t miss this opportunity to transform the way your organization builds trust and cultivates a people-first culture!

Lynn Heckler, Chief Culture Officer, Bluepact Strategy Group

Growth Summit - Reaching the "Unreachable": How to Grow by Appealing to Millennials and Gen Z’ers

Happy Hour in Exhibit Hall

Opening Night Entertainment

Award Winning Mentalist Frederic Da Silva is performing his mind reading magic show, Paranormal, at the CU Leadership Convention! Be prepared for an evening of mystery, magic, and hypnosis as Frederic delivers a mind-bending, unforgettable evening.

Experience the impossible as internationally acclaimed mentalist Frederic Da Silva takes the stage at the CU Leadership Convention 2025. Known for his mesmerizing show PARANORMAL, Frederic will captivate you with mystery, magic, hypnosis, and mind reading that will leave you spellbound.

Voted Best Mentalist in Europe and ranked as the #1 Magic Show in Las Vegas, Frederic’s jaw-dropping mind reading, elegant humor, and unique charm promise an unforgettable performance. Witness the magic and see why audiences around the world are left questioning reality!

Opening Night Reception is open to registered attendees and guests.

Agenda

Conference - Thursday 14th

Exhibit Hall Open

Breakfast of Champions

Come prepared to share with your peers ONE idea that worked in your CU, and enjoy a delicious breakfast to begin the day! All attendees have been asked to RSVP to ensure availability.

Opening Day Keynote - What AI Can Do -- and Can't

What AI Can Do – and Can’t

Speaker: Janelle Shane, Artificial Intelligence Speaker, Humorist

AI is making headlines and disrupting banking. But what IS artificial intelligence, and what is it good at? AI expert Janelle Shane takes a weird and humorous approach to a complex topic and talks about the kinds of problems where AI will succeed, fail, or succeed at solving the wrong problem entirely. She has been featured on the main TED stage, in the New York Times, The Atlantic, WIRED, Popular Science, All Things Considered, Science Friday, and Marketplace, as well as being Futurist in Residence at the Smithsonian. Her book, “You Look Like a Thing and I Love You: How AI Works, Thinks, and Why It’s Making the World a Weirder Place” uses cartoons and humorous pop-culture experiments to look inside the minds of the algorithms that run our world, making artificial intelligence and machine learning both accessible and entertaining. Shane was named one of Fast Company’s 100 Most Creative People in Business, and an Adweek Young Influential.

Keynote - The Connection Quotient: Elevating the Industry Experts to A Leadership Powerhouse

The Connection Quotient: Elevating the Industry Experts to A Leadership Powerhouse

In many credit unions, leaders are often promoted for their technical expertise, with the expectation that their leadership abilities will evolve. While this can be the case for some, for others, the transition to effective leadership doesn’t always happen naturally.

So, what happens when disruption strikes? When change accelerates into full-scale chaos?

Leaders who lack practiced leadership skills in key organizational areas often manage teams that are disengaged, less productive, and ultimately less profitable.

In this session, we will explore proven strategies that enable leaders to identify and address their leadership gaps. Attendees will engage with The Connection Quotient, a sophisticated assessment tool designed to help leaders build stronger teams, drive deeper engagement, and cultivate a thriving organizational culture.

This session will underscore the importance of having a clear, actionable roadmap to elevate industry experts into true leadership powerhouses. Participants will leave with practical insights and tools to transform leadership potential into impactful, sustainable success.

Speaker: James Pogue, Ph.D., CEO, JP Enterprises

2025 Neoteric Changemaker Award Ceremony

Dennis Sullivan, Convention Chairman

Renee Sattiewhite, President & CEO, AACUC

Transitional Break

CXO Summit Resume

Leadership Summit - Suits and Skirts – Game On!

Women at all executive levels have been seeking power equity for decades to no avail. Intentionally or unintentionally, men are keeping women from attaining powerful c-suite and boardroom positions – to the detriment of bottom-line performance. The reasons may vary, but the results do not. Discover why this is happening and to what extent it is hampering the performance of your CU. All genders are invited to join this dynamic and eye-opening discussion to better understand why it is important to make significant and immediate changes and discuss paths toward making progress. Takeaways include: (1) awareness of the problem, (2) acceptance of the need to change, and (3) the development of strategies to make significant inroads to removing the unconscious bias that exists in organizations and better position them to influence behavioral change in the community in which they operate.

Teresa Freeborn, President (ret.), Kinecta FCU and author of Suits and Skirts – Game On! The Battle for Corporate Power

Teresa Freeborn

President and author of Suits and Skirts - Game On! The Battle for Corporate Power

Read bioMarketing & Branding Summit

AI Summit

CXO Summits – details to follow

Lending Summit

CXO Summits – details to follow

HR Summit - The Serious Business of Happiness: Proven Principles for High Performance

The Serious Business of Happiness: Proven Principles for High Performance

In this session you’ll learn the surprising science that links happiness to success: happiness is associated with greater sales, creativity, problem-solving, health, and even stock performance. Having established the business case for happiness at work, you’ll learn how to leverage happiness for high performance through the lens of a business case where we turned around a struggling mid-size company to the tune of $3M. You’ll get a new perspective on your organization and proven principles to apply in your organization.

Jackson Kerchis, Co-founder & Partner, Happiness Means Business

Trending Summit - The Triple Win: A People-First Approach to CU Mergers

The Triple Win: A People-First Approach to Credit Union Mergers

Dan Stoltz, CEO of Blaze Credit Union, knows that successful mergers are about more than numbers. Drawing on his experience leading 10 mergers in 11 years, Stoltz discusses how prioritizing people over process results in stronger, more resilient credit unions. In this session, he shares how genuine listening, honoring each credit union’s legacy, and delivering on promises create successful mergers. Stoltz rejects a “cookie-cutter” approach, recognizing that each credit union’s unique culture, strengths, and concerns makes each merger distinctive. Mergers from $500K to $2B in assets, he has seen it all—including when things don’t go as planned. He emphasizes doing mergers with heart and addressing the human side of mergers, rather than solely focusing on balance sheets. Attendees will gain insights on making mergers a triple win for employees, members, and communities while preserving the things that matter most.

Dan Stoltz, CEO, Blaze CU

Tech Demo - The Loan Feature that Changes the Game – for You and Your Borrowers

Today’s borrowers expect flexibility. Tomorrow’s growth depends on delivering it, without sacrificing control or margins. In this live demo, Kasasa CEO Gabe Krajicek will introduce the Take-Back® Loan: a transformative lending feature that lets members pay ahead while keeping access to their money. More than a feature, it’s a strategy – one that helps credit unions compete on value, not just rate. The Take-Back® Loan integrates with your existing systems and loans already on your books, enabling you to grow deposits, deepen engagement, and stand apart in a crowded and competitive market.

Gabe Krajicek, CEO, Kasasa

Sponsored by Kasasa

CU Connect

CEO Forum: AI in Action - Unlocking Efficiency, Innovation & Growth for Credit Unions

Artificial Intelligence (AI) is no longer just a future concept—it’s a present-day catalyst transforming financial services. This dynamic, executive-level session is designed specifically for credit union CEOs to explore how AI is being applied across the financial services sector—from major breakthroughs in customer engagement to back-end efficiencies that are redefining productivity. Learn where the real ROI is being found today, and how credit unions of all sizes can harness AI to compete, innovate, and thrive.

What to Expect:

- Industry Snapshot: Get a concise overview of the current state of AI in banking and adjacent industries, with a focus on real-world success stories and trends driving measurable impact.

- Tactical Use Cases: Explore practical applications of AI in credit unions—automating member support, streamlining marketing workflows, enhancing risk management, and optimizing internal operations.

- Peer Collaboration: Participate in interactive discussions with fellow executives on how they’re experimenting with or implementing AI, and share lessons learned on overcoming common roadblocks such as talent gaps, data silos, and regulatory concerns.

- Visionary Workshop: Roll up your sleeves in a guided workshop session to map out an “art of the possible” AI-powered customer journey—from onboarding to retention—designed to inspire new thinking around product innovation and service delivery.

Whether you’re just beginning to explore AI or looking to deepen your strategy, this session will equip you with the knowledge, inspiration, and peer insight to turn insights into action.

Vishal Madhavan, Managing Director and Partner, Boston Consulting Group

Networking Break in Exhibit Hall

Leadership Summit - How Internal Talent Mobility Creates Long-Term Leadership Excellence

Research shows that a culture of “internal mobility” can help employers develop and retain better leaders who drive growth. This session will help your credit union break out of a top-down pyramid-shaped succession plan, and create a program that engages, retains, and develops your best talent.

Danielle Scodellaro, Sr. Executive Benefits Specialist, TruStage

Sponsored by TruStage

Marketing & Branding Summit - Marketing your CU in the Joyful and Dark Moments in Your Members' Lives

Credit unions change people’s lives. However, when we tell our stories as financial institutions, we often talk about the brighter moments we can support. All of us navigate the darker times, and nearly all of those darker moments, from cancer to divorce to domestic and sexual violence to death, have financial underpinnings. In this interactive session, hear from Tansley Stearns, president & ceo of Community Financial Credit Union, about how they are marrying insights from real human experiences with subject matter expertise and an innovation competency to chart the course toward financial well-being in the dark and lighter times. You’ll leave this session with ideas your credit union can use immediately and inspiration for how you can create positive impact that inspires members to share your story for you.

Tansley Stearns, President & CEO, Community Financial CU

AI Summit - From Buzz to Benefit: A Practical Path to AI for Credit Union Leaders

Artificial Intelligence isn’t just the future—it’s already quietly powering decisions, processes, and member experiences in credit unions today. This engaging session will cut through the AI hype to provide clarity on what AI actually means for your credit union. Through a simple, actionable framework, we’ll explore how to evaluate AI technologies, identify no-regret opportunities for immediate impact, and build a confident strategy for adoption. You’ll walk away understanding not just how AI works, but how to align it with your mission, governance, and member experience. Whether you’re skeptical, curious, or already experimenting—this session will help you lead with confidence in a rapidly evolving landscape.

Mitch Rutledge, Co-Founder and CEO, Vertice AI

Sponsored by Vizo

Lending Summit - Bridging Gaps: Empowering Communities with Non-Prime Auto Lending Solutions

CEO Tyler Valentine explores the transformative potential of non-prime auto lending in fostering financial inclusion and mobility. This session delves into how credit unions can address the unique needs of underserved members while navigating the challenges of risk management and making money. See how StagePoint Federal Credit Union earns a return after losses and expenses of 11.50% on non-prime loans and drives economic empowerment for its members and community.

Tyler Valentine, President & CEO, StagePoint FCU

HR Summit - From Managers to Leaders: Enhancing Employee Experience Through Technology

The session will explore how technology can transform managers into effective leaders and enhance the employee experience at credit unions. By leveraging technologies like an employee experience platform, managers can gain insights into employee performance, engagement, and satisfaction. This data-driven approach empowers managers to make informed decisions, act on feedback, foster a positive work environment, and support employee growth. Attendees will learn practical strategies for utilizing technology to build strong leadership skills and improve overall organizational culture, ultimately driving success and satisfaction within the credit union

Rob Hoyle, Chief People & Technology Officer, Vantage West CU

Trending Summit - Latest Threat Actor Trends & Your Most Important Security Control

In today’s cyber landscape, where threats are constantly evolving, one of the most vital yet overlooked controls is ensuring that you have immutable and tested backups with real Recovery Time Objectives (RTOs). While many organizations focus on perimeter defenses, firewalls, and threat detection systems, they often underestimate the importance of a backup strategy that can be trusted under the harshest conditions.

Threat actors are becoming more sophisticated. They are not just focusing on breaching your defenses but are also targeting and destroying backup systems, leaving organizations vulnerable to extended downtime and irreversible data loss. We’ve seen an uptick in attacks where ransomware groups and nation-state actors aim to lock up critical data and render backup systems useless, forcing victims into tough situations. As these attacks continue to increase in both frequency and severity, businesses without a robust backup strategy face a serious risk of falling victim to cyber incidents that can take weeks or even months to recover from.

The key to surviving these attacks is not just having backups in place but ensuring they are immutable, meaning they cannot be altered or deleted by unauthorized users, including attackers. Furthermore, these backups need to be regularly tested to validate their effectiveness in actual recovery scenarios, ensuring that you can restore operations quickly and with minimal business disruption. Without a reliable, tested backup system with established RTOs, the damage from a cyber-attack can be devastating.

As we look ahead, the importance of backup systems cannot be overstated. It’s not just a cybersecurity measure—it’s an essential part of your organization’s continuity plan. You may be thinking about firewalls, detection systems, or encryption, but the most important control—one you might not be focusing on—is ensuring your backups are as strong as your primary defences.

Heath Renfrow, Co-Founder and Chief Information Security Officer, Fenix24

Sponsored by Fenix24

Financial Summit

CXO Summits – details to follow

CEO Forum - CEO Forum: AI in Action - Unlocking Efficiency, Innovation & Growth for Credit Unions (cont)

CEO Forum: AI in Action – Unlocking Efficiency, Innovation & Growth for Credit Unions

Artificial Intelligence (AI) is no longer just a future concept—it’s a present-day catalyst transforming financial services. This dynamic, executive-level session is designed specifically for credit union CEOs to explore how AI is being applied across the financial services sector—from major breakthroughs in customer engagement to back-end efficiencies that are redefining productivity. Learn where the real ROI is being found today, and how credit unions of all sizes can harness AI to compete, innovate, and thrive.

What to Expect:

- Industry Snapshot: Get a concise overview of the current state of AI in banking and adjacent industries, with a focus on real-world success stories and trends driving measurable impact.

- Tactical Use Cases: Explore practical applications of AI in credit unions—automating member support, streamlining marketing workflows, enhancing risk management, and optimizing internal operations.

- Peer Collaboration: Participate in interactive discussions with fellow executives on how they’re experimenting with or implementing AI, and share lessons learned on overcoming common roadblocks such as talent gaps, data silos, and regulatory concerns.