Kamran Khan

Managing Director, Head of Sustainable Finance for Asia Pacific, Middle East and Africa, Deutsche Bank

Part of the Sustainable Investor Summit Asia | October, 2026

Singapore

Thank you to everyone who joined us at RI Asia 2025, Asia’s leading event for sustainability in public markets and fixed income.

We hope you enjoyed hearing how senior asset owners, fund managers, banks, and corporates are putting sustainability into practice – from navigating the impact of geopolitical developments, evolving taxonomies requirements, climate adaptation and physical risk, to biodiversity strategy, and net-zero commitments.

Forming part of the Sustainable Investor Summit Asia, this event united leaders across public and private markets to shape the future of sustainable finance.

Head of Sustainability, La Caisse (CDPQ)

Learn how one of the world’s most advanced institutional investors is turning climate commitments into practice – accelerating decarbonisation across Asia and globally.

Making sense of geopolitical shifts, regulation and global market divides.

From conservation responsibilities to new data, metrics and investment approaches.

Exploring new mechanisms, pitfalls and opportunities for adaptation and biodiversity.

Scaling transition pathways across Southeast Asia and beyond.

Deep dive into scenario planning and resilience in increasingly volatile conditions.

Learning from the best on ISSB, CSRD and evolving regional taxonomies.

Redefining stewardship and impact in complex regulatory and cultural contexts.

From materiality to additionality: can listed markets deliver both returns and impact?

Valuable insights into sustainable finance

Gain key insights from industry leaders on the trends shaping investments today. High-level discussions will focus on strategies vital to advancing Asia’s future economy and sustainability goals.

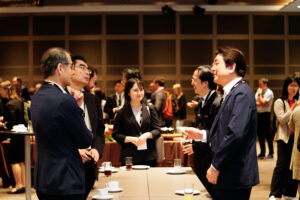

Expand your network

Engage with a wide range of stakeholders across the ESG spectrum, from banks, pension funds, insurers, NGOs, think tanks, and financial regulators. Build relationships that can enhance your professional development.

Asia-focused content with a global view

Join local and international experts to explore how Asian business can thrive in a sustainability-focused world, with discussions on emerging trends, global practices, and innovative solutions for long-term growth.

A limited number of complimentary passes are available for eligible asset owners to join the event.

Complimentary investor passes are limited to foundations, endowments, trusts, insurance companies, single family offices, sovereign wealth funds and pension funds who are actively making fund commitments and do not engage in third-party fundraising activities or collect fees for advisory/consulting services.

Registration is now closed for 2025, but if you’re interested in being among the first to register for RI Asia 2026, please reach out to Elliot Chae, our Head of Investor Relations – APAC at elliot.chae@pei.group.

Responsible Investor Asia provides an opportunity to make connections with an exclusive audience of sustainable finance decision makers.

Share your solutions, collaborate and network with senior-level executives through bespoke sponsorship packages to meet your 2026 business goals.

The Sustainable Investor Summit Asia brings together thought leaders from both private and public markets across Asia and beyond, sparking dynamic discussions on the ongoing evolution of sustainability in Asian financial markets.

The summit offers a unique opportunity to connect with 500+ professionals, gain cutting-edge insights, and explore the latest innovations shaping the future of sustainable finance.

Responsible Investor Asia Forum is the region’s most prominent gathering for institutional investors driving sustainability in public markets and fixed income. As a sponsor, you will connect with a targeted audience of senior decision makers, including asset owners, fund managers, banks, and corporates.

The agenda, crafted with the editorial insight of Responsible Investor and aligned with investor priorities, provides a powerful platform to demonstrate your expertise, build brand visibility, and engage with organisations turning sustainability ambition into action. Sponsoring the forum positions your firm at the heart of Asia’s sustainability investment conversation, strengthens relationships with influential stakeholders, and shapes the direction of responsible capital across the region.

Connect with Asia’s sustainable finance community, including asset owners, fund managers, banks, insurers, corporates, and regulators.

Meet institutional investors leading ESG implementation across public markets and fixed income, and explore partnerships that turn ambition into action.

Hear editorially curated insights from market leaders and practitioners across investment, regulation, and corporate sustainability.

Network with sustainable finance decision makers

Engage directly with asset owners, fund managers, insurers, banks, corporates, and regulators who are shaping sustainable investment strategies around the world.

Elevate your brand visibility

Amplify your presence through branding, digital promotion, and curated networking opportunities that connect you with the global responsible investment community.

Showcase your thought leadership

Position your organisation as a trusted authority by contributing to editorially curated panels and presentations that highlight expertise and provide insight on the most important issues in sustainable investment.

Curated 1-to-1 meetings

Benefit from a bespoke outreach programme to facilitate introductions with the prospects you want to meet most ahead of the summit, helping you build connections before (and after) you even step into the room.

If you’re interested in featuring on the agenda at the RI Asia 2026, please reach out directly to Boris Petrovic, Head of Sustainable Investment Events at PEI Group.

Managing Director, Head of Sustainable Finance for Asia Pacific, Middle East and Africa, Deutsche Bank

Read bio

Senior Investment Strategist – Sustainable Investment, New Zealand Superannuation Fund

Read bio

La Caisse (formerly CDQP) are one of the most advanced institutional investors in the world in their climate investing approach.

In this session we’ll understand how La Caisse are turning convictions into practice. Learn what levers they intend to work to accelerate the decarbonisation of companies and the real economy, in Asia and globally.

Head of Sustainable Investing Specialists APAC, J.P. Morgan Asset Management

Read bio

GCF is the largest climate fund in the world with committed capital of $62 billion. GCF invests as a Limited Partner in climate funds launched by private fund managers. In this session we’ll explore:

Head of Sustainability & Stewardship, Asia-Pacific, Director, Impax Asset Management

Read bio

If you’re interested in featuring on the agenda at the RI Asia 2026, please reach out directly to Boris Petrovic, Head of Sustainable Investment Events at PEI Group.

Responsible Investor Asia provides an unrivalled platform for asset owners investing in sustainable finance. Join the leading regional asset owners to discuss the latest responsible investing trends and compare best practices and allocation strategies for 2026 and beyond.

A limited number of complimentary passes are available exclusively for asset owners. Explore the conference benefits and find out which of your peers will be attending.

Registration is now closed for 2025, but if you’re interested in being among the first to register for RI Asia 2026, please reach out to Elliot Chae, Head of Investor Relations – APAC at elliot.chae@pei.group.

Enrich your network, build lasting relationships, and exchange valuable perspectives with your investor peers through investor-only breakfasts, networking breaks, lunches and much more.

Hear from our industry-leading speaker line-up, discover the latest trends and stay aligned with future innovations in the market.

Discover remarkable investment opportunities and leverage expertise focused on regulation, human rights, biodiversity, net zero and more.

Connect and arrange one-to-one meetings with the biggest and best ESG managers in the market.

Complimentary investor passes are limited to foundations, endowments, trusts, insurance companies, single family offices, sovereign wealth funds and pension funds who are actively making fund commitments and do not engage in third-party fundraising activities or collect fees for advisory/consulting services.

All registrations are subject to review and approval by the organiser, who reserves the right to decline applications that do not meet the eligibility criteria.