Where capital meets conviction

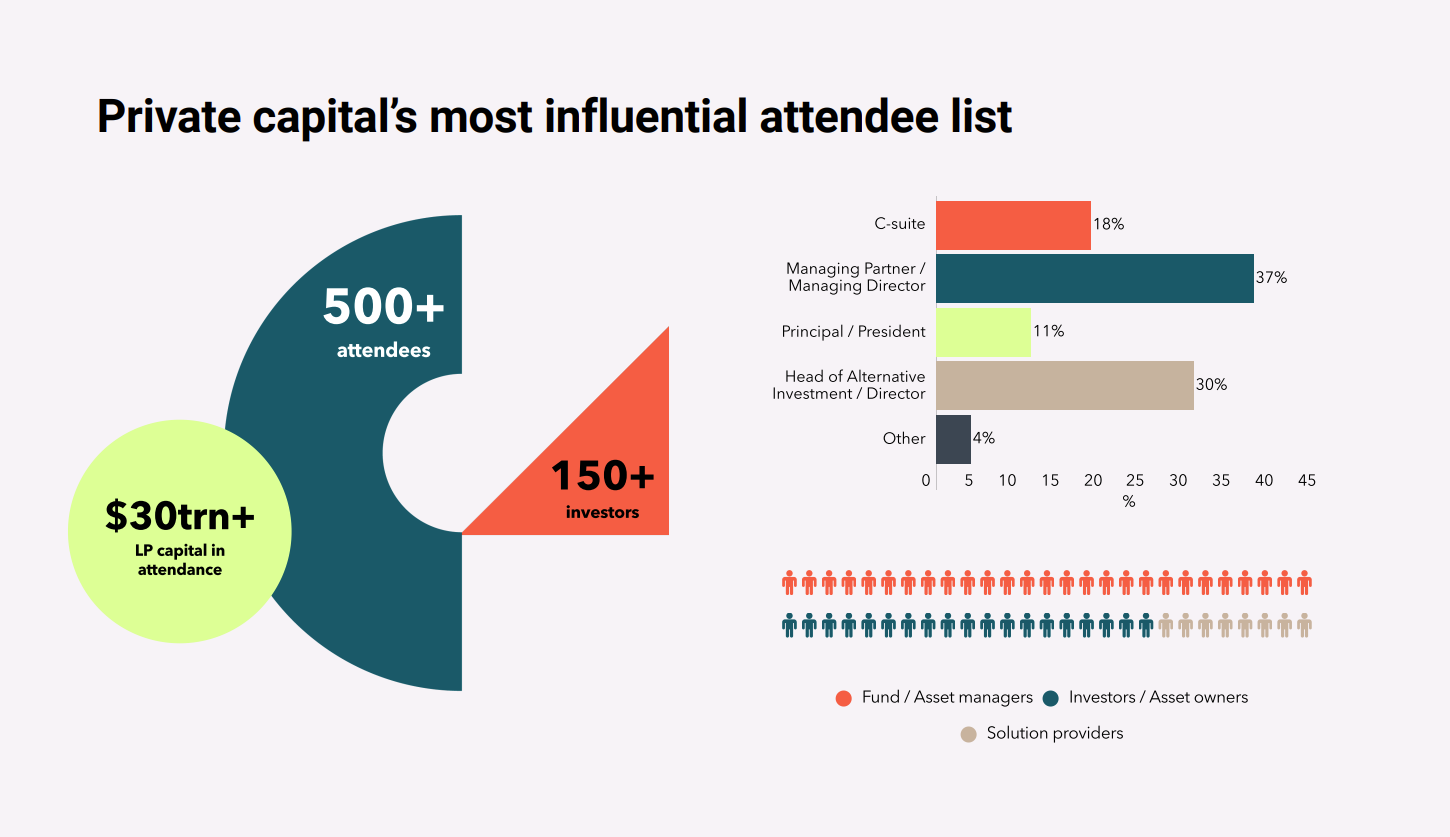

NEXUS unites the world’s most influential private equity leaders and capital allocators.

This is the intersection of market insight and global perspective. Where candid conversations spark transformative action and the next wave of opportunity is identified and seized.

Step into the room where strategic relationships ignite, capital moves with intent, and transformative deals are made.

Shape your strategy

Share your proven strategies with top leaders and take home a page from their playbook

Spark partnerships

Forge international partnerships, and tap into global capital flows with your team

Showcase your value

Exclusive conversations on the mega-trends that will impact how you invest

NEXUS brings together private equity's most influential LPs

Alaska Permanent Fund

AustralianSuper

AXA IM Alts

Briar Hall

CalPERS

CDPQ

Hightower

HOOPP

MassPRIM

Mubadala

New Jersey Division Of Investment

NYC Retirement Systems

OMERS

OTPP

Rockefeller Global Family Office

SWIB

Temasek

TRS Texas

Steve Poliner, Texas TRS

An incredible event, which presented so many opportunities to visit with friends old and new and to garner unique insights into our space. With the bar set so high, I am excited to see what next year will bring!"

Why do investors bring their teams?

> LP Council led by the people allocating to private equity

> Investor-only dinners and dedicated networking time

> Find your next fund manager

Why do managers attend?

> Pre-arranged meetings with active investors

> Market insight to fundraise amid turbulent geopolitics

> Swap tactics for raising funds

Why do leading firms partner?

> Networking with the entire private equity industry under one roof

> Premium access to catalyze fresh business

The Connections Concierge

Effortless meetings with the right people

Our team hand-selects high-value meeting recommendations based on your goals, ensuring you’re connected with the right people before the event even begins.

We’ll handle the introductions so you can focus on building relationships that matter – no guesswork, no wasted time.

NEXUS keynotes influence global investment and allocation trends

Registration questions

Anna Dorokhin

anna.d@pei.group

Sponsorship

inquiries

Jimmy Kurtovic

jimmy.k@pei.group

Speaking opportunities

Ben Moss

ben.m@pei.group

Industry leading insight from the biggest names in private equity

Agenda

Day 1 - Sunday 22nd

Registration opens

Join us the day before NEXUS for engaging networking activities where you will connect with peers, setup meetings for the conference week and enjoy a relaxed start to the conference!

Golf: The Annual NEXUS Cup (invite-only)

Join attendees for a round of golf (18 holes) and networking in the sun.

All levels of experience are welcome.

Culinary Class: Pizza Making

Don your apron and practice your pizza spinning skills as you connect with attendees over a self-made lunch.

Pickleball & Partnerships

Join fellow attendees for games of pickleball. Get into the competitive spirit and make connections before the conference has even begun!

Networking drinks

Join us for an evening of relaxed networking at the bar, connect with your peers, build relationships and get a head start on your meetings for the rest of the week!

Rising Stars Dinner (Invitation-only)

(Award recipients, emerging managers, next generation leaders)

Speed Networking

(Meet NEXUS attendees in a relaxed setting prior to the event)

Agenda

Day 2 - Monday 23rd

NEXUS Run Club

Join your peers for an invigorating run around the beautiful grounds of the JW Marriot & Ritz-Carlton Grande Lakes. Start your conference networking early!

Welcome Breakfast and Registration

Institutional LP Council meeting (invite only)

GP briefing

PEI welcome address

Welcome from the NEXUS Chairperson

Keynote interview: What’s next? How leading allocators are future-proofing portfolios

- Navigating liquidity, return expectations, and risk amid challenging macroeconomic conditions

- The evolving role of private equity within institutional portfolios over the next 10 to 20 years

- Shifting LP perspectives on manager relationships and partnership strategies

Headline investor panel: Macro meets mandate: how trade, policy, and politics are shaping investment strategy

- The effects of tariffs, nearshoring, and geopolitical tensions on portfolio strategies

- Impact of global policy shifts on LP/GP alignment and cross-border deal flow

- LP preferences: balancing geographic diversification versus thematic specialization from GPs

Networking and coffee break

Cross conversation: How LPs and GPs are shaping the next era of dealmaking

- How evolving LP expectations are redefining GP strategies in deal sourcing, underwriting, and sector focus

- Unlocking value: the rising influence of co-investments, anchor commitments, and bespoke mandates in today’s deal landscape

- Navigating tension and synergy: where GPs and LPs align—and clash—in a slower, more selective market

GP panel: Co-investment & fundraising strategies for a new era

- Leveraging co-investments to strengthen LP relationships and fast-track capital commitments

- Shifting expectations on access, transparency, and economics amid a more selective fundraising landscape

- Innovative fund design, fee alignment, and structural flexibility as competitive advantages in today’s market

Moderator:

Robert Blaustein, Partner, Kirkland and Ellis

Lunch

After lunch, the conference splits into 3 concurrent content forums: Emerging Managers, Secondaries and Private Wealth. Only qualifying attendees can attend the Emerging Managers Forum; anyone can attend the Secondaries and Private Wealth forums.

Welcome from the Secondaries Chairperson

Keynote: The macro-economic environment

- The impact of rising rates, inflation pressures, and geopolitical tensions on secondaries deal flow

- Key macro indicators guiding LP and GP timing and strategic decisions

- The evolving risk-return landscape: navigating challenges and seizing opportunities amid global market dislocations in secondaries

Panel: Evolving strategies in GP-led secondaries

- Innovative structuring of continuation vehicles by GPs to attract fresh capital

- Critical alignment factors LPs prioritize when evaluating GP-led transactions

- Evolving exit dynamics: new strategies for liquidity management across fund portfolios

Cross conversation: What’s driving strong demand for LP-led deals?

- Exploring the key drivers fueling today’s surge in LP-led activity

- Evolving pricing dynamics in LP-led transactions and hotspots for capital deployment

- Outlook for deal volume growth and structural innovation in LP-led deals through 2025 and beyond

Networking and coffee break

Panel: Emerging strategies in secondaries

- Emerging strategies gaining traction in secondaries, from single-asset deals to preferred equity

- The rise of data-driven investing: leveraging analytics to enhance secondaries decision-making

- Identifying white space opportunities in non-traditional segments of the secondaries market

Panel: Unlocking liquidity: the rise of credit secondaries

- How credit secondaries are enhancing liquidity amid a tightening fundraising landscape

- The expanding role of NAV-based lending and structured solutions in credit secondary transactions

- Attractive credit assets in today’s risk-adjusted investment environment

NEXUS Grand Opening Cocktails

Annual Dinner

Private Wealth Dinner

Welcome from the conference chair

Welcome from the conference chair

- Key differentiators influencing institutional LPs’ decisions to back emerging managers in today’s market

- How can first and second-time funds demonstrate institutional readiness and strategic clarity?

- Common red flags and how can new GPs proactively address them

LP panel: Choosing the right manager and product to suit your strategy

- Attributes LPs prioritize in emerging managers to align with evolving portfolio objectives

- How LPs evaluate fund size, specialization, and team dynamics in an increasingly competitive market

- Emerging trends shaping LP preferences among co-mingled funds, SMAs, and niche investment strategies

Cross conversation: Value creation for portfolio company growth

- How can emerging managers implement credible value creation playbooks with lean teams?

- Operating models that resonate with LPs focused on measurable post-investment impact

- How first-time managers are gaining an edge through specialization and sector-specific expertise

Networking and coffee break

Panel: Winning the deal: how emerging managers compete in today’s market

- Key sourcing challenges facing new managers in today’s market

- Strategies for emerging GPs to win deals without overpaying in a competitive landscape

- What creative structures and partnerships are helping early funds close transactions?

Panel: Deal-first, fund-later: The rise of independent sponsors

- How independent sponsors are reshaping the path to ownership

- Raising capital without a fund – strategies to secure investors and structure deals

- What do LPs need to know before writing the first check?

NEXUS Grand Opening Cocktails

Annual Dinner

Private Wealth Dinner

Welcome from the conference chair

Keynote: Private capital, personal wealth: how the private equity landscape is opening up

- What’s fuelling interest in private equity? Why now?

- Tailoring strategies for private wealth channels by GPs

- Long-term implications of retail capital on the private equity ecosystem

Panel: How private wealth is changing the rules for GP access

- Why private wealth platforms, family offices, and RIAs are becoming key allocators and how that’s changing the GP playbook

- How are GPs adapting fund structures, co-investments, and communication to meet the needs of private wealth?

- Relationship over track record – what truly resonates with private wealth investors when selecting GPs

Cross conversation: Private markets for private wealth – unlocking access, education & execution

- Navigating platforms to bring private funds to HNW clients

- Tools and frameworks to evaluate GPs, explain private market strategies, and communicate clearly to clients

- What do RIAs expect from GPs in terms of support, transparency, and communication?

Networking and coffee break

Panel: Retail capital and an uncertain Washington DC: policy, taxes and market sentiment

- What potential policy shifts could reshape private wealth investment strategy?

- Preparing clients for increased volatility and tax uncertainty: Approaches by RIAs and GPs

- Lessons from past administrations shaping current portfolio positioning

Panel: Debt market outlook: private credit’s role in the portfolio

- Allocations across the private credit spectrum by RIAs and family offices

- Products and structures gaining traction in wealth management channels

- How are GPs adapting their private credit offerings for retail and semi-institutional investors?

NEXUS Grand Opening Cocktails

Annual Dinner

Private Wealth Dinner

Agenda

Day 3 - Tuesday 24th

NEXUS Run Club

Join your peers for an invigorating run around the beautiful grounds of the JW Marriot & Ritz-Carlton Grande Lakes. Start your conference networking early!

Welcome Breakfast and Registration

Breakfast briefings

Chairperson’s opening remarks

Keynote interview: How are macro-economic trends reshaping private equity?

- The impact of inflation, interest rates, and geopolitical shifts on capital deployment

- Structural adjustments investors are making in response to persistent market volatility

- Emerging regions and sectors demonstrating resilience amid macroeconomic challenges

GP Leaders panel: Dealmakers at the helm – navigating complexity in today’s market

- How are leading GPs balancing pricing discipline with deployment mandates?

- Effective approaches to deal origination, structuring, and partnership formation

- Adapting execution strategies for a higher-rate, slower-growth environment

LP Leaders panel: How global allocators are positioning themselves for the future

- How are institutional LPs re-evaluating exposure across asset classes?

- Return expectations and liquidity considerations shaping allocations

- How are LPs evaluating fund structures, co-investments, and pacing for 2025-2026?

Networking break and refreshments

Fireside chat: Leveraging the secondaries market to address liquidity challenges

- Using secondaries to manage overallocation and liquidity needs by large institutions

- Looking at innovations in deal structure enabling greater flexibility

- Where is pricing headed across LP-led and GP-led transactions?

Fireside chat: Key trends shaping the future of private debt

- What’s driving continued capital flow into private debt amid public market volatility?

- Differentiation strategies among managers in direct lending, special situations, and opportunistic credit

- A review of the macro and regulatory risks facing the private credit boom

Networking lunch

Cross Conversation: Private equity’s role in the energy transition

- Which segments of the energy value chain are drawing the most private equity interest?

- Strategies for GPs to balance impact, regulatory compliance, and financial returns in climate-aligned investments

- Optimizing capital structures to support scalable and sustainable energy infrastructure projects

Fireside chat: Sports investment: a scalable asset class?

- The growing appeal of sports teams, media rights, and infrastructure among global investors

- Distinctive deal structures in sports compared to traditional private equity sectors

- Macro and cultural trends shaping future growth opportunities in sports investments

Networking break and refreshments

Fireside chat: Where the smart money is going in tech investments

- Investable tech sectors emerging amid the AI hype cycle

- Building conviction in dynamic verticals such as cybersecurity

- The role of responsible innovation in driving long-term private equity value creation

Panel: Mid-Market – unlocking opportunities in the investment sweet spot

- Why North American mid-sized deals provide a compelling balance of risk, return, and access

- Sourcing proprietary deal flow and differentiation strategies to overcome auction fatigue

- Innovative approaches to value creation, operational enhancement, and securing premium exits in a fragmented market

Fireside Chat: What next for private equity?

- Key structural shifts shaping the next era of private markets

- Strategic approaches to innovation, scale, and global expansion for private market firms

- Long-term outlook for private equity as it evolves into a mainstream asset class

Networking bar open

LP Leaders Dinner

GP Leaders Dinner

Agenda

Day 4 - Wednesday 25th

NEXUS Run Club

Welcome Breakfast and Registration

Breakfast briefings

Welcome from conference chair

Keynote: Deep dive into tech innovation and the future of venture capital

- Which emerging technologies are early-stage investors most excited about and why?

- The latest innovations in computer vision, natural language processing, robotics and other AI subsectors more

- What should later-stage investors be doing now to make sure they don’t miss out on the next big tech innovation?

Panel: Investing in energy transition

- A deep dive at sub-sectors that offer the most attractive risk-return profiles

- How are PE firms structuring deals in renewable energy – more platform plays or direct asset acquisitions?

- Emerging technologies that will be game-changers for PE investors in renewables over the next 3–5 years

Networking coffee break

Panel: Redefining finance – the future of Fintech

- A keen look at how non-financial platforms are becoming financial services providers

- Use cases of AI in underwriting, fraud detection, and customer service

- How investors are pricing regulatory risk, tech obsolescence, and customer acquisition cost

Panel: Healthcare – unlocking value in PE’s stronghold

- Why healthcare remains a resilient and attractive sector for investors

- How are GPs and operators capitalizing on innovation in outpatient care, behavioral health, and diagnostics?

- Strategies for staying ahead of changing policies, managing compliance costs, and building value while mitigating exposure

Panel: AI – from hype to alpha

- What are the real-world examples of AI driving measurable returns in private equity portfolios?

- How are firms integrating AI into internal operations, diligence, and portfolio company strategy?

- What are the ethical, governance, and talent considerations GPs must address as AI scales?

Lunch to go and conference end

Welcome from conference chair

Keynote: How LPs are rethinking private credit allocation

- How LPs are adjusting private credit exposure across direct lending, structured, and opportunistic strategies

- Emerging allocation trends by region, risk profile, and fund structure compared to traditional fixed income

- The role of private credit in portfolio construction, liquidity planning, and risk diversification

Panel: Private credit 2.0

- How are managers moving beyond direct lending into asset-backed, distressed, and special situations?

- GP strategies to differentiate and stay competitive in a crowded market

- How LPs evaluate specialization, sourcing, and underwriting in today’s credit landscape

Networking coffee break

Panel: Deal sourcing, structuring and execution in 2025

- How are private credit managers sourcing quality borrowers and pricing risk?

- Emerging trends in covenants, loan structures, and capital stack seniority

- How co-investments, bespoke mandates, and flexible fund structures enabling LPs to participate directly in deal execution

Cross conversation: The liquidity playbook – NAV lending, fund financing and the secondary credit market

- Use of NAV-based lending, preferred equity, and structured tools to unlock liquidity in mature portfolios

- Current state of private credit secondaries and LP strategies for managing exposure and pacing

- How do these tools impact fund dynamics, LP capital calls, and portfolio flexibility in the current fundraising environment?

Panel: The art of distressed investing – turning trouble into triumph

- Exploring how managers evaluate distressed and special situations deals amid economic uncertainty

- Best practices for underwriting, negotiating covenants, and structuring investments to protect downside

- How are private credit investors integrating distressed and special situations strategies?

Lunch to go and conference end

The heart of NEXUS

Among the energized crowd of private equity’s most powerful leaders, you will embark on a personalized journey at NEXUS to maximize your time and effort. Just tell us who you want to meet and we’ll take care of the rest!

The extensive networking program will help you cultivate relationships that drive results for your business and extend far beyond the 3 days in Orlando.

Winston Hubbard, ZSP Capital Group

“The greatest benefit for me is the networking and the opportunities that you can get involved in. It’s all about the people that you meet here.”

Golf: The NEXUS Cup

Culinary Masterclass

Pickleball Match

Future of Private Equity Lunch

Investor dinners

Women’s breakfast

The Connections Concierge

Effortless meetings with the right people

Our team hand-selects high-value meeting recommendations based on your goals, ensuring you’re connected with the right people before the event even begins.

We’ll handle the introductions so you can focus on building relationships that matter – no guesswork, no wasted time.

Networking reception + nightly open bar

Among the energized crowd of private equity’s most powerful leaders, you will embark on a personalized journey at NEXUS to maximize your time and effort. Just tell us who you want to meet and we’ll take care of the rest!

The extensive networking program will help you cultivate relationships that drive results for your business and extend far beyond the 3 days in Orlando.

Interact with PEI’s editors and industry leaders behind the scenes

Why read the headlines when you can shape them? Get in the room with the teams making the moves everyone talks about.

Front-row access to the conversations and connections defining private equity worldwide.

Our esteemed speaker lineup

NEXUS brings together the brightest minds in private equity.

For agenda inquiries please contact the program director, Ben Moss at ben.m@pei.group.

Chris Eckerman

Senior Portfolio Manager, Head of Co-Investments, State of Wisconsin Investment Board (SWIB)

Get a taste of the NEXUS difference

Orlando Bravo & MK Flynn keynote discussion

Orlando Bravo, co-founder and managing partner of Thoma Bravo, joined PEI Group’s MK Flynn on the NEXUS 2024 main stage.

Orlando revealed that Thoma Bravo had one of its best years for realizations in 2023, handing more than $13 billion back to investors. He noted that the firm’s largest exits were to strategic buyers. You can watch their session on demand by clicking the image on the right.

David Mussafer with Madeleine Farman

Advent International’s chairman and managing partner, David Mussafer, sat down with PEI Group’s Madeleine Farman for a wide-ranging chat on the final day of NEXUS 2024.

They cover Advent’s approach to deal-making over the last 12-18 months, the firm’s dialogue with LPs in the current environment and Mussafer’s wider predictions for investments and exits in 2024.

Jon Gray & Richard Melville PEI Group’s Editorial Director

Jon Gray graced the NEXUS 2024 stage in Orlando to share how Blackstone stays on top of the fast moving industry.

Watch the entire interview on-demand for a thrilling glimpse into the mind of a true private equity trailblazer.

Built for the capital behind the market

Designed for allocators. Built for what’s next.

Join NEXUS to:

> Trade strategies with peers who see what you see – and what you don’t

> Sharpen your outlook with insights from those allocating across the risk curve

Qualified investors are eligible for complimentary attendance.

Huseyin Burak Erten, Coalition of Hope Foundation

"You can spend a minimum of 5 years to gain the insights of the PE industry and build up a network and have 250 plus meetings on your own, or you can join PEI NEXUS and achieve the same."

Institutional

Join investor-only sessions and networking activities for frank discussions with your peers on strategies delivering results

Family Office

Build relationships with partners that can play a role in a sophisticated private markets portfolio

Private Wealth

Meet the trailblazers of private equity and build a deeper foundation of trust with top-tier fund managers

NEXUS 2025 united private equity’s top voices

NEXUS keynotes influence global investment and allocation trends. They represent the largest institutions in private markets and inspire action throughout our industry. Get the NEXUS 2025 agenda

Qualified investors are eligible for complimentary attendance.

Meet the managers. Shape the market.

NEXUS centers on the priorities of institutional investors. Fortify your portfolio through candid peer exchange and insight-led sessions built to address today’s allocation challenges.

Join NEXUS to:

- Swap notes with peers in off-the-record, investor-only sessions

- Discover emerging fund managers that can deliver outsized returns

- Connect with industry titans leading the most influential firms in private markets

Qualified investors are eligible for complimentary attendance.

NEXUS 2025 welcomed private equity's most influential LPs

Alaska Permanent Fund

AustralianSuper

AXA IM Alts

Briar Hall

CalPERS

CDPQ

Hightower

HOOPP

MassPRIM

Mubadala

New Jersey Division Of Investment

NYC Retirement Systems

OMERS

OTPP

Rockefeller Global Family Office

SWIB

Temasek

TRS Texas

Optimize your agenda - amplify outcomes for your team

Closed-door Limited Partners Council

In-depth strategy analysis with the largest pension funds in the world. Recalibrate partnership models, unpack new allocation trends, sharpen transparency norms.

Connections Concierge

Start with your team’s wish-list and your Connections Concierge will hand-pick the best peers and managers for you to schedule meetings with and also be available to make introductions.

Find your next buyout manager

Amid choppy waters, meet next-gen managers with diverse strategies, chilling return potential, and the hunger to deliver alpha – before they’re oversubscribed.

Portfolio construction debates

Where LPs compare notes on survival and strategy. From continuation vehicles to NAV lending, hear what’s working (and what isn’t) in unlocking capital while preserving long-term value.

Investor-only dinners

Break bread at the Secondaries Investor Dinner and LP Dinner a private setting with fellow LPs to exchange unfiltered insights, compare allocation strategies, and build trusted relationships that extend far beyond the event.

Networking all day everyday

Build your network with the peers, managers, and solution providers shaping your allocation strategy. Including a women’s breakfast, networking reception, nightly late bar, and networking escapades.

Chetan Mallikarjunaiah, RBC

"Great sessions, amazing panelists and cutting edge topics."

Shape your strategy

Join peer-to-peer discussions and exchange expertise to uncover high-quality investment opportunities

Spark partnerships

Our networking service connects you with the right people at the right time in the right place

Stay ahead

Leave NEXUS with strategies and connections that can accelerate growth in your private markets portfolio

Safeguard legacy. Expand opportunity.

From promising ventures to established assets, find investments that yield sustainable returns for generations to come.

Join NEXUS to:

- Make valuable connections with the right people, at the right time

- Benchmark against your peers to identify the best strategy for your portfolio

- Connect with powerful managers shaping the future of the asset class

Family offices are subject to approval.

NEXUS 2025 welcomed private equity's most influential LPs

Alaska Permanent Fund

AustralianSuper

AXA IM Alts

Briar Hall

CalPERS

CDPQ

Hightower

HOOPP

MassPRIM

Mubadala

New Jersey Division Of Investment

NYC Retirement Systems

OMERS

OTPP

Rockefeller Global Family Office

SWIB

Temasek

TRS Texas

“Great sessions, amazing panelists and cutting edge topics.”

Chetan Mallikarjunaiah, RBC

Shape your strategy

Join peer-to-peer discussions and exchange expertise to uncover high-quality investment opportunities

Spark partnerships

Meet major fund managers building platforms dedicated to the needs of RIAs and private wealth managers

Stay ahead

Leave NEXUS with connections that can play a key role in a sophisticated private markets portfolio

Forge global alliances

Engage with GPs and LPs from across the globe poised to collaborate and align with your values.

Gain perspective through candid, off-the-record conversations with peers and managers navigating the same complex landscape.

Offering you an edge without the noise.

Fund managers are reshaping PE for RIAs like you

Private equity is evolving for private wealth, seize the momentum and make sure your clients’ portfolios have a front row seat.

Join to:

- > Connect with top private equity managers building platforms tailored for you

- > Shape the conversation to ensure that your evolving needs are met

Qualified RIAs and private wealth managers are eligible for complimentary access.

Joachim Bader, CFGI

"I made many incredibly valuable connections with fellow attendees that are highly relevant for me and my company."

Shape your strategy

Examine the fund structures and platforms private equity firms are building that align with your client’s needs

Spark partnerships

Our networking service connects you with the right people at the right time in the right place

Stay ahead

Leave NEXUS with connections that can play a key role in a sophisticated private markets portfolio

Proven strategies to navigate the complexities of fund selection

Engage with GPs renowned for their private wealth expertise, successfully bringing PE to their high-net-worth clients. They offer tailored opportunities to navigate your strategy through alternative investments.

Get connected with institutional-grade alternatives and build a more-informed private markets strategy that turbocharges returns.

The Connections Concierge

Effortless meetings with the right people

Our team hand-selects high-value meeting recommendations based on your goals, ensuring you’re connected with the right people before the event even begins.

We’ll handle the introductions so you can focus on building relationships that matter – no guesswork, no wasted time.

Meet the LPs who move markets

NEXUS is where market momentum builds. Stay top of mind as the most influential investors in private markets define what’s next.

Decode the investment preferences of global LPs by peering firsthand into into their allocation strategies, preferences, and investment criteria. Gain cross-border insight, forge international partnerships, and tap into global capital flows.

Through a networking program that can be tailored exactly to your needs – connect with active investors you won’t see anywhere else.

NEXUS 2025 welcomed private equity's most influential LPs

Alaska Permanent Fund

AustralianSuper

AXA IM Alts

Briar Hall

CalPERS

CDPQ

Hightower

HOOPP

MassPRIM

Mubadala

New Jersey Division Of Investment

NYC Retirement Systems

OMERS

OTPP

Rockefeller Global Family Office

SWIB

Temasek

TRS Texas

The Connections Concierge

Effortless meetings with the right people

Our team hand-selects high-value meeting recommendations based on your goals, ensuring you’re connected with the right people before the event even begins.

We’ll handle the introductions so you can focus on building relationships that matter – no guesswork, no wasted time.

Matching institutional capital to emerging managers

NEXUS serves as your springboard to success, to forge and fortify valuable LP relationships.

Tailored networking sessions and matching technology levels the playing field for emerging managers and highlights your unique strategies to institutional investors.

Build real relationships with decision-makers driving capital, strategy, and innovation. Leave with actionable insight and the kind of access that shifts outcomes.

NEXUS unites private equity’s top voices

Shape your strategy

Engage with leading funds and institutional investors to build relationships and gain visibility among key industry players

Spark partnerships

Join strategic roundtables and gain insights into effective fundraising, marketing, and hiring tactics your peers are deploying

Stay ahead

Leave NEXUS with critical connections established to pave the way for future investment opportunities

With thanks to our sponsors

Discover fresh business opportunities

NEXUS unites the full spectrum of decision-makers, from global allocators to next-generation fund managers.

With unmatched access, premium branding opportunities, and a networking-forward agenda, NEXUS is where your influence takes root and your value becomes essential.

Connecting the entire private equity industry under one roof, NEXUS is the most effective and efficient way to meet investors and fund managers to drive your future success.

Industry leaders who joined us in 2025:

“An incredible event, which presented so many opportunities to visit with friends old and new and to garner unique insights into our space. With the bar set so high, I am excited to see what next year will bring!”

Steve Poliner, Texas TRS

Stand out from the crowd at NEXUS

A limited number of firms can secure a dedicated place for pivotal conversations.

Keep your brand front and center in your most essential discussions. Bolster brand presence and captivate industry leaders through sponsorship.

Add your voice to private equity’s future

Be part of the debates driving private equity forward.

Share your firm’s perspective, spotlight your expertise, and connect your brand with timely industry insights.

Gain premium visibility with the entire NEXUS audience.

Networking all day, every day

The 2026 networking program builds on last year’s momentum and on your feedback. Delivering even more ways to connect with key players shaping private equity.

Start a conversation with Jimmy Kurtovic and design a sponsorship strategy that ensures your brand leaves a lasting impression synonymous with influential networking.

Golf: The NEXUS Cup

Culinary Masterclass

Pickleball Match

More networking escapades to be announced.

FAQs

Tickets and registration

Can I change the name on my ticket or transfer it to someone else?

Do I need to bring a printed ticket, or can I use a digital one?

We strongly encourage registering in advance. If you arrive without a registration, you will need to complete your purchase online and may experience a delay. Please email Anna Dorokhin at anna.d@pei.group to confirm pricing and availability.

Where/how do I check in on arrival?

Check in at the registration desk located in the Ritz-Carlton Ballroom Pre-Function area to collect your badge. We ask that you wear your badge at all times during the conference hours. Please bring photo ID.

What time is registration open?

– Monday, March 10: 7:30am – 6:00pm

– Tuesday, March 11: 8am – 6:30pm

– Wednesday, March 12: 7:45am – 12:00pm

Event schedule

Where can I find the event agenda?

Can I reserve a space for the sessions on Monday, March 10?

Although it’s not a requirement to pre-register, you can reserve a space at these forums by completing the relevant pre-event survey:

How do I know which session on Monday, March 10 is best suited for me?

See below the qualifications for each forum:

1) Private Wealth Forum – open to all attendees

2) Institutional LP Council – limited to pension funds, foundations, endowments, family offices, insurance companies, sovereign wealth funds and healthcare systems who are actively making fund commitments and do not engage in third-party fundraising activities or collect fees for advisory/consulting services.

3) Emerging Managers Forum – for those classified as managers raising Funds I-III.

Networking

Are there any networking opportunities around the conference?

– Leaders in Private Equity: Women’s Breakfast on Monday, March 10th, 8am. Let us know if you plan to attend by completing the pre-event survey: the LP/RIA survey or all other attendee survey.

– The Networking Zone, hosted by the Connections Concierge Team, will be open on Tuesday, March 11 and Wednesday, March 12.

– The NEXUS Grand Opening on Monday, March 10. Join us in the Ritz-Carlton Grand Ballroom from 3:15pm to formally kick off NEXUS 2025 followed by a Networking Reception on the DaVinci lawn from 6pm.

– Nightly Networking Bar – Monday, March 10 and Tuesday March 11. Join us for drinks hosted by PEI in the the Ritz-Carlton Lobby Bar at the end of each day. No RSVP needed, badges are required.- Golf: The NEXUS Cup – Wednesday, March 12 from 1pm

– Partnerships & Pickleball Match – Wednesday, March 12, 1pm-3pm

– Culinary Masterclass (pizza making) – Wednesday, March 12, 1pm-3pm*Please note, spots at the end-of -conference activities are limited. Book your place by completing the pre-event survey: the LP/RIA survey or all other attendee survey.

Can I go to the Future of Private Equity Lunch or the Women’s breakfast?

The FPE Lunch is open to those attending the ILPC or Emerging Managers Forum only and is otherwise invitation-only.

Anyone, man, woman or nonbinary person can attend the Women’s breakfast.

How do I book a meeting via the Connections Concierge service?

1) Fill in your profile survey here:

LP/RIA survey

All other attendee survey

2) Download the app here to see the attendee list and profiles. You can message attendees directly to arrange your meetings.

3) Or contact the NEXUS Connections Concierge Team who will help set up a meeting and provide a designated space in the Networking Zone.

LPs or RIAs may email Max Burnand at max.b@pei.group ahead of the Summit or find him at the NEXUS Connections Concierge desk between March 11-12. Please ensure your profile has been completed via the survey so Max can identify the right meetings for you. Max will provide a list of recommended meetings for you and put you in touch directly to set up a meeting time.

GPs may email Ben Grubner at ben.grubner@pei.group ahead of the Summit or find him at the NEXUS Connections Concierge desk between March 11-12. Please ensure your profile has been completed via the survey so Ben can identify the right matches for you. Ben will provide a list of recommended meetings and you can use the app to arrange your meetings directly.

Venue and Travel

What is the best way to get to the venue (parking, public transport, etc.)?

The hotel is approximately 12 miles from the Orlando International Airport, easily accessibly by car.

The Ritz-Carlton provides daily valet parking for a fee and the adjoining JW Marriott provides self-parking for a fee.

How do I book a room at the Ritz Carlton?

The NEXUS Room block at the Ritz-Carlton is now sold out. To find accommodation nearby, please visit the hotel maps option here for a list of hotels with availability.

Is there a specific entrance for ticket holders?

The NEXUS Room block at the Ritz-Carlton is now sold out. To find accommodation nearby, please visit the hotel maps option here for a list of hotels with availability.

Is there a coat check or storage options for personal belongings?

For guests of the Ritz-Carlton, coat or luggage storage is available through the bellman service.

For all other attendees, luggage storage will only be available at the event on Wednesday, March 12 from 8am – 12pm.

A location built for networking

The Ritz-Carlton Orlando, Grande Lakes

4012 Central Florida Parkway

Orlando, FL 32837, United States

Please use the link below to see a list of available hotels in the area.

Book your room

Please contact customer services if you need assistance at customerservices@pei.group

Our esteemed speaker lineup from 2024

Elizabeth Burton

Managing Director and Senior Client Investment Strategist, Client Solutions Group, Goldman Sachs Asset Management

Marion N. Chebet, MBA

Senior Portfolio Manager, Director of Impact Investing, Johnson Financial Group

Chris Eckerman

Senior Portfolio Manager, Head of Co-Investments, State of Wisconsin Investment Board (SWIB)

Dr. Indermit Gill

Senior Vice President of Development Economics and Chief Economist of the World Bank Group

Lori Hall-Kimm

Senior Managing Director & Head of Global Private Equity, Healthcare of Ontario Pension Plan (HOOPP)

Milwood Hobbs Jr.

Managing Director and Head of North American Sourcing & Origination, Oaktree Capital Management

Eneasz Kądziela

Deputy Chief Investment Officer and Head of Private Equity, Office of the New York City Comptroller’s Bureau of Asset Management

Matthew Liposky

Chief Investment Operating Officer, Massachusetts Pension Reserves Investment Management (MassPRIM)

Tadasu Matsuo

Managing Director, Head of Global Alternative Investments, Japan Science & Technology Agency (JST)

Adebisi Oje

Sales Director Data, Advanced Analytics & Artificial Intelligence US Financial Services, Microsoft

Anne Philpott

Managing Director, Junior Capital & Private Equity Solutions, Churchill Asset Management

Paul Sanabria

Senior Managing Director & Global Co-Head of Secondaries, Manulife Investment Management

Andrew Siwo

Director of Sustainable Investments and Climate Solutions, New York State Common Retirement Fund

Robert "Vince" Smith

Deputy State Investment Officer and Chief Investment Officer, New Mexico State Investment Council

Powering the growth of private wealth in private equity

The Private Wealth Forum is where top RIAs connect with leading private markets managers.

Join the leaders revolutionizing how private wealth managers can access alternative investments, from firms such as Advent International, Blackstone, KKR, and TPG.

Learn how wealth managers have successfully integrated PE into their offerings, the structures they recommend, and meet with the managers that can provide real growth to you and your clients.

RIAs serving HNWIs may be eligible for complimentary access to the forum and more.

Connect

Meet major fund managers and RIAs navigating the $80 trillion private wealth opportunity for private equity.

Understand

Examine the fund structures and platforms private equity firms are building that align with HNW client needs.

Deploy

Participate in discussions to plan how to successfully grow the impact of private wealth in private equity.

Meet trailblazers in private wealth

Who should attend?

RIAs

Understand how private equity firms are adapting their fund structures and platforms to align to your needs

Heard at NEXUS 2024

“Product design is the key to unlocking the $80 trillion individual investor opportunity.”

Jon Gray, Blackstone

Why you should be in the room

- Find out why the RIA strategy is mobilizing. Why private equity, why now?

- Discover successful private equity strategies already being deployed by RIAs representing HNWIs.

- Blueprints on incorporating private equity into a HNWIs portfolio through new fund structures and platforms.

- Link with the right partners whose ethos aligns with your needs, risk profile and return expectations.

- Shape the conversation of the future of private wealth in private equity.

Networking

Diversifying a private wealth portfolio with private equity can skyrocket returns and NEXUS will provide the best opportunity for family offices and RIAs to connect with leading fund managers in exclusive networking and expert-led discussion.

7 questions RIAs should be asking of private equity funds

Discover how private equity can help you unlock new growth opportunities for your private wealth clients. Robert Picard, Head of Alternative Investments at Hightower Advisors, gives his take on the rising demand for private equity in PEI’s whitepaper.

Sponsorship gives you

- Engagement and thought leadership with RIAs leading the way for HNW clients

- Better understanding of the evolving needs of RIAs

- Participation in curated networking

For more information about sponsorship opportunities, contact Jimmy Kurtovic by emailing jimmy.k@pei.group or calling +1 646 356 4504.

Where emerging funds and investors converged

As large institutional investors are increasingly mandated to invest in emerging managers, NEXUS 2025 was the place to connect with rising funds that can deliver outsized returns.

The Emerging Managers Forum elevated emerging managers to simplify connections with allocation decision-makers.

Who attended?

Emerging Managers

Engaged with LPs actively seeking to allocate funds to emerging managers

Institutional Investors

Seized opportunity to gain alpha in their portfolios by investing early in emerging talent

Why you should have been there

- To have realized how LPs approach first time secondaries funds, sector specialization standards, challenging distribution rates, and exit activities.

- To have gained insights on generating liquidity in private equity and the ability of emerging managers to deliver sustained returns over time.

- To have heard from the experts on fine-tuning investor relations and enhancing your story.

- To have connected with emerging managers who align with strategy preferences and portfolio needs.

Networking

Early investment in emerging funds can supercharge an LP portfolio and NEXUS provided the best opportunity for emerging managers and investors to take part in exclusive networking and expert-led discussion.

The Future of Private Equity Lunch

You met the changemakers and the next generation of private equity leaders, recognized by Private Equity International.

**In an exclusive networking environment this invite only luncheon was composed of leading institutional investors, top performing emerging managers, award winners from PEI’s publications and influential VIPs in the private markets space.**

– Matched on portfolio needs and dissected the best strategies for demonstrating long-term partnership potential

– Discovered how to best approach building a track record on a deal-by-deal basis

– Shared best practices on how to empower the most successful talent pathways for outperformance

Sponsorship included

- Engagement and thought leadership with rockstar firms of the future

- Better understanding of the evolving needs of emerging managers

- Participation in curated networking

For more information about sponsorship opportunities, contact Jimmy Kurtovic by emailing jimmy.k@pei.group or calling +1 646 356 4504.

Elite networking. World-class content. Fuel future success.

Where capital meets conviction

Access to

NEXUS

Book now to join private equity’s most powerful leaders and influential capital allocators in February.

Complimentary investor passes

A limited number of complimentary passes will be available for institutional investors and family offices.

Complimentary RIA passes

A limited number of complimentary passes will be available for Registered Investment Advisors.

Elevate your firm at PE's most influential event

Why partner as a sponsor?

NEXUS brings together leading managers in private equity for engaging conversations that will raise your profile and elevate awareness of your unique offering.

Seize the spotlight to share your vision, build powerful connections and strengthen relationships with investors through formal and informal networking.

Discover NEXUS sponsorship offerings

Golf: The NEXUS Cup

Showcase your brand with a memorable day on the course, providing a relaxed setting to connect with influential investors and top fund managers.

Pickleball Match

Let your competitive spirits fly. Ensure your brand stands out in a relaxed and competitive atmosphere – perfect for sparking conversations.

Culinary Masterclass

Where sophistication meets hands-on experience. Close connection with top-tier attendees in a uniquely engaging, intimate environment.

How to get in touch

For more information, contact Jimmy Kurtovic at jimmy.k@pei.group or +1 646 356 4504.

Grand Opening Session

Take the stage as the Grand Opening Session sponsor, gaining premium visibility with the entire NEXUS audience. Set the tone for the event, aligning your brand with innovation and influence.

Future of Private Equity Lunch

Put your firm at the heart of the industry’s future. Network with emerging managers, rising stars, and LPs focused on the next generation of private equity.

Agenda Sessions

Align your brand with expertise and thought leadership. Connect your name with timely industry insights, positioning your brand as an integral part of NEXUS’ knowledge-sharing.

NEXUS-wide Branding

Amplify your brand across NEXUS with wide-reaching sponsorship visibility. This package provides multiple touchpoints to keep your brand top of mind throughout the event.

Networking Bar

Position your brand as the catalyst of high-energy networking. Be at the center of dynamic exchanges, fostering connections that drive influence and opportunity.

Build connections - private & semi-private meeting spaces

Secondaries Investor Dinner

This prestigious dinner is an ideal platform for your brand to engage decision-makers in a focused, impactful setting.

Meeting Rooms

A dedicated place for pivotal conversations while keeping your brand front and center in NEXUS’ most essential discussions.

Investor Dinners

This unique opportunity offers a sophisticated backdrop for building valuable relationships – making your brand synonymous with influential networking.

Investors and RIAs attending

Connections made easy

Meetings are at the heart of NEXUS. And the dedicated meetings concierge team will ensure you meet the right people at the right time to get the most out of your experience in Orlando.

Just tell us who you want to meet and when – we’ll do the rest! Whether you prefer to connect in the dedicated meeting lounge, outdoor networking areas, reserve a private meeting space or plan a dinner, the opportunities are endless and we are here to support you.

Meetings are at the heart of NEXUS. And the dedicated meetings concierge team will ensure you meet the right people at the right time to get the most out of your experience in Orlando.

Just tell us who you want to meet and when – we’ll do the rest! Whether you prefer to connect in the dedicated meeting lounge, outdoor networking areas, reserve a private meeting space or plan a dinner, the opportunities are endless and we are here to support you.

Meetings are at the heart of NEXUS. And the dedicated meetings concierge team will ensure you meet the right people at the right time to get the most out of your experience in Orlando.

Just tell us who you want to meet and when – we’ll do the rest! Whether you prefer to connect in the dedicated meeting lounge, outdoor networking areas, reserve a private meeting space or plan a dinner, the opportunities are endless and we are here to support you.

1. Sign up

Book now to secure the best rate at NEXUS.

And bring your team to maximize value.

2. Objectives

Our meetings concierge team will be in touch to understand your objectives and who you want to meet.

3. Profile

The NEXUS Networking app launches in January. Check your profile is up to date and check out the attendees.

4. Wish list

Your concierge will be in touch to recommend meetings, or you can create your own wish list.

5. Schedule

Once a meeting is accepted, your party will be sent an invitation with a time and place to meet.

6. Check in

Arrive at NEXUS with a schedule full of meetings, and a plan to optimize your time in Orlando.

Meet your concierge team

Your concierge team will be ready onsite with smiling faces to connect you with the investors and managers shaping our industry.

Max Burnard | Membership Success Executive

Ben Grubner | Customer Success Associate

Chris Tamms | Head of Network, Private Funds CFO

Private equity’s most powerful attendee list

Get excited about NEXUS 2026

Thank you for your interest in NEXUS 2026.

Explore our event website for more information. We hope to see you at NEXUS on February 22-25, 2026 in Orlando.

NEXUS keynotes influence global investment and allocation trends

For agenda inquiries please contact the program director, Ben Moss at ben.m@pei.group.