International

Operating Partners Forum New York

October 29-30, 2025

Convene Brookfield Place, 225 Liberty, New York

The largest global event for private equity value creation

Join the world’s leading PE firms to uncover the best methods to deliver cross-functional portfolio optimization at a critical time.

Connect with 500+ operating partners in exclusive networking opportunities and collaborative sessions to uncover the future of PE value creation.

Optimize your portfolio companies

Hear first-hand perspectives on how to further develop your operational efficiencies.

Network with top value creators

Connect with the largest global community of private equity operating partners.

Empower your operating team

Find the right tools and knowledge to create cross-functional value.

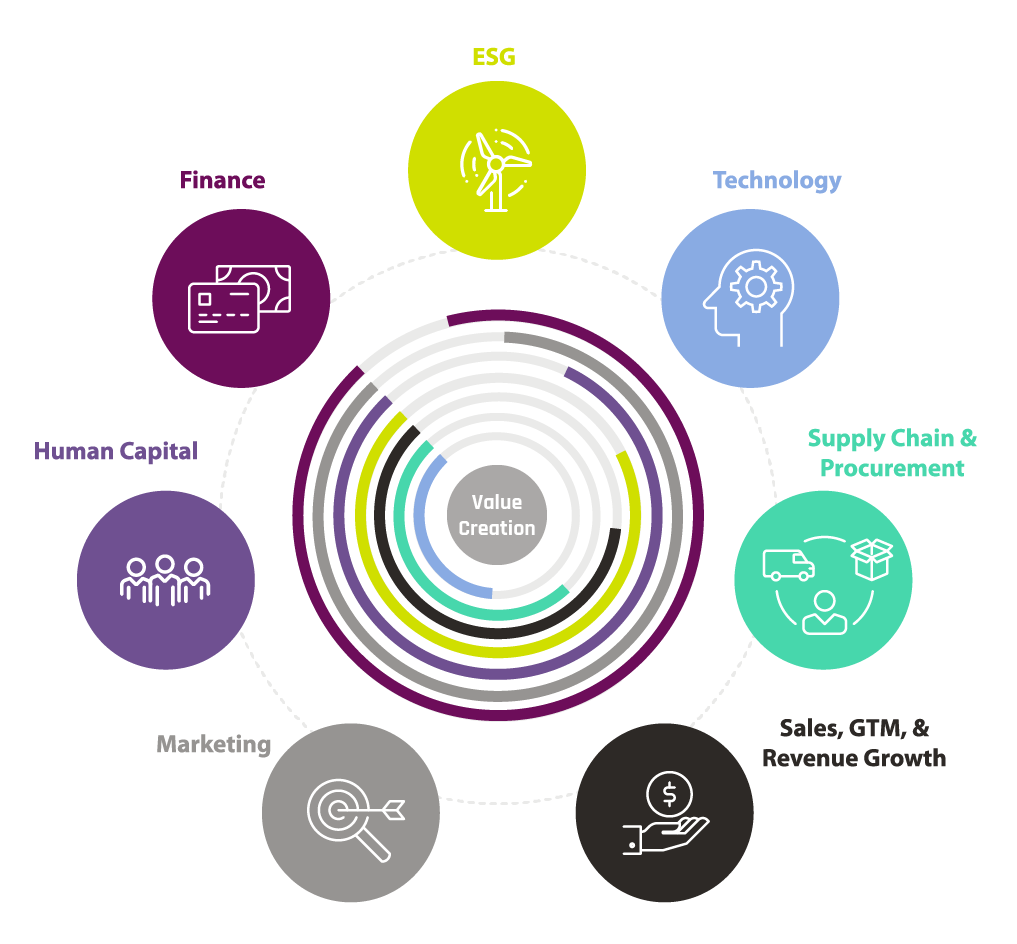

Agenda highlights

Our unique agenda offers extensive networking activities, plus interactive working groups, think tanks, panels, breakfasts, and lunch discussions. The agenda is carefully curated to feature the most prominent functional areas in value creation. Highlights include:

- Heads of value creation/team leaders’ insights

- Practical and functional use cases for AI in PE

- The growing importance of operating partners: showcasing and measuring performance

- Future functional levers across the entire investment lifecycle

- AI’s impact on the Operating Partner-Deal team dynamic and the future of PE

- And much more…

“You have to keep yourself current and our firms are not academies for becoming better operating partners…The PEI Operating Partners Forum is the only academy that exists for Operating Partners.”

Aaron Miller

Apollo Portfolio Performance Solutions

Apollo Global Management

Connect with a global community of functional specialists

How does your compensation compare?

The 2025 Operating Partners Compensation Survey will provide a temperature check of the market and aggregates the responses of 300+ operating partners across:

- Team make-up

- Compensation

- Incentive packages

- Portfolio company engagement

- And more…

Speakers

Kush Tulsidas

One Rock Capital Partners

It is a fantastic place to network with top operating talent in PE and learn the cutting edge work that their firms are doing to create value. I highly recommen…

Greg J. Pappas

Berkshire Partners

The Operating Partners Forum is the foremost event where the largest ecosystem of operating partners, suppliers and resources gather annually.

Nicole Weil

Kelso & Company

“The content is relevant for my role and I get to meet the smartest people in the industry.”

Our unique agenda offers interactive working groups, think tanks, panels, breakfast and lunch discussions. The agenda is carefully curated to feature the most prominent functional areas of value creation.

If you are interested in a speaking role please contact Marc Mele at marc.m@pei.group.

Download the preliminary agenda

Agenda

Pre-conference events - Tuesday 28th

Operating Partners Forum NY Pre-Event Welcome Reception (invitation-only for operating partners)

Venue: Gitano NYC, Waterfront, Pier 17, Seaport, New York

Join the operating partners attending the New York Forum at our opening grand reception. Exchange valuable insights with your peers in a relaxed setting and build your connections before the conference kicks off.

Pre-Event Dinners (invitation-only for operating partners)

Venue: Tin Building, 96 South St, New York, NY

Join us for private networking-style dinners designed exclusively for team leaders, functional specialist and generalist operating partners attending the NY Forum. You will receive an invite to select the dinner that best represents your role:

Heads of Value Creation – Team Leaders Dinner (invitation-only)

GTM, Sales and Revenue Growth Operating Partners Dinner (invitation-only)

Technology and Digital Operating Partners Dinner (invitation-only)

Finance Operating Partners Dinner (invitation-only)

Generalist Operating Partners Dinner (invitation-only)

Supply Chain and Procurement Operating Partners Dinner (invitation-only)

Human Capital Operating Partners Dinner (invitation-only)

Agenda

Day 1 - Convene Brookfield Place, 225 Liberty, New York - Wednesday 29th

Registration and breakfast

: Think tanks for full-time operating partners: value creation war rooms (invitation-only for operating partners)

These closed-door discussions will allow you to learn and share best practices of successful operating partners with your peers. Please select one of the rooms:

Think Tank 1 Digital and Technology Operating Partners

Think Tank 2 Human Capital/Talent Operating Partners

Think Tank 3 GTM, Sales and Revenue Growth Operating Partners

Think Tank 4 Finance Operating Partners

Think Tank 5 Heads of Value Creation: Team Leaders

Breakfast deep dive discussion 1 (invitation-only for operating partners)

Optimizing and measuring operating partner performance: comparing scorecards

This deep dive breakfast session designed solely for operating partners will allow the audience to join an interactive discussion with designated expert facilitators.

Breakfast deep dive discussion 2 (invitation-only for operating partners)

Operating partner-CEO alignment: dos and don’ts

This deep dive breakfast session designed solely for operating partners will allow the audience to join an interactive discussion with designated expert facilitators.

Breakfast deep dive discussion 3 (invitation-only for operating partners)

Operating partner-CTO synergies to maximize value

This deep dive breakfast session designed solely for operating partners will allow the audience to join an interactive discussion with designated expert facilitators.

Breakfast deep dive discussion 4 (invitation-only for operating partners)

How operating partners align and deliver value creation with CFOs

This deep dive breakfast session designed solely for operating partners will allow the audience to join an interactive discussion with designated expert facilitators.

Breakfast deep dive discussion 5 (invitation-only for operating partners)

Tariff impact analysis: comprehensive strategies to remain resilient

This deep dive breakfast session designed solely for operating partners will allow the audience to join an interactive discussion with designated expert facilitators.

PEI’s welcome and chairmen’s opening remarks

Panel 1 The legends of value creation — what I wish someone had told me

Panel 2 Maximizing value creation planning early in the hold period: key steps

Panel 3 AI’s impact on Operating Partner-Deal team dynamics and the future of PE

Panel 4 Heads of value creation views: what does excellence looks like in an operating partner and the team?

Networking Break

Panel 5 The portco CEO perspective: key considerations for operating partners

Panel 6 The value of pre-exit value creation to strengthen and refine the investment thesis

Panel 7 An inside look into the evolution of the operating partner role across the lifecycle

Panel 8 AI-led value creation in operations: showcasing real AI examples to transform business processes

Interactive Working Group 1 (for operating partners only) | Executive recruitment and retention in the current marketplace

This session designed solely for operating partners will allow the audience to join an interactive discussion with designated facilitators.

Interactive Working Group 2 (for operating partners only) | Optimizing your sales, marketing, and customer success processes

This session designed solely for operating partners will allow the audience to join an interactive discussion with designated facilitators.

Interactive Working Group 3 (for operating partners only) | Uncovering how to leverage Agentic AI and its future impact on VCPs

This session designed solely for operating partners will allow the audience to join an interactive discussion with designated facilitators.

Interactive Working Group 4 (for operating partners only) | Driving portco performance in the current economy: dissecting challenges and opportunities

This session designed solely for operating partners will allow the audience to join an interactive discussion with designated facilitators.

Interactive Working Group 5 (for operating partners only) | Operating partner perspectives on how to best create alignment and synergies with investment partners

This session designed solely for operating partners will allow the audience to join an interactive discussion with designated facilitators.

Networking Lunch

Functional lunch discussion 1 (invitation-only for operating partners) | Unlocking advanced pricing strategies: how are you thinking about it?

This closed-door deep dive lunch discussion designed solely for operating partners will focus on strategic areas to enhance value.

Functional lunch discussion 2 (invitation-only for operating partners) | A deep dive into market dynamics: employee benefits program optimization

This closed-door deep dive lunch discussion designed solely for operating partners will focus on strategic areas to enhance value.

Track 1 Recruiting and selecting AI talent for your portfolio companies

Track 2 Bridging the gap: unifying GTM and finance for operational excellence

Track 3 Cybersecurity case study: CISO-OP alignment and effectiveness

Track 4 100-day finance value creation playbooks: operating partner recipes

Track 5 Working with founder-led company CEOs: operating partner insights

Track 6 Building high-performance teams: alignment, accountability, and results

Track 7 Personalizing and refining your GTM playbooks

Track 8 Leveraging AI for the mid-market: firsthand implementations revealed

Track 9 Office of the CFO optimization: key drivers for M&A and exit readiness success

Track 10 Optimizing supply chain technology platforms: automation, collaboration, and intelligence

Coffee Break

Track 11 Leaders in AI: why firms now need an AI operating partner

Track 12 Commercial due diligence: strategic groundwork for long-term success

Track 13 Identifying the data metrics that matter to maximize value at exit

Track 14 Power pairing: unlocking value through the CTO-CFO partnership

Track 15 What makes a great supply chain/procurement operating partner: key insights from functional specialists

Track 16 Leveraging the human capital leader's role in thesis development and diligence

Track 17 The silent killers of value: addressing revenue leakage and cash flow blind spots

Track 18 The evolution of 100-day tech value creation playbooks

Track 19 Executive recruitment and selection of the modern CFO

Track 20 Value creation for industrials: success stories to drive returns

Interactive Working Group 6 (for operating partners only) | The latest on broad-based employee ownership across organizations: comparing results

This session designed solely for operating partners will allow the audience to join an interactive discussion with designated facilitators.

Interactive Working Group 7 (for operating partners only) | Unlocking commercial analytics to drive growth throughout the lifecycle

This session designed solely for operating partners will allow the audience to join an interactive discussion with designated facilitators.

Interactive Working Group 8 (for operating partners only) | Comparing tech and digital operating partner models and ecosystems

This session designed solely for operating partners will allow the audience to join an interactive discussion with designated facilitators.

Interactive Working Group 9 (for operating partners only) | The future finance function: strategic tech initiatives for the office of the CFO

This session designed solely for operating partners will allow the audience to join an interactive discussion with designated facilitators.

Interactive Working Group 10 (for operating partners only) | Sharing notes on key priorities in year one to drive long-term value

This session designed solely for operating partners will allow the audience to join an interactive discussion with designated facilitators.

End of day one grand reception

End of day one grand reception

Agenda

Day 2 - Convene Brookfield Place, 225 Liberty, New York - Thursday 30th

Registration and breakfast

: Think tanks for full-time operating partners: value creation war rooms (invitation-only for operating partners)

These closed-door discussions will allow you to learn and share best practices of successful operating partners. Select one of the rooms:

Think Tank 1 New Operating Partners (1-2 years in PE)

Think Tank 2 Advanced Operating Partners (3+ years in PE)

Think Tank 3 Senior Operating Partners (10+ years in PE)

Breakfast deep dive discussion 1 (invitation-only for operating partners) | The evolution and acceleration of change management: operating partner new playbooks

Breakfast deep dive discussion 2 (invitation-only for operating partners) | The exit edge: actions that unlock 10%+ valuation upside in the last 18 months

This breakfast deep dive discussion designed solely for operating partners will allow you to join an interactive discussion with designated facilitators.

Breakfast deep dive discussion 3 (invitation-only for operating partners) | Operational due diligence in the age of AI: a new paradigm

This breakfast deep dive discussion designed solely for operating partners will allow you to join an interactive discussion with designated facilitators.

Breakfast deep dive discussion 4 (invitation-only for operating partners) | Overcoming barriers: how operating partners unlock and deliver digital transformations swiftly

This breakfast deep dive discussion designed solely for operating partners will allow you to join an interactive discussion with designated facilitators.

Breakfast deep dive discussion 5 (invitation-only for operating partners) | An inside look into the future of operating partner models and team structures

This breakfast deep dive discussion designed solely for operating partners will allow you to join an interactive discussion with designated facilitators.

Chairman’s welcome

The rise of the operating partner in PE: what does the future hold?

LP views of the operating partner and value creation in private equity

Networking break

Perspectives on the modern CEO: what great looks like through the eyes of the operating partner

Investment partner perspectives: dos and don’ts for operating partners

Break

Interactive Working Group 11 (for operating partners only) | Management team performance and assessments across the investment lifecycle

This session designed solely for operating partners will allow the audience to join an interactive discussion with designated facilitators.

Interactive Working Group 12 (for operating partners only)| The power of data science to accelerate value across the lifecycle

This session designed solely for operating partners will allow the audience to join an interactive discussion with designated facilitators.

Interactive Working Group 13 (for operating partners only) | Leveraging AI as a key component of your commercial strategy

Interactive Working Group 14 (for operating partners only) | How operating partners collaborate across functions to deliver the VCP: sharing what’s real and actionable

Interactive Working Group 15 (for operating partners only) | Mastering your role as an operating partner on boards

This session designed solely for operating partners will allow the audience to join an interactive discussion with designated facilitators.

Networking Lunch

Functional lunch discussion 3 (invitation-only for operating partners) | The future of cybersecurity: playbooks to enhance and protect in the AI era

This closed-door deep dive lunch discussion designed solely for operating partners will focus on strategic areas to enhance value.

Functional lunch discussion 4 (invitation-only for operating partners) | The modern CRO: skills and traits of commercial leaders to unlock value

This closed-door deep dive lunch discussion designed solely for operating partners will focus on strategic areas to enhance value.

Women in PE value creation lunch (invitation-only for operating partners)

This closed-door lunch discussion will explore what it’s like being a woman in PE portfolio operations.

PEI presents the 2nd annual operating partners compensation survey results

Discover the latest figures in operating partner compensation for 2025 across functional areas, models, AUM, seniority levels, and more.

Closing remarks and end of conference

Build your operating partner community

Expand your relationships and build a lasting network with our operating partner exclusive networking events.

Connect with leaders in value creation to share ideas, solve challenges, and benchmark strategies that will level up your day-to-day operations.

Operating Partners Forum New York Welcome Reception (invitation-only)

Tuesday, October 28

Gitano NYC

Exchange valuable insights with your peers in a relaxed setting and build your connections before the conference kicks off.

Operating Partners Forum New York Networking Dinners (invitation-only)

Tuesday, October 28

Tin Building

Join us for one of seven private sit-down dinners, split by functional area, designed exclusively for operating partners attending the Forum.

Day 1 Grand Reception

Wednesday, October 29

Our grand reception will allow you to chat and get to know your operating partner peers at the end of the first day of the Forum. Hear what is on everyone’s mind after a full day of valuable insights.

Breakfast Discussions

Wednesday and Thursday, October 29-30

Share your views and learn from peers about specific value creation levers in five intimate discussions exclusively for operating partners.

Lunch Discussions

Wednesday and Thursday, October 29-30

These closed-door conversations, exclusively for operating partners, will explore key strategies for your portcos and PE firms to enhance value.

Sessions designed for collaboration

Think Tanks

Put your heads together with other operating partners to examine niche areas of value creation. With crowd-sourced discussion topics, these peer-led sessions will provide personalized takeaways.

Interactive Working Groups

Hear how your peers are navigating specific value creation levers. These interactive discussions, facilitated by our expert speaking faculty, will provide a closer look at specific cross-functional topics.

Pre-Event Resources

For speaking opportunities, contact Marc Mele at marc.m@pei.group or call +1 646 581 9295.

Engage with the largest operating partner community

Private Equity International’s Operating Partners Forums are a unique blend of networking, collaboration, and thought leadership between private equity operating partners, portfolio operations teams, and sponsors.

Each event is custom designed to encourage conversation about value creation best practices, relationship building, and knowledge sharing across functional areas on the most pressing issues facing investment and portfolio companies. Access to the Forum is limited to value creation experts from private equity firms and sponsors.

For more information on ways to engage with PEI’s Operating Partners community, please contact Lawrence Dvorchik at lawrence.d@pei.group or call on +1 (646) 545-4429