Relations

Network

Where private markets IR & marketing professionals connect, learn, & lead

An inclusive year-round peer community

Building LP trust, raising capital, growing your brand, managing key relationships—the list of priorities for investor

relations, marketing, and communications professionals is endless.

Join a trusted community that supports your goals with the expertise, tools, and networking opportunities you need to elevate your impact.

Enhanced peer learning

Our commitment to your success means providing key opportunities to connect with peers. As a member, you’ll have access to in-person and virtual gatherings across the US. Expand your peer network, connect directly with investors, and gain insights that drive success year-round.

Tailored executive coaching

Work with Dr. Ben Elman, an expert in leadership, management, and communication, on executive coaching tailored to the unique demands of private markets. Build the skills and strategies you need to lead with confidence and drive greater impact at your firm.

Timely, expert analysis

Gain access to exclusive industry content and analysis tailored for investor relations, marketing, and communications professionals. Stay current on private markets industry trends, fundraising best practices, and performance strategies.

The Investor Relations Network Compensation Survey provides a temperature check of private markets compensation trends across AUM, job function, location, and more.

Save on access to industry events

Share best practices in fundraising and LP relations with the largest community of investor relations, marketing and communications leaders at the New York Forum. With 20 years of rich history, this event* offers invaluable networking, interactive discussions, and actionable insights to empower your team and elevate your firm’s success.

*IR Network members get save 20% off all PEI event ticket purchases.

Personalized support

Our dedicated Network Manager serves as your concierge, facilitating introductions to peers and solutions providers so you can overcome any obstacle in your way. This tailored service helps you advance your career goals and build a network you can rely on.

Exclusively for Members

Year-round access to LPs and top IR peers

We’re committed to your success—starting with who you connect with.

As a member, you’ll gain access to regular in-person gatherings across the US, and virtual meetings, designed to foster meaningful peer connections.

These events are built to strengthen your network, deliver valuable insights, and keep you connected all year long

Upcoming meetings

How to tap into the family office market

July 22, 2025

Virtual meeting

Discuss the necessary marketing tactics, resources, and market trends to attract family offices.

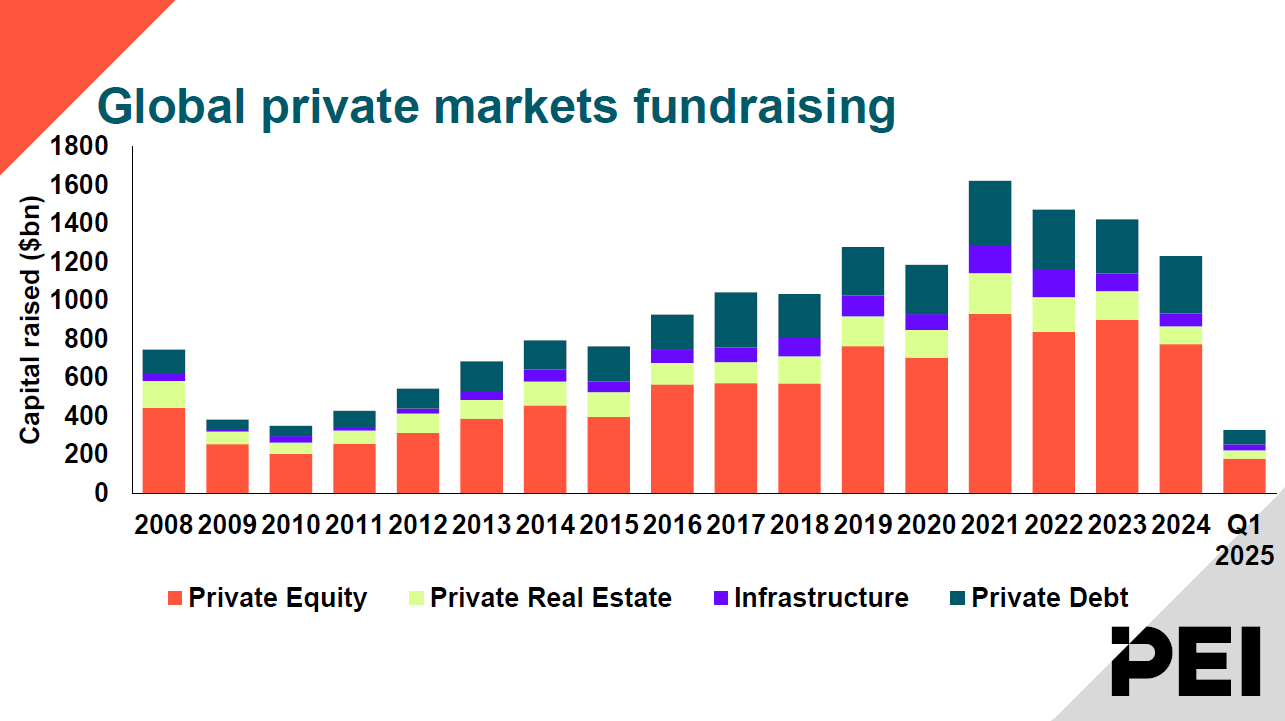

2Q update on the state of private markets

July 24, 2025

Virtual presentation

Hear the latest quarterly data, sentiment, and outlook on global and regional private markets.

Fundraising abroad

August 12, 2025

Virtual presentation

Explore key trends in international markets and strategies for reaching foreign investors.

Meet your new professional community

Who are the Investor Relations Network members?

Connect year-round with investor relations, marketing, and communications professionals in private markets.

While our members span countries, career levels, and sectors, the Network offers the chance to gather with the common goals of collaboration and professional growth.

Featured networking opportunities:

Flagship Forums

Gather with an elite crowd of private markets professionals for panels, networking, and more.

Regional meet-ups

Connect over cocktails at thought leadership roundtables on timely topics.

Virtual panels

Learn from leading PE firms about the current state of the market.

Office hours

Connect with speakers privately at our annual Forums to ask questions after their panels.

Virtual discussions

Connect with peers to benchmark strategies and solve shared challenges.

Executive coaching

Learn best practices across a variety of topics designed to further your career.

Broaden your industry connections

Introducing the Investor Relations Network

An inclusive peer community for IR and marketing professionals in private markets

Investor relations, marketing, and communications professionals in private markets face unique challenges. Building trust, raising capital, managing stakeholder relationships, and conveying performance and brand strength in a dynamic industry can be a lonely, daunting task. The Investor Relations Network is here to help. Backed by PEI’s expertise and convening power, join an exclusive, trusted community that supports your goals with the expertise, tools, and networking opportunities you need to elevate your impact.

Join the must-attend New York Forum

Share best practices in fundraising and LP relations with the largest community of investor relations, marketing and communications leaders. With 20 years of rich history, the New York Forum offers invaluable networking, interactive discussions, and actionable insights to empower your team and elevate your firm’s success.

Enhanced peer learning and benchmarking

Our commitment to your success means providing key opportunities to connect with peers. As a member, you’ll have access to frequent in-person and virtual gatherings across the US. These events are crafted to strengthen your peer network, deliver valuable insights, and expand your network year-round.

Tailored executive coaching

Enhance your skills with executive coaching from Dr. Ben Elman, a specialist in leadership, management and communications focused on private markets. Tailored for alternative assets investor relations, marketing, and communications professionals, you will gain the tools to elevate your impact and influence at your firm.

Personalized support for strategic introductions

Our dedicated Network Manager serves as your concierge, facilitating introductions to peers and solutions providers so you can overcome any obstacle in your way. This tailored service helps you advance your career goals and build a network you can rely on.

Stay ahead with timely, expert analysis

Gain access to exclusive industry content and analysis tailored for investor relations, marketing, and communications professionals. Stay current on private markets industry trends, fundraising best practices, and performance strategies.