Patricia Rodrigues Jenner

Member of Boards LGAS/AER plc and Investment Committees , GLIL Infrastructure/AIIM

In 2026, we’re moving to a new venue to deliver more access, more impact, more business.

The Infrastructure Investor Global Summit is growing — giving you even greater opportunities to connect with leading investors, shape the conversation, and drive your strategy forward.

Following a record-breaking event in 2025, the move to a larger venue marks a bold step into the future. Expect expanded networking, enhanced content, and an even more powerful platform for global infrastructure.

Be the first to hear what’s next. Register your interest now to get exclusive updates on the 2026 event.

Connect with LPs from across the globe over 4 days

Gain global insights from industry leaders

Expand your network. Deepen relationships. Secure capital.

Solution: The Infrastructure Investor Global Summit – the #1 event for global infrastructure investing. Here’s why:

Meet ALL THE KEY PLAYERS – top investors, fund managers, and strategic partners – ready to connect and drive deals.

Learn from ALL THE INDUSTRY LEADERS on our stages, delivering insights you can act on immediately.

Discover ALL THE MAJOR DEALS and industry-shaping announcements happening here first.

James Hatwell

james.hatwell@pei.group

+44 (0) 203 994 7961

Alexander Jakes

alexander.j@pei.group

+44 (0) 203 862 7498

Luca Greene

luca.g@pei.group

This 4-day event, featuring an editorially-driven agenda, offers dynamic discussions and unparalleled insights into the latest infrastructure challenges.

Showcase your solutions, elevate your brand, and position your organisation as a thought leader, while connecting and collaborating with the industry’s top influencers and investors for maximum visibility.

Gain global insights from industry leaders

Connect with $1.2tn of infrastructure capital over 4 days

Expand your network. Deepen relationships and secure capital

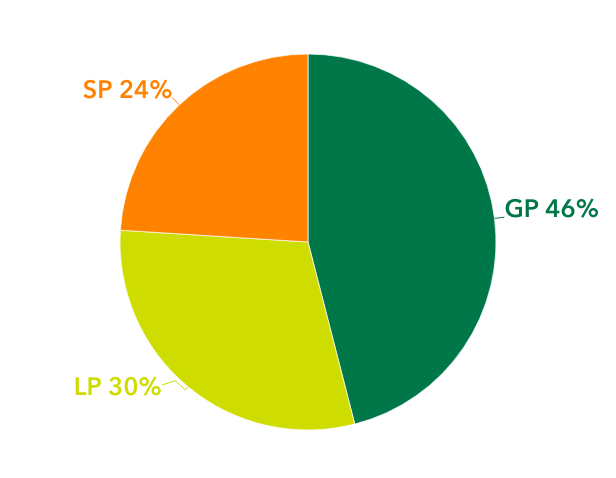

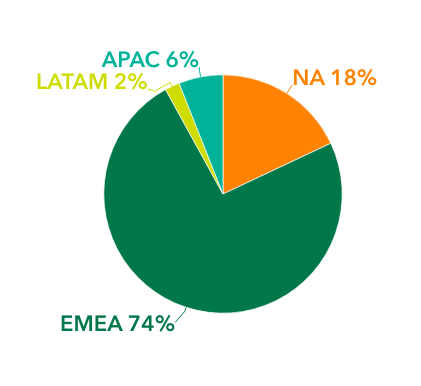

Senior decision-makers, represent a diverse range of institutions including public and private pension funds, insurers, family offices, fund managers, investment consultants, law firms, banks, and placement agents.

Engage in premium networking with potential clients and increase your brand’s presence both digitally and during live sessions. Leverage the Infrastructure Investor event app for seamless networking and collaboration.

Sponsors can highlight their thought leadership and industry expertise through speaking engagements and targeted content on key topics.

Our sponsorship packages deliver exceptional value for your investment, offering a variety of benefits tailored to meet your specific needs and objectives.

For more information or if you are interested in speaking at the Summit, please contact James Hatwell.

james.hatwell@peimedia.com | +44 (0)20 3994 7961

Find investors who match your investment strategies and set up meetings ahead of the event on our membership platform.

Showcase your profile ahead of the event and use our membership team to connect with the right decision makers.

Access unique, critical insight exclusive to members throughout the year along with preferential rates to attend any event within the Infrastructure Investor Network portfolio.

The Network’s dedicated membership team will ensure your experience at the Global Summit is first class with personalized introductions and timely roundtable discussions.

Connect with top LPs, build lasting relationships and discuss opportunities that will help take your firm to the next level with the Infrastructure Investor Network.

Unlock your fundraising potential at the forum and beyond with the Infrastructure Investor Network.

Unlock your firm’s potential at the Forum and beyond when you join the Infrastructure Investor Network.

Purchase 12 month membership to attend the Global Summit, and enjoy exclusive access to:

We are a professional membership offering exclusive access to investors, a wide range of resources, thought leadership and more. The Network provides members with essential information on market trends, compliance topics, regulatory insights, useful tools, online and in-person events and a comprehensive resource library. Members have access to behind-the-scenes, closed-door conversations among a community of peers who share their knowledge and expertise within our trusted Network.

PEI continues to deliver an excellent Global Summit year after year. The Global Summit brings together the best thought leaders in our industry, and provides op…

I am honoured to have had the opportunity to deliver the digital infrastructure keynote at the Infrastructure Investor Network Global Summit. It is particularly…

PEI continues to deliver an excellent Global Summit year after year. The Global Summit brings together the best thought leaders in our industry, and provides opportunities to discuss new investment arenas, emerging challenges, and ongoing developments in infrastructure. We always enjoy the learning, networking, and business development opportunities that the Global Summit provides, and look forward to another successful event in 2024.

I am honoured to have had the opportunity to deliver the digital infrastructure keynote at the Infrastructure Investor Network Global Summit. It is particularly exciting to witness the emergence of digital infrastructure as a distinct asset class within the broader infrastructure landscape. The summit provided the DigitalBridge team with a unique platform to connect with our global partners in an intimate and informative setting, congratulations to the organizers for another great event!

New for 2023, the Global Summit Investor Council will be dedicated to serving our institutional and private investors in attendance.

This invite-only forum will take place on Thursday 23rd March, and will involve various formats, including:

Offering unparalleled insights and opportunities to network with your fellow LPs, the Investor Council is not to be missed for those that are eligible to attend.

Learn the latest industry insight from experts of the asset class. Find out how to protect your portfolio from inflation, high interest rates and geopolitical instability and so much more.

Reconnect with your fellow investors and gain important and unfiltered peer-to-peer insights in this ever-changing environment.

Connect with 600+ leading institutional investors actively allocating to infrastructure.

The Investor Council is part of the industry leading Infrastructure Investor Global Summit. The Global Summit will take place across four days and is your best opportunity to connect with your peers, learn from inspirational speakers and stay at the forefront of the infrastructure market.

Resilience and returns: unlocking infrastructure debt’s potential in a volatile market

The Infrastructure Investor Global Summit provides an unrivalled platform for institutional and private investors and allocators investing in infrastructure to gather.

A limited number of complimentary passes are available for eligible allocators and institutional and private investors to join the event. Complimentary investor passes are limited to foundations, endowments, trusts, insurance companies, single family offices, sovereign wealth funds and pension funds who are actively making fund commitments and do not engage in third-party fundraising activities or collect fees for advisory/consulting services.

Shaking up the market – assessing the impact of mergers, acquisitions and the emergence of new players.

Continuing to champion the energy transition in a deglobalizing, destabilised world

Assessing the impact of 2024 elections across Europe, America & beyond on global infrastructure policy

AI – innovation, application and supplying demand in the infrastructure market

Making core

infrastructure

sustainable

Private infrastructure’s critical role in power generation and transmission

Enrich your network, build lasting relationships, and exchange valuable perspectives with your investor peers through investor-only breakfasts, networking breaks, lunches and much more.

Hear from our industry-leading speaker line-up, discover the latest trends and stay aligned with future innovations in the market.

Discover remarkable investment opportunities in sectors including emerging markets, the energy transition, infrastructure debt and more.

Connect and arrange one-to-one meetings with infrastructure’s biggest fund and asset managers in the market.

The 2026 Summit will be hosted at STATION Berlin, set within the heart of Germany’s capital city.

Address:

STATION-Berlin

Luckenwalder St. 4-6

10963 Berlin

Germany

Dive into essential insights and connect with industry leaders through a concise agenda featuring key discussions, networking sessions, and expert panels. The agenda ensures you’re primed to seize every opportunity.

Download the full agenda across the 4 days OR take a look at the individual forum agendas below.

If you are interested in speaking at the Infrastructure Investor Global Summit 2025, please contact:

James Hatwell

james.hatwell@pei.group

+44 (0) 203 994 7961

The Infrastructure Investor Global Summit offers unparalleled opportunities to network with the world’s leading investors in Berlin. Our out-of-hours networking functions are the ideal setting to build strong relationships with investors and secure commitments. See below for the exciting plans we have in store.

Monday 6pm | Listo Lounge, The Hilton

Excellent branding opportunity for the opening networking reception of the week. 500+ attendees, complimentary drinks, canapes, entertainment and more. Put your brand in front of your key target markets from the get go.

Available for sponsorship.

Tuesday 7am | Hilton Hotel reception

In its third year, our popular morning charity 5km run will be joined with a walk for those who prefer an easier pace. Take this opportunity to venture outside and see some historic Berlin landmarks and enjoy a dedicated breakfast upon your return.

Sponsored by Arclight Capital Partners.

Tuesday 6:30-8pm | The Hilton

After day one of the Global Investor Forum, our official drinks reception will take place in the networking area. Expect also our charity e-sports competition on the big screen, a keynote book signing, our specialist DJ and plenty of drinks and canapes.

Sponsored by Paul Hastings.

Tuesday 9pm | Bellboy Bar Berlin

Continue the networking into the night with our inaugural Global Summit Party. Continuing late into the night, there will be a dancefloor, cocktails and resident DJ. A great opportunity to stay front of mind with the industry.

Available for sponsorship.

Wednesday 6-8pm | Solar Sky Bar

Following our dedicated Women in Infrastructure breakfast and DE&I panel taking place earlier on the Wednesday, this invite-only, exclusive drinks reception will take place in a unique offsite location in Berlin with 200+ of infrastructure’s most influential women in attendance.

Sponsored by Finance in Motion.

To discuss sponsoring these opportunities, please contact Alexander Jakes on alexander.j@pei.group.

Event access and 12-month Network membership

£5875 plus VAT

Group Rate:

Purchase 3 or more passes in one transaction to unlock our group discount. Contact: luca.g@pei.group

A limited number of complimentary passes are available for eligible allocators and institutional and private investors.

Limited to foundations, endowments, trusts, insurance companies, single family offices, sovereign wealth funds and pension funds.

Examining macroeconomic trends influencing investment in emerging and growth markets, focusing on fundraising challenges, sovereign and climate risk strategies, digital and energy infrastructure megatrends, and comparative investment opportunities across different regions globally.

Join us for a keynote fireside chat between one of the legendary pioneers of infrastructure investing, Bayo Ogunlesi, Founder, Chairman and Chief Executive Officer (CEO) of Global Infrastructure Partners (GIP), now a part of BlackRock, and Zak Bentley, Americas Editor at Infrastructure Investor

Moderator: Zak Bentley, Americas Editor, Infrastructure Investor

Speaker: Bayo Ogunlesi, Founder, Chairman & Chief Executive Officer (CEO), Global Infrastructure Partners (GIP), a part of BlackRock

Mujde Zeynel, Director, Castalia

Moderator:

Mujde Zeynel, Director, Castalia

Speakers:

Matthew Jordan-Tank, Director of Sustainable Infrastructure Policy and Project Preparation, EBRD

Pushkar Kulkarni, Managing Director Infrastructure & Sustainable Energies, CPP Investments

Jordan Schwartz, Executive Vice President, Inter-American Development Bank Group (IDB)

Neda Vakilian, Head of Investor Relations, Actis

Moderator:

Chandra Reddy, Corporate Advisory and Principal Investments, Beyond Advisory

Speakers:

Mamoun Jamai, Head of Digital Infrastructure, ADIA

Sundeep Malik, Head of Portfolio Development International Business, Zurich Airport International

Andre Sales, Managing Partner & Infrastructure CEO, Patria Investments

Alice Usanase , Lead, Europe, Middle East & Francophone Africa, Africa Finance Corporation

Head Portfolio Development International Business, Zurich Airport International

Read bio

Moderator:

Mark Moseley, Principal, Moseley Infrastructure Advisory Services

Speakers:

Erik Becker, Regional Industry Manager, Infrastructure and Natural Resources, South East Asia and Pacific, IFC

Ali Karimzada, Head of Strategic Projects Division, Ministry of Economy of Republic of Azerbaijan

Ahmed Mubashir, Head of Infrastructure, EMEA & India, AIMCo

Anand Rajagopal, Sustainability Research Lead, Phoenix Group

Saad Ul Islam, Investment Director, Infrastructure Equity, British International Investment

Regional Industry Manager, Infrastructure and Natural Resources, South East Asia and Pacific, International Finance Corporation (IFC)

Read bio

Head of Strategic Projects Division, Ministry of Economy of Republic of Azerbaijan

Read bio

Sustainability Research Lead – Global Investment Research & Ratings, Phoenix Group

Read bio

Moderator:

Hans-Peter Egler, Director, Sustainable Infrastructure / Technical Assistance, South Pole Group

Speakers:

Saed Arar, Head of Infrastructure Investments, Mubadala Investment Company

Lucie Bernatkova, Vice President, Portfolio Manager, Impact Investments, Allianz Global Investors

William Brent, Chief Marketing Officer, Husk Power

Srini Viswanathan, Founder & CEO, AltEons Energy

This session will assess two real life investment opportunities in the emerging markets while addressing the associated risks and strategic considerations. This session will highlight the key takeaways and strategies that led to success.

Moderator: Jeff Schlapinski, Managing Director of Research, Global Private Capital Association (GPCA)

Speakers:

Alper Akar, General Manager, ICA

Viktor Kats, Managing Partner, Augment Infrastructure

Moderator:

Georg Inderst, Principal, Inderst Advisory

Speakers:

Aditi Bhattacharya, Unit Head, Private Sector and Climate Finance, Asian Development Bank

Alexandre Chavarot,Senior Advisor, Resilience Finance, Howden

Gergely Horvath, Investment Officer / Infrastructure & Climate Action Funds, European Investment Bank

Lisa Pinsley, Head: African Climate Acceleration Fund, African Infrastructure Investment Managers

Thomas Walenta, Principal and Co-Head for Asia-Pacific and Europe, Fund of Funds, responsAbility Investment AG

Investment Officer / Infrastructure and Climate Action Funds, European Investment Bank

Read bio

Head: African Climate Acceleration Fund, African Infrastructure Investment Managers

Read bio

Co-Head for Asia-Pacific and Europe, Fund of Funds, responsAbility Investments AG

Read bioThis session will showcase a series of back-to-back case studies, providing an in-depth look at how institutional investors and Multilateral Development Banks (MDBs) are driving infrastructure investments in emerging economies. Attendees will gain valuable insights into the evolving role of institutional and MDB investors in shaping the future of infrastructure across diverse regions.

Moderator:

Eugene Zhuchenko, Managing Director, Etore Advisory

Speakers:

Muneer Ferozie, Regional Head of Transaction Advisory Services, International Finance Corporation (IFC)

Matthew Jordan-Tank, Director of Sustainable Infrastructure Policy and Project Preparation, EBRD

Representatives from different emerging and growth regions will argue why their respective regions are providing the most opportunity across different infrastructure assets.

Moderator: Dr. Hubert Danso, CEO & Chairman, Africa Investor Group

Speakers:

Patrick Lee, Operating Partner Infrastructure Australia & Asia, PATRIZIA – The Philippines

Eduardo Aranibar, Founder, Compass Earth Capital – Brazil

Benas Poderis, Partner, Head of Investment Management, Nter Asset Management – Lithuania

Karsten Sinner, Head of Infrastructure Fund Investments, European Bank for Reconstruction and Development (EBRD) – Central & Eastern Europe

Head of Infrastructure Fund Investments, European Bank for Reconstruction and Development (EBRD)

Read bioMujde Zeynel, Director, Castalia

We explore private capital’s role in bridging the infrastructure investment gap, the unique market dynamics at play and the topics that are top of mind for investors. With 30 years of experience investing in infrastructure, gain insights from Macquarie Asset Management’s Head of Real Assets into the importance of strong partnerships and global connectivity to create value and shape successful investments in an evolving landscape.

Moderator: Bruno Alves, Editor-in-Chief, Infrastructure Investor

Leigh Harrison, Head of Real Assets, Macquarie Asset Management

Focusing on the critical role of sustainable infrastructure in investment success, addressing how to measure sustainability, navigate sustainability challenges, responsibly power AI, promote biodiversity, comply with regulations, and assess the impact of sustainable investments on financial performance.

Join us for a keynote fireside chat between one of the legendary pioneers of infrastructure investing, Bayo Ogunlesi, Founder, Chairman and Chief Executive Officer (CEO) of Global Infrastructure Partners (GIP), now a part of BlackRock, and Zak Bentley, Americas Editor at Infrastructure Investor

Moderator: Zak Bentley, Americas Editor, Infrastructure Investor

Speaker: Bayo Ogunlesi, Founder, Chairman & Chief Executive Officer (CEO), Global Infrastructure Partners (GIP), a part of BlackRock

Anna Baumbach, Partner, Palladio Partners

Moderator: Simon Whistler, Head of Real Assets, Principles for Responsible Investment

Speakers:

Thomas Bayerl, Global Head Illiquid Assets, Member of the Board of Management, MEAG MUNICH ERGO Kapitalanlagegesellschaft mbH

Lucie Delzant, Sustainable Finance Lead, Axa Climate

Eugene Holubnyak, Co-Founder, Avalon International Corporation

Sam Lissner, Partner, Ridgewood Infrastructure

Moderator: Nathalie Tidman, Editor, Infrastructure Investor Deals

Speakers:

Derek Chu, Head of American Real Assets, AustralianSuper

Kristina Kloberdanz, Chief Sustainability Officer, Macquarie Asset Management

Oxana Megglé , Sustainable Finance Lead, IFC

Shami Nissan, Head of Sustainability, Actis

Melisa Simic, Senior Director of Sustainability, Nuveen

Moderator: Joss Blamire, Director, Infrastructure standards, GRESB

Speakers:

Damian Braud, Head of NBS and Senior Managing Director, Ardian

Lisa Junghans, Project Lead, Kompetenzzentrum Wasser Berlin

Jakub Skavroň, Chairman of the board, Climate & Sustainable Leaders Czech Republic

Moderator: Frank Dornseifer, Managing Director, Bundesverband Alternative Investments

Speakers:

Catherine Edet, Head of Environmental, Social and Governance, STOA Infra Energy

Ruairi Revell, Head of Sustainability – Economic Infrastructure, aberdeen

Nik Stone, Head of ESG, Nala Renewables

Mark White, Senior Analyst, Albourne Partners

Speaker:

Christian Heller, CEO, Value Balancing Alliance

ERM will discuss the critical intersection between ESG and Technical DD and how these themes play a strong and material role in value creation planning. The session will focus on live examples of investments and the value created, and share insights on the value creation levers such as opex savings, cost of capital, revenue enhancement and enterprise value.

Moderator: Jaideep Das, Partner, Global Leader of Services and Innovation, ERM

Speakers:

Luke Gorton, Senior Managing Director and Head of Europe, John Laing

Allard Ruijs, Chief Investment Officer, CVC DIF

James Mittell, Director, Actis

Moderator: Maria Yakushenko, Investment Specialist Infrastructure and Private Natural Capital, APG Asset Management

Speakers:

Anna Baumbach, Partner, Palladio Partners

Michael Brand, Managing Director, Co-Head of Real Assets, Aksia

Severin Buchwald, Senior Expert Sustainable Finance, MEAG

Paris Fronimos, Director, Infrastructure & Renewable Resources, BCI

Petya Nikolova, Deputy CIO and Head of Infrastructure Investments, New York City Retirement System, Office of the Comptroller

In this session, two experts will engage in a lively debate examining the impact of sustainable investments on overall portfolio performance. Participants will discuss whether integrating sustainability criteria into investment strategies genuinely enhances financial returns or if it merely serves as a marketing tool.

Moderator: Simon Whistler, Head of Real Assets, Principles for Responsible Investment

Speakers:

Gwen Colin, Head of ESG and Partner, Vauban Infrastructure Partners

Cristina Rotariu, Director, Renewables Energy, Allianz Capital

Anna Baumbach, Partner, Palladio Partners

We explore private capital’s role in bridging the infrastructure investment gap, the unique market dynamics at play and the topics that are top of mind for investors. With 30 years of experience investing in infrastructure, gain insights from Macquarie Asset Management’s Head of Real Assets into the importance of strong partnerships and global connectivity to create value and shape successful investments in an evolving landscape.

Moderator: Bruno Alves, Editor-in-Chief, Infrastructure Investor

Leigh Harrison, Head of Real Assets, Macquarie Asset Management

Exploring the latest trends and challenges in digital infrastructure, focusing on capital allocation and fundraising, the challenges and opportunities of powering the demand for AI, data centre market dynamics, sustainability requirements, and the future landscape of digital assets through expert panels and discussions.

Join us for a keynote fireside chat between one of the legendary pioneers of infrastructure investing, Bayo Ogunlesi, Founder, Chairman and Chief Executive Officer (CEO) of Global Infrastructure Partners (GIP), now a part of BlackRock, and Zak Bentley, Americas Editor at Infrastructure Investor

Moderator: Zak Bentley, Americas Editor, Infrastructure Investor

Speaker: Bayo Ogunlesi, Founder, Chairman & Chief Executive Officer (CEO), Global Infrastructure Partners (GIP), a part of BlackRock

Andrea Logan, Director, FirstPoint Equity

Moderator: Thomas Bumberger, Managing Director & Partner, BCG

Speakers:

John Apostolides, Investment Partner, Palistar Capital

Steven Marshall, Chairman, Cordiant Capital

Erica Noda, Global TMT Sector Lead for Global Clients & New Business, International Finance Corporation (World Bank Group)

Joshua Parrish , Managing Director, Credit, DigitalBridge

Laurens-Jan Sipma, Senior Director, APG Asset Management

Global TMT Sector Lead for Global Clients & New Business, International Finance Corporation (World Bank Group)

Read bio

Moderator: Andrew Hayward, Senior Investment Due Diligence Analyst – Real Assets, Albourne Partners

Speakers:

Stephan Freitas Krause, Director – Infrastructure Financing, KfW IPEX Bank

Isabelle Kemlin, Business and Innovation Executive / Vice Chair of the Board, RISE – Research Institutes of Sweden / Swedish Datacenter Industry

Phil Green, Managing Director, Sumitomo Mitsui Banking Corporation

Business and Innovation Executive - RISE / Vice Chair of the Board - Swedish Datacenter Industry

Read bio

Moderator: Fran González Menéndez, Partner, Analysys Mason

Speakers:

Jeroen Kleinjan, Managing Director, Global Lead Telecoms, ING

Inka Klinger, Head of Project Finance, Hamburg Commerical Bank AG

Nacho Rios, Founding Partner, Rivergo Advisors

Darragh Stokes, Managing Partner, Hardiman Telecoms

Moderator: Matt Himler, Principal, ECP

Speakers:

Melissa Grant, Director, Aksia

Bill Green, Managing Partner, Climate Adaptive Infrastructure

Henrik Hansen, CEO, Danish Data Center Industry

Phoebe Smith, Managing Director, PATRIZIA

Stefan Wala, Head of Origination, Kommunalkredit Austria AG

Moderator:

Speaker:

Speaker:

Lisa Weaver-Lambert, Board Advisory and Strategic Business Transformation, Data & AI Executive

Board Advisory and Strategic Business Transformation, Data & AI Executive

Read bioModerator: Andrea Logan, Director, FirstPoint Equity

Speakers:

Ashli Aslin, Partner, Senior Analyst, Infrastructure, Albourne Partners

Christian Fingerle, Senior Managing Director, StepStone Group

Benjamin Hemming, Head of Illiquid Assets Debt, MEAG

Sachin Prinja, Investment Director, Real Assets, Cambridge Associates

Mark Weisdorf, Chair of the Investment Committee, IST3 Investment Foundation

Moderator: Joss Blamire, Director, Infrastructure standards, GRESB

Speakers:

Wouter Koning, Executive Director / Head of Digital Infrastructure, ABN AMRO Bank N.V.

Anand Rajagopal, Head of Sustainability Research, Phoenix Group

Lucas Ruland, Director Digital Infrastructure Finance, NIBC Bank

Nat Sahlstrom, Chief Energy Officer, Tract Capital

Sustainability Research Lead – Global Investment Research & Ratings, Phoenix Group

Read bio

Every participant will endorse alternative technologies and developments they view as key to the evolution of digital infrastructure assets:

Moderator: Andrea Logan, Director, FirstPoint Equity

Speakers:

Andrea Logan, Director, FirstPoint Equity

We explore private capital’s role in bridging the infrastructure investment gap, the unique market dynamics at play and the topics that are top of mind for investors. With 30 years of experience investing in infrastructure, gain insights from Macquarie Asset Management’s Head of Real Assets into the importance of strong partnerships and global connectivity to create value and shape successful investments in an evolving landscape.

Moderator: Bruno Alves, Editor-in-Chief, Infrastructure Investor

Leigh Harrison, Head of Real Assets, Macquarie Asset Management

The Global Investor Forum is the centrepiece platform for the Summit. Spanning two days, the forum features over 150 speakers, with global leaders from leading infrastructure investment managers, complemented by LP voices and eye-catching out-of-industry keynotes. Covering topics from geopolitics to AI, from value creation to secondaries, and much more, the Global Investor Forum tackles all the key themes under infrastructure’s broadening umbrella.

Nicholas Lockley, Global Head of Events, PEI Group

Olivia Eijking, Director/Founder, Kreen Limited

Moderator: Stancel Riley, Co-Head Financial Sponsors & Strategic Solutions, Mizuho | Greenhill

Deepa Bharadwaj, Head of Infrastructure Europe, IFM Investors

Tavis Cannell, Global Head of Infrastructure, Goldman Sachs Alternatives

Marc Ganzi, Chief Executive Officer, DigitalBridge

Sikander Rashid, Managing Partner and Head of Europe, Infrastructure, Brookfield

Angelo Acconcia, Partner, ArcLight Capital Partners

Moderator: Wilhelm Schmundt, Managing Director and Senior Partner, Global Head of Infrastructure Investors , Boston Consulting Group

Jack Howell, Co-President, Stonepeak

Gijs Voskuyl, Managing Partner, CVC DIF

Don Dimitrievich, Portfolio Manager, Senior Managing Director, Energy Infrastructure Credit, Nuveen

Gwenola Chambon, CEO & Founding Partner, Vauban Infrastructure Partners

Mohmed El Gazzar, Senior Partner, I Squared Capital

Moderator: Jonathan Dillon, Partner, Clifford Chance

Bruno Candes, Partner, InfraVia

Michael Hill, Executive Vice President, Global Head of Infrastructure, OMERS Infrastructure

Lucy Heintz, Partner, Energy, Actis

Jim Hughes, Managing Partner, EnCap Investments L.P.

Marco van Daele, CEO, SUSI Partners AG

Moderator: Justin Bower, Co-Founder, FirstPoint Equity

Gabriele Damiani, Head of Core/Core + Infrastructure, Swiss Life Asset Managers

Alina Osorio, President, Fiera Infrastructure

Jeff Jenkins, Founder & Partner, Bernhard Capital Partners

Minal Patel, Global Head of Infrastructure, Schroders Capital

Louis-Roch Burgard. , Co-Head, Equity Investments, Infranity

Moderator: Ali Miraj, Global Lead, Infrastructure Sponsor Coverage, ING

Olivia Wassenaar, Partner, Head of Sustainability & Infrastructure, Apollo Global Management

Roopa Murthy, Partner, Head of EMEA Infrastructure Debt, Ares Management

Anish Butani, Managing Director, Infrastructure, bfinance

Nicolas Motelay, Managing Director, New End Associates

Marta Perez, Head of Infrastructure, Allianz Global Investors

Moderator: Angelika Schöchlin, Managing Partner, Antin Infrastructure Partners

Davide Tavaniello, Co-CEO, Hippocrates Holding

Rodolfo Guarino, Co-CEO, Hippocrates Holding

Moderator: Jon Phillips, Chief Executive Officer, Global Infrastructure Investor Association (GIIA)

Daniel Lau, Portfolio Manager, CalSTRS

Rowan te Kloot, Managing Principal Energy Transition Infrastructure, HSBC Asset Management

Esther Peiner, Partner, Head of Private Infrastructure, Partners Group

Scott Lebovitz, Managing Partner and Head of Transition Infrastructure, TPG

Martin Neubert, Chief Investment Officer & Partner, Copenhagen Infrastructure Partners

Chief Investment Officer & Partner, Copenhagen Infrastructure Partners P/S (CIP)

Read bioModerator: Meredith Bishop, Senior Vice President, Prosek Partners

Recep Kendircioglu, Global Head of Infrastructure Equity, Manulife

Scott Jacobs, CEO & Co-Founder, Generate Capital

Stephen Dowd, Chief Investment Officer – Private Infrastructure Strategies, CBRE Investment Management

Bill Green, Managing Partner, Climate Adaptive Infrastructure

Emil W. Henry Jr., CEO & CIO, Tiger Infrastructure Partners

Chief Investment Officer – Private Infrastructure Strategies, CBRE Investment Management

Read bio

Moderator: Alexandra Dimsdale-Gill, Partner, Clifford Chance

Misha Nahorny, Managing Director, Arjun Infrastructure Partners

Ross Posner, Managing Partner, Ridgewood Infrastructure

Emmanuel Rogy, Partner, Cube Infrastructure Partners

Christopher Beall, Founder & Managing Partner, NOVA Infrastructure

Roderick MacDonald, Director Investment Management, Finance in Motion

Moderator: Alice Brogi, Partner, Gibson Dunn

Dimitar Lambrev, Senior Portfolio Manager – Infrastructure Investments, UNIQA Insurance Group

Manuel Häusler, Senior Managing Director and Member of the ASF Management Committee, Ardian

Brent Burnett, Global Head of Infrastructure and Real Assets, Hamilton Lane

Henry Willans, Managing Director, Goldman Sachs Alternatives

Marc Meier, Managing Director, Partners Group

Moderator: Mary Lavelle, Partner and Global Co-Head of the Private Funds and Secondaries group, Freshfields

Francois Bouillon, Partner, Ely Place Partners

Francisco del Pozo, Head of Infrastructure Funds, Bestinver

Tim Rees, Principal, StepStone Group

Moderator: Kasper Struve, Founder, Unified Investors

Maria Aguilar-Wittmann, Co-Head of Infrastructure Fund & Co-Investments, Allianz Capital Partners

Dr. Alexandra von Bernstorff, Managing Partner, Luxcara

Ravi Parekh, Managing Director, GCM Grosvenor

Andrew Cogan, Managing Director and Portfolio Manager of Fengate Infrastructure Yield Fund, Fengate

Alistair Ray, Chief Investment Officer, Dalmore

Moderator: Sven Seppeur, Director, Investment Management, Private Markets, FERI AG

Gabriele Todesca, Head of Infrastructure Investments, European Investment Fund

Leonhard von Metzler, Managing Director, Taunus Trust GmbH

Ulla Agesen, Head of Infrastructure, NIO

Takako Koizumi, Head of Business Development, Office of the CEO, Mitsui & Co. Alternative Investments

Michael Aitken, Portfolio Manager, NZ Super Fund

Head of Business Development, Office of the CEO, Mitsui & Co. Alternative Investments

Read bio

Moderator: Carlos Zuloaga, Global Head of Energy, BBVA

Andrew Truscott, CEO, John Laing

Simon Davy, Managing Director, Investments, Equitix

Dominic Helmsley, Head of Core Infrastructure, ABRDN

Moderator: Gonzalo Cantabrana, Managing Director, EMEA Infrastructure Sector Lead, S&P Global Ratings

Goncalo Bernardo, Investment Partner, Palistar Capital

Adam Pickard, Principal, Grain Management

Pia Lambert, Executive Director, Morrison

Matteo Colombo, Managing Director – Head of Digital Infrastructure, L&G

Emily Azer, Director, Data Infrastructure, GI Partners

Grab a drink, enjoy some canapes and take your opportunity to race a 6-time winning F1 driver, Ralf Schumacher, as part of our F1 simulator tournament

Cecilie Søndergaard Nielsen, Managing Director, Founder, CN8 Leadership Confidence

Olivia Eijking, Director/Founder, Kreen Limited

Moderator: Camille Egloff, Managing Director and Senior Partner, Boston Consulting Group

Perry Offutt, Partner, Head of North America, Morrison

Christian Wiehenkamp, Chief Investment Officer, Perpetual Investors

Nathalie Wlodarczyk, Managing Director, Gatehouse Advisory Partners

Ross Israel, Head of Global Infrastructure, QIC

Moderator: Federico Fruhbeck, Partner, Gibson Dunn

Dr. Mathias Bimberg, Managing Partner, Head of Infrastructure, Prime Capital

Carl Elia, Vice President & Director, Global Infrastructure Investments, TD Asset Management

Stéphane Kofman, Partner, Head of Value Add Funds, InfraRed Capital Partners

Pooja Goyal, Chief Investment Officer of the Infrastructure Group, Carlyle

Michael Hoverman, Executive Director – Infrastructure, Greystar

Vice President & Director, Global Infrastructure Investments, TD Global Investment Solutions

Read bio

Moderator: Nathalie Tidman, Editor – Infrastructure Investor Deals, PEI Group

Martin Ragettli, Head of Infrastructure Investments, IST Investment Foundation

Jean-Francis Dusch, Chief Executive Officer, Global Head of Infrastructure & Structured Finance

Chief Investment Officer Infrastructure Debt, Edmond de Rothschild Asset Management (UK)

Emmett McCann, Co-CEO, Duration Capital Partners

Natasa Kovacevic, Managing Director, Infrastructure, CPP Investments

Chief Executive Officer Global Head of Infrastructure & Structured Finance Chief Investment Officer Infrastructure Debt, EDMOND DE ROTHSCHILD ASSET MANAGEMENT (UK) LIMITED

Read bio

Moderator: Gonzalo Fernández Turégano, Global Sector Head of Financial Sponsors, BBVA

Graham Matthews, Head of Infrastructure, PATRIZIA

Andrew Honan, Co-Managing Partner, MML Keystone, MML Capital

Robert Dupree, Principal, Co-Head of the Investments group and Co-Head of Infrastructure & Impact, CIM Group

Karen Donelec, Partner, Ancala

Principal, Co-Head of the Investments group and Co-Head of Infrastructure & Impact, CIM Group

Read bio

Moderator: Mark Weisdorf, Chair of the Investment Committee, IST3 Infrastruktur Global

Hilkka Komulainen, Global Head of Sustainability & Impact, Quinbrook Infrastructure Partners

Rhizlaine Tabari Bosli, Infrastructure Investment Director, Crédit Agricole Assurances

Christian Couturier, Co-CEO, Carbometrix

Rahul Advani, Managing Partner, SER Capital Partners, LLC

Laurence Monnier, Senior Adviser, Gira Strategic Finance

Global Head of Sustainability and Impact, Quinbrook Infrastructure Partners

Read bio

Moderator: Lisa Weaver-Lambert, Board Advisory and Strategic Business Transformation, Data & AI Executive

Spence Clunie, Managing Partner, Ancala

Jim Metcalfe, Co-Managing Partner & Chief Executive Officer, Astatine Investment Partners

Michael Pollan, Managing Partner, Omnes Capital

Vicente Vento, Founder & CEO, Digital Transformation Capital Partners GmbH

Roderick Gadsby, Managing Director, Northleaf

Board Advisory and Strategic Business Transformation, Data & AI Executive

Read bio

Hear from a fund manager and their portfolio company on how they are practically implementing value creation processes into their active asset management strategy

Moderator: Eugene Zhuchenko, Managing Director, ETORE Advisory

Juan Caceres, President, Axium Infrastructure Europe

Subahoo Chordia, President & Head – Real Assets, EAAA Alternatives

Moderator: Jane Bowes, Partner, Threadmark

Bertrand Loubieres, Head of Infrastructure Finance, AXA IM Alts

Rob Johnson, Managing Director & Global Head of Direct Lending, EIG

Nicholas Stockdale, Partner and Head of Europe, QIC

Tom Murray, Managing Partner and Chief Investment Officer, Power Sustainable Infrastructure Credit

Garret Tynan, Managing Director, European Head Project Finance & Infrastructure, KBRA

Moderator: Olivia Eijking, Director/Founder, Kreen Limited

Joost Bergsma, Global Head of Clean Energy, Nuveen Infrastructure

Michael Bonte-Friedheim, Founding Partner & Group Chief Executive Officer, NextEnergy Group

Olivier Aubert, Managing Director – SWEN Impact Fund for Transition (SWIFT) Strategy, SWEN Capital Partners

Nicolas Rochon, Founder & CEO, RGREEN INVEST

SWEN Capital Partners, Managing Director – SWEN Impact Fund for Transition (SWIFT) strategy

Read bio

Moderator: Monika Bednarz, Managing Director, Lagrange Financial Advisory

Roland Kaufmann, Head of Transportation Investments, Senior Investment Manager, Reichmuth & Co Investment Management AG

Alexis Ballif, Managing Director Infrastructure – Transport, Ardian

Carlo Maddalena, Senior Portfolio Manager, APG Asset Management

Walter Manara, Partner, DWS

Robert Mah, President, Guardian Smart Infrastructure Management

Head of Transportation Investments, Senior Investment Manager, Reichmuth & Co Investment Management AG

Read bio

Moderator: Alexandre Chavarot, Senior Advisor, Resilience Finance, Howden

Laurent Chatelin, Partner, Infrastructure, Eurazeo

Guilherme Dzik, Managing Director, Kingston Infrastructure Partners

Anne Chataigné, Senior Programme Manager, Adaptation & Resilience, Institutional Investors Group on Climate Change (IIGCC)

Senior Programme Manager Adaptation and Resilience, Institutional Investors Group on Climate Change (IIGCC)

Read bioGPIF is a public pension fund designed to support the future of Japan. Its mission is to contribute to the stability of the national pension scheme, by securing investment returns with minimal risk and a long-term focus. As of September 2024, GPIF’s asset size is 258.7 trillion Japanese yen. GPIF employs long-term and diversified investment as its principal investment strategies.

This presentation will provide an overview of the pension system in Japan, GPIF’s investment mandate, its perspective as a LP investing in alternative assets, and its aspirations for the future.

It is the speaker’s hope that the audience will gain insight into GPIF’s goals and priorities.

Kiko Emae, Senior Director, Government Pension Investment Fund (GPIF)

Bruno Alves, Senior Editor, Infrastructure Investor

Marc Ganzi, Chief Executive Officer, DigitalBridge

Transport available to the Women + Ally Cocktail reception venue from outside the Hilton at 18.00, 18.15 and 18.30

As interest rates have risen in recent years, debt and credit strategies have increasingly become a mainstay of LP investment portfolios. The Infrastructure Debt forum is unique in providing a deep-dive into debt strategies across the infrastructure spectrum, as a market previously dominated by banks evolves, and long-term project financing becomes a key cog in the future of sustainable infrastructure.

Agnes Mazurek, Independent Consultant, United Nations Economic Commission for Europe

Moderator: Kate Campbell, Founding Partner, Astrid Advisors

Jean-Francis Dusch, Chief Executive Officer, Global Head of Infrastructure & Structured Finance, Chief Investment Officer Infrastructure Debt, Edmond de Rothschild Asset Management (UK)

Luke Fernandes, Head, Infrastructure Finance US, Swiss Re Asset Management

Hamed Khodabakhsh, Co-Head of European Credit, Global Infrastructure Partners (GIP), a part of BlackRock

Katharina Kort, Managing Director, BofA Securities

Peter Jeranyama, Debt Origination Manager, Pension Insurance Corporation

Chief Executive Officer Global Head of Infrastructure & Structured Finance Chief Investment Officer Infrastructure Debt, EDMOND DE ROTHSCHILD ASSET MANAGEMENT (UK) LIMITED

Read bio

Co-Head of European Credit, Global Infrastructure Partners (GIP), a part of BlackRock

Read bio

Moderator: Jane Bowes, Partner, Threadmark

Mariana Graça, Investment Specialist – Sustainability & Impact, Emerging Africa & Asia Infrastructure Fund

Greg Scott, Senior Portfolio Manager, Phoenix Group

Isabella da Costa Mendes, Founding Partner & Co-CIO, ImpactA Global

Christopher Bredholt, Chief Underwriting Officer, Development Guarantee Group

Bérénice Arbona, Head of Infrastructure Debt, LBP AM European Private Markets

Investment Specialist - Sustainability & Impact, Emerging Africa & Asia Infrastructure Fund

Read bio

Moderator: Monika Bednarz, Managing Director, Lagrange Financial Advisory

Xi Chen, Principal, QIC

Jamie Clark, Senior Director, Infrastructure Debt – EMEA, MetLife Investment Management

Vivek Sapra, Senior Advisor, Infrastructure Investments, Ampega Asset Management and Independent Board Director

Isil Tanriverdi Versmissen, Head of Infrastructure Debt Transactions, MEAG

Jerome Neyroud, Head of Infrastructure Debt Investments, Schroders Capital

Senior Advisor, infrastructure Investments, Ampega Asset Management and Independent Board Director

Read bio

Moderator: Kunal Govindia, Senior Credit Risk Analyst, Phoenix Group

Jorge Camina, Partner & Head of Sustainable Infrastructure Credit, Denham Capital

Sinead Walshe, Director, Infrastructure Debt, Aviva Investors

Jan Weismüller, Managing Director, Global Head of Infrastructure & Transportation Finance, Landesbank Baden-Württemberg

Georgia Dunne, Director, Infrastructure & Project Finance, NatWest

Managing Director, Global Head of Infrastructure and Transportation Finance, Landesbank Baden-Württemberg

Read bio

Moderator: Agnes Mazurek, Independent Consultant, United Nations Economic Commission for Europe

Alex Wilson, Managing Director & Head, Corporate Banking Europe & Asia, CIBC Capital Markets

Moderator: Florian Bucher, Analyst, Alternative Markets, Bundesverband Alternative Investments e.V. (BAI)

Jennie Rose, Head of American Private Credit, AustralianSuper

Moderator: Hans-Peter Dohr, Founder & Managing Director, ICA – Institutional Capital Associates

M. Nicolas Firzli, Director-General, World Pensions council

Markus Schaen, Principal Fixed Income Portfolio Manager, MN

Alexander Schmitt, Senior Portfolio Manager, Global Private Debt, Allianz Global Investors

Aurélie Hariton-Fardad, Managing Director, Head of EMEA Portfolio Management, Private Credit, MetLife Investment Management

Managing Director, Head of EMEA Portfolio Management, Private Credit, MetLife Investment Management

Read bioModerator: Matias Sottile, Partner, Ayres Partners

Olaf Müller, Head of Infrastructure Finance, Landesbank Baden-Württemberg

Eric Scheyer, Managing Partner, Elda River Capital

Andjela Djordjevic, Vice President, Infrastructure & Energy Private Debt, Berenberg

Moderator: Ope Onibokun, Investment Director, British International Investment

Nicholas Blach Petersen, Partner, Copenhagen Infrastructure Partners

Celine Tercier, Head of Infrastructure Debt Funds & Mandates, AEW

Raphael Laidez, Senior Director, Infrastructure Financing, CDPQ

Agnes Mazurek, Independent Consultant, United Nations Economic Commission for Europe

The energy transition continues its relentless push towards decarbonising the planet, with this reflected in the significant fundraising and deployment in private infrastructure towards transition strategies. The Energy Transition forum provides the perfect setting to delve into the latest developments in energy and renewable assets; assess how geopolitics and macroeconomics are playing their part, and determine the path towards achieving net-zero.

Ionna Trofimova Elliot, CEO, The POLICY CLUB, Borderless Renewables

Moderator:Ionna Trofimova Elliot, CEO, The POLICY CLUB, Borderless Renewables

Tore Mengshoel , Portfolio Manager Energy & Infrastructure Department, NBIM

Paul Rhodes, Head of Energy Transition Infrastructure, Asia Pacific, HSBC Asset Management

Raphaël Lance, Global Head of Private Assets, Head of Energy Transition Funds, Mirova

Ross Grier, Chief Investment Officer, Next Energy Capital

Oliver-Victor Pawela, Partner, tidir

Moderator: Geraldine Barlow, Managing Director, Infrastructure, Affinius Capital

Kashif Khan, Director, MetLife Investment Management

Alejandro López Delgado, Managing Director, Infrastructure, CDPQ

Jan Vesely, Partner, EQT

Maria Zaheer, Partner & Head of North America, Alexa Capital

Erik Strømsø, CEO, BW ESS

Moderator: Adrian Dwyer, Chief Executive Officer, Infrastructure Partnerships Australia

Patricia Rodrigues Jenner, Member of Investment Committees, UK’s GLIL & Africa’s AIIM

Laurent Segalen, CEO, C4S Invest / Abloco Energy – Co-host Redefining Energy

Chris Thompson, Underwriter, Axis Capital

Bakr Abdel Wahab, Chief Investment Officer, Vortex Energy

Scott Jacobs, CEO & Co-Founder, Generate Capital

Member of Infrastructure Investment Committees, UK GLIL & Africa’s AIIM

Read bio

Moderator: Louisa Yeoman, Founding Partner, Astrid Advisors

Josh Gilbert, Co-Founder & CEO, Sust Global

Nataliya Katser-Buchkovska, CEO, Founder, Green Resilience Facility/ Ukrainian Sustainable Fund

Angenika Kunne, Managing Director, Head of Infrastructure Equity, Aviva Investors

Johana Afenjar, COO, Telis Energy

CEO, Founder, Green Resilience Facility/ Ukrainian Sustainable Fund

Read bio

Moderator: Elin Aberg, Senior Director, Institutional Business, KGAL Investment Management GmbH

Matej Lednicky, Head of Transaction Management Infrastructure, Kgal GmbH & Co.KG

Dr. Gerhard Schwartz, Managing Director, GP JOULE Projects GmbH & Co.KG

Moderator: Olivia Eijking, Director/Founder, Kreen Limited

Mark McAllister, Chair, Ofgem

Moderator: Hugo Lidbetter, Partner, Osborne Clarke

Frederik Beelitz, Advisory Principal, Aurora Energy Research

Christoffer Adrian, Director Renewables, Infrastructure & Transition, DNB Markets

Ingrid Edmund, Investment Director, Downing LLP

Richard Hulf, Managing Director HydrogenOne, Cordiant Capital

Moderator: Tom Taylor, APAC Reporter, Infrastructure Investor

Michael Bonte-Friedheim, Founding Partner & Group Chief Executive Officer, NextEnergy Group

Igor Lukin, Managing Director, Direct Infrastructure, Allianz Global Investors/Allianz Capital Partners

Louise Burrows, Head of Government Affairs, Global Renewables Alliance (GRA)

Alberto Sánchez Miravalles, Regulatory Affairs Manager, Carbon Capture & Storage Association

Christophe Hug, Managing Partner, Tilia GmbH

Two LPs from different corners of the world provide us with insight into their energy transition portfolio and ambitions for 2025 and beyond.

Case Study 1: CPP Investments

Moderator: Eugene Zhuchenko, Managing Director, ETORE Advisory

Bianca Ziccarelli, Managing Director, Canada Pension Plan Investments

Case Study 2: YIELCO Investments

Moderator: Adam Smallman, Director of Membership Content, PEI Group

Claudio Ghisu, Managing Director, YIELCO Investments

Ionna Trofimova Elliot, CEO, The POLICY CLUB, Borderless Renewables

The Summit is the world’s largest and most influential gathering of the global infrastructure ecosystem, bringing together investors, developers, fund managers, policymakers and industry innovators.

Power players in the infrastructure space choose the Summit for a reason. “I haven’t found any other event where people are so eager to collaborate and make deals happen.”

Discover what it’s like to be at the heart of where global infrastructure business gets done—from the perspectives of our attendees.

organisations attended in 2024

top 100 infrastructure fund managers

top 75 global infrastructure LPs

Serkan Bahçeci, Arjun Infrastructure Partners

![]()

Monday 17 March | 6-8pm

Kick off the Summit in style! Join our annual welcome drinks and connect with fellow Network members in a relaxed, social setting. It’s the perfect way to break the ice and set the stage for meaningful connections over the days ahead.

Tuesday 18 March | 7-8.15am

Energise your morning with an invigorating walk or run through the beautiful streets of Berlin. This refreshing start to the day is an ideal opportunity to connect with like-minded LPs and GPs.

![]()

Tuesday 18 March | 6.30-8.30pm

Race against F1 legend Ralf Schumacher in an adrenaline-fueled e-sports tournament, with DJ Ali setting the vibe. After his keynote, Schumacher joins the drinks reception and F1 simulator competition. Ready to claim the IIGS F1 champion title? Game on!

Tuesday 18 March | 9pm-12am

Don’t let the night end early! Continue the celebration with more food, drinks, and entertainment at the Official After Party. A lively setting for mixing business and pleasure, it’s the perfect capstone to an exciting day.

Tuesday 18 & Wednesday 19 March

Taking place on Tuesday and Wednesday, our dedicated network team will host three exclusive workshops: the Emerging Managers Meet & Greet, Women’s Mentoring Workshop, and Sustainable Infrastructure Think-Tank. These closed-door sessions offer a rare opportunity for focused networking with a committed LP-GP audience. Spaces are limited—contact our network team to RSVP.

Wednesday 19 March | 8-9am

Our female Network members are invited to exclusive Women’s Circle gatherings. Start your morning with an inspiring breakfast as you connect with peers, share experiences, and build a supportive community.

Wednesday 19 March | 6.30-9.30pm

Join the Women’s Circle for an exclusive evening of delicious cocktails, plentiful food, and networking, all set to the backdrop of a live DJ. Connect with peers, share experiences, and build a supportive community.

Elevate your firm’s stature as a symbol of expertise and influence in the industry at the Infrastructure Investor Global Summit.

Connecting the entire infrastructure investment ecosystem under one roof, the Global Summit is the most effective and efficient way to meet investors, fund managers, and industry leaders to drive your future success.

With a second-to-none speaking faculty and an agenda built for networking, there is no better place to elevate your thought leadership and brand visibility among key decision-makers in infrastructure investing.

Networking is at the heart of the Global Summit. Our unique matching technology will suggest the best connections for you to schedule meetings based off your profile. Our on-site networking team will also be available to make introductions.

As a service period, your presence at the Infrastructure Investor Global Summit isn’t just about attendance- it’s about leadership. Take advantage of sponsorship opportunities to:

* Showcase thought leadership by leading a session or panel.

* Enhance brand visibility with strategic on-site placements.

* Engage one-on-one with LPs and GPs seeking your expertise.

Don’t miss the opportunity to shape the future of infrastructure. Be part of the conversations that matter and ensure your expertise is seen, heard, and valued by the industry’s leading players.

Power your networking with our exclusive event app, proudly sponsored by Morrison. Effortlessly connect with the right people, schedule meetings, and browse attendee profiles—all in one place. Stay ahead with real-time access to the agenda, speaker details, and session updates.

Networking is at the heart of the Summit. Our smart matching technology suggests the best connections for you, while our on-site team is ready to make introductions. Get started and make every conversation count!

Download the app and start building valuable connections before you arrive in Berlin!

![]()

Looking to connect with another attendee? Our meeting booking system lets you schedule 15-minute time slots with designated table locations on-site. Don’t miss this great networking opportunity.

No more worrying about running out of business cards! Your profile includes a unique QR code that other attendees can scan to access your name, job title, and email address—making it easy to stay connected after the event.

Our intelligent matchmaker, located in the app’s networking area, uses your profile to recommend people to meet. Interested in someone? Give them a thumbs up. The more you interact, the smarter the recommendations become. If both parties give a thumbs up, it’s a match!

Tailor your event experience by selecting agenda sessions you don’t want to miss, ensuring you make the most of your time at the summit.